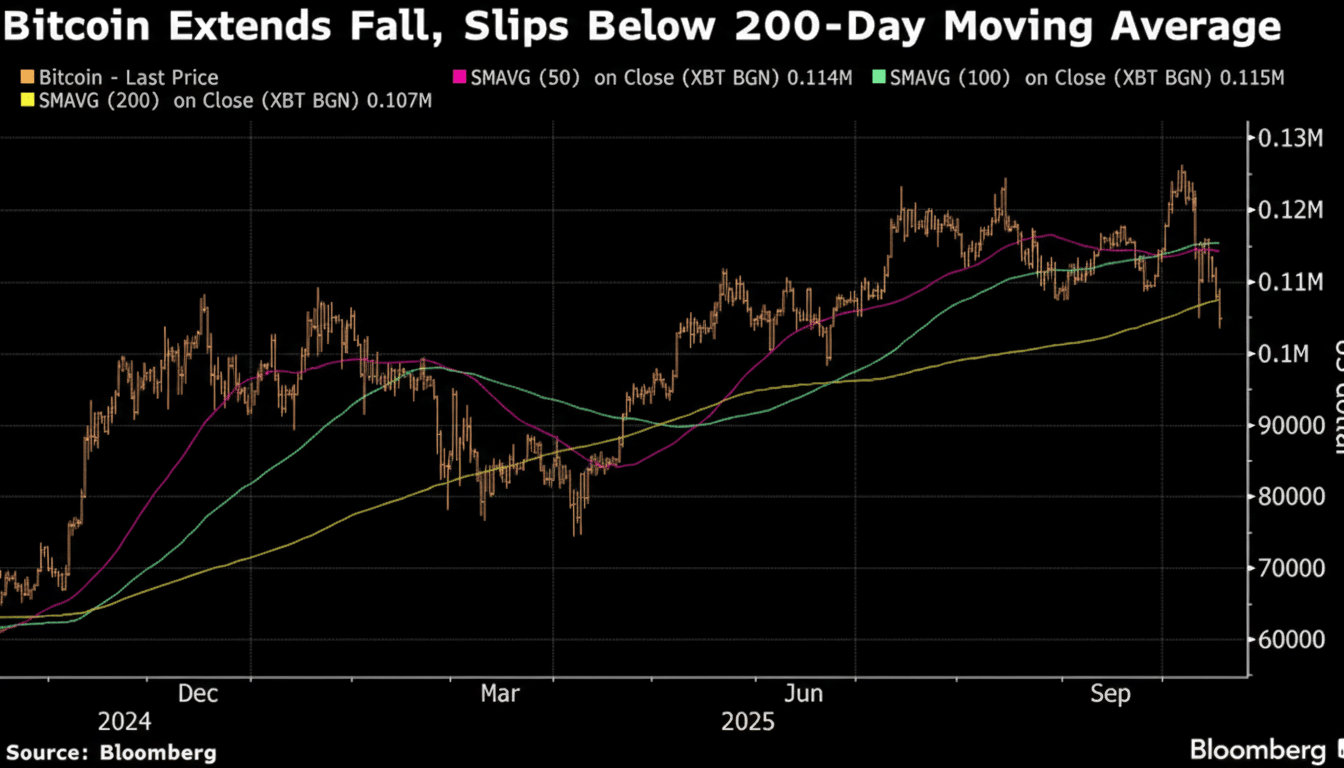

Bitcoin’s bruising week isn’t over yet. After Thursday’s sharp drop, the largest cryptocurrency slipped to an intraday low near $81,600 before stabilizing around the $83,000 area, still down roughly 1.5% on the day. With billions in leveraged positions flushed out and risk appetite shaky, traders are asking the right question: will Friday bring another leg lower?

Where Bitcoin Stands After Thursday’s Rout

Thursday’s selloff pushed Bitcoin to price levels last seen in April of the prior year, snapping a multi-week uptrend and catching overexposed longs off guard. Derivatives trackers such as CoinGlass estimate that about $1.7 billion in crypto positions were liquidated during the slide, with an overwhelming majority—about 93%—coming from long bets.

That imbalance helps explain the velocity of the move. As long positions auto-closed, cascading liquidations amplified downside momentum and widened spreads across exchanges. While spot prices have steadied into the $83,000 range, order books remain thinner than earlier in the week, leaving the market vulnerable to quick swings.

What Likely Triggered the Bitcoin Selloff

Leverage was the obvious accelerant. Open interest had been building across major venues, and as price slipped below widely watched support zones, margin calls and forced unwinds followed. Funding rates, which had hovered in positive territory, flipped toward neutral or modestly negative on several exchanges—an indication that longs lost their grip.

Macro jitters didn’t help. A firmer U.S. dollar and renewed debate around the Federal Reserve’s policy path have pressured risk assets broadly. Crypto historically trades like a high-beta proxy for tech stocks, and the correlation can reassert quickly when volatility spikes. On-chain, analytics firms such as Glassnode have also pointed to profit-taking by short-term holders as price momentum stalled.

Spot flows added another layer. Early-week indications of cooling demand from spot Bitcoin funds—combined with slower net inflows from stablecoins—reduced the steady bid that had been supporting higher prices. Market structure data from providers like Kaiko show that when top-of-book liquidity thins, even routine selling can punch below support.

Key signals to watch on Friday for Bitcoin price

- ETF and fund flows: Preliminary flow snapshots for spot Bitcoin products will be scrutinized. Sustained net outflows could keep pressure on spot markets, while a return to net inflows often coincides with intraday recoveries.

- Funding and basis: If perpetual funding stays negative and futures basis compresses, it suggests sentiment remains defensive. A shift back to slightly positive funding during a flat price period can foreshadow stabilization.

- Open interest rebuild: After a flush, healthy markets typically see open interest return gradually alongside tighter spreads. A rapid re-leveraging by longs, by contrast, risks another squeeze on any dip.

- Liquidity depth: Watch bid-side liquidity around psychological levels such as $82,000 and $80,000. Improved depth—measured by resting bids within 1% to 2% of spot—reduces the odds of air pockets during sell programs.

- Options positioning: Weekly expiries often cluster around popular strikes. If spot hovers near a heavy gamma zone, market makers may hedge in ways that dampen volatility; if it drifts away, hedging can amplify moves.

Will Bitcoin drop further today, or stabilize soon?

Short answer: the risk of another push lower remains elevated, but a wholesale breakdown is not a foregone conclusion. With liquidity lighter and sentiment fragile, intraday headlines or outsized orders can tip the tape. A clean retest of the $80,000 area would not be surprising, especially if fund flows disappoint or if equities wobble into the close.

That said, several countervailing forces could cap downside. Post-liquidation markets often stabilize as forced sellers exhaust, and negative funding can entice tactical buyers. If spot products show improving net inflows and order-book bids thicken, a grind back toward the mid-$80,000s is plausible, with a sharp short-covering rally possible if price reclaims prior support decisively.

For now, the base case is choppy, headline-sensitive trading with a slight bearish tilt. Seasoned desks will keep risk tight, favoring reduced leverage, watching basis and funding in real time, and letting the market reveal whether Thursday’s flush was a capitulation step or just the middle of a broader drawdown.