Cognition AI, maker of the autonomous coding agent Devin, has closed a $400 million round that puts the startup at a $10.2 billion valuation, according to Bloomberg. The leap underscores how aggressively capital is chasing “agentic” AI platforms that promise not just code suggestions but end-to-end software development.

A premium price for agentic AI

The valuation implies a multiple that only a handful of AI companies can command. With annual recurring revenue from Devin reported at $73 million, the price tag works out to roughly 140x ARR—an order of magnitude above typical late-stage software benchmarks. Investors are betting that autonomous AI agents can compress development cycles, cut costs, and unlock new product velocity in ways that conventional coding assistants cannot.

Bloomberg also reports Cognition’s net burn has stayed under $20 million since its founding, a notable stat in a category where compute spending often swells faster than revenue. Capital efficiency at this scale helps justify the premium and signals discipline around infrastructure provisioning and go-to-market.

Devin’s traction and what enterprises buy

Devin is pitched as an autonomous software engineer: it plans tasks, writes and executes code, debugs, runs tests, files pull requests, and integrates with developer tooling. While rivals such as GitHub Copilot, Sourcegraph Cody, Replit Agents, and AWS Q Developer center on in-IDE assistance, Devin is designed to handle multi-step projects with minimal human oversight. That step-change—from assistive to agentic—appears to be driving enterprise pilots and expansion deals.

ARR rising from about $1 million previously to $73 million suggests early product-market fit among teams tackling large backlogs or modernization projects. The strongest near-term use cases are likely greenfield microservices, test generation, and routine maintenance tasks where autonomy lowers toil without tripping compliance or safety thresholds.

The round and strategic moves

Founders Fund led the financing, with participation from existing backers Lux Capital, 8VC, Elad Gil, Definition Capital, and Swish Ventures, per Bloomberg. The investor mix blends deep-pocketed growth capital with operators who know developer tooling and AI commercialization—useful for navigating both high-cost training cycles and enterprise sales.

Cognition recently acquired Windsurf, an AI coding startup whose top leaders and research talent had been hired by Google just prior. The addition brings complementary research and systems expertise as agent-centric models increasingly rely on orchestration, tool-use planning, and long-horizon reasoning—areas where strong research benches matter as much as raw model size.

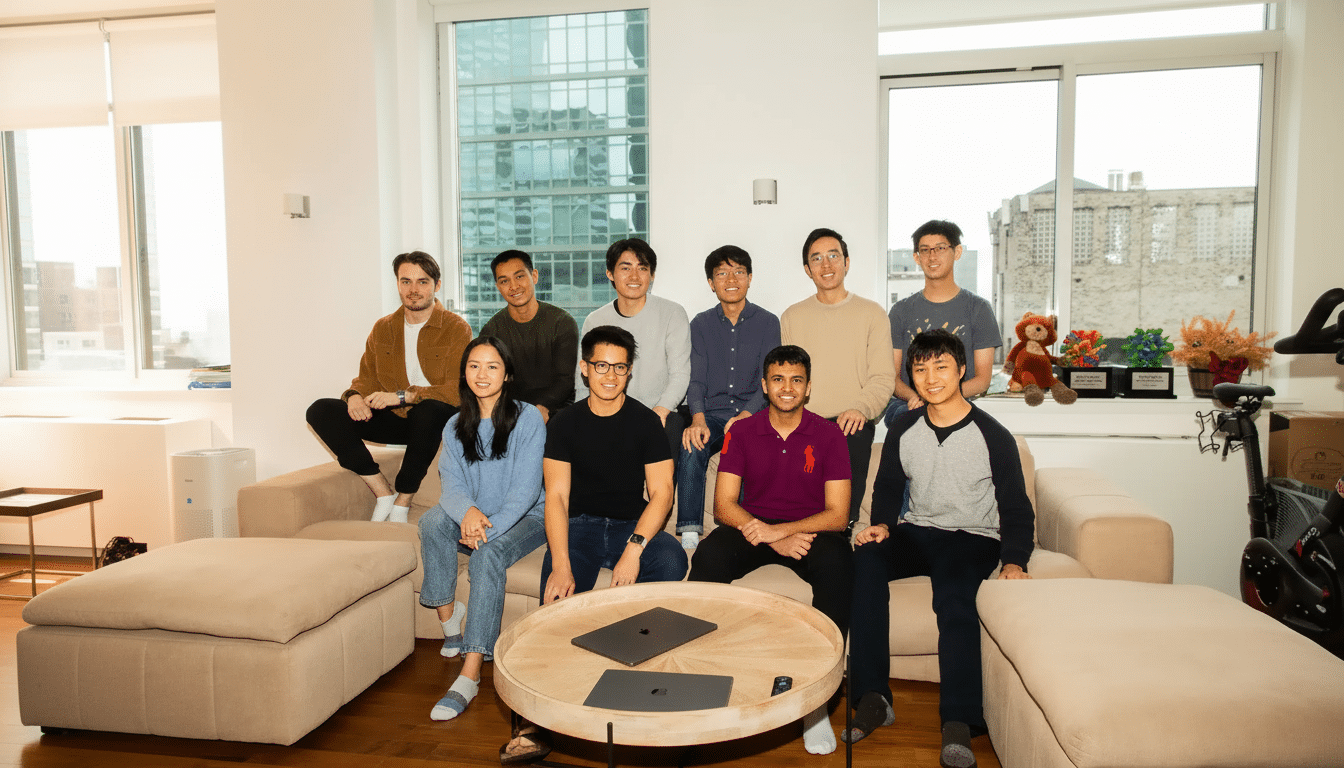

Culture risks amid hypergrowth

The company’s internal pace has drawn scrutiny. Bloomberg reported a layoff of 30 people and buyout offers extended to roughly 200 employees, tied to expectations of 80-hour, six-day work weeks. For a frontier AI shop, that posture may sustain rapid iteration, but it risks retention challenges in a market where experienced researchers and platform engineers are in short supply and heavily courted by hyperscalers.

For customers and investors, the question is whether a demanding culture accelerates breakthroughs or invites operational brittleness. The best-performing AI organizations combine speed with rigorous evaluation, safety review, and reproducibility. Cognition’s reported capital efficiency suggests process discipline; sustaining it while scaling headcount and revenue will be the next test.

Competition and defensibility

The coding-agent arena has intensified. OpenAI has pushed deeper into tool-use and planning; Google and Anthropic are embedding reasoning upgrades across their stacks; incumbents like Microsoft and Amazon are bundling developer copilots with cloud credits and enterprise security controls. Cognition’s moat will hinge on measurable productivity gains—fewer escaped defects, shorter lead times, higher deployment frequency—not just demos.

Integration breadth also matters. Enterprises will expect Devin to play nicely with GitHub and GitLab, Jira, Terraform, Kubernetes, and CI/CD pipelines, with audit trails that satisfy internal risk teams. If Devin can consistently close tickets and ship compliant code in live environments, the company can defend premium pricing against bundled alternatives.

What the deal signals

Despite a broader pullback in late-stage tech, large AI rounds continue to clear when the commercial story aligns with credible efficiency metrics. As tracked by industry researchers like PitchBook, investor appetite remains strongest for products that turn foundation model advances into workflow-level ROI.

For Cognition, the mandate is straightforward: convert agentic promise into repeatable enterprise outcomes while keeping unit economics in check. If Devin can reliably deliver working software at lower cost and higher speed, the lofty multiple will look prescient rather than exuberant.