Europe’s proposal to ban sales of combustion cars by 2035 just became more ambiguous and the people making the next generation of electric mobility are not happy about it. The European Commission’s new approach would let as much as 10% of the new fleet be hybrids or other non-zero-emission models in 2035, if manufacturers buy carbon credits — a policy that comes as part of a broader Automotive Package designed to maintain industry “flexibility” and competitiveness.

Electric startups and climate-focused investors say the message is clear: a slower electrification, higher level of uncertainty, and more leverage for incumbents who wanted even more time. For many young companies, policy clarity is oxygen; ambiguity jacks up financing costs and slows factory build-outs, partnerships and hiring.

- What Changed, and Why It Matters for 2035 EV Goals

- Startups Say: A Risky Slowdown in Momentum

- Carmakers Split as Policy Signals Change

- Infrastructure & Supply Chain Continue to Be the Bottlenecks

- China’s Emergence Adds Competitive Pressure

- Emissions Math and the Price of Waiting in Europe

- What to Watch Next as EU Negotiations Move Forward

What Changed, and Why It Matters for 2035 EV Goals

The initial rule called for all new car sales to be zero-emission by 2035. The revision retains the headline year, but would reduce that to 10 percent for non-zero-emission models if carmakers offset those emissions using other means. The Commission contends that this will, in turn, allow breathing space as Europe ramps up batteries, chargers and critical materials.

Startups counter that offsets are a poor stand-in for the end of the tailpipe. Independent evaluations like those by the European Court of Auditors and standard setters, such as ICVCM, have time and again highlighted integrity and durability gaps within voluntary carbon markets. If the offset channel fails to deliver, Europe risks higher actual emissions with little industrial benefit.

Startups Say: A Risky Slowdown in Momentum

Founders and climate VCs from the group behind the Take Charge Europe letter, which was signed by execs at companies including Cabify, EDF, Einride and several battery and charging startups, have urged the Commission to keep the 2035 zero-emission line unchanged. The case they are making is pragmatic, not just ideological: Clear demand signals scale up, and scale drives costs down.

Learning-curve effects are particularly strong for batteries and power electronics. Double the cumulative production usually leads to significant cost reductions, which applies across lithium-ion cell manufacturing and EV drivetrains. That also has the effect of smoothing a process that can take four or five periods before the doublings begin; watering down the target by 10% in its pivotal year will risk pushing back those doublings, keeping costs (bill-of-materials being what it is) high for longer and making it harder for European entrants to compete on price.

Carmakers Split as Policy Signals Change

Legacy manufacturers were lobbying for flexibility; their supply chains are extensive, and EU auto contributes about 6.1 percent of employment, according to the Commission. But not every incumbent sought a slowdown. Volvo has publicly stated that it would be able to meet a 2035 ban and has warned that backsliding on long-term goals risks undermining competitiveness by freezing private investment in charging infrastructure and clean manufacturing.

Industry groups are also concerned that offset costs of compliance could be passed on to sticker prices. If hybrids keep holding shelf space but become more profitable under the new rules, manufacturers might hold marketing budgets in place for them, delaying BEV adoption just at a time when network effects of charging and second-hand should be compounding.

