The Nordic startup scene is not only having a moment; it’s multiplying gains. A convergence of investor interest, founder ambition, and policy momentum has propelled the region’s enterprise value to about half a trillion dollars, according to Dealroom and regional investment agencies; by some estimates, more than $8 billion in 2024, even as global markets cooled—a lasting shift rather than a speculative bubble.

From Stockholm and Helsinki to Copenhagen, Oslo, and Reykjavik, the playbook is gelling around a trifecta of innovation in AI, deep tech, and climate. A wave of fresh-out-the-trenches operator angel investors, see-what-sticks university pipeline programs, and hyper-proactive government initiatives are compressing the time-to-market of globally competitive companies—all without losing focus on capital efficiency.

- Why the Nordics are expanding now: culture, policy, and capital

- Funding and exits by the numbers across leading Nordic hubs

- AI, deep tech, and climate provide a sustained Nordic competitive edge

- Policy and public money are important catalysts for Nordic growth

- What could cool things off for Nordic startups in the near term

- What to watch next as the Nordic startup surge consolidates

Why the Nordics are expanding now: culture, policy, and capital

Founders often mention an underappreciated catalyst: a risk-tolerant culture with strong safety nets. It’s easier to quit a stable job and try something audacious if you know that health care, education, and child care aren’t in doubt. That’s going to create a higher velocity of experimentation and a more robust early-stage funnel.

English-language fluency and public digital-by-default services decrease the friction for global go-to-market. These include BankID across Sweden, NemID/MitID in Denmark, and Norway’s BankID. Thanks to these systems, secure digital identity has become typical, helping turn the region into a laboratory for fintech businesses, e-commerce, and identity-dependent platforms. This infrastructure edge allows startups to ship faster with better compliance from day one.

Crucially, and as is also notably the case with Germany, the Nordics have a compounding alumni effect. Operator angels now contribute, write checks, and provide guidance to the next generation, who have feedback loops tightened and distribution channels unlocked that new teams rarely receive anywhere else, from people who built Spotify, Klarna, Supercell, Unity, Wolt, Northvolt, or Pleo.

Funding and exits by the numbers across leading Nordic hubs

The region is punching above its weight on capital efficiency and results. According to Atomico’s yearly State of European Tech reports, the Nordics rank among the highest in tech investment per capita and unicorns per capita. The combined ecosystem value is estimated by Dealroom to be around $500 billion, with Stockholm and Helsinki among Europe’s most valuable regions outside London and Paris.

Despite more challenging later-stage conditions, the Nordics continue to create headline outcomes: DoorDash’s acquisition of Wolt in a €7 billion deal, Visa’s acquisition of Tink, Tencent taking a majority in Supercell, and Microsoft acquiring Mojang are all indicative of a region that builds globally relevant products early.

Nasdaq Stockholm and First North have in the past provided an exit route for growth-company investors, and bankers across the region say that as profitability has improved the IPO window is slowly opening.

Importantly, capital is diversifying. Domestic funds such as Northzone, Creandum, byFounders, Inventure, Seedcamp-accredited Nordic investors, and NordicNinja are increasingly accompanied by U.S. and European crossover firms in growth rounds, preventing overreliance on a single capital source.

