Databricks raises $4 billion at a $34 billion valuation: As companies of all kinds demand high-level A.I. services and tools, Databricks just raised a big pile o’ money to provide them with those capabilities. The round illustrates how bullish investors are on platforms that can turn enterprise data into production-grade AI applications — and not waiting around for an IPO.

Why Investors Are Willing to Pay for More

The company’s valuation is up about 34% from yet another previous $100 billion mark just a few months ago, as it rides the wave of AI infrastructure revenue growth and accelerating demand. In a statement to investors, Databricks said its annualized run rate now extends past $4.8 billion annually, an amount up 55% from year-ago levels, and with more than $1 billion of that tied to AI products. That combination of growth and product mix is a rarity at Databricks’ scale, and goes some distance to explaining why the late-stage Series L came with pricey premium pricing.

- Why Investors Are Willing to Pay for More

- An AI stack built on enterprise data for real-world apps

- Staying private to remain nimble and scale quickly

- Hiring plans and global expansion across key regions

- Who backed the round: investors across asset classes

- For enterprises: what CIOs and data leaders should expect

Crossover investors were unicycle CTOs whereas unicorns and elephants all have leadership with go-to-market backgrounds, so I’ve had to recalibrate toward companies who control data, governance, and model access within one stack — the bottlenecks that determine whether AI pilots become production systems.

In that regard, Databricks’ value is as much about distribution and industry adoption as it is AI horsepower.

