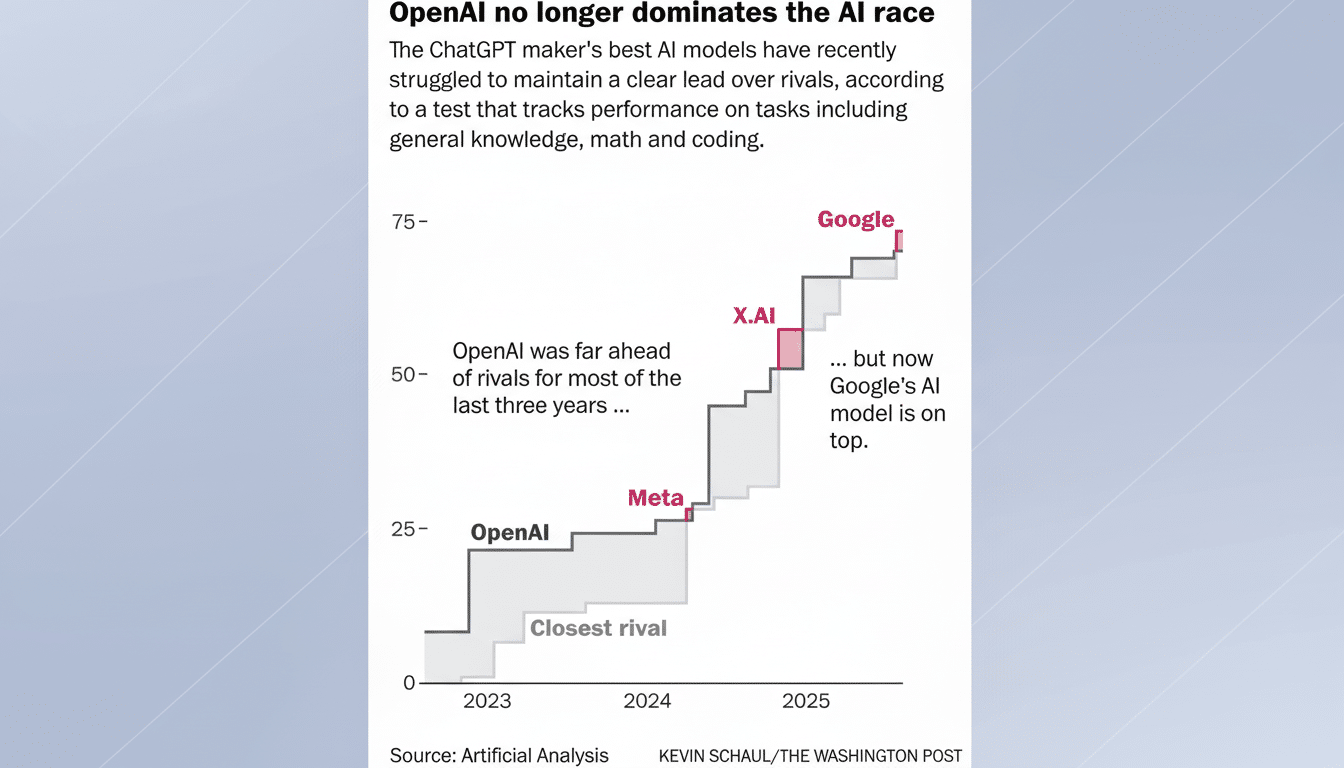

ChatGPT’s previously blistering growth is cooling, according to newly released estimates from Sensor Tower. The news comes as OpenAI continues to lead its pack of consumer-facing AI models in terms of downloads and monthly active users. The report highlights an evolving competitive dynamic: Google’s Gemini is growing faster in a number of areas and closing the gap on engagement.

Sensor Tower Suggests a Tapering Usage Trend

ChatGPT represents approximately 50% of worldwide mobile downloads among the top AI chatbots and 55% of global monthly active users, solidifying its leading position, according to Sensor Tower’s analysis. On a year-over-year basis, ChatGPT saw its MAUs increase by an impressive 180% as of November, a reminder that the category is still rapidly growing.

The view over the next few months is less exciting. From August to November, global MAUs for ChatGPT grew only about 6%, reaching an estimated 810 million — a sign that the pandemic-induced growth may already be saturated in key markets. In contrast, aggregate growth of the leading peer set exceeded ChatGPT for both downloads and usage indices over this horizon.

Gemini Adoption and Engagement Is Growing

Google’s Gemini saw an MAU rise of about 30% from August to November, boosted by the introduction of its Gemini Nano image-generation model. Sensor Tower also points out that time spent in the Gemini app has at least doubled recently, clocking an average of around 11 minutes per day — up by 120% since March.

Distribution is what’s doing a lot of the heavy lifting for Google. In the U.S., around two times more Android users access Gemini via system-level entry points than through the standalone app. That OS-level access cuts straight through app discovery friction and might be pivotal in Android-first markets where Google’s services are particularly sticky.

Engagement Split Shows a Significant Usage Shift

ChatGPT’s average time spent per day grew only 6 percent in recent months but dropped 10 percent from July to November, according to Sensor Tower. While ChatGPT continues to be the tool of choice for general inquiries and creative prompts, Gemini’s spike in activity last week suggests that users are playing around more with its multimodal capabilities, like image generation and system-integrated prompts.

Market Share Rebalancing Among Top Chatbots

In the last seven months, Gemini increased its share of global MAUs among top AI chatbots by about three percent, while ChatGPT’s share declined by a similar amount in that time frame. The competitive field is also expanding: Perplexity and Claude realized triple-digit growth this year, with Perplexity up 370 percent and Claude 190 percent over last year.

Download momentum echoes the theme. Global downloads of ChatGPT were up 85% year over year as of November, compared with a cohort average increase of 110%. Gemini grew 190% and Perplexity 215%, which again demonstrates that niche features, faster iteration cycles, and specific use cases can be daisy cutters in acquisition channels.

Why the Slowdown, and What Might Turn It Around

A number of forces are likely behind the slowdown. The initial pacesetters, the early adopters, have largely been gobbled up; mainstream users are now doing a cost-benefit analysis on functionality versus coolness. Cross-platform duplication also works to water down marginal growth: the same person could try ChatGPT on desktop and Gemini on Android, spreading out rather than deepening engagement in one place.

Feature parity is another factor. With competitors increasingly shipping advances in personalized results, reliability, and multimodal workflows, that gap is starting to close. Sensor Tower’s report comes as OpenAI employees are told to get a move on (link paywalled), specifically around product upgrades — personalization and image generation among them.

What to Watch Next as AI Chatbot Competition Evolves

The next battleground for competition will be fought in three areas: platform distribution, differentiated abilities, and continued use. Gemini gets a native on-ramp on Android with Google’s system-level surfaces. OpenAI’s counterweight might emerge from more fused-together mobile experiences, better multimodal creation tools, and enterprise-friendly reliability that reduces the time from experiment to daily habit.

For now, the leaderboard hasn’t changed — ChatGPT is still well ahead of anything else hitting the market. But the velocity has shifted. If Sensor Tower’s trendlines hold, growth will be more and more gameable by engagement per user and how simple the platform is to reach. In a maturing category, that’s how durable market share gets forged.