GameStop has shut down a bizarre trade-in loophole that allowed customers to generate more store credit than the cost of a new console, a stacking error that went viral and briefly turned a standard promotion into a profit engine for savvy shoppers.

How the trade-in credit glitch worked and scaled fast

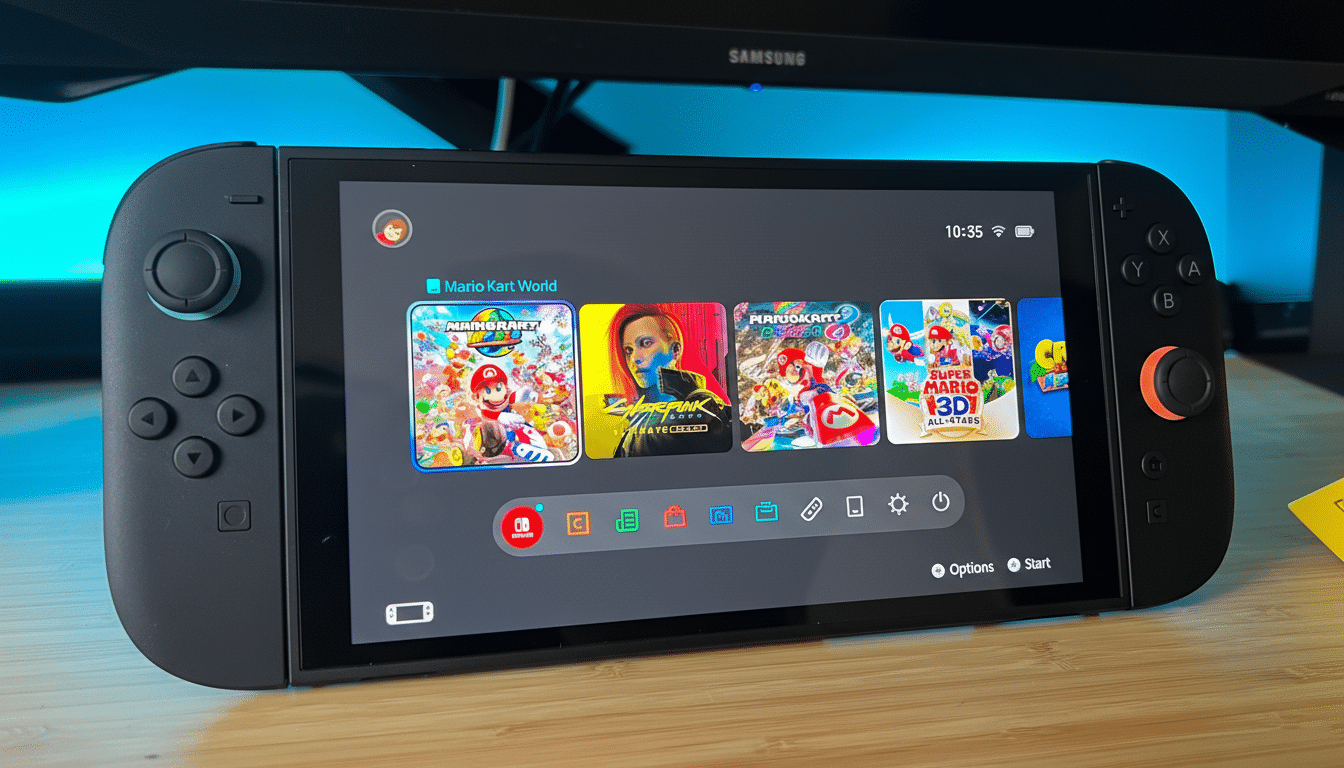

The exploit centered on the Nintendo Switch 2 and specific trade-in bonuses tied to buying a pre-owned game. After purchasing a new console, customers could immediately trade it back as a pre-owned unit, and the system—when combined with a qualifying pre-owned game purchase—issued credit that exceeded the original outlay. One widely shared example from creator RJCMedia showed a console bought for $414.99 yielding $472.50 in credit after the trade-in and promo boost, enabling repeat cycles that netted hundreds in surplus credit.

Once the method spread on social platforms, GameStop moved quickly to halt the program and recalibrate its promotions. In a public statement, the company acknowledged a system error that valued the pre-owned trade higher than the new retail price, and said it had updated the promotion rules to prevent repeated conversions of a new console into escalating credit.

Why overlapping promotions created negative-margin credit

This kind of arbitrage usually stems from overlapping incentives. Trade-in values are dynamically set based on market demand, inventory targets, and expected resale margins. Retailers often add time-limited “boosts” to spur attachment—such as awarding extra credit when a customer also buys a pre-owned game. If internal safeguards don’t cap how promotions stack or don’t compare final credit against the product’s retail price, routine discounts can create negative-margin transactions.

It’s a known risk in retail systems engineering: when promos, SKUs, and return states intersect, edge cases emerge. Common guardrails include maximum daily trade-ins per customer, cool-down periods before trading in newly purchased hardware, and logic to block any trade value that clears a threshold relative to MSRP. GameStop’s fix appears to have restored those checks.

What GameStop said—and didn’t—about the trade-in error

GameStop characterized the issue as a “narrow window” where customers could repeatedly run the same transaction for effectively unlimited credit. The company emphasized that its promotions have been adjusted and that stores aren’t intended to function as cash machines for arbitrage. It did not indicate whether it would retroactively cancel credits already issued, though retailers typically reserve the right to review transactions deemed abusive under program terms.

Impact on customers and GameStop’s retail strategy and costs

For customers, the immediate change is straightforward: the specific stack that created outsized credit is gone, and future trade-in offers will likely come with stricter rules around eligibility, timing, and ID verification. Expect more prominent disclosures and automated blocks against trading in newly purchased hardware within a short window.

For GameStop, the episode lands amid a long-running transition. As digital downloads dominate software spending, physical retailers increasingly lean on pre-owned inventory, hardware attachments, and accessories to preserve margins. Industry trackers such as Circana have documented the shift toward digital distribution, and analysts have repeatedly noted that trade-ins help drive store traffic and additional purchases. Reports have also highlighted planned store closures in the U.S., underscoring the pressure on brick-and-mortar operations as consumer behavior changes.

A familiar lesson in promotion design and safeguard testing

Promotions are meant to nudge behavior—trade the old, buy the new, pick up an extra game—without flipping the unit economics. When multiple incentives overlap, retailers must test for combinatorial outcomes, cap rewards relative to MSRP, and restrict rapid-fire trade cycles. In this case, a simple arithmetic miss turned a loyalty carrot into an arbitrage bonanza.

The loophole has been closed, but the takeaway lingers: in an era of dynamic pricing and viral how-to videos, it takes only one misconfigured rule for a promo to scale in the wrong direction. GameStop’s swift patch suggests those guardrails are now back in place—and that future trade-in events will be engineered with far less room for “infinite” anything.