An AI stack built on enterprise data for real-world apps

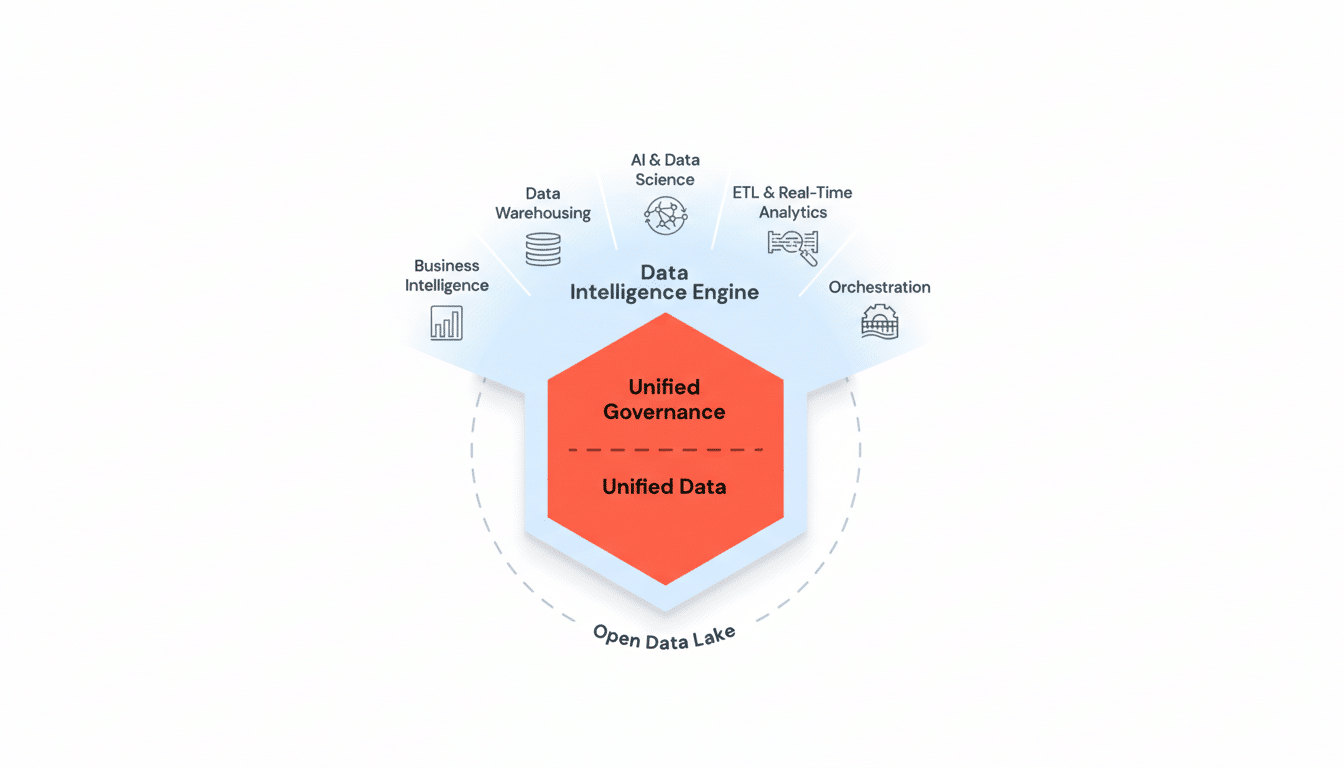

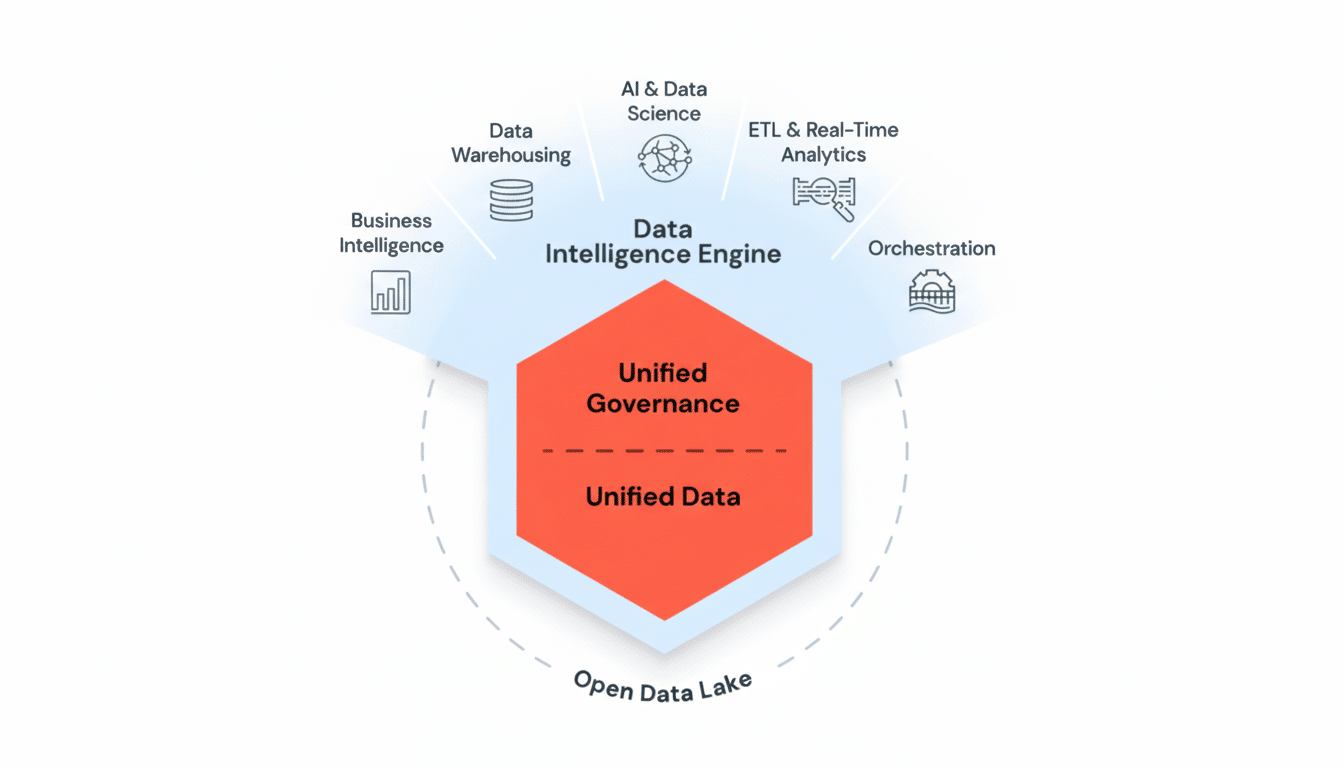

Databricks’ approach to AI consists of three main components:

