Amazon is starting a trial of “ultra-fast” deliveries promising to drop off essentials like cleaning products and cold remedies at doorsteps in 30 minutes or less, an experiment that could ratchet up competition with rivals like Walmart. The move thrusts the retail giant more squarely onto confrontational turf with instant-commerce players and signals that its own last-mile network is being pushed up to a speed tier it had largely confined to groceries and same-day hubs.

What Amazon Is Testing in Its 30-minute Delivery Pilot

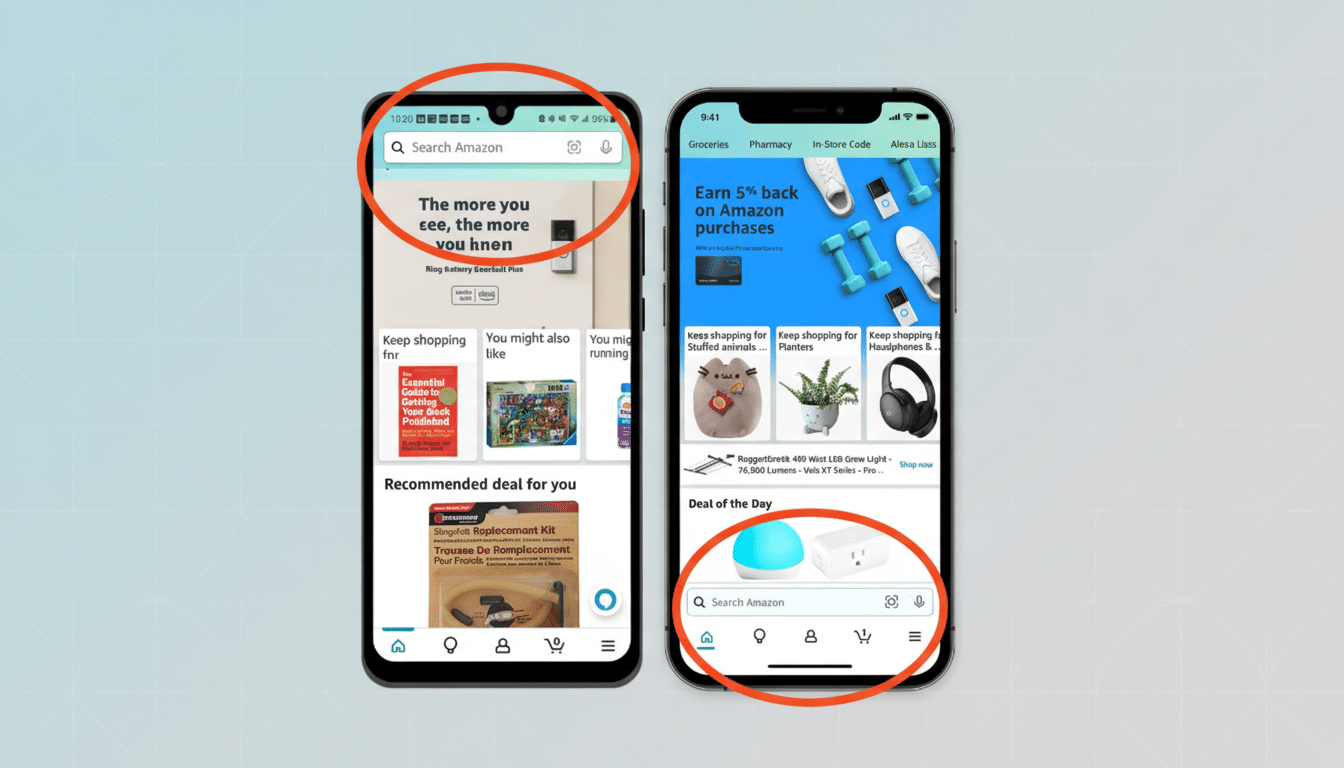

The pilot introduces a 30-minute delivery option within the Amazon app for deliveries in select neighborhoods. Shoppers can purchase a curated blend of fast-moving staple items — you know, milk, eggs, snacks, toothpaste, cosmetics, OTC medicine, pet treats, diapers and paper goods along with small electronics as well as seasonal products — and follow the driver in real time with tipping already baked into checkout.

