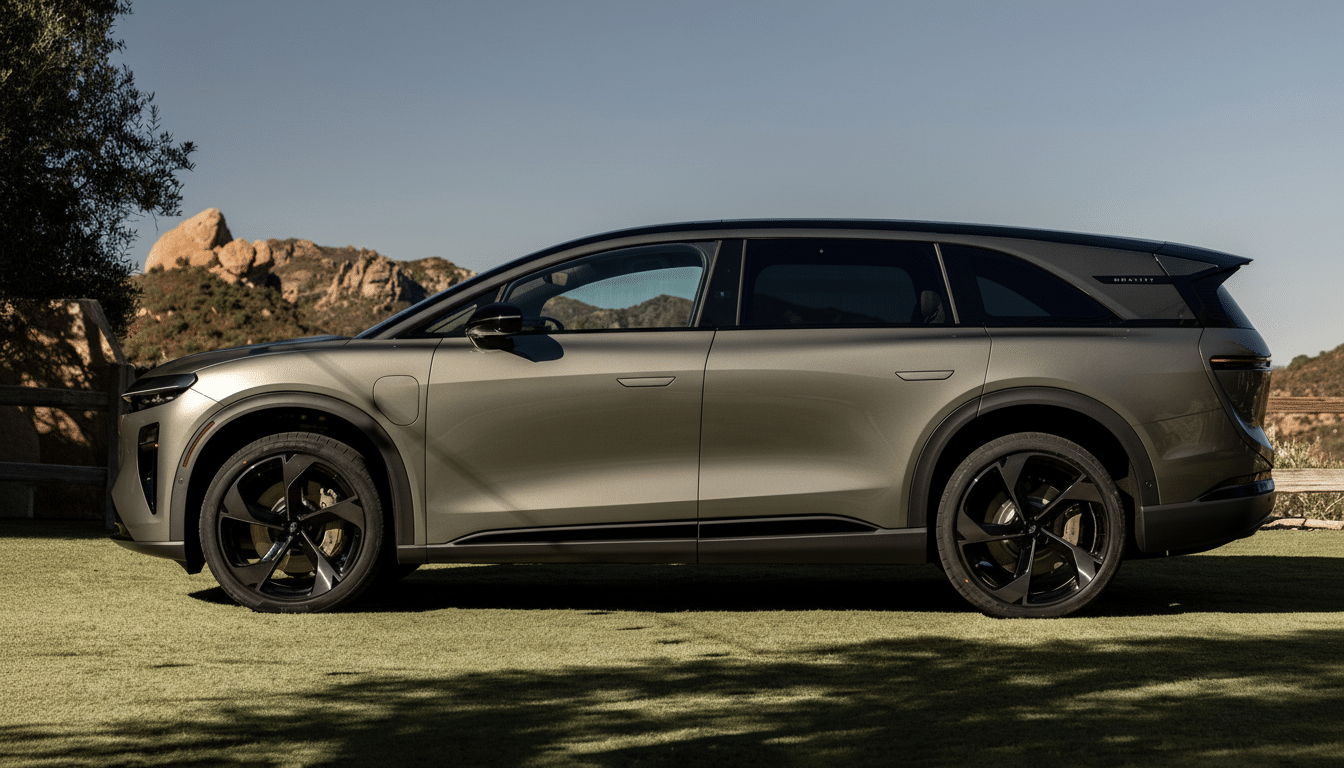

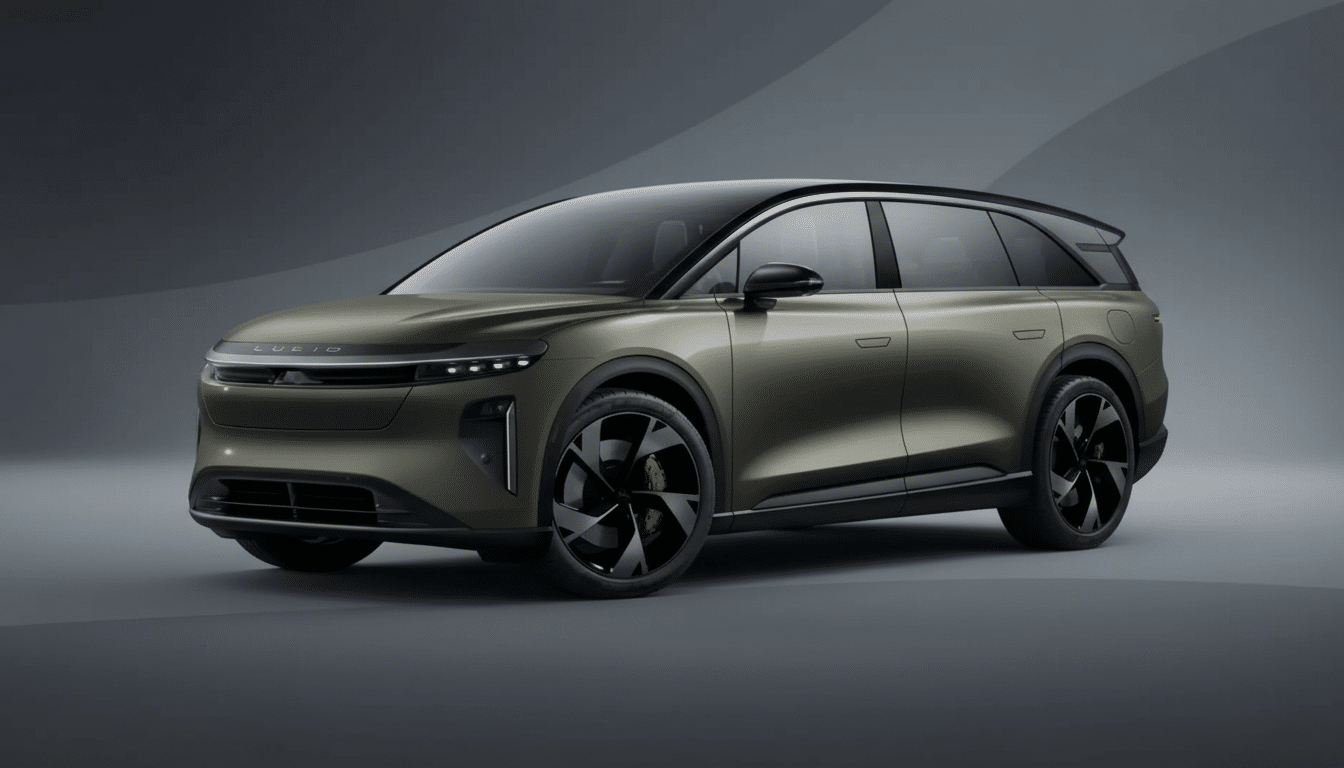

Uber just took the wraps off of its production-intent robotaxi that it’s developing alongside Lucid and Nuro, and, of course, it looks like it was designed by a premium EV maker dipped in autonomy.

Built on Lucid’s three-row Gravity SUV, the ride-hailing model gets a full 360-degree sensor array, Nuro’s self-driving stack, and a cabin designed for shared rides taken through Uber’s app.

A High-End Robotaxi, With Practical Touches

The centerpiece is the roof module: a neat shelf-like assembly that nests long-range LiDAR, imaging radars, and high-resolution cameras to provide overlapping fields of view around the vehicle. An LED halo ring mounted on the stack shows a rider’s initials at pickup, a small but ingenious signal that helps mitigate curbside confusion—Waymo riders in Atlanta and Austin will appreciate the concept.

Inside, the Gravity bones shine. Uber says up to six passengers can fit comfortably, a key lever for pooled trips and event surges. Separate touchscreens allow passengers to change the temperature, seat heat, and audio playback without leaning across a stranger. Those displays also render what the autonomy system “sees,” lane geometry, other road users, and upcoming maneuvers, a transparency practice that has turned into table stakes for rider trust.

