Airbnb is taking its Reserve Now, Pay Later option worldwide, widening access to a booking flow that lets guests secure stays without paying at checkout and settle the balance closer to arrival. The feature, previously piloted in select markets, is designed to reduce upfront friction while keeping refunds aligned with each listing’s cancellation policy.

Only listings with flexible or moderate cancellation terms are eligible, a guardrail that aims to balance guest convenience with host certainty. Airbnb positions the rollout as a travel-focused spin on the buy now, pay later model that reshaped online retail, but tuned to trip planning where costs are larger, dates are fixed, and group coordination is common.

How the Reserve Now, Pay Later Feature Works for Bookings

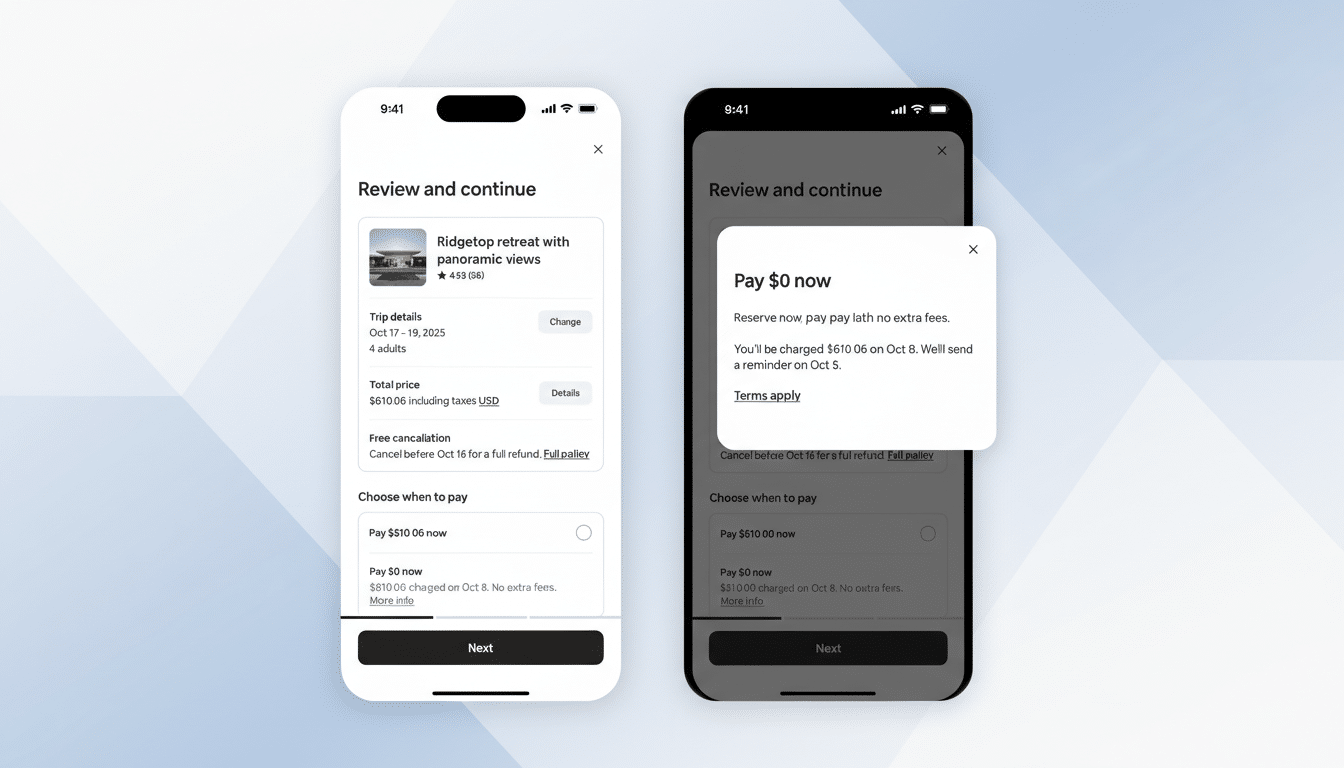

At checkout, eligible guests can choose to reserve immediately and be charged nearer to check-in, instead of paying the full amount upfront. If plans change within a listing’s cancellation window, the guest avoids losing money paid at the time of booking because no charge was taken yet. Standard host rules still apply once that window closes, so clarity on deadlines matters.

The mechanics are intentionally simple: defer the charge, keep the cancellation policy intact, and make high-ticket trips psychologically and financially easier to commit to. For multi-city itineraries and family gatherings, shifting cash outflows until dates are firmer can be the deciding factor between browsing and booking.

Early Data and Host Impact from Airbnb’s Reserve Now, Pay Later

Airbnb says the option has seen strong traction in earlier pilots, reporting 70% adoption among eligible bookings. The company also credited the feature with adding nights booked, extending lead times, and nudging guests toward larger entire homes—particularly four-bedroom-plus properties—lifting average daily rates in the process. CFO Ellie Mertz told investors the behavior shift was visible across cohorts using the feature.

There is a trade-off: Airbnb’s overall cancellation rate edged up from 16% to 17%, with a higher rate among users of the deferred payment option. Management characterized the increase as modest relative to the platform’s baseline. For hosts, the upside of earlier, higher-value reservations may offset a slight bump in volatility, especially for those already operating with flexible or moderate policies.

Why This Matters for Travelers and Hosts Using Pay Later

For guests, deferring payment improves cash flow, a familiar benefit from e-commerce BNPL but more consequential in travel where a single stay can represent a month’s discretionary budget. In an Airbnb-commissioned survey conducted with Focaldata, 60% of U.S. travelers said flexible payment options are important when booking a holiday, and 55% said they would use one. That demand signal aligns with the company’s early adoption numbers.

Consider a group booking an entire home for a reunion: locking in dates now, without paying today, can reduce coordination friction and protect plans while flights and work schedules settle. On the supply side, hosts who enable eligibility via flexible or moderate terms may see earlier commitments and larger-party demand. Clear communication on policy cutoffs and reminder prompts before charge dates will be key to minimizing last-minute churn.

BNPL Context and Oversight for Deferred Travel Payments

Airbnb has experimented with pay-later mechanics before, including split-deposit options and an installments partnership with Klarna. The global expansion signals confidence that the in-house version—synchronized to host policies and travel timelines—can scale.

The move also lands as regulators in major markets, including the U.S. and U.K., push for clearer disclosures and stronger consumer protections around installment products. While Reserve Now, Pay Later differs from traditional credit-like BNPL—there’s no revolving loan and the charge is simply deferred—best practices still apply: transparent terms, timely reminders, and straightforward paths to cancel within policy.

What to Watch Next as Airbnb Scales Pay Later Rollout

Key metrics to monitor include host adoption in top destinations, changes in average booking lead times, and the gap between cancellation rates for users and non-users of the feature. Watch, too, for geographic nuances: cross-border travelers may find deferral particularly attractive given currency swings and visa uncertainties.

If the current patterns hold—higher conversion, earlier commitments, and larger-party stays with only a marginal uptick in cancellations—Reserve Now, Pay Later could become a default expectation across short-term rentals. For Airbnb, the prize is more demand locked in sooner; for guests, it’s flexibility without giving up fee-free exits inside the rules they already understand.