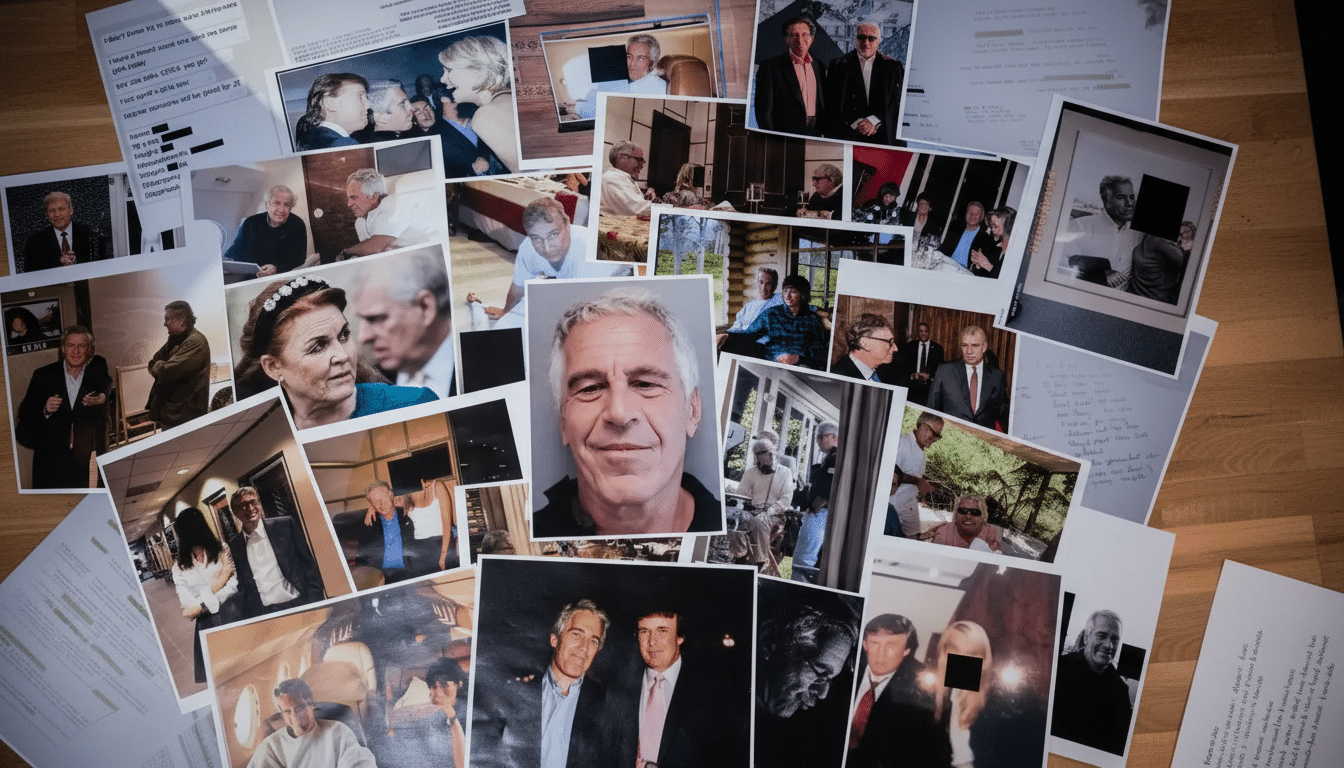

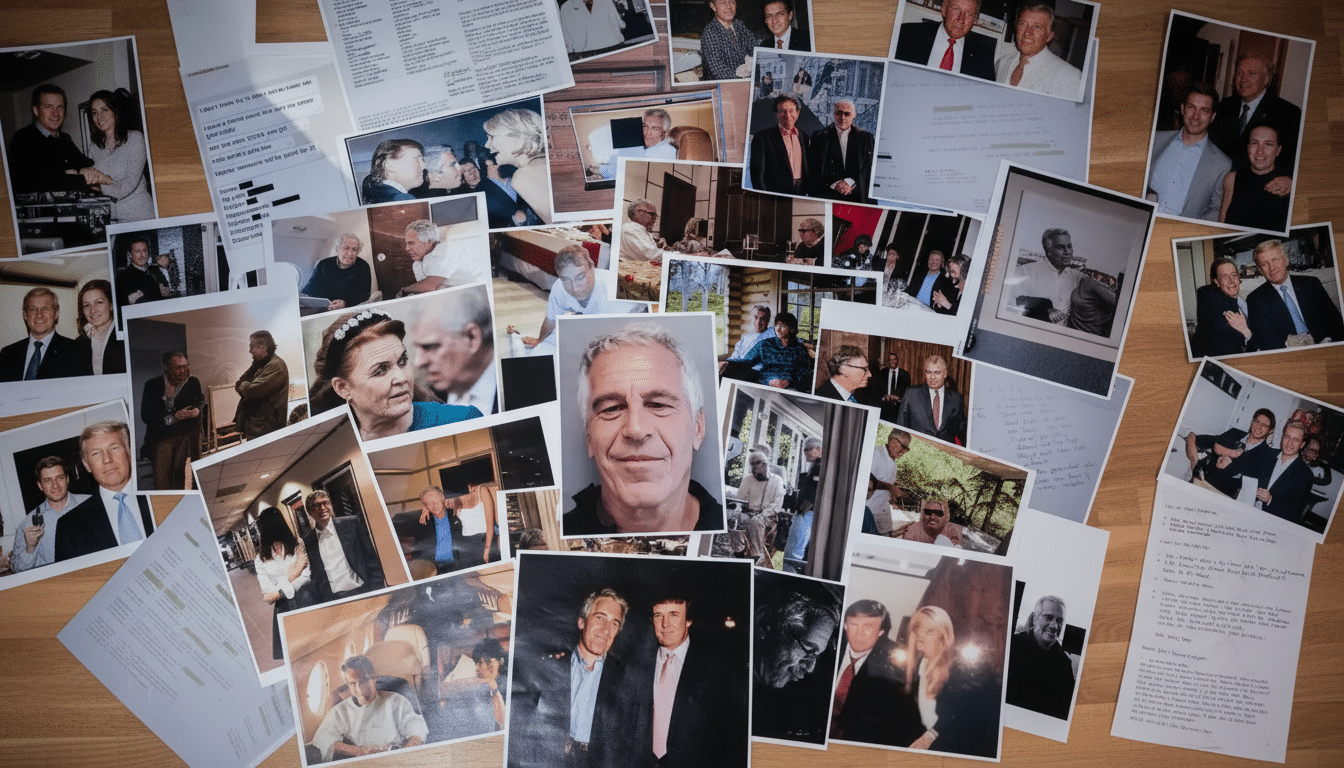

Newly released Justice Department documents tied to Jeffrey Epstein have surfaced a web of attempted dealmaking around electric vehicle startups at the peak of Silicon Valley’s mobility gold rush. The records, including years of emails, sketch out how intermediaries courted Epstein as a potential backer for marquee EV names even after his criminal conviction—revealing not just who was in the room, but how opaque capital, hype cycles, and information edges shaped the sector.

What the Files Show About EV Startup Dealmaking

Correspondence reviewed by journalists indicates a little-known financier, David Stern, repeatedly pitched Epstein on stakes in Faraday Future, Lucid Motors (then pivoting from a battery supplier to a luxury EV brand), and the Los Angeles-based startup that became Canoo. The emails suggest Stern pressed for confidential color from bankers, discussed rumored strategic interest from legacy automakers, and weighed whether to buy blocks of shares at “fire sale” prices to flip them if a larger investor stepped in. Despite the outreach, Epstein did not ultimately invest in those companies, according to the documents.

- What the Files Show About EV Startup Dealmaking

- Opaque Capital in the EV Boom and Hidden Ownership Risks

- The Quick-Flip Mindset Behind EV Deal Arbitrage

- Why Silicon Valley Looked Away During the EV Rush

- A Reality Check on the Startups Named in the Files

- What Investors Should Do Now to Vet High-Velocity Deals

The communications also place these approaches firmly in the years after Epstein’s earlier guilty plea—underscoring a discomforting throughline: access to capital and networks often eclipsed reputational red flags when deals appeared time-sensitive or richly priced.