Nuro Software Runs on Nvidia Drive Hardware Platform

Under the hood, Nuro’s driverless software taps into hardware based on Nvidia’s Drive AGX Hyperion reference platform, which is purpose-built for high-bandwidth sensor fusion and functional safety. Expect things like redundant compute, power, and networking paths, as well as over-the-air updates so the fleet can harness perception and planning improvements without visiting a service bay.

Its pedigree hails from driverless delivery pilots in several cities, where the company refined low-speed operations, remote assistance protocols, and fleet command. Translating that expertise to passenger service ups the ante on comfort, worst-case behaviors, and human-machine interaction—hence the attention paid to in-cabin interfaces and clear exterior signaling.

How Fast This Scales Depends on Economics

There’s no avoiding the cost question. The Lucid Gravity has a starting price of approximately $79,900 before considering the addition of automotive-grade LiDARs, radars, high-dynamic-range cameras, compute, and safety redundancy. And while LiDAR prices have fallen by more than 70% in the last five years, according to an industry analysis, a premium EV turned robotaxi is not a cheap asset.

Hardware costs must drop by 50–75% to make widespread deployment pencil out, Uber executives have said. The payoff is obvious: labor is today the largest part of the economics of a trip. Public filings and third-party research consistently seem to show that drivers pocket the majority of fare money—sometimes as much as 70 percent—with Uber’s take rate varying depending on the market. Autonomy changes that cost structure, but only once capital and operating cost per mile exceed the human-driven baseline—maintenance, insurance, teleoperations, and roadside support included.

Unsurprisingly, Uber is positioning this as a “premium” service at launch. It echoes the experience level of Uber Black, not UberX, as the supply chain, utilization rates, and part costs mature. A six-seat configuration is also said to make higher-revenue trip-pool options more feasible, possibly paving the way toward competitive per-mile pricing.

Bay Area First With a Big Fleet on the Water

Uber, whose plan is to start in the San Francisco Bay Area and then expand more broadly, would be able to manufacture at Lucid’s plant in Casa Grande, Ariz. The goal: a 20,000-plus vehicle fleet once scaling is underway. Because the rides are dispatched via Uber’s app, the company can mix and match human drivers and several different driverless partners in a single marketplace, distributing supply to demand almost instantaneously.

That partner model is already present. Beyond Lucid and Nuro, Uber has cut autonomy pacts with everyone from Waymo to Volkswagen to Nvidia, and even upstarts like Avrides. Overseas, it said it was going to test vehicles using Baidu’s Apollo Go platform in London. The plan is to bet on a combination of technologies and manufacturing bases—particularly the Chinese EV makers’ skill at scaling advanced hardware more cost-effectively—in order to put robotaxis on the fast track to affordability.

Safety and Regulation Will Determine the Road Ahead

The introduction of robotaxis in the U.S. remains under intense examination. The National Highway Traffic Safety Administration has proactively issued software recall campaigns for autonomous systems when problems have been uncovered, and California regulators have revised their expectations for incident reporting and operational design domains following high-profile reverses. Zoox, meanwhile, announced a software recall recently to reduce unnecessary lane changes, showing how rapidly safety updates need to be shared across fleets.

When Uber itself shut down its in-house program after a fatal crash in Arizona during testing, it pivoted to the partner-first approach. The design today—redundant sensors, explainable interfaces, conservative maneuvers—reflects lessons learned across the industry. Geofenced service areas, weather limitations, and remote help are all likely to be part of early operations, with capabilities growing as data and comfort levels accrue among regulators.

What to Watch Next for Uber’s Lucid-Nuro Robotaxi

Three things will determine whether this robotaxi becomes a line item in the Uber app: how much it costs per mile, rider satisfaction, and safety performance. If Nuro and Nvidia’s platform can lower operating expenses, especially while Lucid adds capacity for production and prices for parts come down, Uber could shift from premium novelty to everyday option. For now, the Lucid-Nuro robotaxi looks like a well-engineered opening gambit—one that’s designed to foster trust, one quiet, predictable ride at a time.