The lone truly usable free cellphone plan in the U.S. just lost its defining perk. Helium Mobile’s Zero Plan, long a favorite as a no-cost backup line, will now require users to keep a card on file and pay monthly taxes and regulatory fees, effectively turning “free” into roughly a $5–$8 out-of-pocket charge depending on location.

What Changed: Helium’s Zero Plan Adds Taxes and Fees

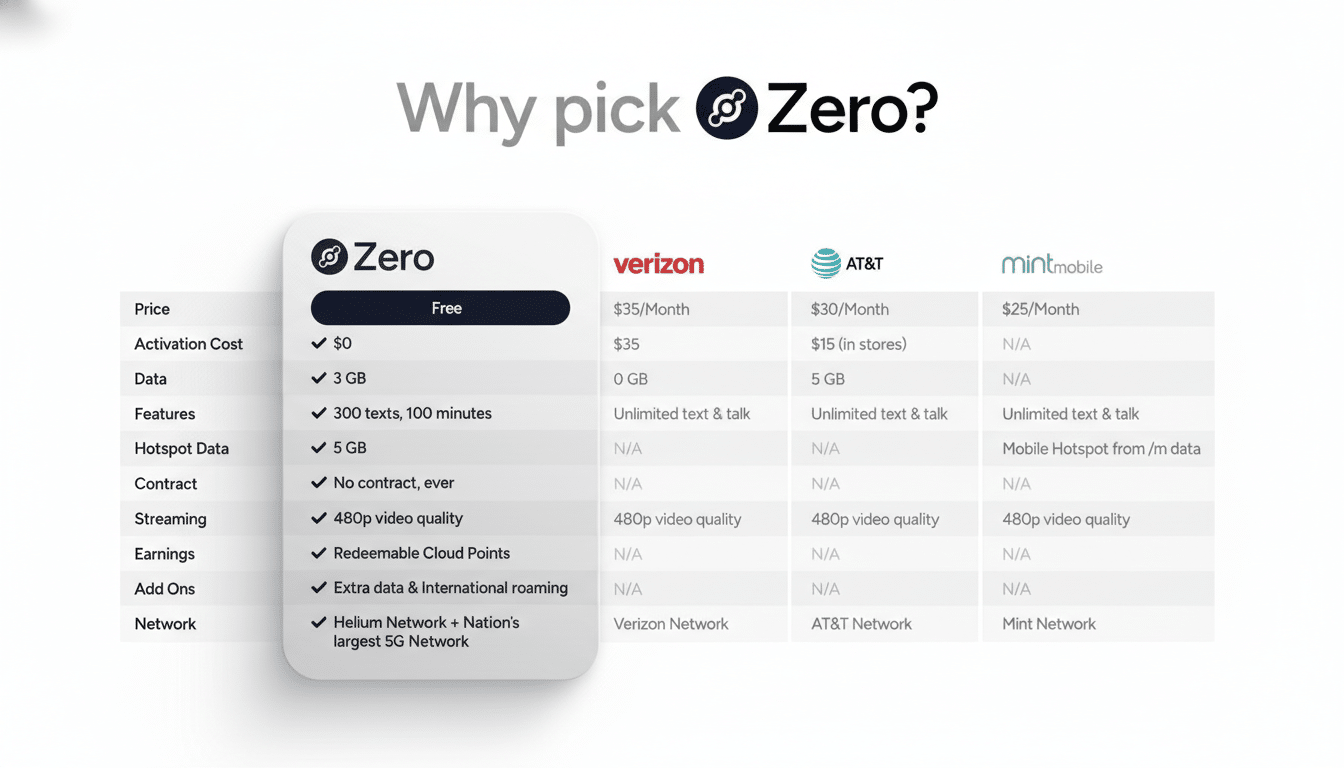

Helium’s Zero Plan hasn’t been discontinued, but it is no longer a $0 total. The service still advertises the same allotment — 3GB of data, 300 texts, and 100 minutes — but customers will see pass-through charges for items like 911 fees, universal service surcharges, and other carrier-imposed assessments that vary by state and municipality.

