Beta Technologies, an early leader in electric aircraft, has outlined the terms of a public debut that could raise as much as $825 million and catapult the Vermont company toward the top ranks of competitors in the advanced air mobility market. The regulatory filing with the U.S. Securities and Exchange Commission proposes a price range of $27 to $33 a share, which would value the company at close to $7.2 billion at the high end.

The offering comes amid a fragile time for the public markets and the wider clean transport sector. By taking the traditional IPO route, as opposed to merging with a SPAC, Beta is gambling that investors now value revenue visibility, disciplined capital plans, and credible certification pathways over early-stage enthusiasm.

What the IPO Terms Reveal About Beta’s Public Offering

With pricing in the high 20s to low 30s per share, Beta joins a crop of climate-tech listings that are leaning on long-term infrastructure and industrial narratives.

Funds will be used for airplane certification, initial production, and development of charging networks to support commercial electric flight.

Unlike most counterparts, Beta has avoided venture capital. Since the company’s founding in 2017 by its chief executive, Kyle Clark, it has raised $1.15 billion from large institutions such as Fidelity and the Qatar Investment Authority, according to past fundraising announcements. Last month, GE Aerospace said it would take a strategic stake and invest $300 million while working on a hybrid-electric turbogenerator—an endorsement from an old-line supplier that could de-risk the powertrain roadmap.

The company pressed on with its registration even though the federal government was in a shutdown, taking advantage of an SEC rule that permits some IPO paperwork to go into effect after a specific time period has elapsed without staff review.

Other issuers, like Navan, have also found this path—highlighting the reopening of the listing window for growth-stage industrial technologies.

