Array reaps rewards of aging network management from Verizon with a new tower access agreement. In a multi-year colocation deal that expands the company’s tenant base and interstate markets, Array is providing tower space to carrier Verizon as part of an exclusive relationship.

“This announcement continues our solid growth that enhances both our geographic reach and increases our multiple tenants’ revenue streams across newly acquired sites,” said Andrew Aster, president for Array.

“Our team has built out much of the UScellular network originally for Chicago SMSA Limited Partnership (UScellular). In accordance with this release, we will be accessing these next-generation-ready structures,” said Aaron Blazar, CEO, Array Network.

The move is intended to enhance Verizon’s 5G coverage and capacity in challenging-to-serve locations, and speed upgrades without having to worry about the expense and time lag of constructing new structures from scratch.

What the New Verizon-Array Colocation Deal Covers

The agreement enables Verizon to place its own radios, antennas and related equipment throughout Array’s nationwide footprint. Colocation is a typical model in the US tower industry: the tower owner provides the vertical real estate, power and space, and the carrier brings along network gear tailored to its spectrum holdings — in this case, Verizon’s C-band or CBRS for mid-band 5G and LTE capacity.

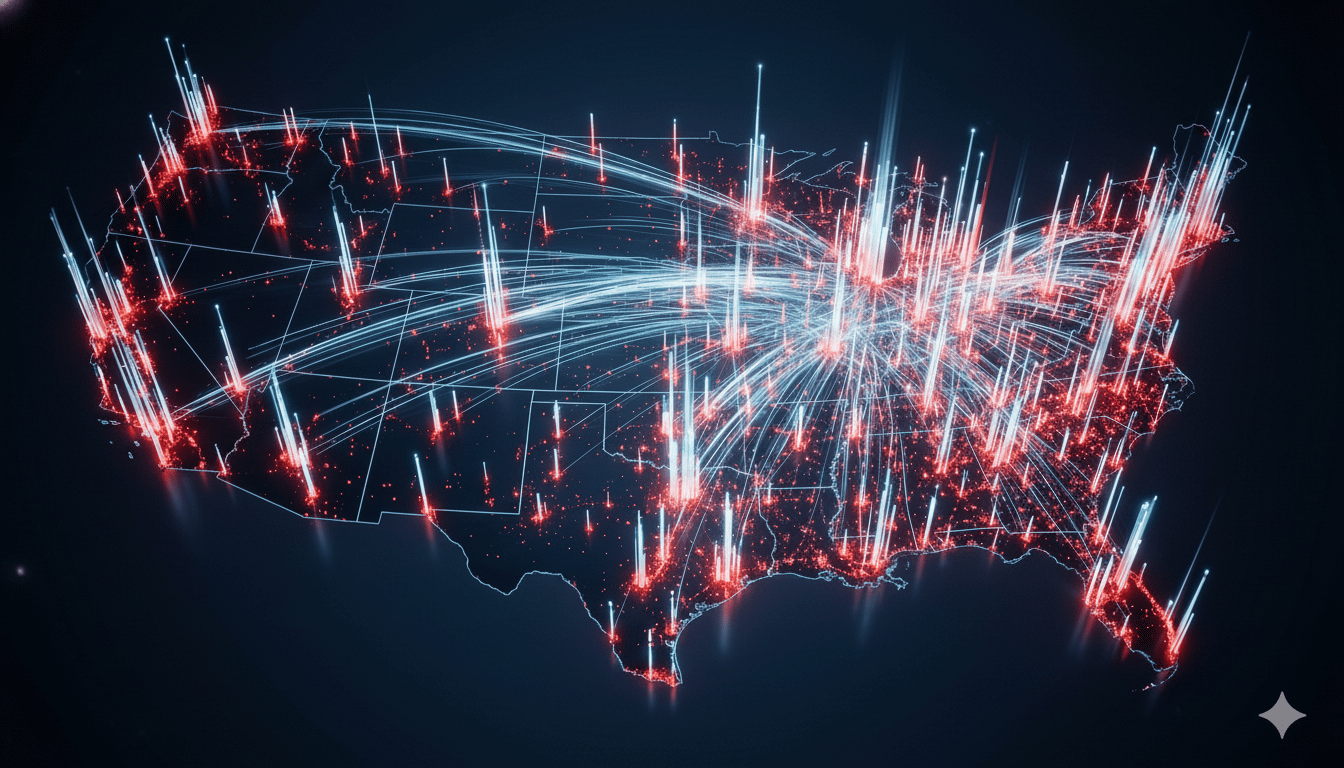

Array is known for having strong coverage in rural and exurban markets that had traditionally relied on UScellular infrastructure. That includes wide sections of the Midwest, clusters of the Pacific Northwest and parts of New England. Verizon’s deployment on these sites should see to it that dead zones shrink, indoor signal in small towns improves and additional mid-band capacity is added where users were previously pushed back down to slower low-band service.

It is the second major carrier deal lined up with these assets. T-Mobile already agreed to use more than 2,000 of the same towers. The ability of multiple service providers to collocate on a site highlights how soon tower deals can expand coverage footprints compared to the extended siting battles that accompany new builds.

Why Verizon Is Renting Towers Instead of Building New Ones

Verizon, along with its rivals, has been divesting itself of towers. The carrier is also selling the remaining 6,339 of its towers to Vertical Bridge for $3.3 billion, in line with the industry model driven by independent landlords including American Tower, Crown Castle, SBA Communications and Vertical Bridge. For carriers, renting usually offers speedier deployment cycles, lower capital paid up front and a focused way to fill coverage gaps.

From a logistical standpoint, renting also can smooth the way. The tower company takes care of permitting, structural analysis and power arrangements, with Verizon concentrating on RF designs, spectrum optimization and backhaul. Such deals can shorten a typical wait time for an upgrade by months, particularly in towns with strict zoning regulations.

