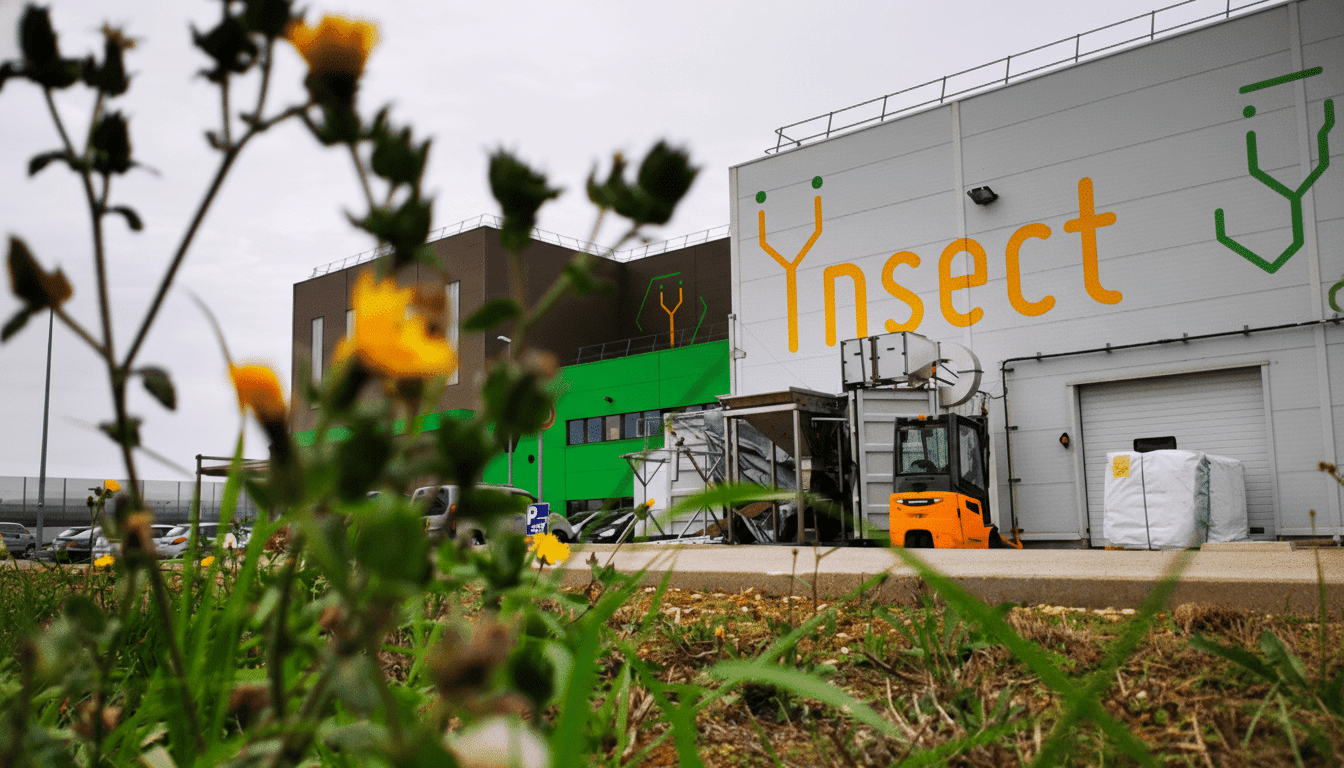

Ÿnsect, a French insect farming pioneer that was at one time a flagship for Europe’s climate tech ambitions, has been placed into judicial liquidation having raised more than $600 million. The flop serves as a tough lesson for industrial moonshots: green dreams die swiftly when the numbers supporting them cannot.

Far from the dominant storyline, Ÿnsect’s downfall wasn’t really about squeamish consumers. Human food was a side bet. The company’s core markets were to be animal feed and pet food — categories that look alike from afar but follow very different economics. Ÿnsect never reconciled the two.

