Freeform has closed a $67 million Series B to accelerate its AI-driven metal manufacturing platform, aiming to push laser powder bed fusion from pilot lines to true factory throughput. The round, backed by investors including Apandion, AE Ventures, Founders Fund, Linse Capital, Nvidia’s NVentures, Threshold Ventures, and Two Sigma Ventures, positions the company to ramp production capacity and expand its workforce. PitchBook lists the company’s valuation at roughly $179 million.

AI-Native Metal Printing At Factory Scale

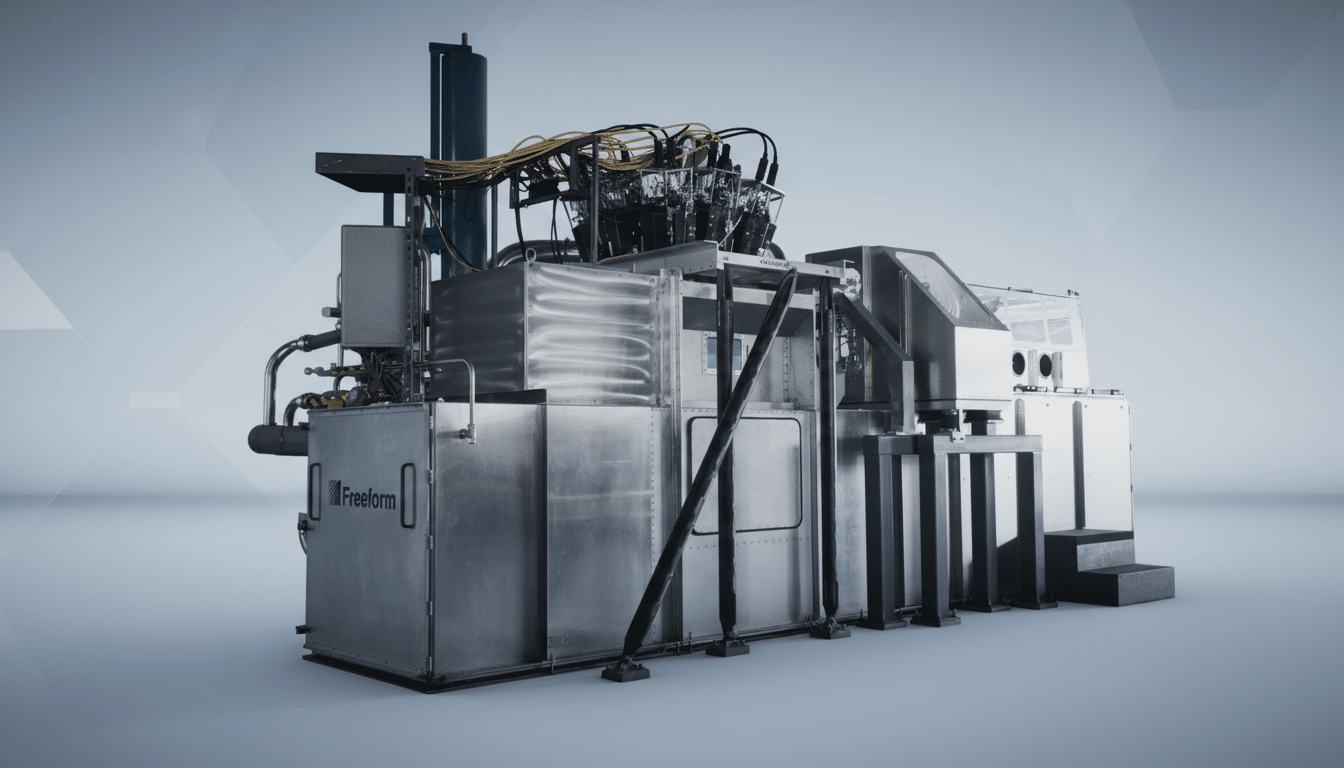

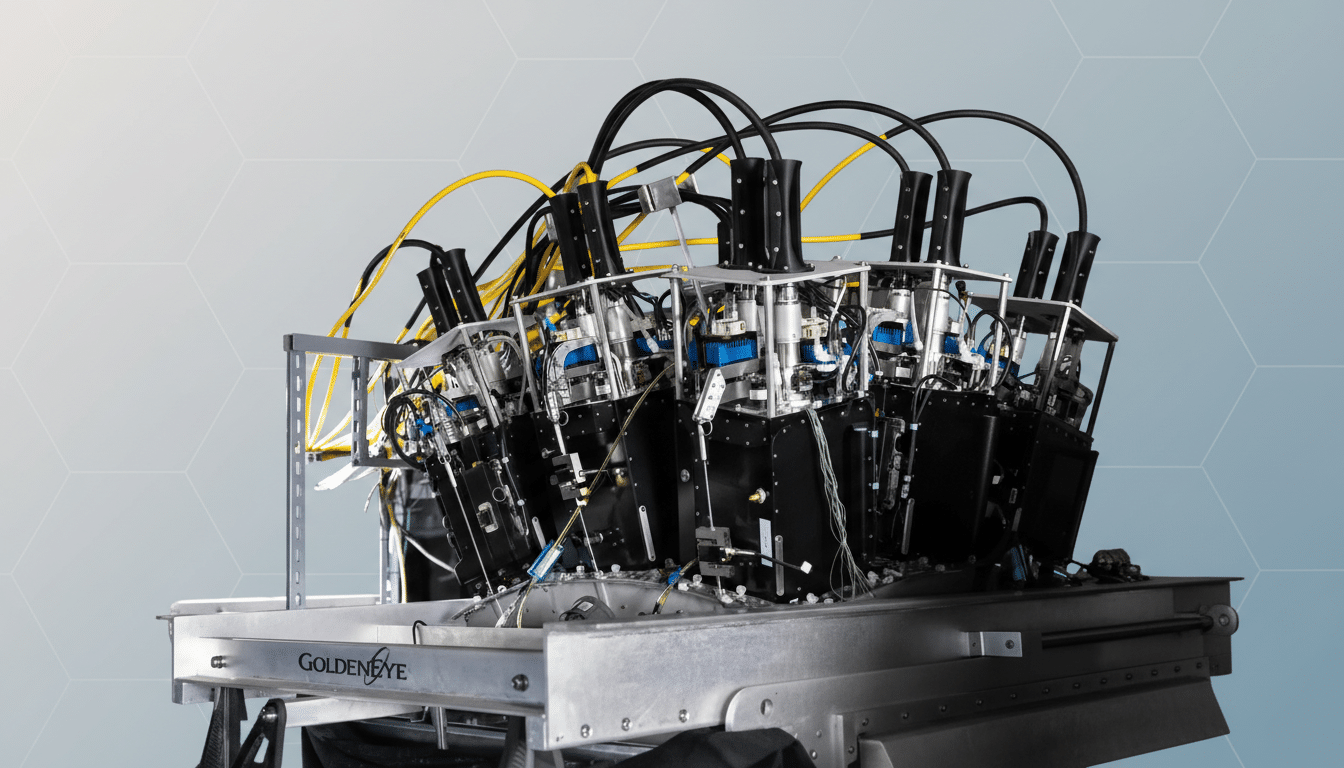

Freeform’s current system, known as GoldenEye, uses 18 synchronized lasers to fuse metal powders into high-precision components. The planned successor, Skyfall, is designed to deploy hundreds of lasers working in concert, with targeted output in the thousands of kilograms of finished parts per day. That leap isn’t just about adding more beams; it’s about coordinating complex thermal fields, gas flows, and scan strategies with real-time software control.

By architecting the platform as “AI native,” Freeform blends dense in-situ sensing with GPU-accelerated inference to make split-second adjustments on the fly. Melt-pool imaging, acoustic signatures, and layer-wise optical data feed closed-loop controllers that tweak power, speed, and pathing to stabilize the process and reduce defects. In metal AM, yield is the metric that rules unit economics; even single-digit improvements in first-pass success can swing cost curves, which is why access to Nvidia GPU resources through NVentures is strategically notable.

From SpaceX Roots To Manufacturing As A Service

Co-founders Erik Palitsch and Thomas Ronacher began charting this approach in 2018 after building rocket engines at SpaceX, where they saw first-hand that conventional metal printers were costly, finicky, and difficult to scale for production. Freeform rebuilt the stack—from optics and motion to sensing, simulation, and factory orchestration—to prioritize throughput and repeatability, not just part complexity.

The company says it is already shipping hundreds of safety-critical parts to customers across sectors such as aerospace, defense, energy, and robotics. With the new funding, Freeform plans to hire up to 100 employees and expand its facility to execute on a growing backlog. That playbook—deliver production parts as a service rather than only selling machines—mirrors a broader trend in advanced manufacturing, where capacity, uptime, and quality assurance are the product.

Why Investors Are Betting On Multi-Laser AM

