US electric car sales have just hit a new high with 9.9 percent of new-car purchases, according to Kelley Blue Book’s latest tally. It is a milestone that illustrates how mainstream battery-powered models have become — but it comes with asterisks, as a number of factors could make the surge difficult to sustain.

A Record Created With Pull-Forward Demand

Analysts cite a textbook “buy-now” phenomenon: As consumers flock to take delivery under the wire, aware that federal incentives are approaching expiration. Each of these: The $7,500 clean-vehicle credit, the $4,000 used-EV credit and commercial clean vehicle have been in play. Customers and dealers, they’ve said, have a tendency to bunch orders when eligibility is expected to tighten — one month’s results tend to be inflated at the expense of those in subsequent months.

This pattern doesn’t mean that demand has disappeared. It means timing matters. In a shift in incentives, households that were previously “on the fence” about making purchases often commit to them more rapidly than usual, leading to a temporary bulge in deliveries that is difficult or impossible to replicate after policy dust settles.

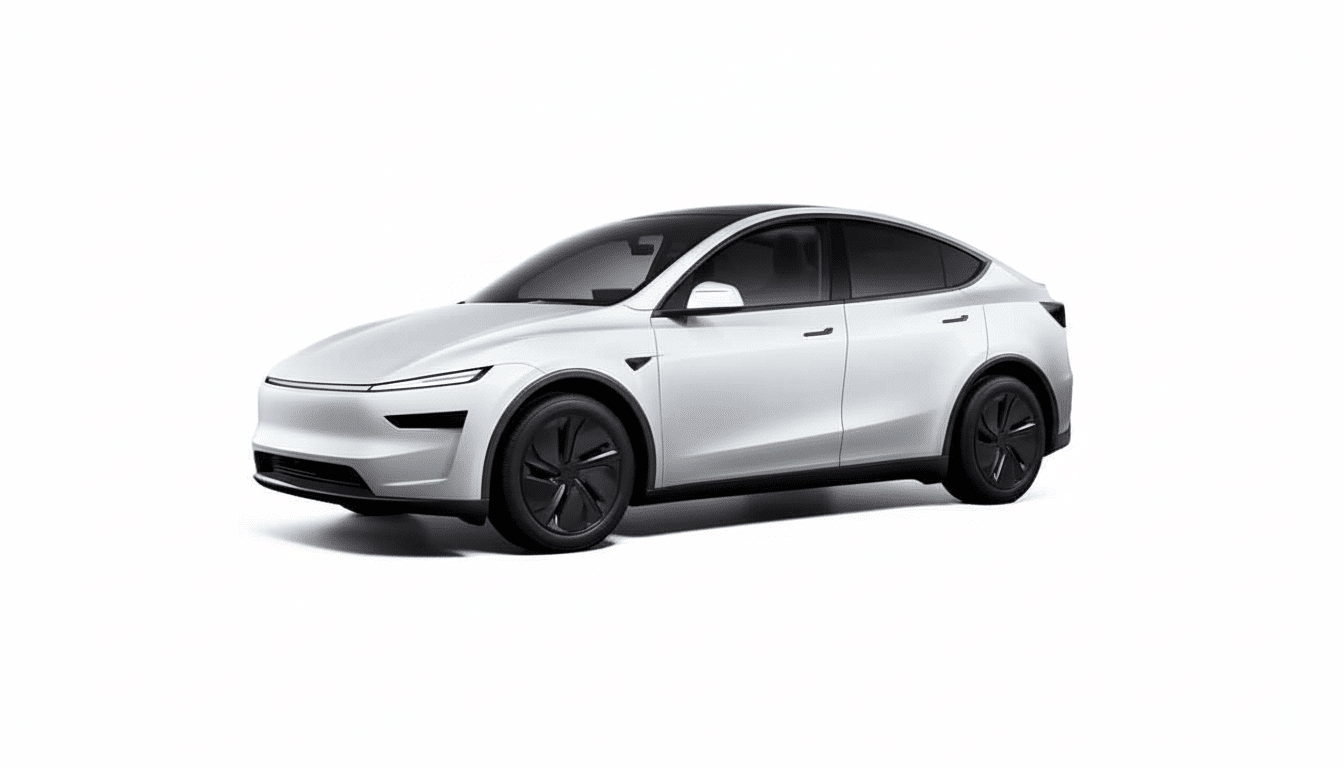

As Teslas Stake Out the Country, Its Stock Slides

One striking element of the new data: Tesla’s share of the U.S. market fell to about 38%, by KBB’s reckoning an eight-year low. That’s more the splutter of a developing market than a collapse. With strong entries from Chevrolet, Hyundai, Kia and Ford among others — many with competitive range, faster charging or more conventional good looks — it is no longer that shoppers accept the status quo of one brand. S&P Global Mobility has observed this for several quarters now: more models, less brand concentration.

The do-or-die race to claim incentives also favored mainstream models that fit below certain price caps or satisfy domestic-content rules. Leases also gave fleet managers, for their part, a tool to minimize total cost of ownership — again spreading whatever individual automaker’s dominance might’ve been achieved.

Prices Jumped — and That Cuts Both Ways

Affordability is still the pressure point of the EV market. That’s because KBB estimates that the average transaction price for an EV landed at $57,245 in the latest period — even after incentives have been taken into account — compared with $49,077 industrywide. On the whole, new-vehicle prices saw their largest one-month gain in about two years, up 2.6% year over year, a development tied to fresh model-year entries and relatively thin discounting offered by manufacturers as well as higher input costs.

Industry tariffs and recalibrations of supply chains are likely culprits, especially for vehicles and components crossing multiple borders before final assembly. If manufacturers rein in incentives to protect their margins, the arithmetic around EVs — already finely balanced with financing rates and resale expectations in mind — becomes more challenging for households that aren’t early adopters.

Charging Access Gets Better, Confidence Does Not

On infrastructure, the news is both mixed and tantalizing. The Department of Transportation’s National Electric Vehicle Infrastructure program moved from a prolonged evaluation phase, with states resubmitting project plans to access funds. The Department of Energy’s Alternative Fuels Data Center reports that the number of public fast-charging outlets is steadily increasing, while more automakers are accommodating themselves to the North American Charging Standard to simplify plugs and payment.

But consumer sentiment hasn’t kept pace. And anxiety about the reliability of public charging, as well as battery life, has been a top obstacle raised over and over by J.D. Power’s EV Index. Until consumer consider reliable, available DC fast-charging and ownership costs that track the promise, growth will grow and ebb with incentives or pricing.

What May Determine the Next Stretch

Whether the record sticks will depend on three variables: policy clarity, market discipline and product execution. Clear rules for who’s entitled to incentives can help take out the guesswork that feeds boom-bust dynamics. Those automakers that keep the line on transaction prices — through scale, localized supply chains and by being clever about trims – will find buyers turned off by mounting monthly payments. And new nameplates that address actual pain points (faster charging curves, better winter performance, smarter energy management) will broaden the reach.

There’s also a regional story. State policies mandating the purchase of zero-emission vehicles and densely packed charging plugs often exceed the national average. And as infrastructure fills in the vast middle of the country, adoption should broaden from coastal metros, dampening encryption’s current volatility to any given market.

Bottom line: The US set an EV sales record because more shoppers found the right vehicle at the right incentive moment. Whether momentum lasts will also depend on whether the market can pivot as quickly from urgency to confidence — arresting a single peak and turning it into a sturdy plateau and, after enough time, a new normal standard.