- An AI-agent database

- A platform for building, training, and deploying agents (which exposes the ideas via programmable APIs)

- An app layer to allow app developers to build data-intelligent software

At the center is Lakebase, which is a Postgres-like database built to be a system of record for AI agents and “vibe coding” workflows that it has developed out of its roughly $1 billion acquisition of Neon. It’s about enabling developers to iterate fast, yet maintain the transactional integrity and lineage across the entire data estate.

On top of that, we have Agent Bricks — a platform for scripting out multi-agent systems that can query proprietary data, orchestrate tools, and enforce policy. Databricks Apps serves as the experience layer, transforming those agents and data pipelines into end-user applications with enterprise-class security and governance. Integration is similar: Anthropic and OpenAI offer customers a way to access top-tier models on the same control plane as free models do, reducing friction around combining publicly usable data with sensitive internal stuff.

The technical throughline will be familiar to data leaders: centralize data engineering, governance, and AI together in one environment to eliminate fragile handoffs. That design choice has captured customer needs as enterprises move past experimentation into yielding such outcomes as forecasting, copilots for analytics and code, and automated decisioning that resides inside business processes.

Staying private to remain nimble and scale quickly

Although the IPO market is beginning to show some signs of life, Databricks is taking advantage of private capital’s latitude for speed. A Series L is odd, but so is the tempo of product expansion and partner activity it’s aiming for. Going private allows Databricks to continue strong investment in R&D and go-to-market without public market quarterly trade-offs, as well as retain optionality for a potential listing sometime in the future.

Strategically, the increase also insulates it against a quickly expanding competitive set. Cloud vendors are baking in their own agent frameworks and model catalogs and vector databases; data clouds are rushing to wire models into governed warehouses. Databricks’ answer is to be the neutral point where it meets enterprises wherever their data lives — across multiple clouds and in a blend of lakehouse, warehouse, and operational stores.

Hiring plans and global expansion across key regions

The Wall Street Journal, which reported the financing earlier, said the company would use the new capital to create thousands of jobs in Asia, Europe, and Latin America and hire more AI researchers. That footprint expansion mirrors where many multinationals are forming data teams and could speed up regional partnerships and localized compliance work — often the gating items to deploying AI broadly.

Who backed the round: investors across asset classes

The funding was led by Insight Partners, Fidelity, and J.P. Morgan Asset Management, with Andreessen Horowitz, BlackRock, Blackstone, Coatue, GIC (the Singapore sovereign wealth fund), MGX, NEA, Ontario Teachers’ Pension Plan Board, Robinhood Ventures, T. Rowe Price Associates (for purposes of the MDL court orders providing disputed access to certain companies’ trial exhibits), Temasek, and Thrive Capital also participating. The roster mixes venture, crossover, sovereign, and private equity investors — a familiar sign that a company is approaching long-term institutional ownership.

For enterprises: what CIOs and data leaders should expect

For CIOs and chief data officers, the lesson is clear: AI agents linked to governed first-party data are moving from pilot to production.

Anticipate more turnkey patterns — think demand forecasting agents in retail, risk and compliance copilots in banking, quality inspection copilots in manufacturing — delivered via the same platform that addresses ingestion, transformation, and model ops.

Industry analysts like Gartner and IDC have emphasized that the spending is moving from proof of concept to sustained platform commitments, and this round prepares Databricks to ride that wave. Capital, product breadth, and partner ecosystem collectively raise the execution bar for competitors. By doing so, however, AWS, Microsoft, etc., are also giving enterprises a better shot at shipping measurable AI outcomes.