Blue Origin is suspending its New Shepard space tourism operations for “no less than two years” as it concentrates people, hardware, and capital on lunar missions. The move halts a five-year run of suborbital flights that took paying passengers past the Kármán line and refocuses the company on New Glenn launches and its Blue Moon lunar lander program.

A Strategic Pivot Toward the Lunar Economy

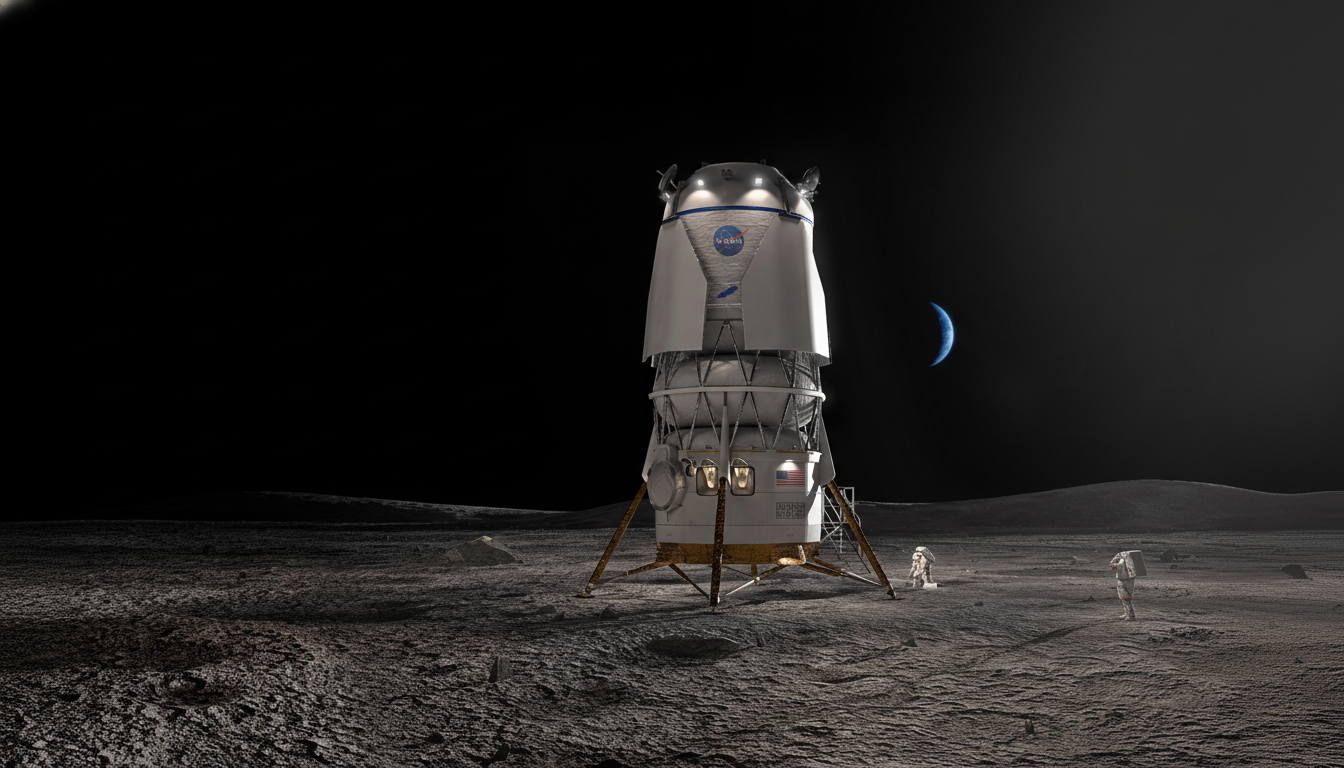

Company leaders framed the pause as a resource reallocation toward the United States’ goal of returning astronauts to the Moon and establishing a sustained presence. The pivot aligns with NASA’s multi-mission lunar architecture and Blue Origin’s role developing a Human Landing System for a future Artemis mission, a contract valued at more than $3 billion. Funneling manufacturing, test infrastructure, and engineering talent from discretionary tourism into deep-space systems is a classic “surge” strategy used across aerospace when programs hit critical milestones.

