GoWish’s shopping and wishlist app is on fire — turning the peak gifting season into a record-setting growth moment. The company says that it has exceeded 13.6 million registered users globally, and soared to No. 2 on the U.S. App Store this week, topping what would be a run of hundreds of thousands of new daily signups in November.

Breakout growth and App Store momentum drive scale

The headline numbers tell a straightforward story. GoWish has doubled its user base year over year, and it now counts some 6.2 million users in the U.S., as well as about one million in the U.K. In the app’s country of origin, purchasing has reached over 3.5M registered users and >50% market penetration, an immensely deep foothold that indicates powerful network effects in gift‑oriented spaces.

Chart placement really only serves as a convenient surrogate for mainstream reach. Debuting in the No. 2 position on the U.S. App Store during a shopping rush means that installs have surged, and word‑of‑mouth is strong. App store trackers have long observed that top‑three placements usually correspond to ongoing daily acquisition and higher retention during peak commerce weeks — the very conditions GoWish is riding.

A business model designed for affiliate scale

Behind the scenes, GoWish transmutes intent to transactions via an extensive commerce graph. The company maintains partnerships with some 65,000 affiliates and over 700 brands directly, and hundreds of merchants are now embedding a “GoWish” button on their webpages to glean shareable, trackable intent. The model is already profitable: net profit after tax was $1.7 million in its fiscal 2024, management says, and being plowed back into growth.

