The nuclear startup Deep Fission has snuck onto the public markets through a backdoor merger that raised around $30 million — a small sum for a capital-intensive industry and a structure that raises as many questions as it answers. The deal was priced at $3 a share, far less than the $10 level at which traditional SPACs aim, and the company said it planned to quote on the OTCQB, a venue known more for early-stage speculation than robust liquidity.

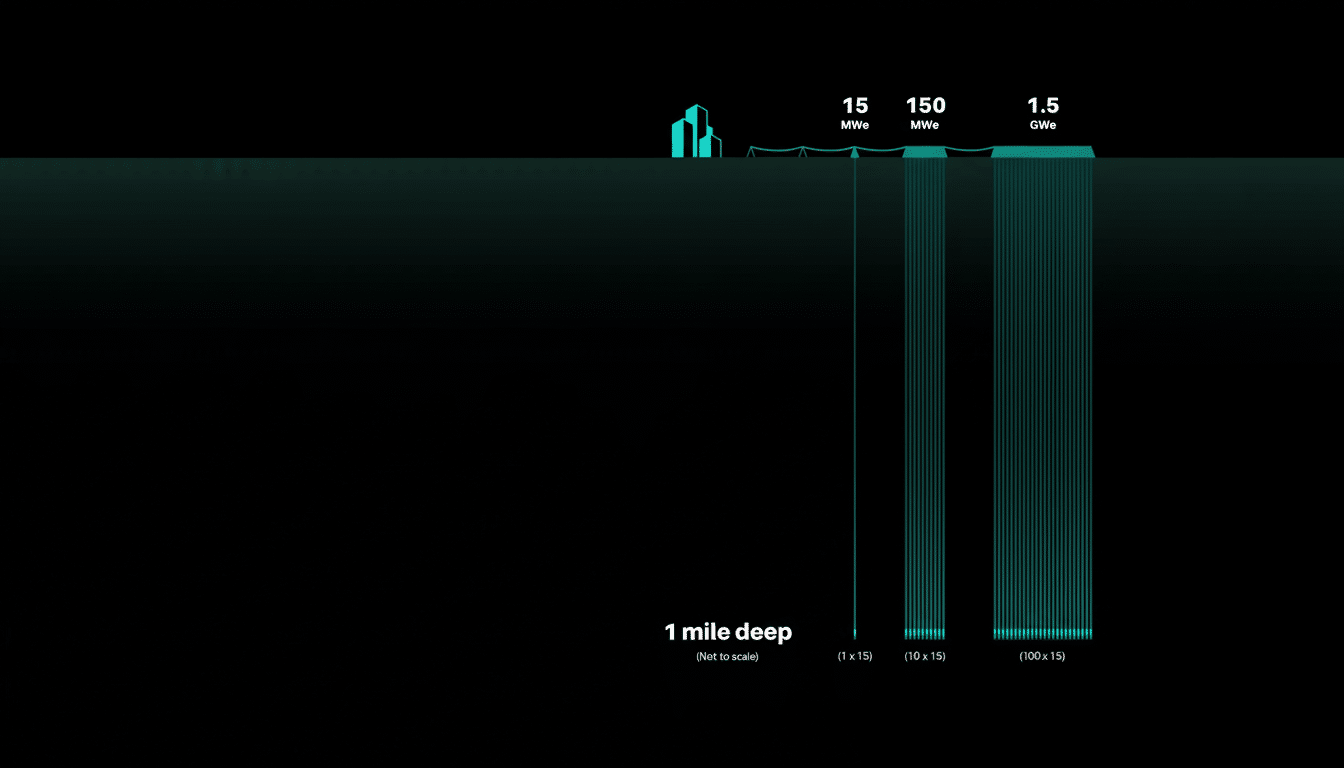

The pitch from Deep Fission is as unusual as the listing. The company is offering as many as 15 megawatts’ worth of small sealed reactors, similar to those used to power nuclear submarines, packed in cylindrical modules that could be dropped down 30-inch-wide holes drilled to a depth of about a mile. By entombing the reactor and much of its balance-of-plant, the company says it can reduce safety risks, streamline siting, and curtail the consequences of worst-case accidents.

A low-price S.P.A.C with high stakes

Reverse mergers are not new to climate tech, but this one was priced in an unusual way. SPACs typically sell units at $10, then fend off redemptions as they approach closing. Going public for $3 is a very low price, and one that Deep Fission clearly preferred to the optics of not doing a deal at all; more probably a PIPE to backstop the deal wasn’t in the offing. Being listed on the OTCQB reduces listing friction, but also reduces the potential investor base and increases volatility.

