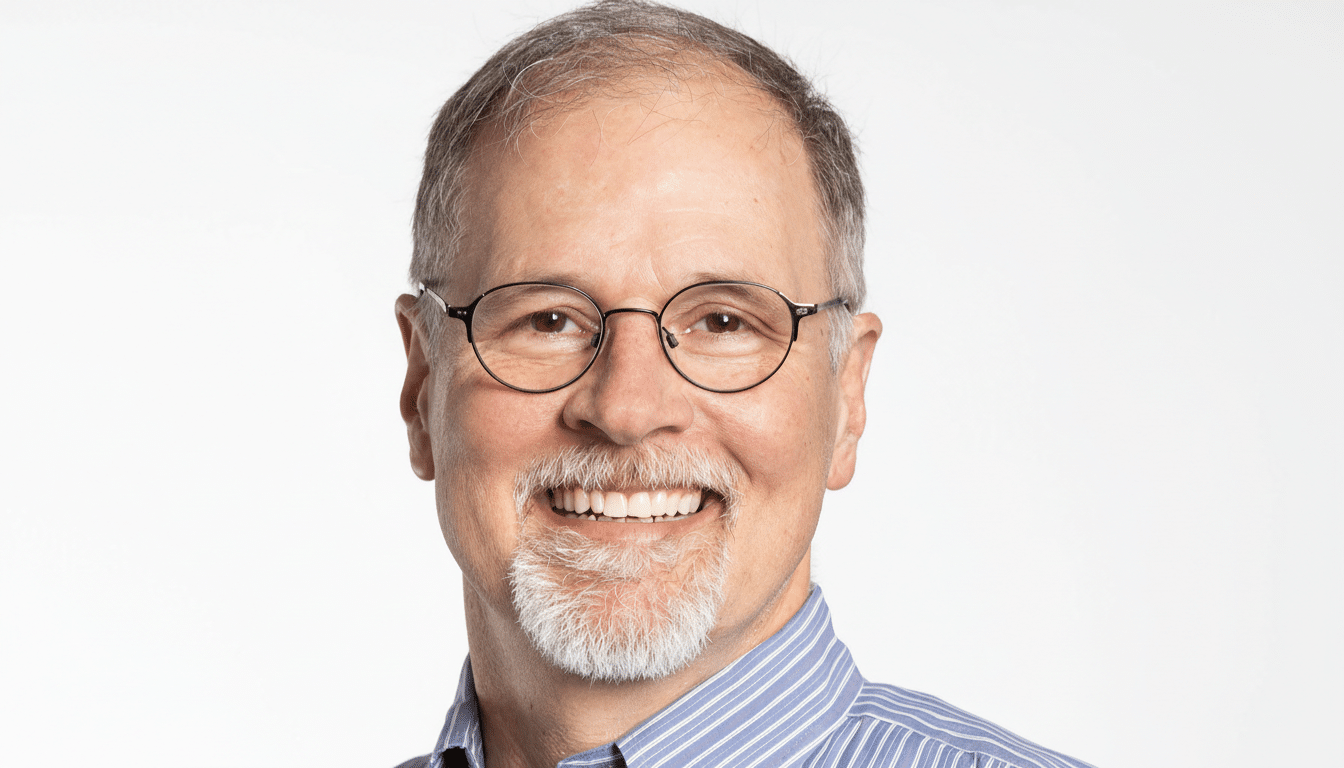

Boston Dynamics is entering a new chapter as Robert Playter steps down as chief executive after nearly three decades at the robotics pioneer. In an internal memo first reported by the Association for Advancing Automation, the company said Chief Financial Officer Amanda McMaster will serve as interim CEO while a search for a permanent successor is underway.

Leadership Transition and Interim Plan for Boston Dynamics

McMaster’s appointment signals a pragmatic handoff focused on continuity: finance leaders tend to guard operating discipline, which matters for a robotics firm scaling from seminal research to durable, repeatable products. A person close to the company described the transition as orderly, with current commercial programs and R&D roadmaps continuing on schedule while the board evaluates both internal and external candidates.

