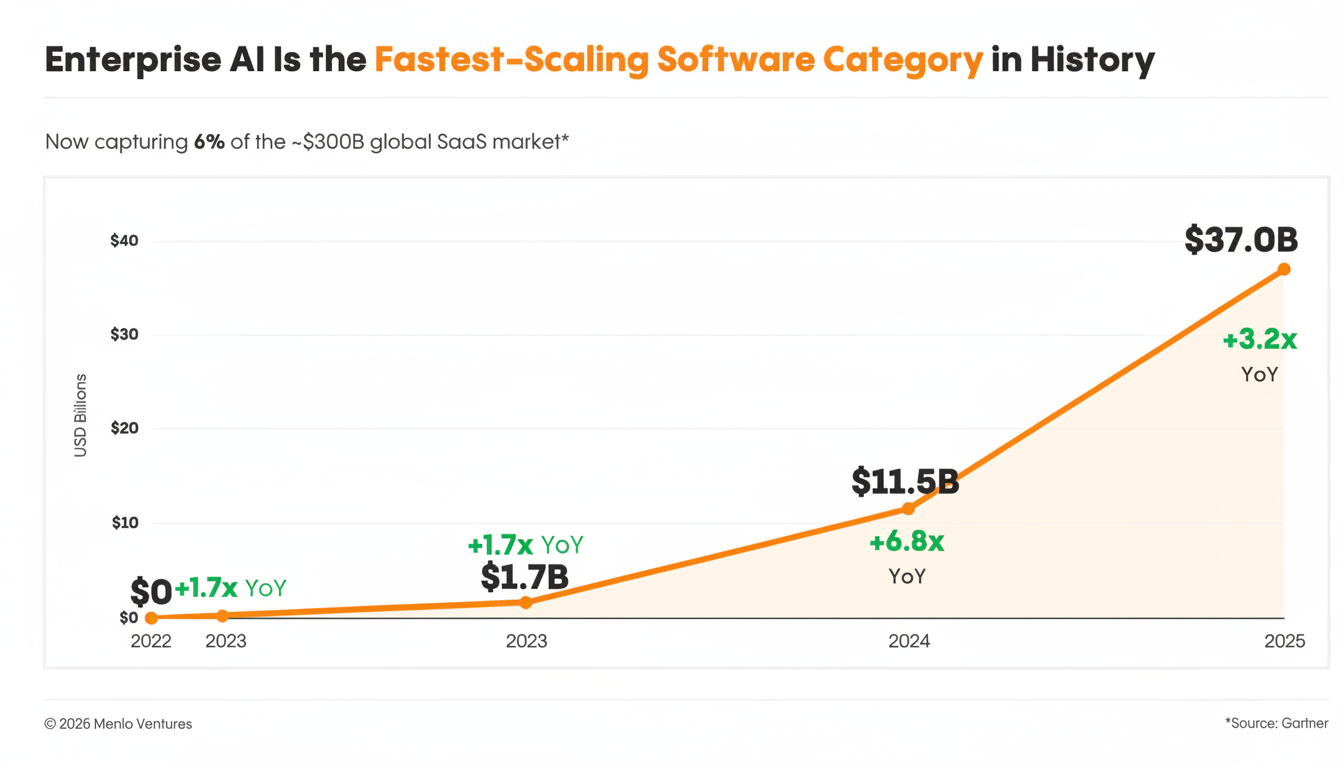

Investors are predicting a dramatic change in enterprise AI next year: budgets will grow, but fewer vendors will be paid. After two years of pilots and proofs of concept, CIOs and CFOs are driving toward consolidation, focusing on platforms and products that actually move the needle on revenue, cost, or risk — while curtailing duplicative tools.

Why Budgets Increase and Vendor Lists Shrink

Enterprises have confirmed enough use cases — customer-support copilots, software-development assistants, contract analysis — to support bigger line items. The financial lens has shifted: leaders are now seeking to cut total cost of ownership, measure productivity gains, and reduce integration headaches. IDC predicts global spending on AI-oriented systems to exceed $300B by 2026, and Gartner has forecast that over 80% of enterprises will be using generative AI APIs or models by 2026 compared to a minute percentage in 2023. That adoption curve, he says, means bigger checks — but not for everyone.

