Complaints of service issues spiked Thursday for Venmo and PayPal, as users flagged trouble logging in and stalled transfers across both payment services. Monitoring services indicated a spate of complaints, indicating that the problem had led to widespread disruptions, with some peer-to-peer payments and account access disrupted.

What Users Are Seeing Across Venmo And PayPal

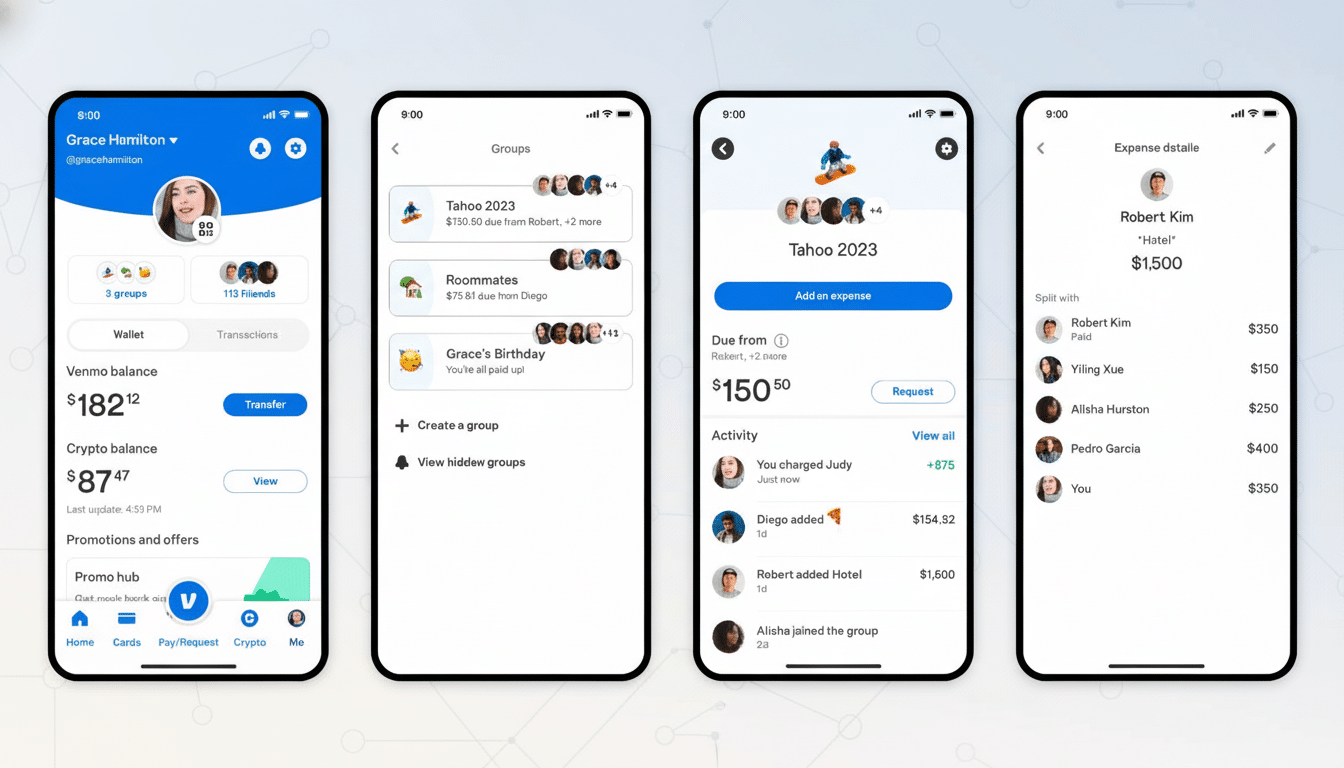

Based on reports from users and an outage tracker, the most common complaints were “Something went wrong” screens appearing upon login, spinning loaders where balances and activity feeds should be, and transfers getting stuck in pending. Some users also complained of having the card declined when using PayPal Checkout and had difficulty sending or requesting money in Venmo chats.

Outages of this sort, however, don’t usually affect all features in equal measure. We often see authentication succeed for some people, with payments or notifications lagging for others, depending on which back-end services are throttled.

What PayPal And Venmo Are Saying About The Outage

PayPal, Venmo’s parent company, admitted the brief service outage and said it had been fixed. Meanwhile, official status pages updated to say core services were working even as some users still reported occasional problems. That mixture is typical of recovery, as systems turn green and caches drain and transaction queues catch up.

DownDetector and Impakteins registered a sharp uptick in user-reported problems for both brands during the incident window, which is typically a good indicator (though not infallible) of real service instability. As the platforms share infrastructure in a single company, it’s not uncommon for them to experience concurrent interruptions.

Why Both Services Can Go Down At The Same Time

Venmo and PayPal share many of the same basic systems — identity and login services, API gateways, cloud components, and payment routing. A problem at any shared layer, say a database cluster, a configuration rollout, or a DNS blip, can suddenly fan out across consumer apps and merchant checkout flows.

Scale magnifies the impact. Recent company filings say PayPal has hundreds of millions of active accounts and processes more than a trillion dollars each year. Venmo has tens of millions of active users — from market-savvy millennials to folks who don’t mind a minor hit to their privacy in exchange for the pleasure of getting dinner over with. A brief disruption can reverberate through gig payments, small-business sales, and personal transfers.

How To Safely Troubleshoot Payment Errors

Before trying again, determine if the issue is widespread or localized. Cross-check service health on PayPal’s and Venmo’s official status pages as well as individual tracking sites. Also try both Wi‑Fi and cellular data to eliminate the possibility of network or DNS silliness on your side.

If a transfer fails, don’t retry it in rapid-fire. They will be auto-released if systems come back up, so duplicates may post, which creates duplicate charges. Instead, check your bank or card statement for a pending authorization. Anything not captured will drop off automatically within a few days; however, it is advisable to keep track of the transaction IDs and timestamps.

If you need to make an urgent payment, try a different rail (such as your debit card, bank transfer from another app, or even another digital wallet) until the services smooth out. Merchants may turn to card-present readers, keyed entries, or any backup processors if they have them.

How To Tell If It’s An Outage Or An Account Problem

Platform outages generally result in general error messages and show staggered device spread. Some account-related issues carry clear warnings and the like, such as needing an ID verification, holds associated with disputes, security flags, etc. If there is just one feature not working — like adding a bank, for instance — it may be an issue related to compliance or risk review more than a system-wide glitch.

Watch out for phishing amid the outage chatter. Scammers take advantage of the confusion with phony “verification” emails and texts. We will never ask for your full password or two-factor codes in official communications over email or direct message. Only log in to your account through the app or by manually entering the address to the official site.

What To Do If A Payment Gets Stuck Or Hung Up

For pending or unknown transactions, keep a record of screenshots, reference numbers, and the recipient details.

If the status does not return to green after reported systems are healthy, please contact support via in-app channels. Consumer protection regulations by agencies like the Consumer Financial Protection Bureau specify time frames for error resolution and provisional credits, particularly in cases of unauthorized transfers.

Most of these types of interruptions are fleeting. As the lines go away, balances and activity feeds generally will match up. If a payment you make is essential — for rent or payroll, say, or on an invoice that is time-sensitive — reach out to the other party and establish a fallback process to ensure your ability to pay so you won’t incur late fees or face shut-off.

Today’s episode underlines both how digital wallets have become interwoven with the daily mechanics of money and the requirements for best-in-class resiliency: diverse fallback options, thoughtful retry semantics, increased caution about security during outages.