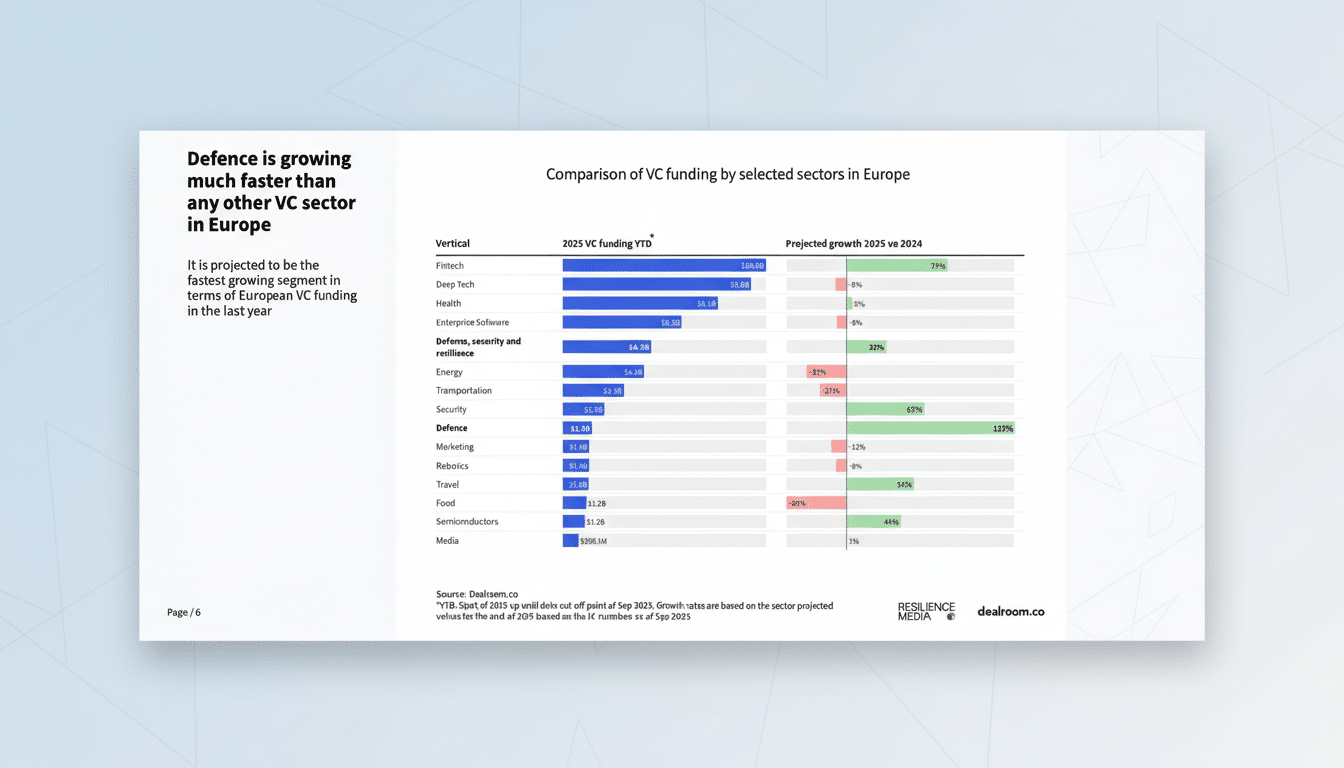

AI, deep tech, and climate provide a sustained Nordic competitive edge

The Nordics are embracing hard issues. Atomico and the European Investment Bank point out a higher proportion of regional deep tech investments than the European average, which they say is dominated by fields including AI, advanced materials, space robotics, and climate tech. Two pioneering players, Finland’s Silo AI and university labs, are working to wedge frontier models into Nordic languages; Sweden’s program known as AI Sweden is aligning industry and academia to speed adoption within large enterprises.

Space is led by Finland’s ICEYE, with that nation sharing synthetic aperture radar satellites—now back up to three—and data sales around the world. In the realm of quantum, IQM and cryogenics leader Bluefors anchor a strong hardware stack for Finland. And bets like Northvolt and H2 Green Steel, two companies with stakes in battery and green industrial manufacturing, place Sweden at the epicenter of Europe’s energy-transition manufacturing. That is one of the reasons that Norway’s ocean-tech and carbon-management ecosystem, covering players like Aker Carbon Capture and offshore wind companies, is fostering a new generation of industrial software and services.

That’s also a matter of pragmatic deep tech tilting. With small local markets, Nordic startups tend to have export in mind from day one and often target enterprise buyers and regulated industries where defensibility, safety, and compliance matter.

Policy and public money are important catalysts for Nordic growth

Public entities serve as catalytic LPs and early customers. Business Finland, Vinnova in Sweden, Innovation Fund Denmark, Innovation Norway, and Iceland’s New Business Venture Fund provide grants, loans, and co-investment to de-risk R&D and commercialization. And they crowd in private capital for deep tech and climate infrastructure through the European Innovation Council and the European Investment Bank.

At the same time, this coordinated scaffolding collapses the distance between lab and market. It nudges university spinouts too, with Aalto, KTH, Chalmers, DTU, NTNU, Lund, and the University of Helsinki all churning out technical founders who can straddle research and product cycles.

What could cool things off for Nordic startups in the near term

The bottleneck, admittedly, continues to be late-stage capital. For many Nordic scale-ups, foreign growth funds are still necessary in rounds beyond the Series B—making them susceptible to macro whiplash. A sluggish IPO market, particularly for technology listings on public Nordic exchanges, postpones liquidity for employees and early investors.

Talent is another pressure point. Engineers flock to the region, but visa regimes and housing costs in hot spots like Stockholm and Copenhagen can limit hiring. The race for talent for senior AI researchers is a global competition, and the price of openness around compensation expectations is going up.

And last but not least, it’s really hard to build heavy industry at startup speed. Battery factories, green steel plants, and carbon capture projects all depend on grid capacity, permitting, and long-term offtake agreements. There’s real execution risk, even with strong policy support.

What to watch next as the Nordic startup surge consolidates

Three markers will indicate whether the boom sticks:

- A pickup in Nordic IPOs for profitable software and climate companies

- More mega-rounds led by a mix of domestic and international investors

- Tangible industrial milestones from the region’s flagship climate projects

If those trends materialize, the Nordics will further entrench their status as Europe’s most efficient startup factory—an ecosystem tailor-made for hard tech, global markets, and disciplined growth. The map of where category leaders are born is already creeping north; the next generation appears to be set to double down.