- What Amazon Is Testing in Its 30-minute Delivery Pilot

- Pricing and availability for the 30-minute service

- How the 30-minute logistics work inside Amazon

- Competitive landscape and precedents in quick delivery

- Why it matters for Amazon, customers and regulators

- What to watch next as the 30-minute pilot expands

Amazon says orders are processed at smaller, specialized facilities near population centers. That footprint — there are two other locations in New Jersey, near Newark and Chatham — has been engineered to slim down pick-and-pack cycles, shrink drive time and standardize safety measures for workers inundated with rapid-fire orders. The company had regionalized its U.S. network prior — moving inventory closer to where demand was located — a precursor to this sort of hyperlocal push.

Pricing and availability for the 30-minute service

For the 30-minute option, Prime members pay a $3.99 fee per order, and other customers are charged $13.99. Carts under $15 prompt a small-basket fee of $1.99 — an essential lever to ensure order economics pencil out on such truncated delivery windows. Early access is available only in select ZIP codes within Seattle and Philadelphia, and those customers will be able to see the upcoming rollout through a dedicated navigation tab inside the app.

How the 30-minute logistics work inside Amazon

Reaching a 30-minute guarantee at scale also depends on inventory precision, compact picker routes and ultra-dense delivery areas. Look for curtailed assortments built around high-turn SKUs, staged close to pack stations and software that batches orders nearby together with the same driver. McKinsey has calculated that last-mile activities can cost more than 50 percent of total shipping costs; taking minutes off them through micro-fulfillment and tight routing are the only ways to make speed economical.

(In city cores, couriers frequently downshift to smaller vehicles — e-bikes or scooters where they are permitted — that can outdistance vans on congested streets.) One study from the University of Westminster in partnership with Transport for London found that cargo bikes achieved urban drops faster than vans, while reducing emissions significantly. Amazon hasn’t said precisely what its fleet mix will look like for the pilot, though the facility placement and item set indicate a similar playbook.

Competitive landscape and precedents in quick delivery

DoorDash, Uber Eats and Instacart have spent years stretching beyond restaurants and groceries to convenience and pharmacy runs, closing the distance between restaurant delivery services and the world of conventional e-commerce. The promised land of instant delivery started up, fizzled and saw several consolidations and market exits in 2023–2024. But the consumer behavior was too compelling: Quick staples and impulse items persist, especially in dense neighborhoods.

Amazon has sampled speed before. It launched Prime Now in 2014 as a one-hour delivery service; Prime Now was sunset earlier this year and integrated into the main app. Internationally, the company has also just launched a 15-minute service in the United Arab Emirates that is seeing some deliveries as soon as six minutes. At home, Amazon has announced that it would spend more than $4 billion on building up its capacity for fast delivery and tripling the size of parts of its network by 2026, with dozens of same-day sites already up and running near major U.S. metros.

Why it matters for Amazon, customers and regulators

For customers, 30-minute delivery reduces the use-case gap between ordering online and running down to the corner store — urgent baby supplies, a missing ingredient for a dish you’re in the middle of cooking, a charger when an unexpected guest just arrived. For Amazon, the experiment is to see if low charges and tips can offset the higher cost per drop and lift Prime engagement and average order frequency.

Labor and safety will receive scrutiny. Hyperfast services contract pickers’ and drivers’ timelines, prompting questions about load, traffic dangers and good work practices. And in large cities such as New York, regulators have already set minimum pay floors for app-based delivery workers, suggesting policy can reshape cost structures for speed-led models. Amazon’s focus on specialized facilities and standardization of processes will be watched as the “antidote for complexity.”

What to watch next as the 30-minute pilot expands

Key signals include on-time rates, average basket size and how often customers return for a pinch of extra salt — and the service’s geographical reach beyond its first two markets. The breadth of inventory and rate of substitutions, especially for fresh products, will show how well the micro-fulfillment is tuned. If performance remains strong and customer uptake is as well, expect a measured expansion to more dense ZIP codes, along with more e-bike-friendly and pedestrian-friendly routing where street infrastructure allows. In sum, the company is testing whether “now” can be fabulous and defensible financially.