Shoppers in search of a smartphone with more memory for their money will be fighting an uphill battle. The reason these whispers are gaining traction is that a big bump back could come in 2026, when certain industry players are rumored to begin having fewer RAM‑equipped phones on their hands than what we have now, as they reposition capacity toward the too‑hot‑to‑handle AI server and high‑bandwidth memory markets.

Why AI demand is squeezing phone memory capacity

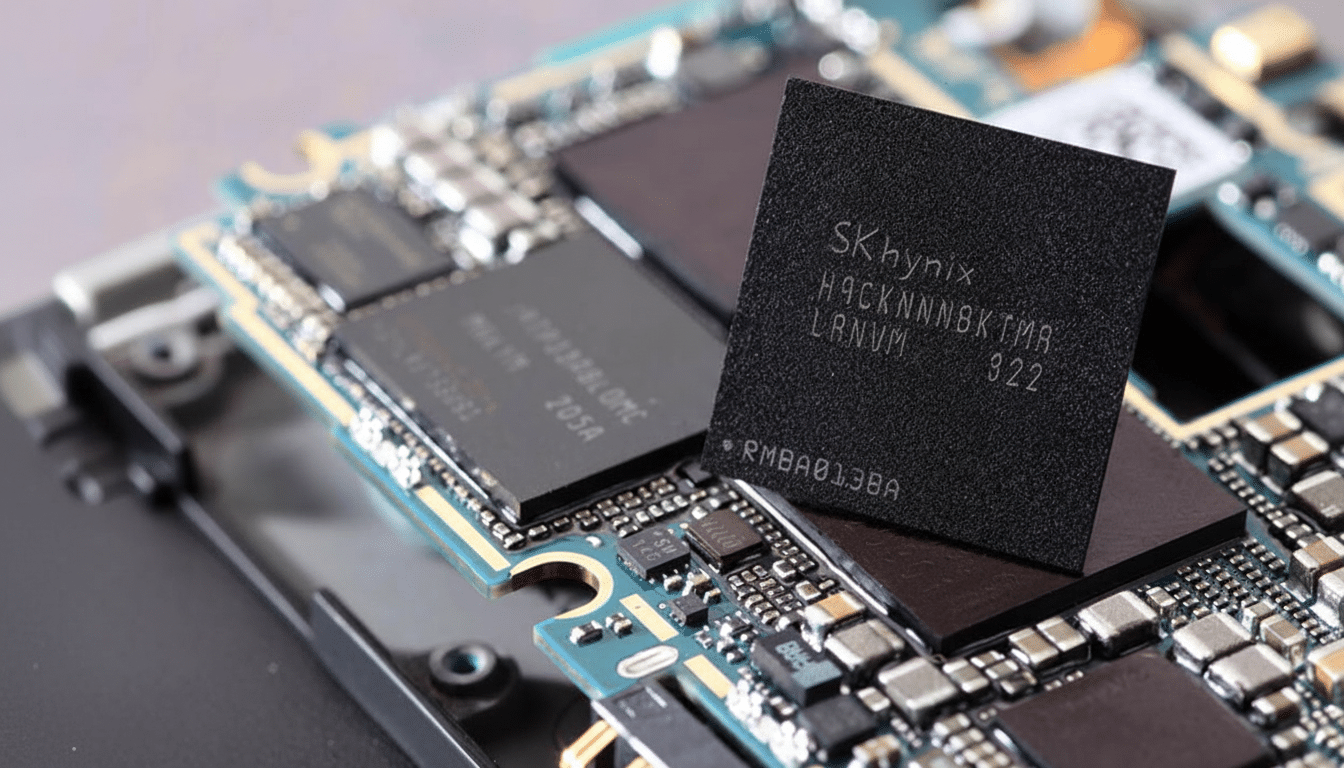

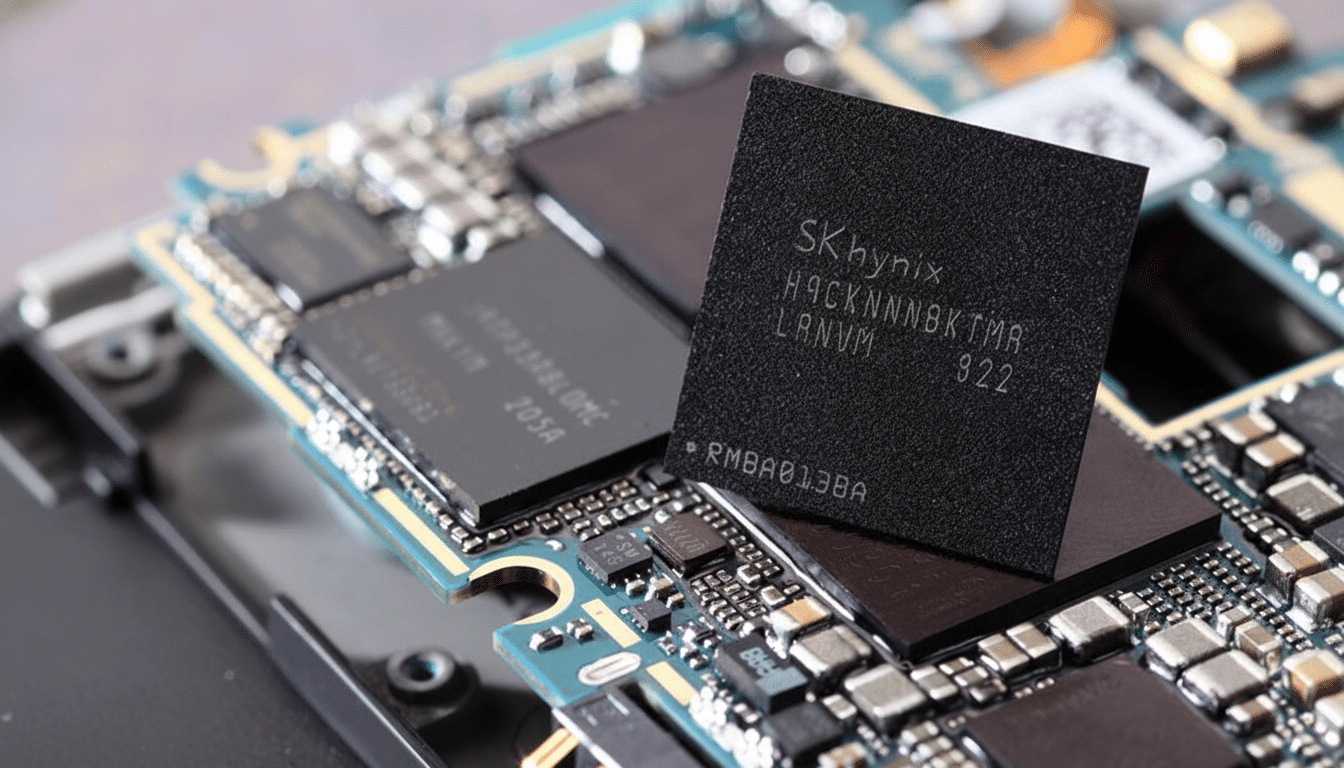

HBM is the silicon for the AI boom. It’s stacked, ultra‑fast DRAM tied to accelerators from Nvidia, AMD, and other vendors — and it sells at a premium. With enterprise demand booming, memory titans including SK hynix, Samsung, and Micron are focusing HBM lines on supply ahead of consumer DRAM like LPDDR that goes into phones.

- Why AI demand is squeezing phone memory capacity

- What phones in 2026 could look like as memory tightens

- Prices are going up and specs are going down

- The workarounds phone makers use, and their trade-offs

- The supply outlook to watch in memory and packaging

- What it means for phone buyers amid tighter memory supply

TrendForce has observed steep DRAM price hikes in 2024 as buyers pursued limited supply, while HBM would remain tight through 2025. Both Gartner and IDC see years of continued double‑digit growth in AI infrastructure spending, an indication that the weight of data‑center memory will not dwindle. The result: less of the wafers and packaging capacity being allocated to the phone parts that keep everyday web browsing, app use, and camera operation running smoothly.

What phones in 2026 could look like as memory tightens

This crunch will lead to a need for spec rollbacks from as early as Q1 2026, according to Lanzuk, a well‑known leaker posting on Naver. The post suggested 16GB RAM models may virtually disappear beyond niche flagships; the amount in 12GB models could be cut by more than a third; and even 8GB units — now common in mid‑range devices — may fall by more than half if vendors return to offering phones at their base capacity with 6 or even 4 gigabytes.

That picture, taken with a grain of salt, fits the supply dynamics. We are already witnessing a bifurcation between “AI‑ready” halo devices and mass‑market models. For the rest of the world, where 16GB phones were already rare, that gap is likely to keep increasing: high‑end handsets could still manage with 12GB, but mainstream devices will settle for somewhere between 6GB and 8GB — and they’ll charge you more for it.

Prices are going up and specs are going down

