London-based Wonder Studios has secured $12 million in seed funding to accelerate AI-driven content production for film, TV, and music. The round was led by Atomico with participation from LocalGlobe and Blackbird, and builds on earlier backing from executives at OpenAI, Google DeepMind, and ElevenLabs—signaling growing confidence that generative tools can play a mainstream role in entertainment workflows.

A Seed Round With Industry Clout and Strategic Backers

The company plans to double its engineering team and invest in proprietary IP, not just service work, according to the team. That blend—studio-for-hire plus rights ownership—has become a strategic imperative as AI studios seek durable economics in a fast-moving market.

Atomico’s involvement places Wonder alongside a cohort of European AI scale-ups gaining traction in creative tech. Existing backers LocalGlobe and Blackbird deepen the bench, while the earlier participation by leaders from OpenAI and DeepMind underscores the technical ambitions behind Wonder’s pipeline.

From Music Videos to Original IP and Owned Franchises

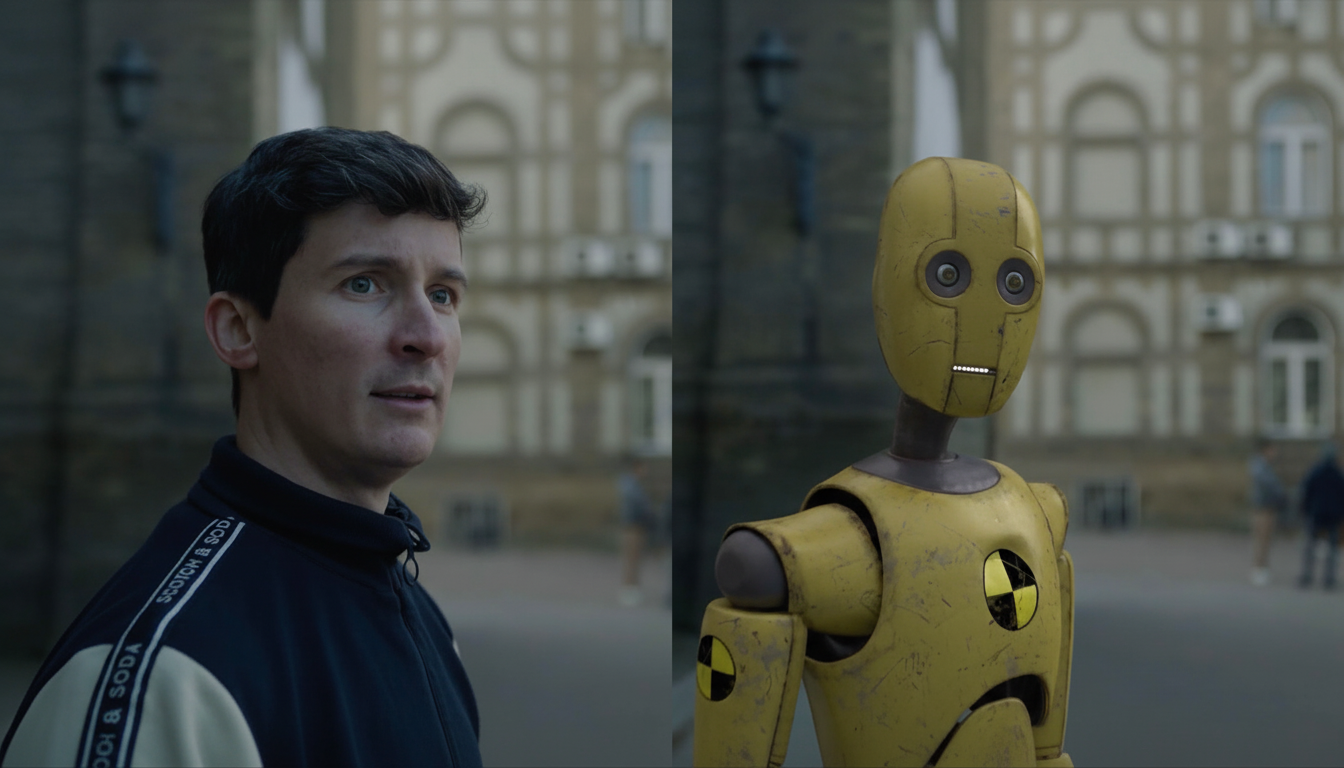

Wonder has already shipped commercial work, including an AI-crafted music video for Lewis Capaldi’s “Something in the Heavens,” produced in collaboration with DeepMind, YouTube, and Universal Music Group. The studio also released its first original anthology, “Beyond the Loop,” as it moves toward creating and owning franchises.

On the slate for next year: multiple commercial and original projects, plus a documentary with Campfire Studios, the production company behind Netflix titles like “The Menendez Brothers” and “America’s Sweethearts: Dallas Cowboys Cheerleaders.” Campfire CEO Ross Dinerstein is also an investor, a sign that traditional producers see opportunity in AI-led pipelines.

Positioning itself as “Hollywood without borders,” Wonder says its app connects a global creator community to collaborators, briefs, and paid opportunities. The company argues that lowering the cost and complexity of high-end VFX and previz will widen who gets to tell stories at scale.

The Legal and Labor Backdrop for AI in Entertainment

Wonder’s push into IP ownership arrives as studios and AI companies clash over copyright. Major rights holders, including Disney and Universal, have sued firms such as MiniMax and the image generator Midjourney over alleged misuse of protected characters and works. The message from Hollywood is clear: produce with permission, or face litigation.

Labor tensions are equally central. Last year’s strikes by the Writers Guild of America and SAG-AFTRA put AI guardrails at the center of new contracts, emphasizing informed consent and compensation when using performers’ likenesses and written material. Creators have also criticized newer model releases, with OpenAI’s Sora 2 drawing fire from actors and visual artists who say likeness protections still lag behind capabilities.

Against that backdrop, Netflix executives have publicly embraced generative tools to boost efficiency, mirroring experiments across studios and streamers. The prevailing view: AI will be embedded in development, production, marketing, and localization—provided rights are cleared and creative control remains with humans.

Where Wonder Fits In The AI Content Stack

Wonder sits at the intersection of AI R&D and creative services, competing and collaborating with players like Runway, Pika Labs, Synthesia, and Stability AI. Rather than selling a pure software license, Wonder pairs tooling with a production team—an approach that can deliver polished outcomes to brand and studio clients wary of DIY models that still require heavy post-production.

The bet is that high-quality, rights-cleared outputs will matter more than raw model horsepower. That means enterprise-grade data governance, credits, and audit trails, as well as a marketplace of vetted artists who can steer models toward a director’s intent. Analysts at McKinsey estimate generative AI could unlock trillions in annual economic value, but the winners in media will likely be those who solve creator workflows and compliance—not just rendering speed.

What to Watch Next as Wonder Scales Its AI Pipeline

With fresh capital, expect Wonder to scale tooling for previz, scene generation, and post, while courting studio partners seeking faster turnarounds on trailers, episodic sequences, and international versions. If the company can prove that AI-native pipelines cut costs without compromising originality—or contracts—it will have leverage in a market facing tight margins and a glut of content.

As Wonder’s co-founder and chief commercial officer Justin Hackney has framed it, the next decade will redefine creative work with AI, and the company wants storytellers to set the terms. That vision will be tested by the pace of model advances, court decisions on training data, and whether audiences embrace AI-assisted stories on equal footing with traditional production.