That $30 million purchases time, not victory. First-of-a-kind nuclear projects often need hundreds of millions just to make it to a licensed, grid-capable prototype. Recent market history is sobering: One small modular reactor developer shut down a flagship project after costs grew too high, and another advanced reactor company that pursued a SPAC experienced significant redemptions before shifting direction. The lesson is the same: The nuclear hardware is a plaything for deep balance sheets and disciplined execution.

Pressure also mounts from the compliance costs that accompany being public. SEC reporting and internal controls and investor relations can eat up a meaningful portion of a startup’s operating budget, especially when core engineering and licensing work is in earlier stages of ramp.

Burying reactors to de-risk the operation

Its underground technique seeks a different sort of risk-reward. Using pressurized water would put the design on a technology lineage that can boast proven performance for naval propulsion and commercial power, where the International Atomic Energy Agency and U.S. Energy Information Administration have published world-leading capacity factors. The invention is siting: a deep, narrow hole built to put thick rock between the core and the surface.

If it were to work, putting it underground could decrease the security perimeter, minimize exposure to external hazards and provide passive heat rejection to the surrounding geology. But the technical challenges are formidable. Hydrogeology, corrosion, access for maintenance, logistics for refueling, spent-fuel removal all challenge engineers. Many of these issues are also being highlighted by the U.S. Nuclear Regulatory Commission (NRC) in advanced reactor pre-application engagements, and the NRC will need to see convincing evidence that the subsurface is a safety asset, not a liability.

Deep siting has antecedents in nuclear waste programmes — Finland’s Onkalo repository is the most commonly invoked precedent — but putting an operating power reactor under the ground is a different ball game. Drawing on low-enriched uranium that is standard in pressurized-water systems could make fuel supply less complicated than in designs that need high-assay fuel — a real-world advantage amid ongoing HALEU scarcity.

Data centers and anchor load

Deep Fission has teamed early with data center developer Endeavor on a plan for 2 gigawatts of capacity. On paper, that’s on the order of 130 units of the company’s 15-megawatt modules (not including maintenance and voltage-inclined packaging). The pitch strikes a chord: Huge hyperscale and AI workloads are devours of around-the-clock power, the queues to interconnect are backlogged, and many grids lack firm, carbon-free supply.

Analysts at the International Energy Agency and grid operators have also cautioned that data center demand is growing even faster than new firm generation. A colocated “micro-nuke” campus could be a what-you-see-is-what-you-get solution that isn’t subject to long lead times for network upgrades, yet still delivers high capacity factors. On the flipside, the challenge of customer concentration risk, and the expectation of ultra-high reliability from day one – a data center will not stand for teething problems in a first-of-kind plant.

Economically, the bar is high. Levelized cost is still the acid test. Although a number of investment banks and consultancies have modeled competitive costs for modular reactors at scale, the cost curve only really bends after a repeatable manufacturing cadence is achieved. Without it, per-unit economics can float up instead of down.

Regulatory and financing runway

Deep Fission was selected for the Department of Energy’s Reactor Pilot Program, a sign that the company could potentially benefit from a more defined permitting process and early federal involvement. That is alongside continuing work by the NRC to modernize advanced reactor licensing processes. Still, there are at least some milestones — site selection, environmental review, safety analysis reports and fuel qualification — that will control timelines more than capital markets will.

On the financing front, the company will most probably need a multi-pronged stack: customer prepayments or offtakes, government cost sharing, strategic equity and, eventually, project finance. Technology-agnostic clean power credits under recent federal policy might enhance project returns, especially when accompanied by domestic content and workforce incentives, but even such benefits need a licensed, operating plant to cash in on.

What to watch next

And we will get a few key tells shortly: final SPAC redemptioon and cash balance disclosures, confirmation of an OTCQB quote and some measure of trading liquidity, and signs of a licensing strategy with the NRC in the short-term. On the engineering front, you’ll see proofs around drilling at scale, underground containment design, passive safety systems and maintainability.

If Deep Fission can prove that a buried, pressurized-water microreactor is viable and cost-effective, it will have revolutionized nuclear siting and security for a new class of customers. If it doesn’t, this SPAC may be remembered as another venture in nuclear finance and not as a coming-of-age for nuclear deployment.