When input costs surge, brands typically do one of three things: jack up prices; downgrade specs; or a bit of both. RAM and NAND flash are both on the rise — TrendForce has also noted that NAND prices are up as enterprise SSD demand peaks — leaving phone makers with little margin to eat inflation, given fixed marketing and distribution costs.

Look for memory to be the first lever that is pulled. Storage tiers could shrink (fewer 512GB options, in other words), and starter RAM may step down to hit psychological price levels. This is a situation where 2026 devices could look slower on paper than the 2025 versions they are replacing, despite processors getting faster and cameras getting better.

The workarounds phone makers use, and their trade-offs

Manufacturers have a few tactics. One is “virtual RAM,” which carves out swap space from fast UFS storage to fill up memory. It is useful for tab hoarding and light multitasking, but it can’t keep up with legit DRAM in bandwidth or latency terms; as a result, heavy gaming, RAW photo editing, and sustained AI workloads still choke.

Another is to push more AI features to the cloud rather than running them on‑device. While this can alleviate RAM pressure, it introduces latency and data costs, and it flies in the face of increasing privacy expectations. Paradoxically, on‑device AI assistants and generative photo tools perform best with 12GB–16GB of RAM to store larger models; reducing memory could limit the very features phone makers want to promote.

The supply outlook to watch in memory and packaging

Capacity is revving up, but not quickly enough to wipe out the imbalance in a hurry. SK hynix has upped its HBM output, Micron is accelerating to HBM3E, and Samsung is chasing the market — and still, advanced packaging like 2.5D and CoWoS is dragging across the whole AI supply chain. As that investment lands, the tilt could play into the hands of data centers through 2025–2026.

JEDEC’s subsequent memory standard for phones is LPDDR6, which should drive speeds even higher — ordinarily at a premium in the early waves. If the shift comes simultaneous to a period of tight supply, early LPDDR6 phones could be pricier or come with less capacity, strengthening that narrative of downgrading for the broader market.

What it means for phone buyers amid tighter memory supply

If you care about multitasking headroom, 2025 might be a smarter upgrade window than continuing to wait. Pay attention to the spec sheets — 8GB might not be the automatic mid‑range sweet spot. And if a vendor’s press release touts headline AI features, be certain they run on‑device using the amount of RAM you have, or default to the cloud.

The upshot: The gold rush for AI, in turn, is helping to change the priorities of memory. Barring a faster‑than‑expected supply surge, 2026 may be the year that smartphones want you to pay them more for less RAM — an unusual step backward in a category that tends to move just one way.