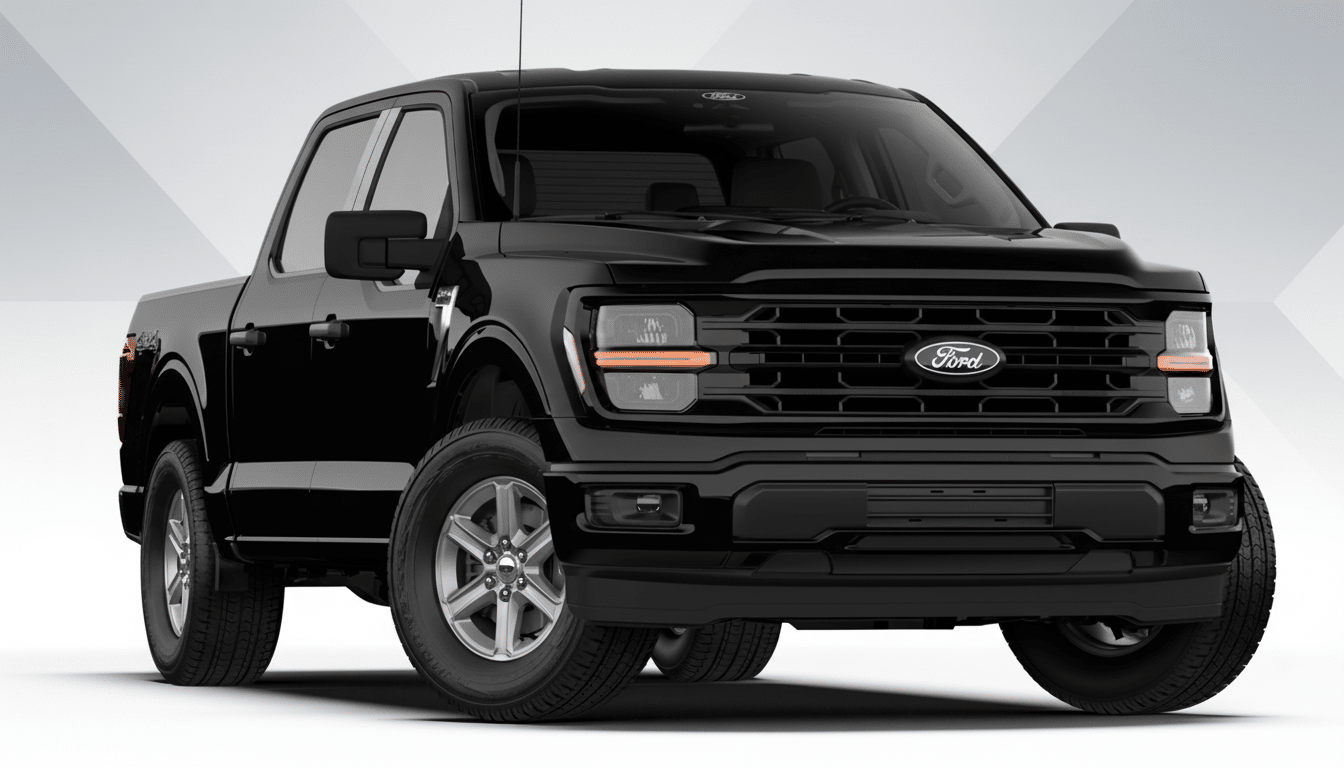

Another fire was reported at Novelis’ aluminum rolling and finishing complex in Oswego, N.Y., a key source of automotive sheet for Ford’s F-150 line that includes the Lightning all-electric pickup. The incident injects new uncertainty into an already fragile supply chain after previous fires interrupted output this fall and led the automakers to reshuffle production plans.

Latest Oswego fire details and context from recent months

No details about the latest fire were immediately released by the company or local officials, but at least three fires have broken out at the site since September. Novelis experienced a significant fire in September which led to the halt of operations, and a smaller one in October as it worked toward bringing processing back online in December. The repeated stoppages illustrate just how complicated and delicate aluminum rolling can be, with furnaces, quench oils, and lubricants representing long-term fire hazards whenever there is a deviation from the process.

