Cerebras Systems raises a $1.1 billion Series G while still in stealth mode, coming close to one year after filing to go public. The round values the AI hardware specialist at $8.1 billion and supplies it with new firepower to scale its inference cloud, grow data center capacity, and deepen U.S. manufacturing — a remarkably large raise that underscores investor conviction in non-GPU AI accelerators as demand skyrockets.

Funding Details and Investor Signals Ahead of Potential IPO

The round was co-led by Fidelity and Atreides Management, along with Tiger Global, Valor Equity Partners, and 1789 Capital, among others. Investors of this caliber who cross over are a classic pre-IPO signal, putting Cerebras in a great position to ease into the public markets when the timing is right. With this funding, the company has now raised nearly $2 billion since its founding in 2015.

Cerebras’ previous round of funding was a $250 million Series F, led by Alpha Wave Ventures, that valued the company at more than $4 billion. Doubling its valuation in the time since, albeit in a choosier capital environment for hardware, shows investor appetite for purpose-built AI compute and the company’s growing commercial footprint.

IPO Path Slows Under National Security Review

An earlier-disclosed $335 million investment from G42, an Abu Dhabi-based cloud and AI company, is under review by the Committee on Foreign Investment in the United States, which has placed a halt on Cerebras’s IPO process. CFIUS reviews are typical with strategic compute and data infrastructure transactions, especially when foreign money is involved. Those familiar with late-stage listings say it’s not unusual to raise a big private round from public-market institutions while regulatory questions clear.

Management has “reiterated” that an IPO is still the plan, but it will “focus on operational scale for now.”

That’s how other deep-tech companies contend with long hardware cycles and national security oversight: build capacity, lock in customers, wait for things to be more visible, and, as necessary, list.

Strategy Bet on Inference and Dedicated Cloud

Cerebras manufactures wafer-scale AI processors and turnkey systems for training and serving massive language models. The company says the demand has shifted from experimental to production-grade inference, and so it stacked its resources in line and announced a new inference-focused cloud. Management says early uptake has been overwhelming, a trend reflected in the expectations of industry watchers such as IDC and Omdia, who forecast a steep rise in inference workloads now that models are making their way into production.

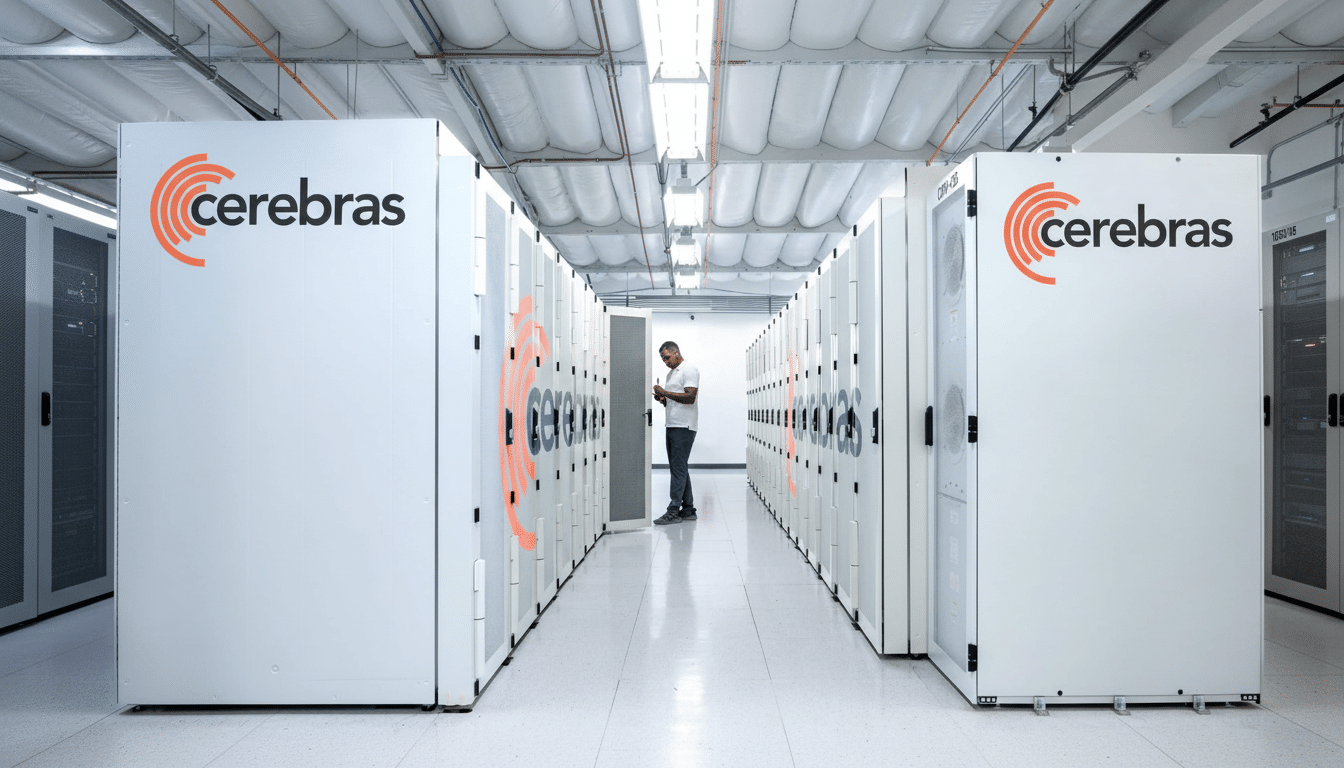

Cerebras has responded to that demand by opening new data centers in Dallas, Oklahoma City, and Santa Clara, with plans for more in Montreal and Europe. The fresh capital will support additional capacity, domestic manufacturing plans with which to slightly speed the company’s scale-up, and R&D projects that the firm has not yet specified. Owning infrastructure instead of leasing third-party cloud resources is what allows Cerebras to maintain control over its performance, availability, and unit economics.

Positioning for a Pinch on Constrained GPU Supply

Cerebras’s value proposition is that it can offer something comparable to a GPU cluster — i.e., high throughput through simple scaling for big models, without the trouble of multi-GPU/much orchestration. It uses a wafer-scale design to minimize communication hotspots that limit the performance of GPUs at scale. Bernstein and Mizuho analysts have observed that ongoing GPU shortages combined with high TCO concerns mean there’s room for differentiated training and inference accelerators.

Partnerships also matter. Cerebras and G42 previously unveiled the Condor Galaxy network of AI supercomputers, designed to offer multi-exaflop capacity for training and serving models. By combining vertical integration—chips, systems, and the cloud—with outsized deployment sizes, Cerebras is hoping to turn architectural advantages into tangible capacity that enterprise buyers can get their hands on today.

What to Watch as Cerebras Scales Its Cloud and Chips

Three key metrics will tell us if the raise amount translates into a lasting advantage:

- Utilization of the new inference cloud and data centers

- Revenue mix between hardware sales and recurring cloud services

- Manufacturing yields and cost curves as volumes ramp

Stay tuned for updates on regulator sign-offs, other crossover investors coming onto the cap table, and benchmarks related to Condor Galaxy expansion.

For the broader AI supply chain, this round serves as a signal that investors are willing to deploy capital at scale behind non-GPU paths, especially when you control the stack and can deliver capacity. Should Cerebras retain demand and margin as it settles into the last IPO hoop, it will serve as a bellwether for how far other specialized AI-silicon businesses can make it to the public markets on terms of their choosing.