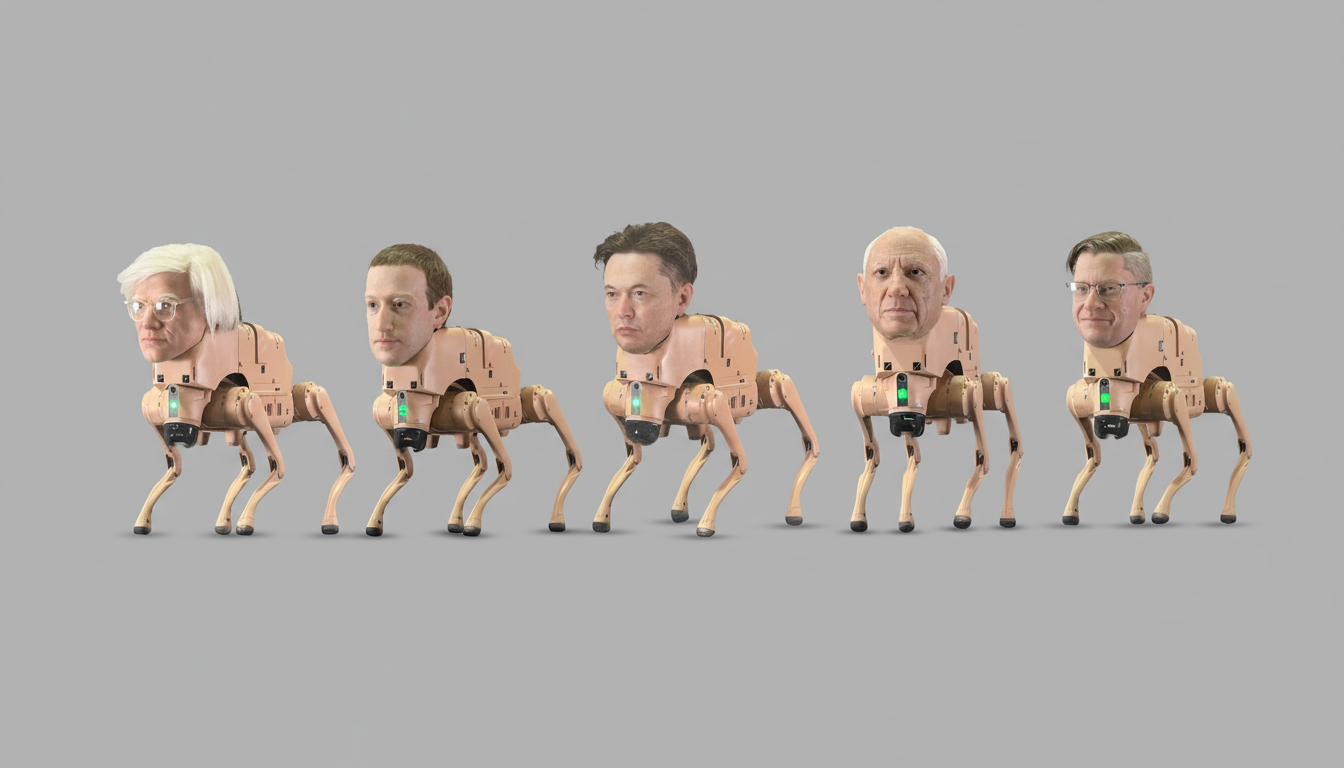

Once again, Mike Winkelmann — better known as Beeple — has flipped the white-cube art world into a tech spectacle. At Art Basel Miami Beach, the digital artist unveiled “Regular Animals,” a pen of $100,000 robot dogs sporting eerily realistic heads modeled after cultural titans — Elon Musk, Mark Zuckerberg, Jeff Bezos, Pablo Picasso and Andy Warhol — along with one face that upstaged them all: his own. The self-portrait dog sold first. That’s a development the artist Beeple himself apparently didn’t anticipate!

Inside Beeple’s Robot Dog Pack at Art Basel Miami

The installation pens Spot-like quadrupeds in a transparent box where they roam, gaze and surveil. Each robot features a hyper-real head sculpt — a meditation on power, ego and the mechanics of fame. (Vyacheslav Oseledko/Agence France-Presse — Getty Images.) The Wall Street Journal says the dogs’ chest-mounted cameras send images into onboard AI systems that translate what the dogs “see” into prints, which are included, in a humorous way, from behind. Out of those outputs, 256 feature QR codes that allow collectors to redeem a free NFT, packaged in what he calls “Excrement Sample” baggies.

The sticker price — around $100,000 for each dog — lines up with the high end of professional quadruped robots once you tack on sensors, compute, custom skins and safety rigging. Guidelines from robotics makers suggest that high-end models can readily exceed six digits, particularly when they are designed for public-facing performances instead of lab floors.

Why Beeple Sold First Ahead of Tech and Art Icons

At a fair where celebrity adjacency is a known draw, the earliest sale of Beeple’s own dog says something.

Collectors weren’t interested merely in a celebrity doppelgänger; they were acquiring authorship and narrative. The piece folds subject into creator, crumpling both into a single ongoing meta-effigy that doubles as a critique of influence and locks down ultimate provenance: the artist as icon. In an attention economy, Beeple’s brand was more powerful than the faces that had been intended to satirize it.

It is also indicative of a wider trend in post-NFT collecting habits. Following the frenzy that greeted Beeple’s breaker at Christie’s, “Everydays: The First 5000 Days” — selling for $69 million, a new high-water mark — the market has skidded back. Data from Chainalysis and other analytics companies indicate that NFT trading volumes fell sharply after peaking, before stabilizing. In that light, a first sale going to the Beeple wax work indicates that buyers value lasting authorship, physical presence and concept rather than mere celebrity memetics or market make-believe.

AI Performance Art Meets NFTs in Interactive Installations

“Regular Animals” is less about gadgets, more of a system: robots do, AI interprets, and the installation spews forth a relentless flow of artifacts. The editioned prints provide tactile takeaways, while the QR-coded freebies serve as cultural receipts — evidence that you spotted the work in the wild. For galleries and fairs, the loop matters: free claims are a low-friction on-ramp for first-time collectors, and they make engagement measurable in ways that don’t turn the artwork into a paywall.

Beeple’s cudgel plan also reflects a trend in media art to offer “experience” installations and performances that combine mechanical theater and generative output. Consider how Refik Anadol’s data-sculptures translate live inputs into aesthetic form; the robotic dogs here serve as performers and printers both. The crude, jokey humor — art that literally “poops” images — makes the spectacle accessible even as it critiques techno-idolatry.

Signals for the Digital Art Market After NFT Boom

Tens of thousands of people attend Art Basel Miami Beach, and the focus there translates into market effects overnight. By situating his face next to the canon and then-next-to-contemporary power players, Beeple gambled that a well-worn art-history frame could puff up his own mythos. The sale order suggests that the gamble paid off: collectors are paying tribute to work that combines conceptual bite with platform-savvy theatrics.

For institutions, there’s also a practical takeaway. Robotics-heavy setups are logistically tricky affairs — insurers, handlers, battery cycles and crowd control all count — but they provide a programmable stage for evolving stories. Each software update, or shift in dataset, can write new outputs without having to rebuild the set, which is a useful model for museums in search of repeatable engagement, and for artists who prefer to have their work live rather than just hang.

For Beeple, the initial sale ratifies a post-boom playbook: ground it in physical spectacle, weave in AI, and treat the NFT as an accessory rather than the main event. For the rest of the field, the message is more stark. In an art economy drowning in famous faces, the most powerful brand in the room may be our own.