- Latest Oswego fire details and context from recent months

- Production and supply chain impacts across Ford and OEMs

- Ford and supplier responses as production cautiously resumes

- Why the Oswego aluminum sheet plant matters to automakers

- Safety and insurance context for aluminum rolling operations

- What to watch next as Novelis and Ford update restart plans

When incidents like this do occur, thermal equipment and coil handling, as well as maintenance procedures, typically become the focus of investigators. While each plant is unique, the round of restarts and additional disruption is a common cycle in heavy industry, where conditions must be brought up gingerly to avoid thermal shock and oil vapor ignition in hot spaces.

Production and supply chain impacts across Ford and OEMs

Ford warned following the September shutdown that supply disruption from Oswego could eventually cost the automaker about $2 billion, in terms of lost production, reworked parts, and logistics friction. The F-150 has been made with aluminum body panels for years, so steady shipments of that type of sheet at the right gauge and temper are critical. After the September fire, Ford slowed production throughout the F-150 lineup and focused on gas and hybrid models over the Lightning to restock inventory and stabilize sequencing.

Stellantis and Nissan also experienced more limited production shortfalls earlier this fall, highlighting how concentrated North American auto-grade aluminum capacity has become. Qualification of standby mills is not easy: body-in-white panels require close surface and formability tolerances, and stamping plants tune dies to actual coil properties. The shortest hitches can reverberate into weeks of bottlenecked throughput as facilities clear backlogs.

The Aluminum Association has forecast as much as 500 lbs of aluminum per light vehicle as a benchmark by mid-decade, spurred on by fuel economy standards and EV range targets. And that structural shift compounds the impact of even a single high-volume sheet mill outage, since there can be one facility or more supplying a number of OEMs via integrated service centers.

Ford and supplier responses as production cautiously resumes

Ford began limited F-150 production in October and has been sorting trims and configurations against the stock of aluminum sheet it was able to obtain. The company has long favored dual-sourcing and safety stocks for critical commodities, but just-in-time manufacturing leaves thin buffers when a core plant stumbles. Researchers at S&P Global Mobility have frequently stressed that metals and chemical inputs are amongst the most difficult to replace quickly in an automotive supply chain—and not least for exterior panels on which surface quality determines so much of customer perception.

Novelis has a larger network of North American plants, with facilities in Kentucky and Ontario, and has pursued capacity expansion to meet demand from auto customers. Still, redirecting volumes involves slotting into the already tight schedules and transporting coils through certified logistics lanes. Ford and Novelis also operate a closed-loop recycling program that captures aluminum scrap from the stamping function, feeding it back into the mill—an efficiency that is increasingly difficult to execute smoothly when the usual production flows are disrupted.

Why the Oswego aluminum sheet plant matters to automakers

Oswego is one of the major finishing centers in North America for automotive-grade 5xxx and 6xxx series aluminum sheet used for hoods, doors, fenders, and beds. The output plant is designed to produce for deep draw and dent resistance, and its coils travel in tight schedules which feed stamping facilities. When a plant like Oswego stops, downstream operations have to scramble that mix, delay some trims, or dip into inventory not originally designed for long periods of outage coverage.

The significance of the site also underscores larger industry gambles on lightweighting. The F-150, with its aluminum body panels, was able to add lightness compared to the old steel one, increasing fuel economy and payload while preserving towing capability. EVs like the F-150 Lightning rely on similar strategies to counter battery weight and protect real-world range.

Safety and insurance context for aluminum rolling operations

Industrial insurers and risk engineers have long highlighted the risks of aluminum rolling, stressing oil management, ventilation, and heavy controls on hot work. NFPA, OSHA, and others provide guidelines that mills use to control ignition sources and housekeeping, but restarts are touchy by their nature. In some cases, business interruption insurance can help mitigate the financial burden, but it doesn’t erase the operational and market implications for OEMs committed to coil chemistries and finishes.

What to watch next as Novelis and Ford update restart plans

Key signposts in the near term now include:

- An assessment of Novelis’ damage and updated restart timeline, with any delay from the previously targeted December recovery likely to echo across Ford’s build schedules.

- New guidance from Ford on F-150 and Lightning output, as well as signs of temporary sourcing from other certified mills.

- Possible pricing pressure on auto sheet and whether other OEMs re-sequence model mixes to save constrained grades.

Until then, the latest Oswego fire underlines a persistent truth for automakers: Even small disruptions at the metals tier can rapidly escalate into a gating factor on high-margin trucks and hot EVs, with financial implications that dwarf any incident footprint on the factory floor.