Three Decades Shaping Legged Robotics at Boston Dynamics

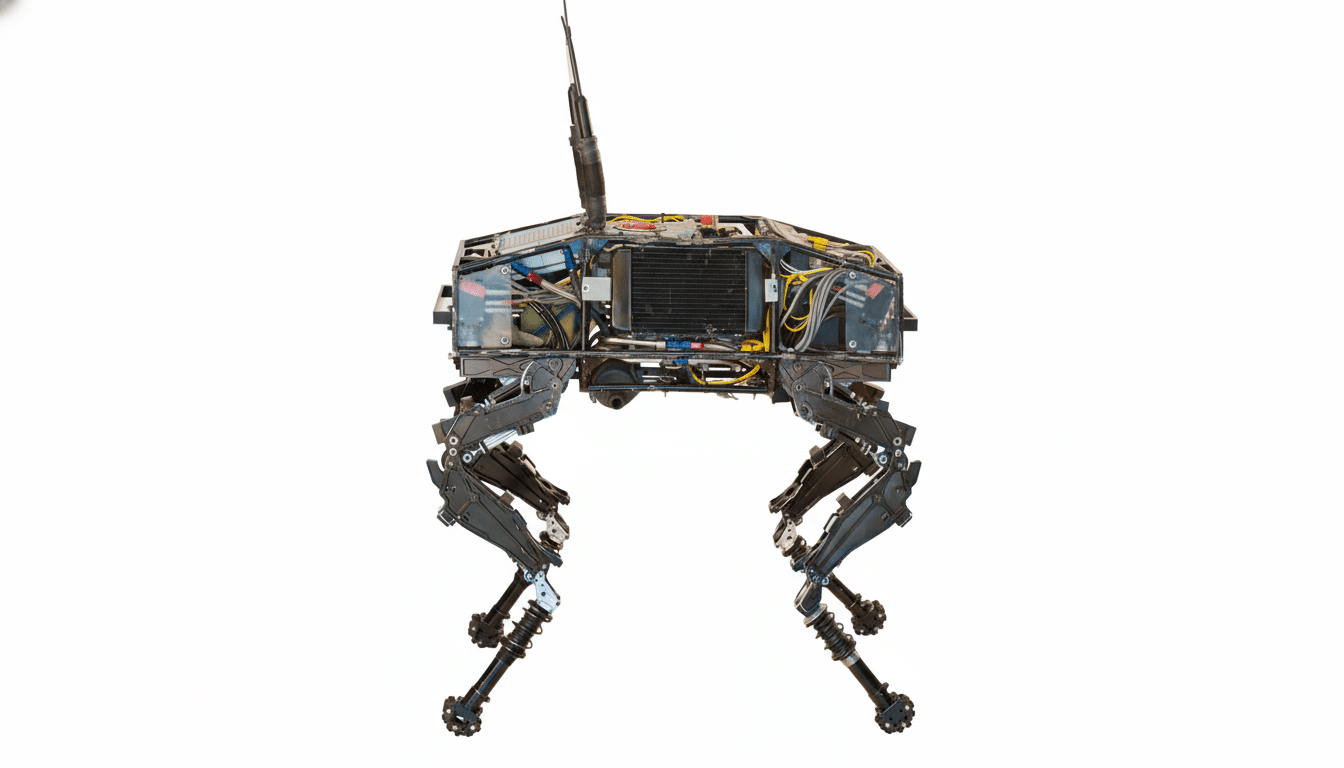

Playter’s tenure maps closely to the evolution of legged machines from lab curiosities to field tools. He served in senior engineering and operating roles before taking the helm, helping steer projects that defined the genre—early quadrupeds like BigDog set performance baselines for balance and locomotion, while successive platforms proved those behaviors could be packaged for real-world work. Colleagues credit him with the push to translate breathtaking demos into sustained, serviceable products.

That translation showed up most visibly in Spot, the company’s agile quadruped, which moved from research platform to commercial fleet. It also informed Stretch, a mobile box-handling robot for warehouses, developed after years of lessons from systems like Handle. The humanoid Atlas, long a research showcase, recently reemerged in an all-electric form, signaling a fresh focus on robust, service-friendly actuation for industrial environments, according to company briefings.

Commercial Footprint And Product Milestones

Boston Dynamics’ commercial strategy zeroed in on inspection, logistics, and safety—areas where painfully repetitive tasks and hazardous sites make autonomy valuable. Energy companies and utilities have used Spot for routine rounds, thermal imaging, and leak detection; National Grid and BP are among the most visible adopters. NASA’s Jet Propulsion Laboratory employed Spot units for research in subterranean exploration. In public safety, pilots have tested quadrupeds for situational awareness, though those deployments continue to prompt policy debates about transparency and oversight.

On the logistics side, DHL Supply Chain announced a multi-year plan to deploy Stretch units in its facilities, following trials to automate trailer unloading and pallet movement. Those enterprise agreements marked a shift from one-off pilots to fleet-level contracts, the kind necessary to build reliable revenue. The International Federation of Robotics reports that industrial robot installations globally have hit record highs exceeding 550,000 units annually, underscoring the broader momentum that product leaders like Spot and Stretch are positioned to tap.

Ownership And Strategic Direction Under Hyundai

Boston Dynamics’ ownership journey—from a spinout rooted in MIT’s legged locomotion research to stints under Alphabet and SoftBank—culminated in its current home at Hyundai. The pairing has strategic logic: advanced mobility and manufacturing scale meet cutting-edge robotics. Hyundai and Boston Dynamics also launched the Boston Dynamics AI Institute with more than $400 million in initial funding, led by founder Marc Raibert, to accelerate breakthroughs in perception, dexterous manipulation, and athletic intelligence. That research engine, operating alongside a maturing product portfolio, gives the company a two-track pipeline for near-term revenue and long-horizon capability bets.

What the CEO Search Signals for Boston Dynamics

The next CEO will inherit a rare asset: brand-defining technology with clear market pull—and the hard problems that come with scaling it. Expect the board to weigh candidates who can deepen enterprise sales, drive cost-down manufacturing, and navigate safety certification and deployment policy. Competition is also intensifying. Agility Robotics has begun warehouse pilots of its Digit platform with major retailers, while newer entrants and research-backed teams are racing to commercialize humanoids and mobile manipulation. Investors and customers will look for a leader who can convert Boston Dynamics’ technical lead into category leadership measured in installed fleets and recurring software and service revenue.

For now, Playter leaves behind a company that helped define what agile robotics can do—and increasingly, what it can sell. With McMaster steadying the helm and a global robotics market expanding, Boston Dynamics’ next move will reveal how a storied innovator plans to win the grind of deployment at scale.