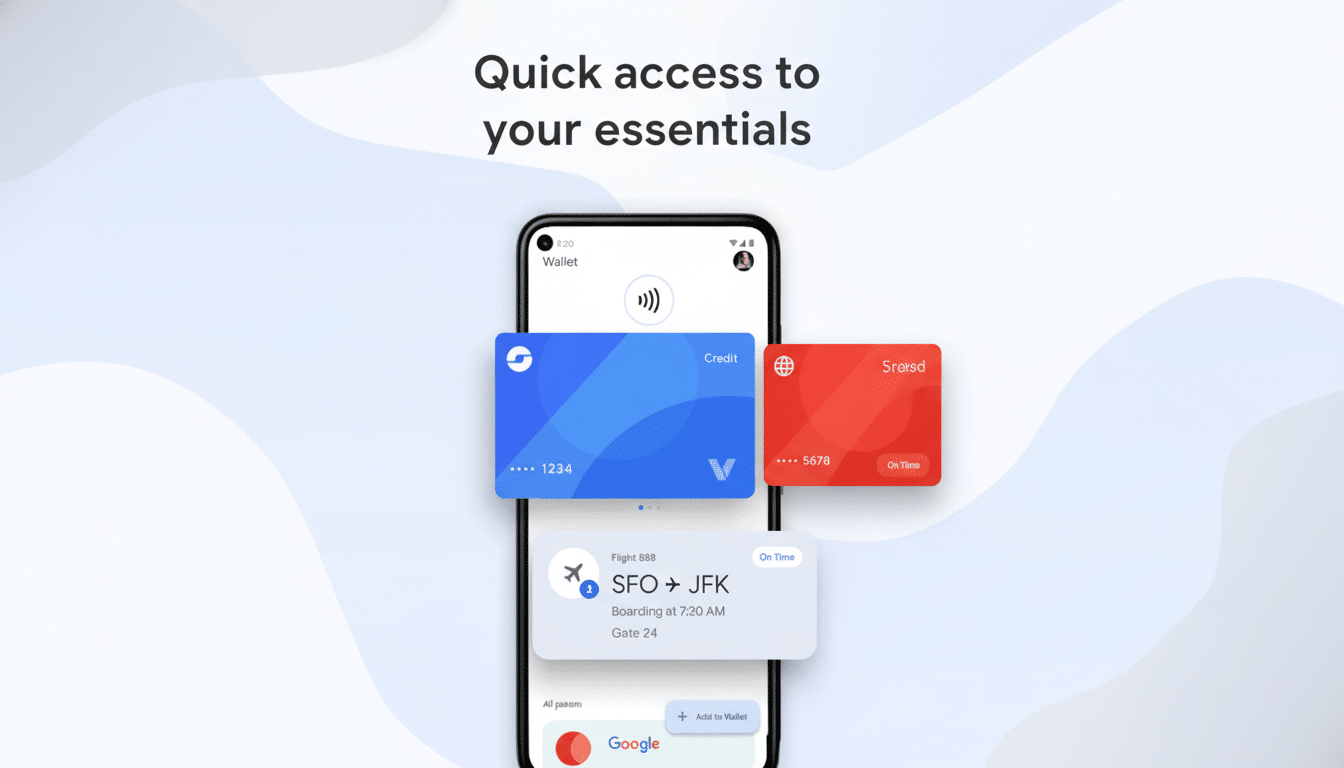

Google is creating a dedicated setting that lets commuters tap through gates without unlocking their phones and without changing their regular tap-to-pay default, quietly transforming usability for riders who manage many payment cards. The idea was found within Google Wallet v25.43.826060251, signaling a substantial, game-changing feature.

The Express Transit Card allows users to select a single debit or credit card for transit costs; after setting this up, you can tap your phone on a recognized transit reader and proceed—no PIN, fingerprint, or face unlock needed. In other words, you can finally have two defaults: one for the subway gate and one for the checkout counter.

While Google Wallet already supports transit in many cities through stored passes or open-loop contactless cards, switching payment cards at the entry has been an annoyance. If you use more than one card, you need to unlock the phone, open Wallet, and pick before passing. Express Transit is especially helpful because transit is time-sensitive and repetitive. Among competitors, only Apple Pay offers a version of this feature.

The move also brings Android closer to parity with competitors. Apple Pay has long offered an Express Transit option—on iPhone and Apple Watch—that does not require Face ID or a passcode and supports power reserve on some devices, allowing gates to open for a few hours after the battery has died. Samsung Wallet also has an express mode for select cards and agencies.

This alignment matters because transit payments are one of the most common use cases for mobile wallets. Contactless now accounts for more than 70 percent of all pay-as-you-go taps in Transport for London across the Underground and buses. New York’s MTA has seen 1 billion OMNY taps as riders have slowly converted from magstripe and MetroCard to bank cards and phones. In Singapore, the Land Transport Authority’s SimplyGo platform has seen millions of riders convert to open-loop contactless. Where transit leads, consumer behavior follows.

Why this Express Transit option is a real upgrade

Riders often keep a specific card for transit, particularly one tied to a budget, business paycheck, or a credit-card rewards category. Being able to mark that card—and leave the rest of your payment configuration unchanged—eliminates the need to compromise. If your default store card is a premium rewards credit card but your transit card is a corporate debit, the new Express Transit Card makes it as simple as possible.

It can also help minimize gate congestion. Readers are typically tuned for sub-500 ms processing to keep lines moving. By eliminating screen unlocks and manual card swapping, the new feature can help address bottlenecks, especially at busy stations during peak times when each extra second lengthens lines.

Security and banking support for express transit mode

Express transit flows build on a well-known exception in payment rules: certified transit terminals can authorize low-value taps without customer verification. This keeps the experience fast while limiting risk.

If your phone is lost, your card remains usable only at transit readers, and you can lock or wipe the device remotely through Find My Device. Issuers and networks enforce transaction limits and velocity checks to minimize abuse.

Not every card will work on day one. Banks must enable no-CVM transit access and may need to issue virtual-only cards for express transit. Some regional debit networks have historically lagged behind international operators in this respect. Processing volume may increase over time, with initial market access growing among major providers and established open-loop transit deployments.

Where Google may launch Express Transit support first

The most likely first markets are cities with open-loop EMV in operation; these systems already accept bank cards and mobile wallets at the gate, such as:

- London (TfL)

- New York (OMNY)

- Vancouver (TransLink)

- Chicago (Ventra)

- Sydney (Opal)

- San Francisco Bay Area (Clipper)

Markets built around closed-loop smartcards and stored-value systems may require additional development before they can support express form factors linked to bank cards.

The bottom line on Google’s Express Transit Card update

A separate Express Transit Card in Google Wallet may seem minor, but it tackles an everyday annoyance with a simple, platform-level solution. It mirrors behaviors commuters like on other platforms while giving Android users the option of distinct defaults for paying and traveling. It’s the kind of quality-of-life improvement that millions will enjoy daily, thanks to the widespread adoption of frictionless transit—one tap at a time.