Where Verizon Customers Are Likely to See Improvements

Expect incremental but meaningful gains. While independent testers have generally found Verizon strong in reliability, its competitors often lead in raw mid-band 5G speeds. RootMetrics has certified Verizon with wide-ranging network reliability across numerous markets, while Opensignal and Ookla data indicate the carrier is closing speed gaps in areas of mid-band density. More tower access is the quickest path to adding that density.

Many Array sites are in underserved corridors, so where the largest lift might be felt is in rural and outer-suburban counties. Imagine a Wisconsin township or an Oregon valley where Verizon coverage today depends on low-band spectrum for reach. Lighting up C-band on an existing tower there can quickly shoot median speeds higher, relieve periods of congestion and improve performance for many of the new customers in the area because fixed wireless access will compete with and support fiber in most areas over time.

Still, 4,400 sites are a small percentage of Verizon’s total macro footprint, so most urban customers will experience little change at all in the near term. Upgrades will arrive market by market as fiber is backhauled, radios are placed in the RAN and optimization teams have a chance to tune handoffs and carrier aggregation. The payoff is often cumulative, as each on-air site tightens coverage contours and raises network capacity for the area around it.

How This Move Fits Into Verizon’s Broader 5G Strategy

Verizon’s 5G playbook revolves around mid-band C-band for wide-area capacity, paired with low-band for reach and millimeter wave for dense hotspots. Access to new towers increases the footprint on the grid where C-band can be deployed at optimal heights and azimuths for both highways and town centers. It also provides an on-ramp for layering in CBRS capacity and enterprise use cases.

The carrier has claimed its Ultra Wideband footprint reaches well more than 200 million people, and adding more colocation sites should keep nudging that number upward and increasing average speeds. For perspective, U.S. cell-site counts as reported by CTIA consistently increase and mid-band spend across the carriers has been abundant, with tower-sharing now industry agreed upon as the way to scale coverage cheaply.

What to Watch Next as Verizon Deploys on These Towers

News around local market turn-ups, particularly in ex-UScellular markets, will be something to watch. Signs of progress will be visible in C-band carriers lighting up, better 5G signal indoors where users previously fell back to LTE and increased speeds on the uplink as spectrum is refarmed and aggregated. That could include enterprise and public safety users that serve rural transportation corridors.

The headline number — 4,400 towers — isn’t going to transform Verizon’s network overnight. But as an act of targeted densification in coverage-challenged areas, it checks all the right boxes: faster deployment through colocation, lower capital intensity and real-world progress where customers most lack it.