- What Changed: Helium’s Zero Plan Adds Taxes and Fees

- Why the Shift Matters for Helium’s Formerly Free Plan

- How It Compares Now Against Other Low-Cost Plans

- Real-World Costs and Coverage on Helium’s Zero Plan

- Who Should Keep Helium’s Zero Plan and Who Should Switch

- What to Watch Next: Fees, Incentives, and Pricing Clarity

Practically, that means a secondary line that once cost nothing now lands in low single digits each month. In high-tax cities, it could edge higher. The Tax Foundation routinely ranks wireless taxes among the most burdensome consumer levies, with a nationwide average around 24% when combining federal, state, and local layers. On a plan with a nominal $0 rate, even flat administrative fees can suddenly loom large.

Why the Shift Matters for Helium’s Formerly Free Plan

Helium Mobile, backed by Nova Labs and running primarily on the T-Mobile network with supplemental Helium hotspots, carved out a niche: a real cellular line usable for travel, emergency backup, kids’ watches, or hotspots without a monthly bill. That set it apart from ad-supported or trial-limited offers that tend to be narrow or temporary.

The economics were always tenuous. Early on, Helium required continuous location data sharing, a move that drew privacy criticism but likely offset costs through data-driven network analytics and incentives. When the company walked back mandatory location collection, it lost a lever that helped underwrite a $0 sticker price. Layer on inflation in network costs, higher customer support loads, and regulatory fees that most MVNOs pass through, and the pivot looks inevitable.

How It Compares Now Against Other Low-Cost Plans

With taxes and fees tacked on, Helium’s Zero Plan remains one of the cheapest ways to keep a working line online, but it is no longer the obvious slam dunk. If you can stretch a couple of dollars more, several low-cost prepaid plans become competitive.

US Mobile’s entry plan runs $10 with taxes and fees typically included, or the equivalent of about $8 per month if you prepay annually. It offers 2GB of data but removes restrictive minute and text caps and lets you choose coverage on one of the big three networks. Tello frequently advertises a $5 tier with limited minutes and 500MB on the T-Mobile network, though taxes are extra and data is far leaner. Visible’s $25 unlimited option remains the price-to-performance outlier for a primary line, but it is overkill for a glovebox backup.

The calculus depends on how you use it. If your backup line truly sits idle except for occasional travel, Helium’s new monthly bite may still be the lowest to keep a SIM active. If you expect to burn through more minutes or want fewer restrictions, bumping up to an all-in $8–$10 option can simplify budgeting and deliver better consistency.

Real-World Costs and Coverage on Helium’s Zero Plan

Expect variation by ZIP code. Cities with higher communications taxes and 911 surcharges can push effective monthly charges above the low end of Helium’s estimate. Meanwhile, the underlying network experience will largely mirror T-Mobile’s footprint, which independent drive tests from firms like Ookla and Opensignal have shown to be strong in urban and suburban areas, with rural results more mixed depending on region.

One subtle upside remains: because Helium’s Zero Plan still meters data at 3GB and caps voice and texts, you get a predictable ceiling that discourages surprise overages. For parents equipping a kid’s first phone or travelers wanting a U.S. number just in case, that control can be a feature, not a bug.

Who Should Keep Helium’s Zero Plan and Who Should Switch

Keep Helium’s Zero Plan if you want the absolute cheapest way to keep a line alive, rarely use voice or SMS, and can tolerate modest admin charges that fluctuate. It is still hard to beat as a dormant backup or an emergency glovebox SIM.

Consider switching if your usage regularly clips the 100-minute or 300-text caps, if you prefer a fixed all-in bill, or if your area’s taxes push Helium’s effective cost toward what more flexible entry plans already charge.

What to Watch Next: Fees, Incentives, and Pricing Clarity

Two variables could reshape the value proposition: Helium’s approach to data collection incentives and broader fee trends. If Helium reintroduces opt-in rewards for analytics or hotspot participation, some users could offset fees. On the regulatory side, wireless taxes rarely move down, but providers sometimes bundle fees to simplify consumer pricing.

The bottom line is clear: the era of a genuinely free, usable phone plan appears over. Helium’s Zero Plan survives, but now as a low-cost backup rather than a unicorn. For budget hawks, the next best move is to compare your local fee load against $8–$10 entry plans and pick the one whose constraints you mind least.