Europe’s startup engine is humming back to life, relatively speaking. This year more than 10 companies crossed the $1 billion valuation threshold, bucking the chill of late-stage funding and highlighting how deep tech, AI, defense and health care are remaking the region’s next generation of category leaders.

While mega-rounds are rarer than the boom years, the new unicorns cut across a striking range of sectors and check sizes — nine‑figure Series As to convertible growth rounds — indicating that investors are looking to back companies with fundamental technology, mission‑critical software and capital‑efficient models. The analyses by PitchBook, by Dealroom and Atomico, all suggest the same trend: less froth, but a healthier profile of Durable, Research and Development Intensive companies scaling to global size.

Where the new unicorns are

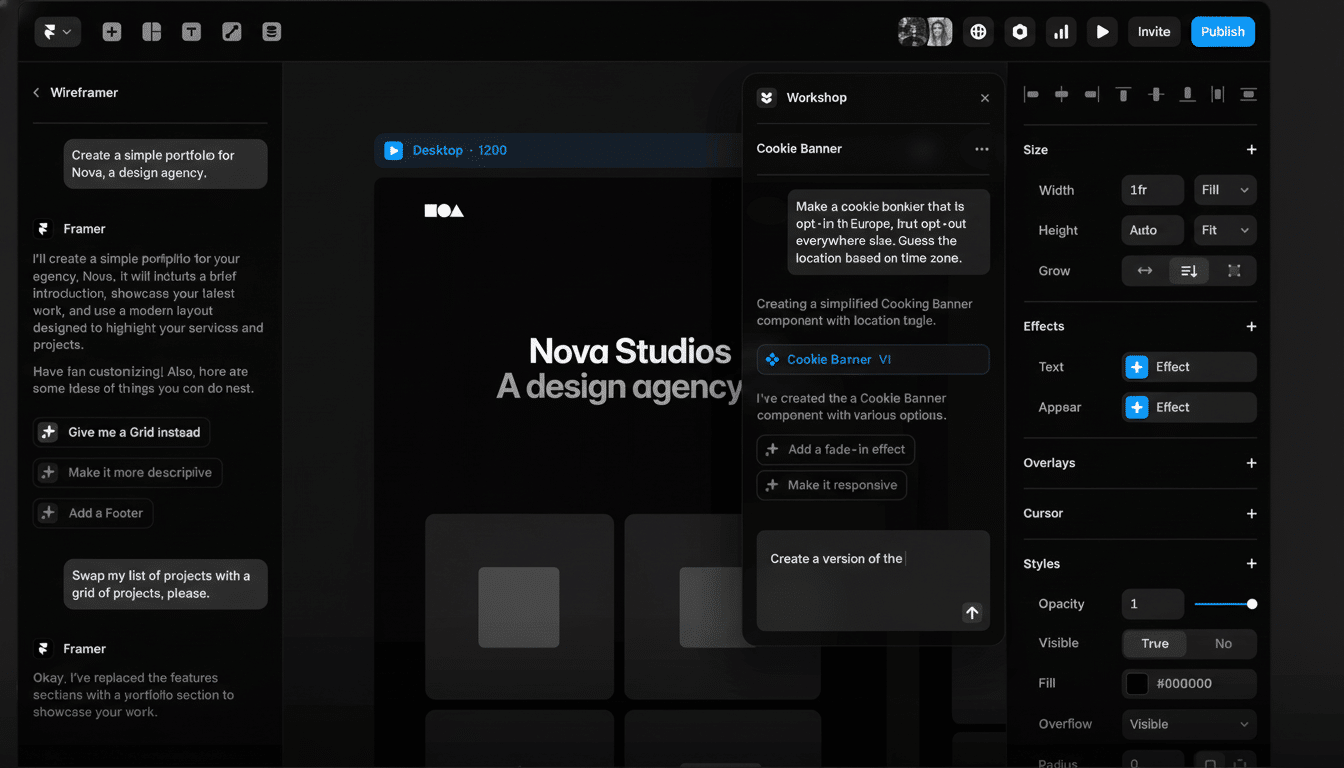

AI remains the headline act. Enterprise AI has also continued to raise ever bigger rounds: Parloa reached unicorn status with a $120 million round that valued it at $1 billion as WFA player Tines became another new deca-corn, raising $125 million at a $1.1 billion valuation, as its software now processes over a billion automated actions for customers every week on its platform. Framer, the design‑forward, no‑code website builder, when it was valued at about $2 billion following a $100 million cash injection to bet heavily on enterprise and AI features. Lovable, the fast‑viraling “AI coding” entrant, shot up to around $1.8 Billion on the heels of a $200 million Series A led by Accel—an unusually accelerated trajectory to unicorn scale that demonstrates AI’s current draw for both devs and execs.

Defense and dual‑use aerospace are just as high profile. Germany’s Quantum Systems was a unicorn on a €160 million Series C from Balderton and strategic investors like Hensoldt and Airbus Defense and Space like autonomy and AI‑native drones as critical infrastructure. Isar Aerospace cleared the threshold with a €150 million convertible deal with Eldridge, contributing to the rise of commercial launches in Europe. The Portuguese, Tekever, which is also developing long‑range maritime surveillance drones (with the support of the NATO Innovation Fund and long‑only investors) confirmed a valuation in excess of £1 billion.