Opaque Capital in the EV Boom and Hidden Ownership Risks

The files illuminate how the last decade’s EV surge attracted capital with complex provenance. As China’s auto sector pushed to look like Silicon Valley—setting up U.S. outposts and seeding startups—money moved through holding companies and family offices that masked true ownership. Canoo became a case study: court filings later identified an unusual investor mix, including a relative of a senior Chinese political figure and a Taiwanese electronics magnate, alongside Stern. Only litigation peeled back the structure.

That opacity was hardly isolated. During the SPAC wave, due diligence often lagged deal velocity. Dealogic and PitchBook data show EV and autonomous-vehicle companies raised tens of billions through blank-check mergers and private rounds in a two-year window, while governance controls and beneficial ownership checks sometimes came after term sheets were signed.

The Quick-Flip Mindset Behind EV Deal Arbitrage

Read together, the emails describe a strategy focused less on building enduring companies and more on transactional arbitrage. One thread referenced canvassing a bulge-bracket bank—identified in reporting as Morgan Stanley—for details on a capital raise at Lucid and weighing whether rumored interest from a major automaker, reported at the time as Ford, could create a near-term exit. It’s the classic spread trade: get in quietly at a discount, sell into a strategic’s valuation uplift. In the end, those specific trades did not materialize for Epstein, but Stern did back Canoo early, helping it off the ground before its later collapse into bankruptcy.

This flipside of innovation theater—the art of extracting returns from anticipation rather than operations—wasn’t unique to one set of actors. It thrived on pressurized timelines, banker whisper networks, and the notion that momentum would paper over messy cap tables.

Why Silicon Valley Looked Away During the EV Rush

Epstein’s prior conviction was public knowledge well before these approaches. Yet the allure of introductions to power, sovereign wealth, and celebrity endorsements repeatedly outweighed caution. The broader backdrop mattered: BloombergNEF estimates global spending on EVs and charging surged into the hundreds of billions in the last cycle, while CB Insights tracked record venture activity in mobility and battery tech. In that climate, warm intros could move rounds by weeks—and valuation by hundreds of millions.

When a market prizes speed, intermediaries who promise shortcuts—access to a strategic, whispers from a syndicate desk, a sovereign fund’s soft circle—gain leverage. The files show how that leverage operated in practice, even when the counterparty carried extraordinary baggage.

A Reality Check on the Startups Named in the Files

Lucid eventually secured a lifeline from Saudi Arabia’s Public Investment Fund, transforming its trajectory with a multibillion-dollar commitment. Faraday Future lurched through leadership turmoil, cash crunches, and delayed production. Arrival’s ambitious microfactory model unraveled amid cost overruns. Canoo, after a splashy SPAC and shifting strategies, filed for bankruptcy. The arc is familiar: lofty narratives, thin governance, and capital stack complexity colliding with the brutal economics of carmaking.

What Investors Should Do Now to Vet High-Velocity Deals

The lesson isn’t that outside capital is suspect—it’s that governance must travel at the speed of the market. Best practices are hiding in plain sight:

- Rigorous beneficial-ownership verification

- Conflicted-party screens

- Independent board oversight tied to financing events

- Explicit information-barrier policies when insiders source “color” from banks

Institutional LP groups like ILPA and industry bodies like NVCA have published guidance that can be adapted to venture and growth rounds in frontier tech.

For founders, the discipline is similar:

- Prefer transparent capital over mysterious money with strings

- Pressure-test investors’ time horizons

- Align governance to withstand rumor-driven cycles

Smart capital still backs hard tech—on terms that reward execution, not just proximity.

The Epstein documents don’t rewrite EV history, but they clarify it. Silicon Valley’s last mobility boom was not only a story of engineering ambition; it was also a story of who had access, what they knew, and how fast they could turn it into a trade. That’s a warning for the next wave—AI hardware, autonomous systems, and whatever acronym comes after—that the cost of looking the other way compounds faster than any markup.