Ethernovia has secured a $90 million Series B round as capital rushes into the infrastructure needed to power “physical AI” — the real-world deployment of intelligent systems across cars, robots, and industrial machines. The San Jose startup builds Ethernet-based processors that aggregate torrents of sensor data and shuttle it with low latency to central compute, a backbone capability for autonomous vehicles and next-gen robotics. The round was led by Maverick Silicon, an AI-focused fund launched by Maverick Capital, with prior backers Porsche SE and Qualcomm Ventures participating.

Ethernovia Targets the Physical AI Data Spine

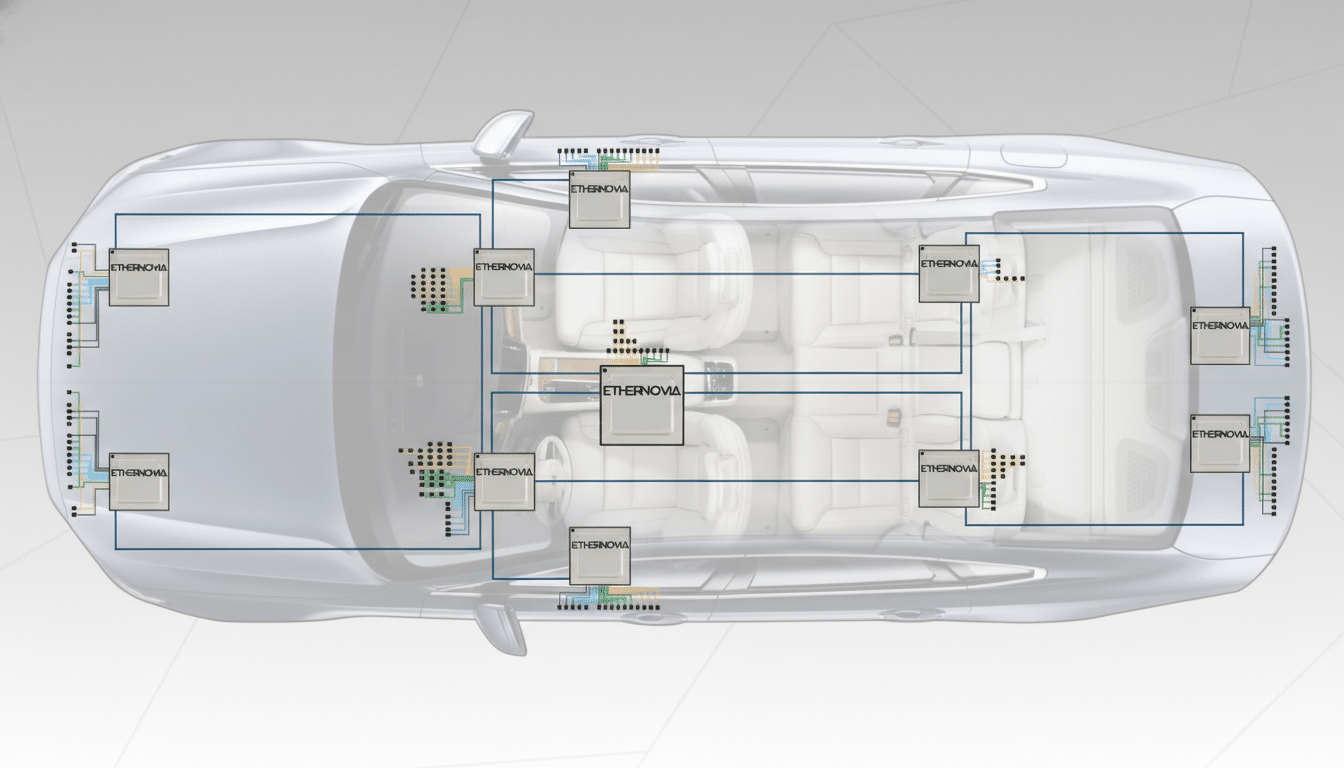

Every camera, radar, lidar, and ultrasonic node in an intelligent machine must deliver data deterministically to a central brain. Ethernovia’s Ethernet-oriented silicon aims to do exactly that: consolidate high-bandwidth sensor streams at the edge and transport them efficiently to domain and zonal controllers. This is the connective tissue for modern electric and autonomous architectures, where traditional CAN and LIN buses are giving way to gigabit-class Ethernet with time-sensitive networking.

The approach aligns with the industry’s shift to zonal E/E designs, which replace dozens of discrete ECUs with a handful of powerful controllers. IEEE standards such as 802.3ch have opened pathways to multi-gigabit automotive Ethernet, while TSN features help guarantee timing. In safety-critical stacks, that matters: latency budgets, redundancy, and isolation must meet ISO 26262 targets as vehicles and robots make split-second decisions in dynamic environments.

Why Bandwidth and Determinism Decide Winners

Data volume is exploding at the edge. Industry estimates often cite that autonomous prototypes can generate several gigabytes per second, with Intel previously projecting up to 4 TB of data per car per day under certain scenarios. Even advanced driver-assistance systems now push multi-gigabit payloads from cameras alone, making 1–10 Gbps links increasingly common inside vehicles. Without a predictable, secure network fabric, expensive AI accelerators sit underutilized.

The economics amplify the stakes. McKinsey projects the automotive software and electronics market to reach hundreds of billions of dollars by the end of the decade as OEMs transition to software-defined vehicles. In that future, the value chain rewards companies that move data faster with fewer watts and greater reliability. Secure Ethernet — often with features like MACsec, hardware isolation, and in-line diagnostics — is becoming a baseline requirement.

A New Class of Backers Bids on Hardware for AI

Maverick Silicon’s lead role underscores how investors are building dedicated vehicles for AI hardware and edge infrastructure, not just model training in the cloud. It’s the first sector-specific strategy from Maverick Capital in its three-decade history, reflecting how integral real-world deployment has become to AI’s next leg. Strategic investors matter too: Porsche SE brings an OEM lens on integration and scale, while Qualcomm Ventures connects to high-performance compute and connectivity ecosystems.

The broader trend is clear. As robots leave labs for warehouses and streets, and as vehicles grow more autonomous, capital is tilting toward enabling technologies: high-speed networking, sensors, power electronics, and safety-certified compute. PitchBook and other industry trackers have noted a rebound in hardware-centric AI deals as investors seek durable moats and revenue tied to production programs, not just cloud workloads.

Automotive Stakes and Competitive Landscape

Automotive silicon is a long game: design-ins are decided years before start of production, and parts must meet stringent AEC-Q qualifications and functional safety requirements. Ethernovia is vying for sockets alongside incumbent networking and MCU suppliers that include Marvell, Broadcom, NXP, Microchip, and Texas Instruments, while adjacent compute platforms from Nvidia, Qualcomm, and Mobileye continue to raise the bar on data ingest and sensor fusion.

Differentiation often comes down to combining bandwidth, deterministic latency, power efficiency, and integrated security in a cost profile automakers can scale across trims. As zonal architectures proliferate, suppliers that can collapse multiple functions into a single, software-configurable device — switches, PHYs, and acceleration where appropriate — gain leverage with OEMs seeking lower weight, fewer connectors, and simpler wiring harnesses.

What This Funding Signals for Ethernovia and AI

The fresh capital should help Ethernovia accelerate tape-outs, validation, and automotive-grade certifications while expanding customer support for global OEMs and Tier 1s. For the market, it’s another signal that the AI cycle is moving from proofs of concept to physical deployment, where reliability and unit economics rule. The companies that tame the data flood at the edge — moving bits predictably, securely, and efficiently — will be the ones that turn AI promise into production reality.