In practical terms, this lets Blue Origin concentrate on integrating its Blue Moon cargo and crewed lander variants, qualifying its BE-7 hydrogen-oxygen engine, and tightening the launch cadence of New Glenn. It also reduces internal competition for highly specialized facilities and personnel—particularly propulsion, avionics, and structures teams that are equally essential to New Shepard turnarounds and lunar hardware.

New Shepard’s Track Record and What Pauses Mean

New Shepard has flown 38 times, carrying 98 people to space and more than 200 scientific payloads, according to the company. The program pioneered vertical rocket reuse in suborbital spaceflight, delivering about four minutes of microgravity to customers and researchers. It also demonstrated robust abort and fault-tolerance when a booster failed during an uncrewed mission, with the capsule safely escaping as designed. Flights resumed only after hardware and process changes—a conservative posture that foreshadows today’s longer pause.

Customers holding paid tickets will face uncertainty on timing, but the company’s science clients—universities, national labs, and startups flying microgravity experiments—may feel the gap most. Expect Blue Origin to work with researchers to re-manifest payloads later or migrate critical experiments to alternative parabolic flight and suborbital platforms where feasible.

New Glenn and Blue Moon Drive the Timeline

The pause comes as Blue Origin prepares for the next New Glenn flight and steps up lunar lander testing at NASA’s Johnson Space Center and other facilities. New Glenn is central to the company’s lunar logistics plan, offering heavy-lift capacity to send lander elements, propellant, and cargo to cislunar space. A steadier New Glenn cadence is a prerequisite for the sustained lunar missions that NASA and industry partners are building toward.

On the surface operations side, the Blue Moon lander and its derivatives hinge on the BE-7 engine, cryogenic propellant management, precision touchdown, and autonomous navigation in low-light, high-dust environments. Concentrating teams on integrated hot-fires, hardware-in-the-loop simulations, and landing sensor validation can compress schedules and reduce risk before crewed milestones.

Competitive Landscape and Policy Tailwinds

Blue Origin is not shifting in a vacuum. SpaceX continues advancing Starship and a crewed lunar lander for NASA, while commercial lander providers are proving stepwise capability with robotic missions. A renewed White House push to accelerate lunar timelines has opened more opportunities for multiple providers, a notable change from earlier single-award strategies. Concentrating on the Moon now positions Blue Origin to meet those policy targets and diversify revenue beyond tourism.

The company also benefits from stronger upstream engine production. Its BE-4 engine, already flying on a partner’s rocket, has matured through successive builds. Increasing BE-4 throughput supports New Glenn while freeing engineering capacity for BE-7 and lunar systems—an internal synergy that makes the pause more than a publicity move.

Tourism Slowdown Mirrors Industry Recalibration

Suborbital tourism has shown demand but remains a niche market. Competitors have also tempered flight plans while developing next-generation vehicles, signaling an industry recalibration from headline-grabbing jaunts to long-lived platforms with repeatable economics. For Blue Origin, the total addressable market for lunar logistics—cargo delivery, surface mobility, science infrastructure, and eventually in-situ resource utilization—could dwarf tourism revenue over the long term.

Investors and suppliers typically prefer focus during complex program phases. Concentration reduces multi-program risk, clarifies hiring priorities, and lets management tie performance metrics to a narrower set of flight-readiness gates. That discipline can be the difference between slipping schedules and hitting mission windows that are dictated by celestial mechanics, not marketing.

What to Watch Next as Blue Origin Prioritizes Lunar Goals

Key indicators will include New Glenn launch cadence, BE-7 qualification milestones, and lunar lander integration progress with NASA. Also watch how Blue Origin manages its science customers during the New Shepard hiatus and whether it introduces updated suborbital offerings after the pause, potentially with higher reliability margins and research-focused configurations.

The message is clear: Blue Origin is trading short flights for a longer horizon. If the company executes, today’s pause could buy down the risks that matter most when the destination is not 100 km up, but nearly 400,000 km away.