Tesla shareholders have approved a performance award for the company’s chief executive, Elon Musk, that could be worth as much as $1 billion — shot through with ambitious targets and all-or-nothing vesting schedules that are about as bold a roll of the dice on pay-for-performance as there is in corporate America.

What the New Award Will Offer and How It Vests

The 2025 CEO Performance Award is fully vested only if Tesla meets a set of (i) market capitalization metrics and (ii) operational milestones in total, before March 2029.

- What the New Award Will Offer and How It Vests

- Targets Behind the Trillion-Valuation and Scale Ambitions

- Why Investors Said Yes to the High-Stakes Tesla Plan

- Governance and Legal Hurdles Facing the New Pay Plan

- Execution Risks and Timelines for Tesla’s Bold Targets

- What to Watch Next as Tesla Pursues Ambitious Milestones

Timeline for vesting and performance criteria

The award vests based on the satisfaction of the criteria along the timeline. The award aims to keep Musk for the long term at Tesla, as well as firmly linking his financial future with that of the company in the form of specific, extraordinary, attainable goals.

Unlike traditional cash bonuses or vesting grants based on tenure, the package pays nothing if targets aren’t met and pays out in full only if all targets are hit. That structure mirrors Musk’s 2018 plan, which employed step-based triggers tied to market cap and business performance as well.

