YouTube’s first exclusive global NFL game distributed to linear television networks reached a total of over 17.3 million average-minute viewers, marking a new platform best for concurrent livestreaming viewership and illustrating how quickly premium sports is turning to digital-first distribution.

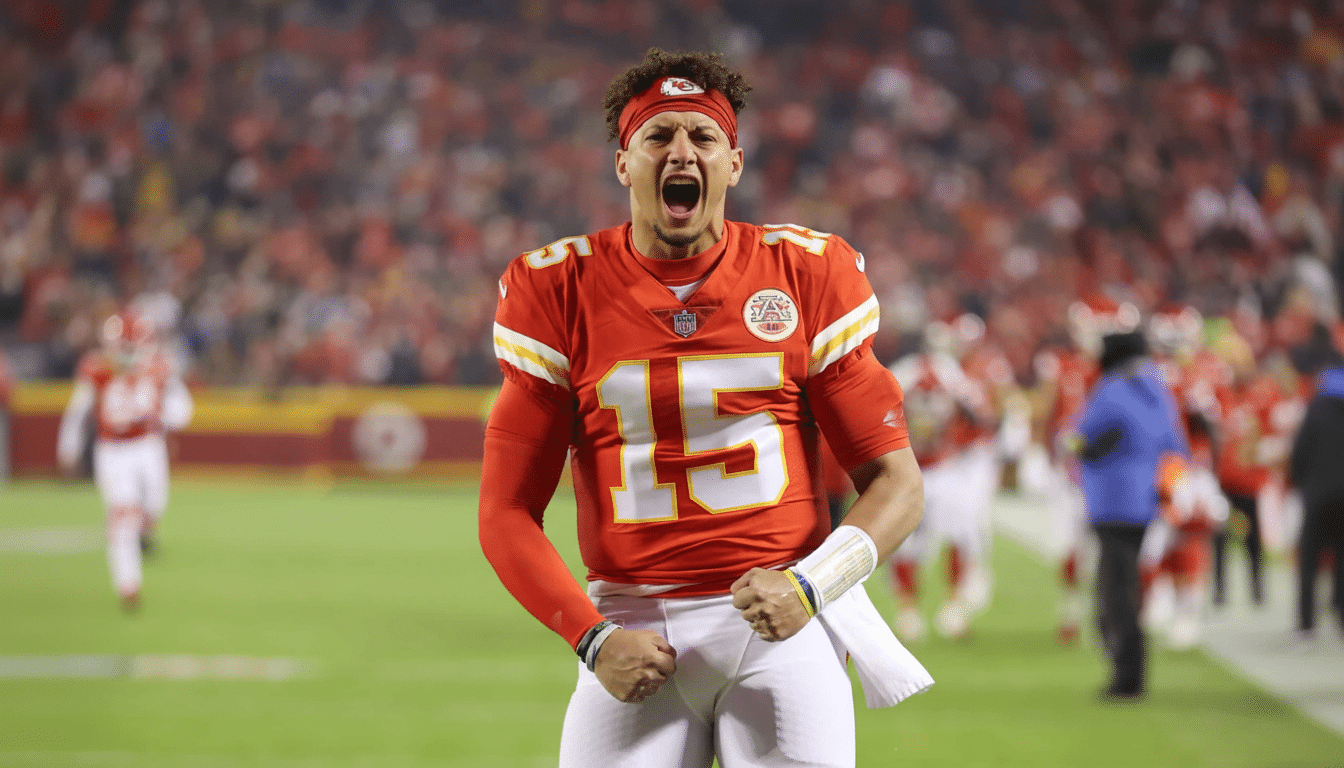

Playing in São Paulo, the game between the Kansas City Chiefs and Los Angeles Chargers was available in over 230 countries and territories. The U.S. provided 16.2 million average-minute viewers across YouTube and other measured platforms, Nielsen said, and YouTube posted another 1.1 million AMA out of the country, a rare globally diversified footprint for an NFL game.

How the 17.3M was calculated

The industry’s preferred apples-to-apples metric is average-minute audience (AMA), which reflects the average number of viewers tuning in to each minute of a telecast. It “flattens peaks and valleys unlike peak concurrency or total reach” and forms the core of the vast majority of ad guarantees. YouTube also said the stream drew its biggest crowd ever in concurrent viewers — another sign of platform stress-testing and viewer engagement intensity.

Nielsen’s addition of connected TV co-viewing and out-of-home estimates could make sports streaming more equivalent to traditional TV. For advertisers, that matters: It turns into a common currency of sorts, with demographic breakouts and duplication analysis across platforms to measure potential incremental reach.

Why this matters for YouTube and the N.F.L.

The telecast is part of YouTube’s expanded NFL pact, a maneuver designed to bolster its live-sports slate and win over brand budgets that have often been earmarked for linear TV. With its Sunday Ticket rights already sending fans to connected TVs, YouTube is establishing itself as a first-screen, not second-screen, place to watch football.

Strategically, YouTube’s unique advantage is identity and interactivity, at scale. The ability to serve targeted ads, control frequency and sequence messaging enjoy clients who never logged in standoff TV can’t offer. If YouTube can reliably add those tools to high-profile sports, it bolsters a pitch based not on amounts of people but measurable results.

Creator-led broadcast bets

YouTube rallied behind its native culture, getting creators like Deestroying, MrBeast, Haley Kalil and Marques Brownlee on-screen and layering in a halftime performance from Karol G. The fan reaction was mixed — some loved the personality-driven approach, while others found it distracting from the play — but the experiment speaks to a larger concept: integrating live sports with creator formats that keep younger audiences interested.

Think of it as a platform-native counterpart to alternate broadcasts like the NFL’s quarterback-centric or “ManningCast”-style shows. If creator-led feeds can help grow watch time, comments, and social lift while it still runs serious analysis on the main feed, YouTube can segment audiences and not sacrifice the core telecast.

How it stacks up

The number is competitive against recent streaming benchmarks. Netflix’s Christmas NFL doubleheader drew an average of more than 24 million viewers, a high-water mark for a strictly digital NFL extravaganza. According to Nielsen, Amazon’s Thursday Night Football games have averaged in the low-teens, indicating solid gains for sports on connected services.

Context counts: the YouTube game was a single, exclusive global broadcast with a unique start time and location, which can either shrink or expand audiences. The larger lesson isn’t one of a league-table victory or defeat, but rather that a natively digital platform can truly provide mass reach and performance-grade targeting in one and the same.

What advertisers will demand next

Actually, buyers will be keen on the composition behind the headline. Anticipate scrutiny of age skews, the co-viewing multipliers on connected TVs, completion rates and unduplicated reach versus linear. With YouTube’s first-party data, brands can also experiment with sequential creative, shoppable overlays and creator integrations that deliver measurable lift from the same audience pool.

If the platform can be stable at higher concurrency and keep the latency low—two pain points with live streams—bigger tentpole buys and sponsorships should come. Success in this area could also lend support to a move toward more exclusive windows, to more than just simulcasts.

The bigger picture

For the NFL, diversified distribution means keeping younger viewers within the ecosystem without ceding scale. Add in a 17.3 million AMA debut on YouTube, and it only confirms that big-game audiences officially don’t belong only to broadcast networks anymore. Then comes the test of repeatability: putting up similar numbers again and again against a variety of opponents while turning the creator layer into an asset, not a distraction.

Should that occur, the line between a traditional sports broadcast and a platform-native, interactive one is likely to continue to blur even more — and the ad market to follow the eyeballs, and the data, into the stream.