Investors at Databricks Ventures, Asymmetric Capital Partners, Norwest Venture Partners, and Snowflake Ventures say the era of experimentation is over. The pattern they’re suggesting is consistent: buyers will continue to coalesce around a shortlist of vendors who can show hard ROI in the field, and they will decrease spending on “nice-to-have” point solutions.

Money for Guardrails and Data Foundations

Safety, governance, and reliability features are now treated as first-class capabilities by executives. Look for more investments in model monitoring, data access controls, secure retrieval, lineage tracking, and content filtering — features that stretch from prototype to compliant, auditable systems. Helping to drive that push is the NIST AI Risk Management Framework and the EU AI Act, which collectively are nudging buyers toward standing up standard oversight and documentation.

Another budget magnet: data plumbing. Leaders are investing in data foundations (cleansing, transformation, vector indexing and policy enforcement) as those investments lift model performance across a wide swath of use cases. Snowflake Ventures and others also anticipate dollars to focus on post-training optimization, including fine-tuning, retrieval-augmented generation, evaluation on pipelines, and cost-aware routing across models.

Platform Gravity Favors Hyperscalers and Data Clouds

Consolidation favors the platforms that sell you models, orchestration, data, and security in one easy plan. Azure OpenAI Service, Google Vertex AI, and AWS Bedrock are momentum plays with enterprise procurement, driven by the fact that they lower vendor risk, simplify consumption-based compliance, and offer predictable economics per unit. Data platforms are heading in the same direction: Databricks and Snowflake now bundle vector search, governance, and application frameworks, pulling spend away from single-purpose tools.

The scouring of SaaS sprawl is advancing this trend. SaaS management reports published by companies such as Zylo have recorded hundreds of apps per large organization, many duplicative. By 2026, CIOs will trade sprawling AI toolchains for platform SKUs, coterminous agreements, and committed-use discounts — fewer invoices, fewer integrations, faster security reviews.

What This Means for Startups Competing in Enterprise AI

The bar is rising. Startups building upon generic foundation models with no proprietary data, unique workflows, or distribution advantages will lose as incumbents embed the same functionality in existing suites. We already have copilots within CRM, ERP, ITSM, and security platforms that are tackling the point-solution frenzy.

Where investors continue to see durable moats: vertical AI on non-public or hard-to-replicate datasets (e.g., specialized health care, industrial IoT, regulated financials), systems with proven unit economics (cost per task and quality measures), and safety or observability layers built into the enterprise stack. Look for more M&A as platforms acquire best-in-class pieces — like Databricks buying MosaicML and Snowflake picking up the search company Neeva — to jump-start their AI roadmaps.

How Buyers Will Choose Winners in the Next AI Cycle

Procurement teams are consolidating evaluation criteria.

Typical checkpoints are:

- Measurable time-to-value of 90 days.

- Clear cost curves and usage controls.

- Security attestations (SOC 2, ISO/IEC 42001, FedRAMP where applicable).

- Solid guardrails and audit trails.

- Model agility — can run a variety of foundation models without re-architecting.

The emerging model is a multi-model approach with a single control plane. Organizations will whittle down to a small handful of strategic vendors for data, models, and guardrails, then permit controlled experimentation at the edge around new use cases. It is a two-tier approach — platform for scale, selective tools for innovation.

The 2026 Outlook for Enterprise AI Budgets and Vendors

If investor predictions come true, in 2026 we’ll see bigger AI budgets, tamer vendor rosters, and faster deployments into core workflows. The winners will demonstrate lasting impact — reducing cost per task, increasing conversion or resolution rates, and mitigating operational risk — all while playing nice with the organization’s existing data and security systems. For everyone else, the pilot carousel is about to whip around.