Targets Behind the Trillion-Valuation and Scale Ambitions

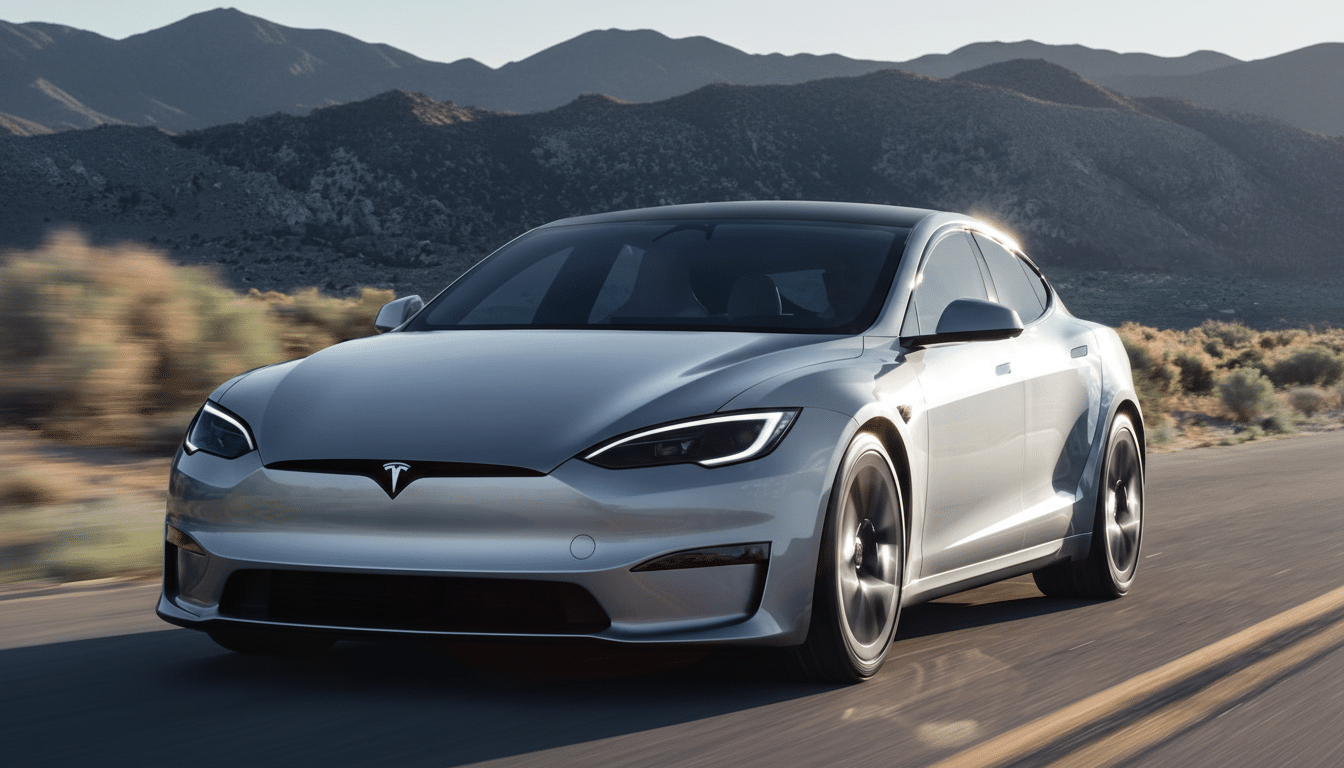

The headline request is audacious: to bring up Tesla’s market value to something like $8.5 trillion. In comparison, Nvidia had been valued at roughly $4.6 trillion and Apple at about $4 trillion under market data widely cited recently. In other words, Tesla would have to add up to a total of two of the most valuable companies on Earth right now.

For practical purposes, the award foresaw an annual supply of 20 million vehicles — a number that would dwarf production by global leaders like Toyota and Volkswagen. Reaching that level would require an enormous infusion of manufacturing capacity, battery supply and global reach that no automaker has achieved yet.

The plan also mentions 1 million robotaxis on commercial duty and 1 million humanoid robots, suggesting autonomy (and robotics) is the centerpiece of Tesla’s thesis. That ambition hinges on material advances in software reliability, safety validation and regulatory approvals across dozens of jurisdictions, and production at scale of Tesla’s Optimus platform.

Why Investors Said Yes to the High-Stakes Tesla Plan

Backers say the package closely aligns incentives: if shareholders benefit from historic gains, the CEO will share in similar proportion; should performance disappoint, he earns nothing from this grant. Supporters also argue that the award helps keep Musk’s time and attention dedicated to Tesla, even as he engages in a flurry of other endeavors.

There is precedent. Shortly after shareholders signed off on Musk’s milestone-based 2018 plan, Tesla’s market capitalization soared in the years that followed, during which time the company built factories at breakneck speed and delivered vehicles by the hundreds of thousands. Several analysts at Bloomberg and major proxy services have used that grant as a sort of case study in risky, high-reward incentive design.

Governance and Legal Hurdles Facing the New Pay Plan

The size and shaping of Musk’s pay has long been a subject of scrutiny. Delaware’s Chancery Court nullified the 2018 package in early 2024 on procedural grounds, before shareholders later re-ratified it. This new plan, which has a higher potential value, most probably will not meet those tests and could face challenges that question whether the board’s process, independence and disclosures satisfy the court’s exacting standards.

Proxy advisors like Institutional Shareholder Services and Glass Lewis have typically eyed outsized awards with suspicion, and dilution. Though the grant pays out in equity and only if successful, it could considerably bulk up Tesla’s share count over time. The accounting treatment also will be relevant: The GAAP recognition of compensation expense can be significant even for performance-based grants, based on probability calculations and fair value.

Execution Risks and Timelines for Tesla’s Bold Targets

For 20 million vehicles, Tesla would need more gigafactories, multi-terawatt-hour battery factories at an accelerated pace and far greater reductions in cost compared to the status quo manufacturing and supply chain. Margin resilience is a key question here as the company ramps volume while juggling growth and pricing and the capital intensity associated with new plants.

Regarding autonomy, Tesla needs to turn its Full Self-Driving software into a regulator-approved, commercially scalable robotaxi service. It also involves measured safety benefits, reliable performance on edge cases and laws that differ by country and state. This would make a fleet of nearly 1 million something previously unseen in Level 4 or better capability.

Musk also hinted at timelines for some future products, including a Roadster unveiling now planned for April 2026. Tesla’s deadlines have frequently moved as engineering realities intrude; investors will be watching whether product and software milestones come closely bunched with the operational and valuation triggers baked into the award.

What to Watch Next as Tesla Pursues Ambitious Milestones

For now, the scoreboard is simple: how fast deliveries are growing, announcements of new factories, battery production and measurable progress on autonomy. The most authoritative updates will come from Tesla’s proxy filings and quarterly reports, while the Bloomberg Billionaires Index and Forbes can track the impact on Musk’s wealth as the stock fights.

Whether the package ends up paying off will depend on performance at a scale that no automaker or artificial-intelligence-fueled mobility platform has yet achieved. The thesis is binary by construction for shareholders: if Tesla becomes the most valuable company in history, then the reward function will have served its purpose.