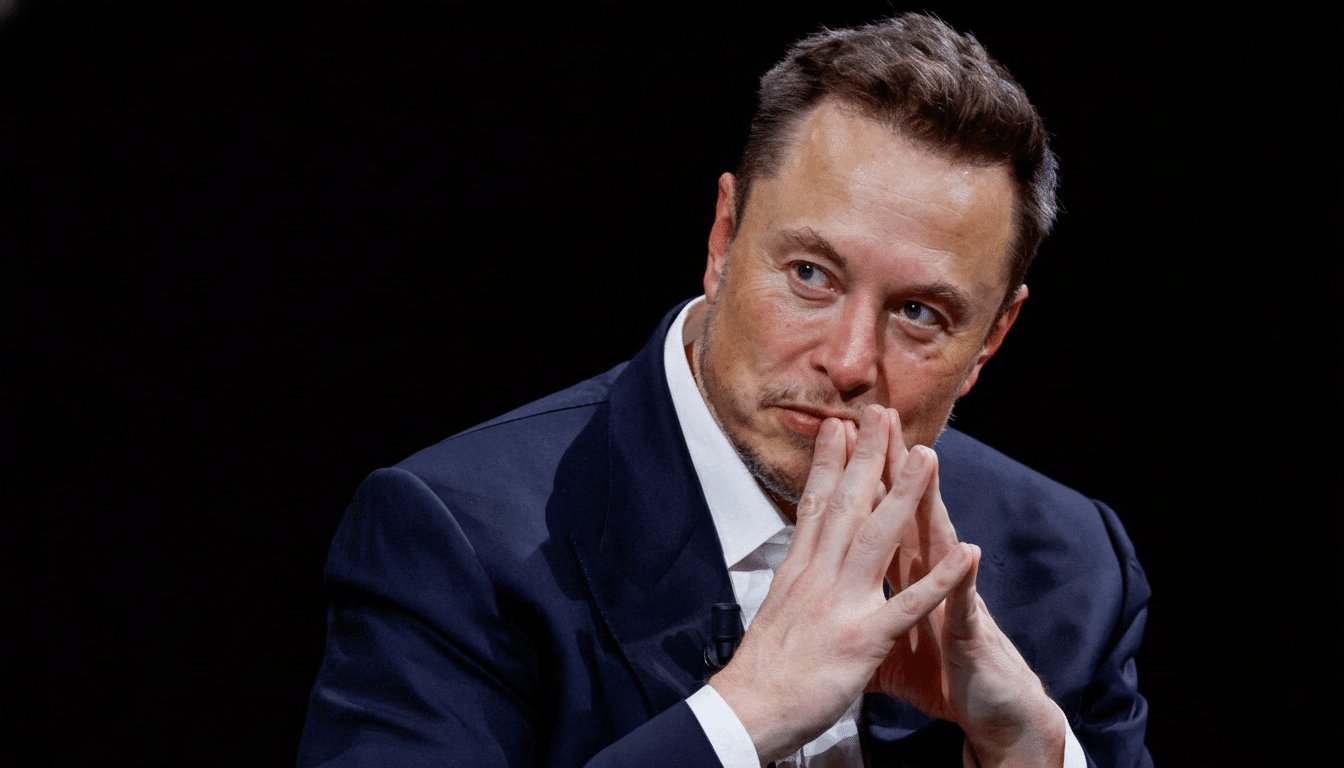

Elon Musk has reached a settlement in a $128 million severance lawsuit brought by four ex-Twitter executives he fired right after purchasing the company, according to a court filing heralding the parties’ deal. Terms were not disclosed, but the settlement ends a high-profile fracas that hung over the $44 billion takeover and Twitter’s transition to X.

The Executives and Their Claims in the $128 Million Severance Case

The case was led by former CEO Parag Agrawal, ex-CFO Ned Segal (who left earlier this year), and former legal leads Vijaya Gadde and Sean Edgett. They claimed they were due change-in-control severance and benefits under company policies and the merger agreement, because Musk wrongfully denied them the amounts by invoking “for-cause” justifications after the deal closed.

The complaint cited the responsibilities of Mr. Channing and Ms. Thomas in ensuring their boss carried through with a purchase he wanted to abandon and cast withholding the severance as retribution. “The company affirmatively took those actions not for any legitimate purpose, but rather to retaliate out of petty spite,” it said.

It even quoted reporting from Walter Isaacson’s biography of Musk as proof of the animus. Although the settlement averts a trial on those claims, it highlights how executive pay protections can turn into flashpoints when controversial deals eventually close under pressure from the courts.

Why the Settlement Is Important for X and Its Future Operations

Settling the dispute removes a legal overhang as X attempts to steady its business, court advertisers, and roll out new products. A trial would have risked discovery into deal communications and internal decision-making in the months immediately following the acquisition — a period already scoured over by investors, watchdogs, and potential partners.

Such settlements are routine when both parties are exposed to the risks of litigation and potential negative impact on reputation. It is rare that you gain from long depositions of the CEO, former directors, and senior lawyers. Corporate governance experts say avoiding extensive depositions of a chief executive officer, former board members, and senior counsels could be a strategic reason to settle. It also sends a message to existing and potential executives and employees about how the company plans to draw a line under takeover-era feuds.

Severance Disputes Entwining the Takeover

The executives are not the only ones fighting over their severance since the acquisition. Just last month, Musk agreed to resolve a class action with about 6,000 Twitter employees who were laid off and claimed they had been given inadequate or no severance following large layoffs of the workforce. That case was part of a larger trend of post-deal claims that former staff said the company had violated policies it had to follow in the wake of its merger.

Such clusters of claims are not uncommon after a rapid restructuring, labor and employment lawyers say, particularly when layoffs come on the heels of a leveraged purchase. They stress that promises made prior to closing must be aligned with post-closing paring back of costs — an arena for disagreement that frequently revolves around what, exactly, constitutes “for cause” and whether documentation is there to support it.

What the $128 Million Probably Represents in Context

The settlement terms are confidential, but the $128 million figure they were seeking aligns with common elements of change-in-control packages at big public companies: cash severance tied to salary and bonus targets, continued health benefits, and possible acceleration of unvested equity. Studies from compensation firms like Equilar suggest that for senior officers, severance multiples fall within the one- to two-times-salary-and-bonus range, with treatment of equity often accounting for the highest dollar values in technology deals.

For the former leaders of Twitter, equity and long-term incentive awards have played a key role in total compensation. If fired without cause soon after acquisition, executives generally claim that equity ought to vest according to plan terms or protections written in (that’s why these disputes often hinge on contract language, board decisions, and timing of termination events).

The Legal Backdrop and What Comes Next for X and Former Execs

The severance battle was an aftershock to the original saga of a court-ordered merger; the contract forced the close of a $44 billion deal. Those flames left scant interregnum and cleared the way for a fast leadership shake-up and subsequent court fights. With the settlement, the parties also avoid a public airing of “for-cause” assertions — as well as the larger issue of whether the merger-era promises were kept.

More to come now that some paperwork has been formalized; expect a formal notice of termination. Onlookers will want to see if there are any policy clarifications in regard to post-acquisition severance at X and the conclusion of any lingering employment-related claims. For both Musk and X, the settlement eliminates a key legal distraction; for the former executives, it finally puts to rest an argument that has hovered over them since the early hours of the takeover.