Infrastructure & Supply Chain Continue to Be the Bottlenecks

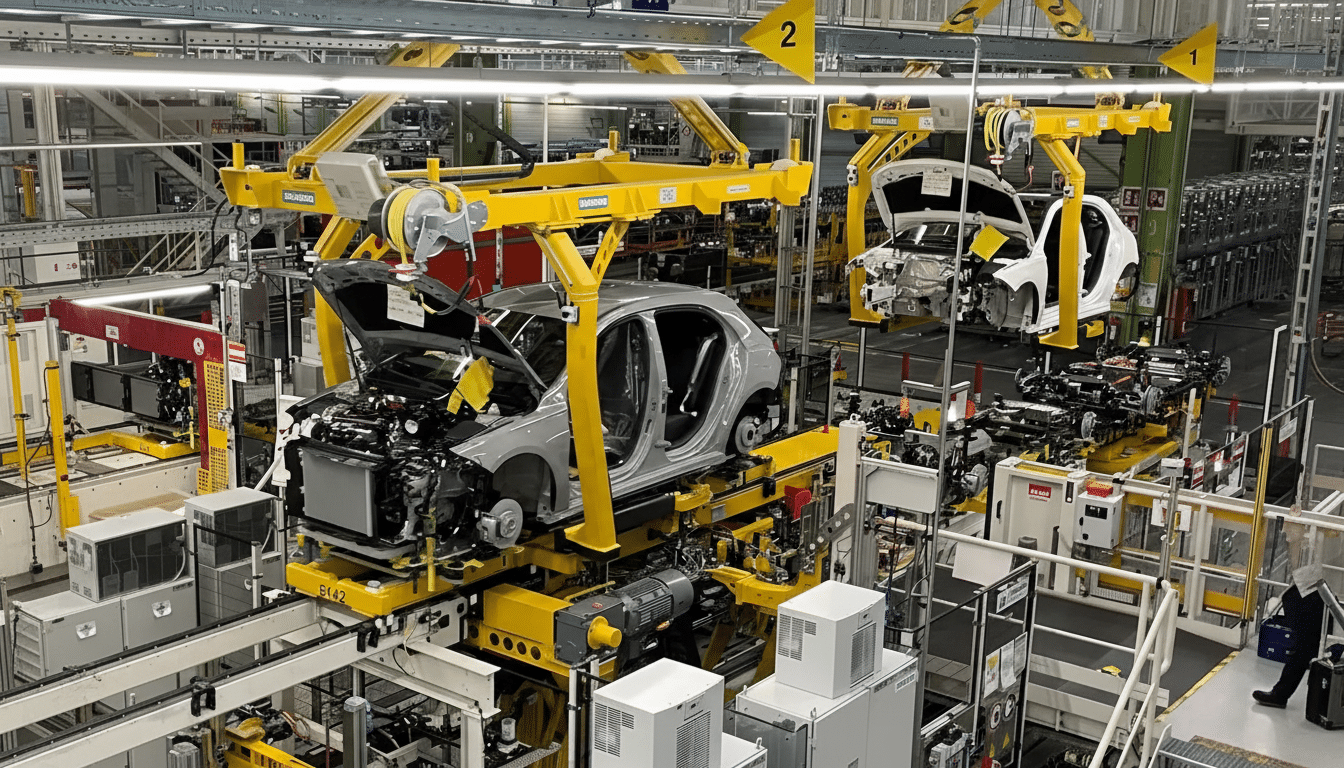

The package features a €1.8 billion Battery Booster to feed domestic cell, component and materials capacity. European battery hopefuls including Verkor, which is ramping a large factory in France, have welcomed that initiative as peers like Northvolt struggle with cost and execution headwinds.

Nevertheless, the funding is small compared to the size of the challenge. According to analysts at BloombergNEF and the IEA, hundreds of billions are required this decade in order to construct mines, refineries, cathode plants and gigafactories, plus more for grid upgrades and high-power charging. Europe’s AFIR rules and national schemes are driving chargers down its backbone corridors, but softer vehicle targets are threatening to dampen usage and delay financial viability for networks and software startups.

China’s Emergence Adds Competitive Pressure

“Chinese brands have rapidly increased their market share in Europe, which is now around 8% and growing of the region’s BEV sales,” said Transport & Environment. The EU has pushed for trade measures on subsidized imports, and the United States has sharply raised tariffs, while the U.K. hasn’t done so — creating a patchwork approach that adds strategic uncertainty for manufacturers plotting European footprints.

Startups caution that diluting the 2035 mandate and protection gaps could trap Europe as an assembly hub for foreign platforms rather than a cradle of full-stack EV innovation — from semiconductors to software-defined vehicles to recycling and second-life batteries.

Emissions Math and the Price of Waiting in Europe

Transport is the biggest emitting sector in the EU outside power, and road vehicles are responsible for most of those emissions. A 10 percent carve-out may not sound like much, but it adds up over model cycles, fleet turnover and infrastructure planning. If hybrids also take longer to sell, charging infrastructure develops apace, used residual values for BEVs stabilize, and corporate fleets (a typical early mover) shy away.

The cumulative effect is a more difficult funding environment for startups across charging, software, battery materials and recycling — made worse in these vital areas for Europe at a time when we need scale to anchor our long-term competitiveness.

What to Watch Next as EU Negotiations Move Forward

All eyes now move to Parliament and Member States on what the rule will finally look like — not least how offsets are defined and verified, how the Battery Booster is used, and whether national procurement and fleet mandates balance out against a weaker EU-wide target.

Founders say the stakes are simple: Either Europe locks in a virtuous cycle of scale, cost declines and exportable expertise or it signals a go-slow approach that will concede ground to faster movers. In the IEA’s forecast that predicts an ever-expanding market for EVs around the world, clarity is a competitive edge — and startups want Brussels to return it.