Emergent, the India-rooted “vibe-coding” platform that lets people describe software in natural language and ship production apps, says it has crossed a $100 million annual run-rate just eight months after launch. The company reports more than 6 million users in 190 countries, roughly 150,000 paying customers, and over 7 million applications created on its service.

A Hypergrowth ARR And What The Math Suggests

The company says its run-rate more than doubled in the past month to top $100 million. With 150,000 paying customers, that implies an average annual spend of roughly $650 per account—an ARPU that looks more like serious prosumer and SMB tooling than a hobbyist sandbox. Emergent credits a mix of subscriptions, usage-based pricing, and deployment and hosting fees, and says gross margins are improving month over month.

While run-rate is not the same as GAAP revenue, it’s a useful pulse on demand velocity. If net revenue retention stays healthy and churn remains low, this early mix of recurring and metered consumption can scale quickly, particularly as customers move from prototyping to production workloads.

Why Vibe-Coding Is Catching Fire With Developers

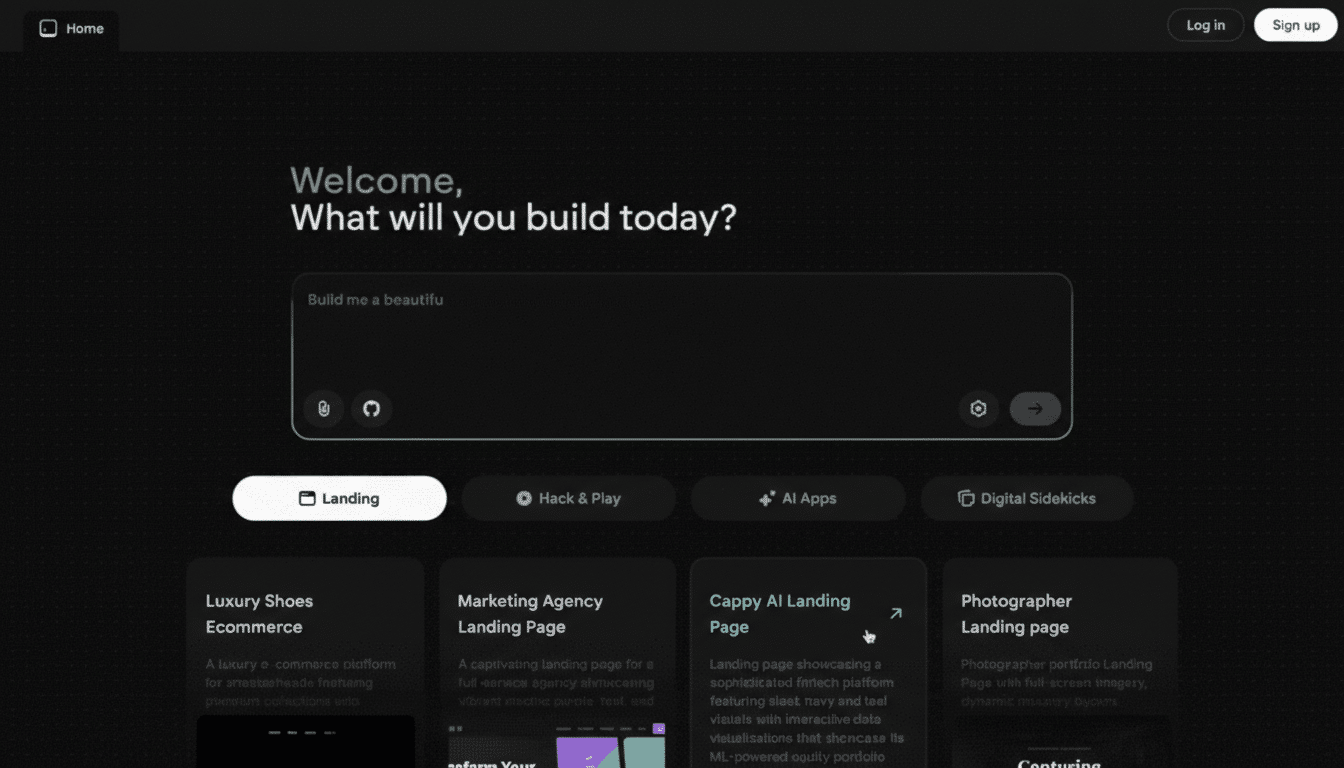

Vibe-coding—essentially using AI agents and natural language to generate and refine working software—has emerged as a bridge between idea and deployable product. Emergent says 80%–90% of new projects on its platform target mobile, with many users building CRMs, ERPs, inventory systems, and logistics tools that would previously have required multi-month dev cycles.

The broader tailwinds are hard to miss. Gartner has projected the low-code development technologies market to post double-digit growth, after estimating a $26.9 billion market in 2023, and Stack Overflow’s 2023 Developer Survey found most developers are already using or open to AI-based coding assistants. The throughline: non-technical teams want autonomy, and engineers want leverage. Platforms that translate intent into shipping code compress both timelines and headcount requirements for routine builds.

Mobile App Launch Extends Agent Workflows

Emergent has rolled out a mobile app on iOS and Android that lets users build with text or voice prompts and publish directly to Apple’s App Store and Google Play. Although still in testing, Emergent says users have already created more than 10,000 applications via the app. Work can hand off seamlessly between mobile and desktop, reflecting the platform’s asynchronous, agent-driven model in which users delegate tasks and review progress later.

That mobile-first emphasis is strategic. As more customers aim to ship on-the-go tools and field apps, the ability to ideate, iterate, and push builds without leaving a phone shortens the loop from concept to release. It also aligns monetization with production usage, where hosting and deployment fees scale with adoption.

Market Footprint And Early Enterprise Forays

Despite its India roots and a Bengaluru office, Emergent says the U.S. and Europe contribute about 70% of revenue. India is the fastest-growing market, buoyed by local pricing that resonates with SMEs digitizing operations. The company has begun pilots for an enterprise tier to meet requirements around security, compliance, and governance—table stakes for larger buyers in regulated sectors.

Enterprise traction will hinge on assurances around data isolation, auditability, and model transparency. Frameworks like the EU AI Act and India’s Digital Personal Data Protection Act will also shape how AI-generated code and customer data are handled across borders.

Competition Is Fierce And Differentiation Matters

Emergent competes with a rising cohort that includes Replit, Lovable, Rocket.new, Wabi, and Anything. Many rivals focus on code generation; Emergent is leaning into end-to-end outcomes—agents, UX scaffolding, deployment, and store publishing. If the company can keep inference costs in check, maintain high-quality guardrails, and deliver opinionated defaults that shorten the last mile to production, it will have a defensible wedge.

Funding helps. In January, Emergent raised $70 million in a round co-led by SoftBank Vision Fund 2 and Khosla Ventures, tripling its valuation to $300 million. Capital gives room to optimize infrastructure, expand compliance features, and shore up margins as the user base deepens.

The Signal Behind The Headline ARR Number

Early ARR at this scale suggests a large cohort is seeing real business value, not just novelty. The crucial next chapters: sustained activation beyond first builds, strong expansion revenue as teams standardize on the platform, and enterprise wins that validate security and governance. If Emergent converts its mobile momentum and agent-centric workflow into durable retention, $100 million run-rate could be a waypoint rather than a peak.