Beta Pursues a Different Path in Electric Aviation

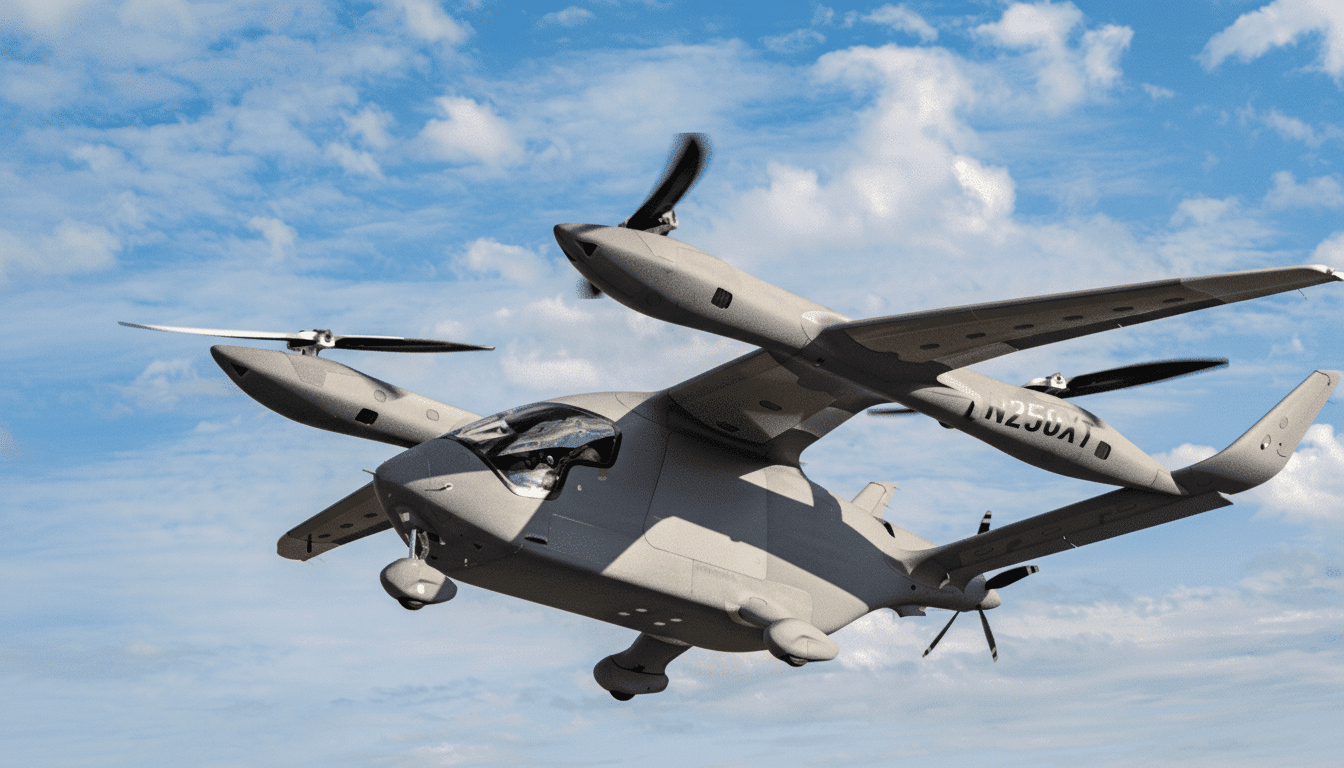

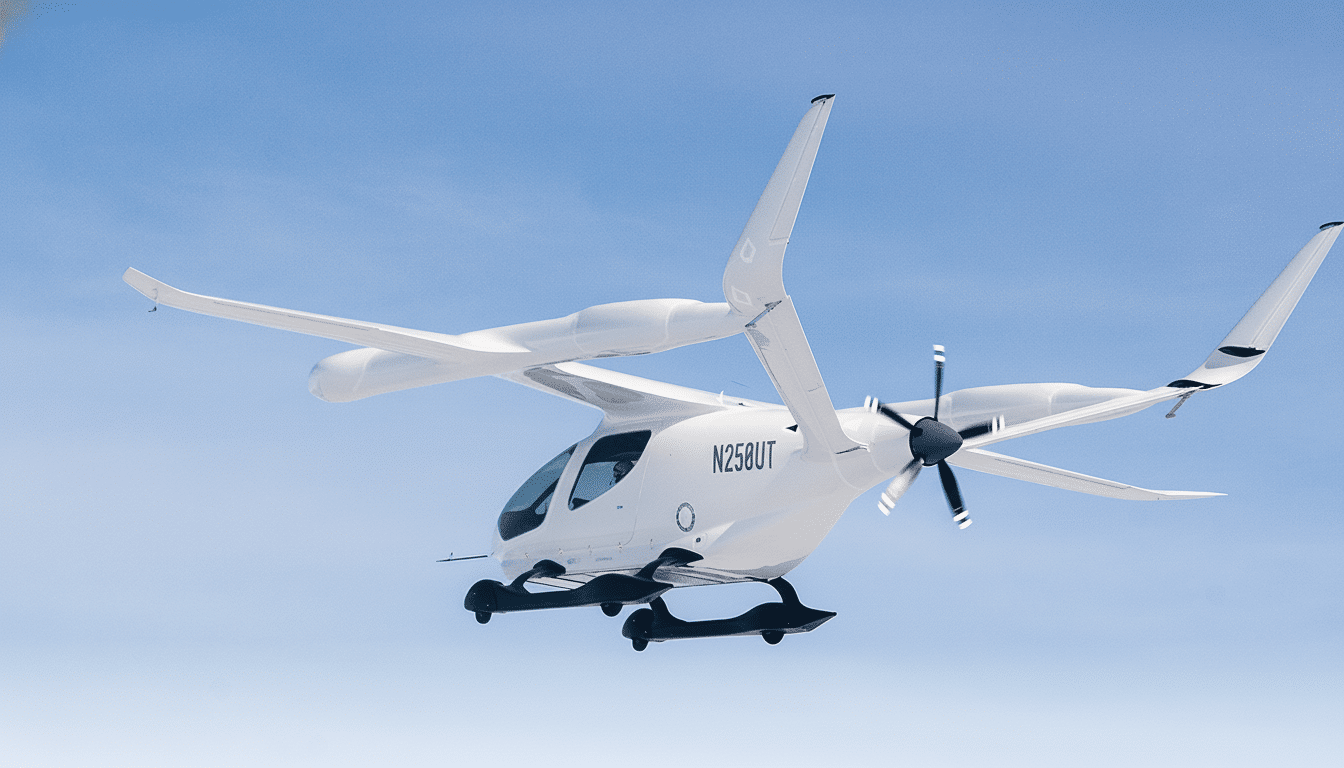

Beta’s strategy diverges from the Silicon Valley playbook. Clark, a Harvard-educated former professional hockey player and pilot instructor who raised turkeys and reindeer to pay his way through school, launched the company from Burlington, Vt., concentrating initially on real use cases—regional logistics, medical transport, and defense test campaigns—not high-speed urban air taxis only.

The company’s aircraft program is generally oriented toward piloted operation and efficient aerodynamics to minimize the imposition on an already short supply of battery energy density. Industry benchmarks are in the 200-250 Wh/kg range for today’s pack-level Li-ion energy density, a constraint that tends to favor designs optimized for range and payload rather than pure vertical flight. Beta’s partnership with GE Aerospace on a hybrid turbogenerator suggests a bridge solution for longer routes where batteries alone might not cut it anytime soon.

Beta has also cut its teeth early on the ground infrastructure side, installing charging stations at airports and logistics facilities spanning multiple states that can talk to one another, according to past company updates. The network approach reflects the lesson of electrification in road transport: cars follow chargers.

Customers, Certification, and the Path to Recurring Revenue

Electric aviation is still a certification-first business. The FAA has made clear that new types of aircraft will move incrementally under the current Part 23 structure and special conditions, with safety cases proven out one by one in the marketplace. It promotes programs that can afford to fly frequently, gather data, and iterate on systems engineering.

Beta’s commercial traction has been in logistics and healthcare. The company has already announced nonbinding orders and partnerships with companies like UPS and United Therapeutics for middle-mile cargo and time-sensitive medical missions. Beta has also done flight test and experimentation work under U.S. Air Force efforts, suggesting that a dual-use path could produce early sales and tough operational data.