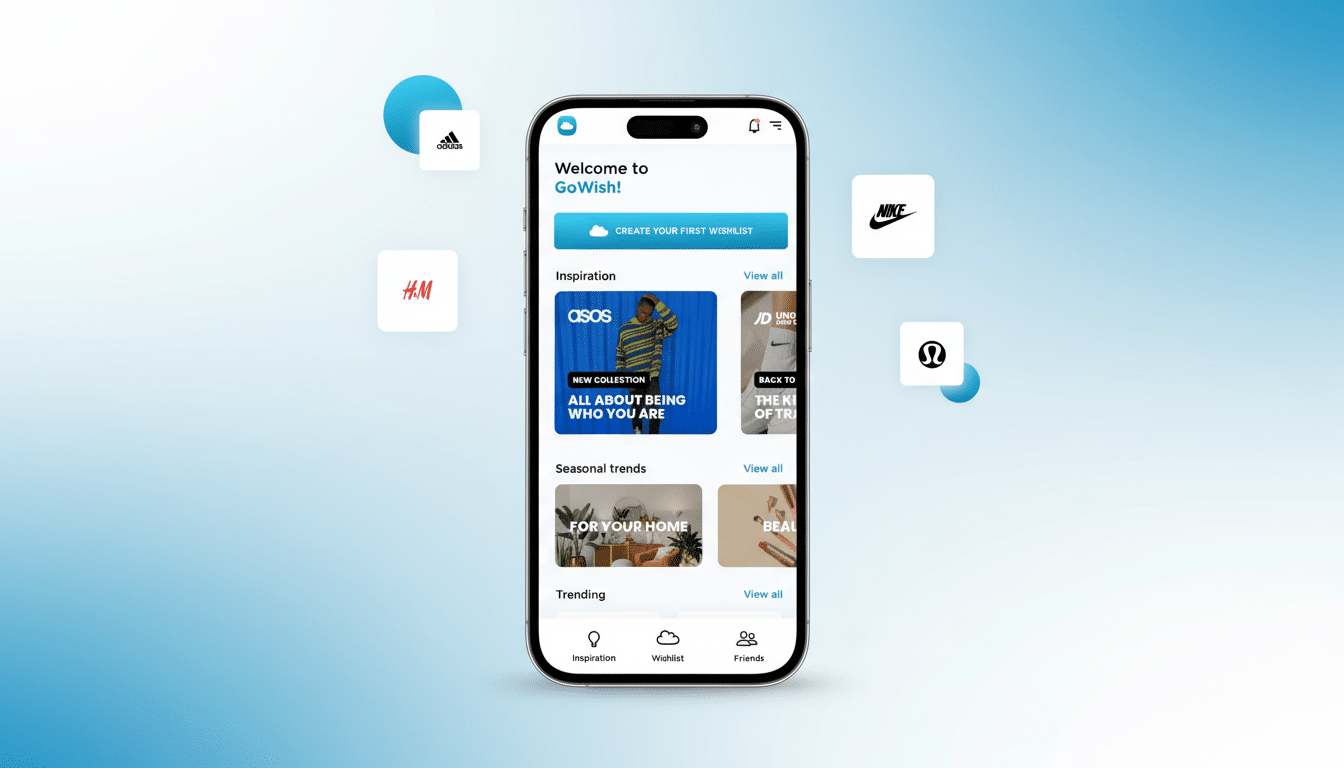

Functionally, it allows people to create multiple wishlists, add items by URL or in‑app search, and tap through to retailer sites to purchase.

The secret sauce is social utility — friends and family can reserve items to prevent duplicates, completing the circle between inspiration and coordinated purchase. And that utility is all the more powerful at scale, especially around recurring events like birthdays and holidays.

Social marketing drives customer acquisition

GoWish’s hike also speaks to a disciplined paid growth playbook. The company attributes efficient spend across Meta, TikTok, Google and Snap for its momentum on the global rollout front. Snap even showcased the app on a quarterly earnings call as a partner success story — rare air for a consumer shopping tool and good evidence its creatives and audience targeting are landing.

The timing helps. Seasonal gifting is also on the rise, and discovery now starts more in social feeds and conversion through retailers. GoWish lies in the middle, consolidating intent and directing traffic to the places that convert best. The cross‑platform positioning means the company can maximize cost of acquisition against downstream affiliate yield, a flywheel that tends to work better in Q4 when basket sizes and return visits increase.

Fix gifting and cut returns with coordinated wishlists

More than growth, the product addresses a true cost center for retail. The U.S. rate of returns on retail purchases was about 14.5% of sales in recent years, according to the National Retail Federation. And by allowing reservations to be made on shared wishlists, GoWish minimizes duplicate gifting — a common cause of return misadventures — and allows shoppers to coordinate on size, color and model before checkout. Fewer mismatches lead to less friction for consumers and lower reverse‑logistics waste for merchants.

Leadership is framing the mission this way: “fix gifting.” Among them are AI components that aim to deliver smarter recommendations and predict trends for different groups of people, as well as for occasions. While it’s not clear exactly how the details would work, the goal is to move from being something akin to a wishlist utility into what could be described as a “global genie” for social shopping — a predictive layer that knows your intent before you say your intent.

From postal spinout into a global ecommerce player

GoWish’s origins are unconventional. The product originated in 2015 within the Danish‑Swedish postal service as Ønskeskyen, a seasonal wishlist tool that proved stickier than was anticipated. The app was then acquired in 2020 by the Danish VC, Dotcom Capital, which spun it out and released an international version. Today, the company is based in Copenhagen and has a team of roughly 90.

This year it was purchased by the London-based private equity firm Capital D, which now has about a third of the business, while Dotcom Capital holds the rest. That new funding and an orderly growth stack have provided the capital for GoWish to rise out of the Nordics into ecommerce’s largest markets, when combined with its native iOS and Android apps, along with a Chrome extension for speedy desktop adds.

What to watch next as GoWish scales into the new year

If trends for this season hold, GoWish heads into the new year with momentum on three fronts: consumer scale, merchant adoption and a profit engine it can reinvest.

Look out for deeper on‑site integrations as more brands add “save to GoWish” calls to action and AI‑powered recommendations that help get to group gifting and list management faster. The company has found a wedge between utility and social behavior — and is building that wedge into a defensible platform at precisely the time when the market is most ready to use it.