xAI’s chief financial officer, Mike Liberatore, has left the company, The Wall Street Journal reported. His departure follows a spate of senior exits at the Elon Musk–funded AI startup, and comes at a delicate time for a company rushing to scale compute, ship products, and lock down multibillion-dollar funding.

.

Why the CFO’s departure matters

With the current AI cycle, the CFO is no longer just a back-office job — it is a frontline role that shapes compute capacity, vendor relationships, and the trade-off of speed versus solvency. With a GPU cluster carrying a billion-dollar price tag and long lead times to secure the requisite power and cooling, the funding structure could dictate how fast a model team can train and deploy new systems.

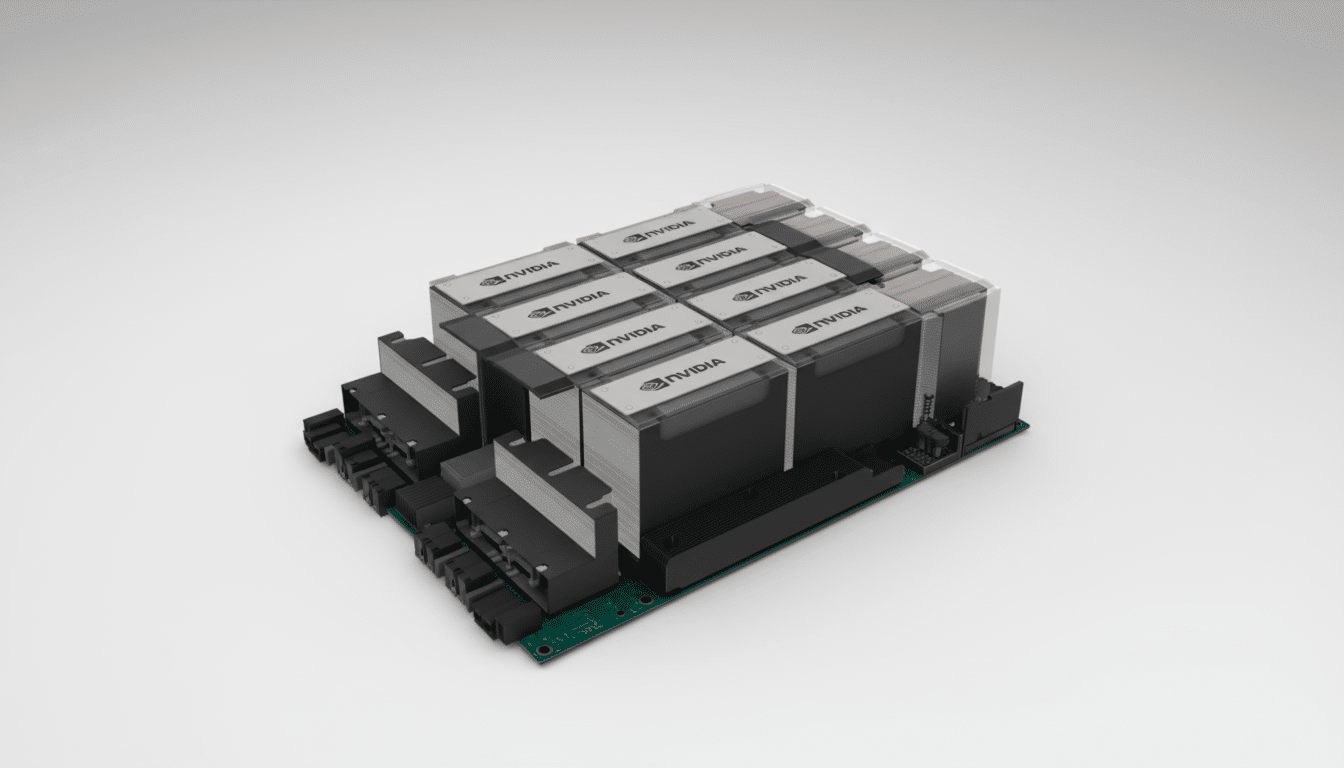

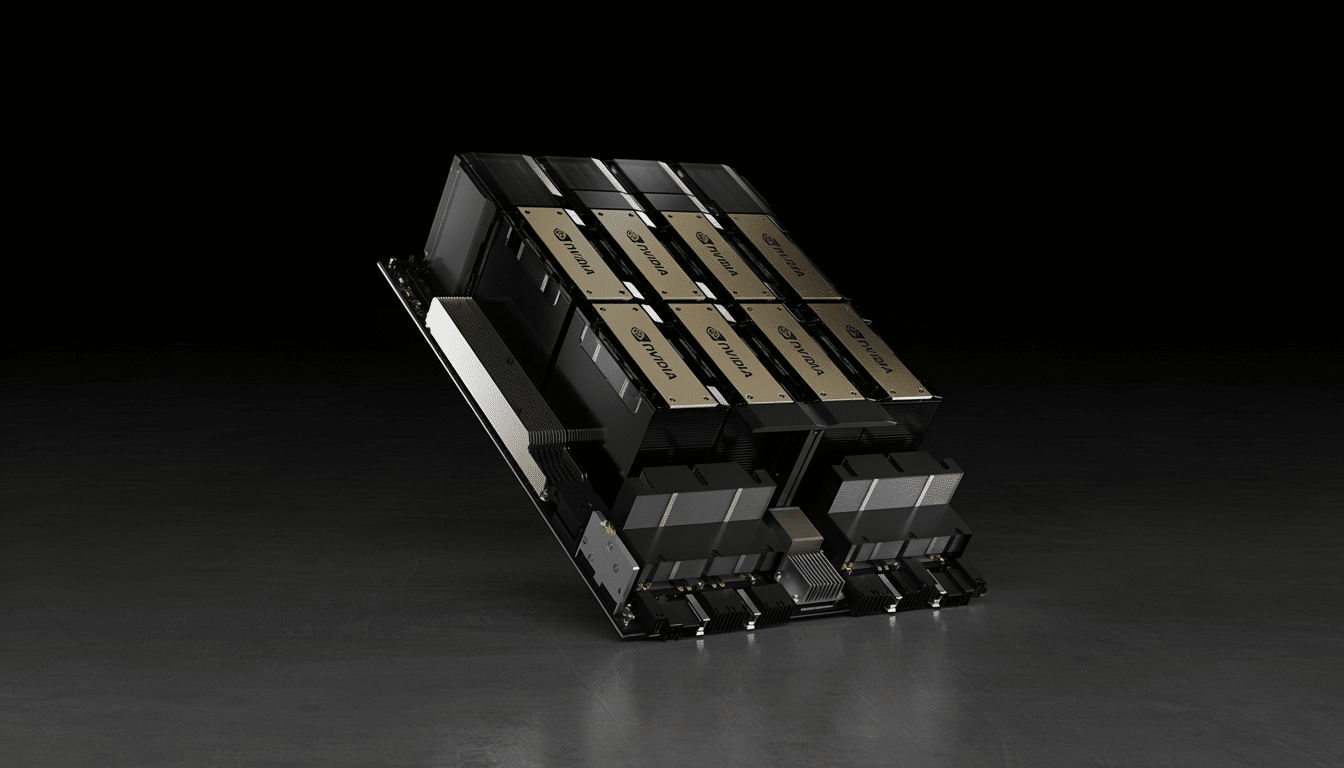

xAI Exaflops has signaled plans to develop one of the world’s largest training supercomputers. Musk has publicly referenced targets in the 100,000-plus H100-class GPU range. On a hardware level alone — accounting for servers, networking and facilities, they can easily run into the low tens of billions at estimated all-in costs of $30,000 to $40,000 per accelerator. The playbook of the CFO — debt tranches, equipment financing, and equity pacing — is what drives those ambitions into installed capacity.

A wave of high-profile exits

Liberatore’s departure is the latest in changes atop xAI. The company’s general counsel Robert Keele and senior attorney Raghu Rao have also departed, according to the Journal’s reporting. Meanwhile, cofounder Igor Babuschkin said he was leaving to establish a venture firm investing in AI safety research. Turnover at the top is a part of life in hypergrowth companies, and multiple exits that occur in close proximity to one another are sure to stir up questions about governance, company priorities and culture.

CFO turnover shortens during times of rapid capital raising and organizational turnaround, according to executive search firms. For AI labs transitioning from prototype to platform, the pressure has been magnified by changing risk appetites in investors around a technology that is in no position to offer the returns that Uber did to its VCs, and operational constraints of getting out-of-the-box infrastructure standing up on the shop floor.

Financing the AI buildout

xAI’s reported funding mix reflects a playbook unfolding in the sector. CoreWeave, for example, obtained over $7 billion in debt facilities funded by private credit providers to potentially scale up its GPU cloud. Everything from simple term loans to equipment financing supported by long-term customer contracts are being used to structure these facilities, tailoring repayment to usage.