Investors will be watching three key milestones after the IPO:

- Compliance and credible progression toward FAA type certification

- Construction of a reliable supply chain for high-voltage systems and battery packs

- The transition of letters of intent to firm orders with service and maintenance agreements

Competitive Landscape and Broader Market Context for Beta

Public peers in advanced air mobility have taken varying paths to market. Joby Aviation, Archer Aviation, and Lilium all went the SPAC route and have been subject to wild share price swings with certification timelines and capital requirements. Beta’s traditional IPO and institutional-heavy cap table might be attractive to those investors who are looking for stricter governance and more transparent use-of-proceeds disclosures.

When it comes to technology, the industry is coalescing around two realistic themes: You’re going to start with piloted aircraft to make certification easier and ramp up training, and you’ll build hybrid options until battery chemistries improve so they can go farther. Analysts at institutions covering aerospace suppliers have stated that regional missions from 200-500 miles could be opened up ahead of all-electric alone through hybrid-electric systems, leading to flights and revenues earlier in life.

Key Risks for Beta Technologies and Signals to Watch

Execution risk remains high. Nontrivial barriers such as battery supply, high-voltage safety standards, and thermal management exist. Certification timetables can change as regulators digest new designs. And so, while customer interest remains promising at an early stage industrywide, firm orders sometimes wait on performance proof, a training pathway, and a total cost of ownership that has to seriously undercut turboprops on capex, secondhand or new, and opex.

But Beta’s combination of institutional support, strategic alignment with GE Aerospace, and focus on near-term use cases gives it a differentiated posture. If the IPO price is good and the company delivers on early certifications and building out facilities, it could help reset how electric aviation companies go public—one utilitarian mission at a time.