Commodity Math Swallowed the Vision for Insect Feed

The pitch to investors and policymakers was seductive: get rid of fishmeal and soy in animal feed and replace it with low-footprint insect protein, while building a model “circular” system where waste would become food at the front end for aquaculture while also gutting methane emissions at the back. Impact-focused backers such as Astanor Ventures and Bpifrance leaned in, and the thesis drew international interest, including from FootPrint Coalition.

Market reality was less forgiving. Animal feed is a price-driven commodity industry, in which millers seldom choose to pay a premium for sustainability. In reality, factory-scale insects will eat already-feed-worthy cereal byproducts, with an expensive processing step. Analysts at Rabobank and others have long predicted that insect meal would have to hit very rigorous cost targets — fishmeal and soy are cheap; insect meal needs to be, too — for it to make any headway in the market; it seldom, if ever, has.

Regulatory tailwinds helped but did not rescue the model. The EU approved insect proteins for aquaculture in 2017 and, as of 2021, pig and poultry feed, expanding the addressable market. But volumes and margins stayed constrained, and buyers remained price-sensitive. Pet food, meanwhile, was more accepting of premiums — but smaller by volume — and based on brand.

Overbuilding Without Proving Unit Economics at Scale

Ÿnsect’s signature bet was Ÿnfarm, a huge automated factory in Northern France that was supposed to be “the most expensive bug farm on the planet.” The plant gobbled hundreds of millions before the company even secured repeatable unit economics. Energy-hungry heating for the mealworms, complex robotics and biosecurity clocked up operating costs just as energy prices soared and interest rates ticked higher.

As growth slowed, Ÿnsect shifted to higher-margin segments, such as pet nutrition, and hired a new chief executive to guide its launch. It then closed the Dutch site it picked up from Protifarm and slashed headcount. But a state-of-the-art plant designed for grain-feed production didn’t simply morph into a pet food concern. Carrying costs, debt, and a mismatched asset base boxed in the company.

Strategy Whiplash and Thin Sales Undermined Growth

Market jitters for the company only magnified execution risk. Ÿnsect was also in pursuit of animal feed, pet food and — after the purchase of Protifarm — human food. Even then, leadership conceded that human food could represent just 10% to 15% of revenue a few years down the road — which was an admission that this deal would remain at the edges right when cash flow matters most.

The spend never translated into top line. Company filings indicate revenues at the core company peaked in 2021 at around €17.8 million, a figure that rose with intra-group transfers, while it reported net losses of €79.7 million in 2023. The chasm between industrial ambition and commercial traction was just too vast to be financially engineered.

Funding Was Impact-Driven, but Ultimately Finite

Ÿnsect’s investors were not tourists from a hype cycle; they were climate-oriented funds and public financiers with wagers to place over strategic sovereignty — and sustainability. Grants, loans, and equity were all mixed together in a convoluted capital stack. But financing project-scale production requires known cash flows, and the company didn’t have long-term offtakes at prices that could underpin increasing energy and capital costs.

As Joe Haslam of IE Business School has argued, Europe tends to finance the daring prototype but underwrite the grind of industrialization too weakly.

The result is what we’re often reading about: pilots are celebrated, gigaplants are announced, and then years of undercapitalized ramp-up ensue during which the market changes and patience wanes.

Lessons for Insect Protein Startups and Policymakers

Ÿnsect’s insolvency is no judgment on insects. Competitors that scale gradually, co-locate with cheap sources of heat or feedstock, and focus upon pet nutrition rather than bulk feed are doing better. Take Innovafeed, which has focused on staged growth and industrial partnerships to reduce energy and logistics costs — a strategy intended to de-risk unit economics before going big.

What’s next is straightforward enough: right-size plants, contract for offtakes with transparent pricing, monetize byproducts like frass fertilizer, and co-locate within energy or agro-industrial sites to tamp down costs. For policymakers, that’s a lesson in pairing R&D and equity with the unsexy basics of industrial buildout — power connections, permitting, and working capital support during ramp.

Ÿnsect was a darling of both the celebrity endorsement and stratospheric expectations. In the end, cash flow is what scales — not charisma. The sector isn’t dead, but only for companies that align their mission with their margin and prove the math before they pour the concrete.