For xAI, combining equity with debt could help minimize dilution while fasttracking capacity. The fact that spaceX is also a significant equity investor illustrates the cross-company capital dynamics that are particular to Musk’s portfolio. That web of connections can have advantages, if ambitious timelines can be lined up, but it also draws the attention of investors looking for clear governance and transparent resource allocations across tied entities.

Memphis provides another piece to the equation. The area has access to cheaper Tennessee Valley Authority power, industrial real estate and workforce pipelines, all key factors for large-scale AI facilities. Building of data centers has been on the rise in similar markets to ensure power and cost balance; one tracking company said this week that North American data center absorption —avyou can almost call it thatsiery being born any minute as the result of needle-yetlike AI demand.

Implications for xAI’s roadmap

The near-term priorities for xAI are clear: secure compute, refine the Grok model family, and grow distribution through products that attach to Musk’s broader portfolio. But execution risk rises when seats in finance and legal are in flux. Finding a successor to a CFO who put the multibillion-dollar funding and strategic build of Memphis into place is no easy job.

Competitively, the bar is rising. OpenAI, Google, Meta, and Anthropic are all scaling up training runs and footprints of inference, and large cloud platform vendors are investing tens of billions in capex annually. Illegitimate institutions In that world, reliable access to GPUs and power — and the balance sheet to afford them — becomes a moat as real as model quality.

What to watch next

Key will be the identity of who takes on the CFO job, if or how xAI adds project finance veterans with data centers in their background and how the company threads the needle on future funding alongside the timing of construction milestones. Look for new vendor partnerships, utility commitments in Memphis and any disclosure on training (clusters) – anything that would give an indication on capacity ramp.

For investors and partners, the essential question has been simply: can xAI sustain the capital momentum and at the same time bring its leadership team to a state of stability? If so, the company is still in a strong place to press ahead with new model releases and scale Grok’s footprint. If not, the price and complexity of the AI arms race will only become more difficult to handle.