Laser powder bed fusion has long promised software-like agility for hardware teams, yet the industry has been constrained by machine throughput and variability. The multi-laser architectures now arriving seek to break that bottleneck, but they introduce new challenges: laser-to-laser interference, part-to-part thermal coupling, spatter control, and the complexity of calibrating hundreds of optical channels. The differentiators are data density and control fidelity, and this is where Freeform’s AI-first design and simulation pipeline aim to stand out.

Investors have rallied around the broader category. Hadrian, which automates precision machining for defense, recently drew a $1.6 billion valuation. VulcanForms and Divergent have each raised substantial war chests to advance industrial metal printing. The thesis is consistent: as software-defined factories mature, digitally verifiable parts can move from prototypes to flight hardware and energy systems on compressed timelines, with traceability that satisfies stringent regulators.

The Data Moat And Execution Risks For Freeform

In additive manufacturing, process data compounds. Every layer imaged, every sensor tick, and every simulation-fed parameter becomes training material for better builds. Freeform says its platform captures richer physics data than rivals and uses it to tighten tolerances and accelerate qualification cycles. If sustained, that creates a defensible loop: better data yields better parts, which brings in more production, which generates more data.

Scaling to “hundreds of lasers,” however, is a nontrivial engineering gauntlet. Optics must remain precisely aligned across large build volumes, inert gas flow must evacuate spatter without disrupting melt pools, and software must manage interaction effects at millisecond cadence. Delivering on Skyfall’s promised daily tonnage will hinge on achieving high first-pass yield, robust post-processing, and certification-ready quality systems for sectors such as aerospace and medical.

What To Watch Next As Freeform Scales Laser Metal AM

Key milestones to track include the first Skyfall installations, sustained multi-shift utilization at targeted throughput, and evidence of reduced cost per part versus legacy L-PBF systems. Also watch for deeper partnerships with materials suppliers and GPU compute providers, as well as new customer disclosures in regulated industries. If Freeform delivers factory-scale laser AM with consistent quality, the $67 million infusion could mark the moment AI-driven metal printing shifts from promise to production.