Health and biotech were responsible for some of the biggest checks of the year. De Facto Systems, a health care data and D.N.A. research concern, that was also started by Nat Turner and Zach Weinberg, secured $400 million from SoftBank, funds that were part of the money SoftBank had committed to buying stock in WeWork.Commonsense Robotics, a developer of robots with facilities that it said could be used to help deliver groceries from a warehouse or from the store, collected $30 million.And Isomorphic Labs, a drug‑discovery spinout from DeepMind, the artificial intelligence lab of Google’s parent company, Alphabet, brought in $600 million from Thrive Capital, along with GV and Alphabet. Verdiva Bio, which is developing an oral GLP‑1 therapy influenced by blockbuster metabolic drugs, became a unicorn right off the bat with a $410 million Series A. Neko Health, a preventative health startup that counts Spotify’s Daniel Ek as co‑founder, raised $260 million at a value of around $1.8 billion to scale full‑body scanning and early detection.

The bank of deep tech infrastructure is punching above its weight. Finland’s IQM followed after raising over $300 million for quantum hardware and a cloud platform, collectively totaling to around $600 million. France’s Zama passed the mark with a $57 million Series B to productize fully homomorphic encryption, which allows companies to compute on encrypted data — an increasingly good capability as AI and privacy requirements intersect.

It’s not just hard tech the sector is crossing. The curated streaming platform and film producer and distributor Mubi reached unicorn status with a $100 million round led by Sequoia Capital. In energy, Fuse Energy, which was founded by former executives at Revolut, was said by The Times to have raised at a value north of $1 billion as it develops a modern renewable utility.

Smaller rounds, stronger signals

Many of these rounds, as small as they are relative to the peak of the cycle, are smaller in absolute dollars, but they’re sending far more credible signals. CB Insights and the Dealroom have also observed how disciplined burn is instrumental in producing unicorns faster through real revenue traction, not just momentum. Some of this year’s entrants hit scale on efficient go‑to‑market models —security and operations automation at Tines, AI‑assisted service at Parloa, design‑led SaaS at Framer — from which it was simpler to put gross margins and net retention under the microscope.

Another theme is strategic capital. Space and defense deals are often fueled by corporate and government‑adjacent backers — Airbus entities at Quantum Systems, NATO Innovation Fund at Tekever — that appear to reflect an ecosystem that now values capability and procurement readiness as much as it once coveted growth rate. Convertible structures, such as the one Isar Aerospace has, likewise indicate late-stage investors who are searching for downside protection while maintaining exposure to potential breakout results.

A genuinely pan‑European pattern

The new unicorns chart a wide geographic spread: the Nordics (IQM in Finland; Neko Health and Lovable in Sweden), DACH (Isar Aerospace, Quantum Systems, Parloa), the U.K. and Ireland (Isomorphic Labs, Tines, Fuse Energy, Mubi), France (Zama) and Portugal (Tekever). University spinouts and research clusters are key—Isar itself is the product of one of the largest ones, the Technical University of Munich, which in recent years has spawned dozens of unicorn‑scale companies —and confirms the thesis stipulated in The State of European Tech on the role of the intersection between world-class research and applied engineering to define Europe’s advantage.

Cross‑border capital remains a constant. U.S. growth firms such as Sequoia, Thrive, General Catalyst, Altimeter and Accel appear alongside Europeans veterans like Balderton, Atomico and HV Capital. That mixture has allowed European startups to scale globally at an earlier stage, particularly in regulated industries, where distribution and partnerships can make or break the P&L.

What to watch next

Two catalysts might keep things going at this rate. First, AI is shifting from pilots to production. Platform that automate while demonstrating compliance: As enterprises harden security, privacy and governance, platforms that combine automation with provable compliance — think Tines, Parloa, Zama — are well positioned. Second, policy tailwinds in defense, energy and health make for long and steady demand curves that play to European advantages in dual‑use hardware, clean power and medical innovation.

Exits remain the open question. I.P.O. windows contract, and many of this year’s unicorns will have to survive on secondary sales, strategic deals or revenue‑funded growth. The European Investment Bank and a number of national funds have argued for larger pools of late‑stage and crossover capital; if they appear, anticipate more home‑grown champions scaling out as independent companies instead of selling early on.

Mind the caveats

Not every unicorn badge is created equal. Some valuations are private, others are inferred and a few are based on convertibles or mixed equity rounds. As analysts at PitchBook are quick to warn, the threat of a down round hasn’t evaporated. But the cross‑section of this year’s cohort — AI software, quantum, drones, biotech, encrypted computing, renewables and media — implies substance along with sizzle.

The headline is straightforward: Europe is creating billion‑dollar companies again — but with a leaning to hard problems and global markets. If that trend persists, the question will no longer be whether the region can mint unicorns, but how many will grow into enduring public companies anchoring the next decade of European tech.