Google is transforming its product for financial search into a far more capable investment assistant — integrating artificial intelligence–like research as well as crowdsourced prediction into the experience. Launching Deep Search built on Gemini for richer answers, integrating prediction market data from Kalshi and Polymarket, and continued expansion of Snap’s redesigned Finance experience (now available in India with English and Hindi language support).

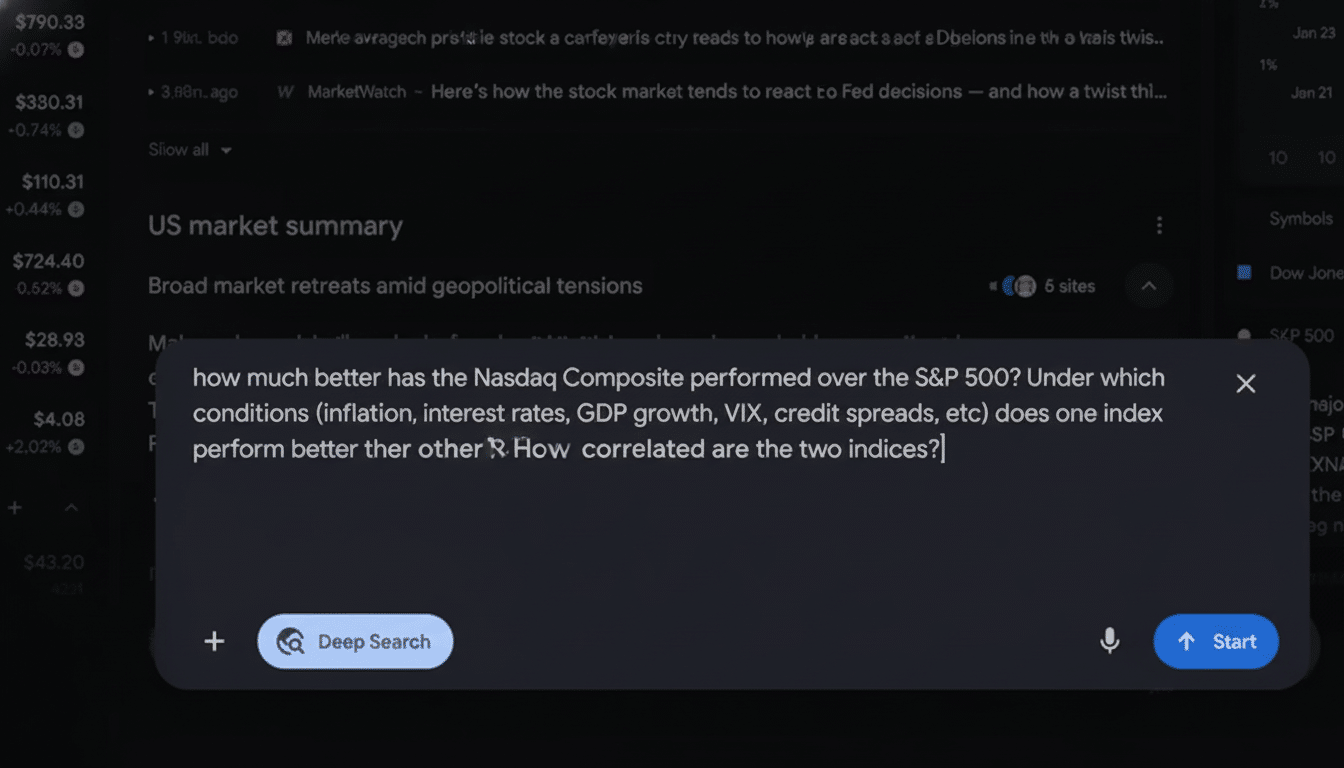

Deep Search Powered by Gemini Comes to Finance

Deep Search lets investors ask complex questions and get a source-backed summary answer. Instead of a single query that returns a list of links, Gemini conducts numerous searches in parallel, reasons across them, and serves up an answer with supporting citations. Responses come in a matter of minutes, and users can view the “research plan” underway to get an idea of how the AI is attacking the problem.

Crucially, Deep Search invites follow-ups. You can drill down to a cited filing, move from fundamentals to competitive positioning, or better filter your screen across sectors. Google AI Pro and AI Ultra customers will get larger usage allowance, but if you can’t wait to try it out, you can join the Finance experiment by visiting Labs. The feature is being released first in the US with a wider rollout to follow.

Income Tracker has updates of AI summaries as they come

In the wake of last week’s update, the new earnings experience pipes in live audio streams of company calls and auto-transcribes them as they’re happening, then generates AI-powered summaries of what actually moved the needle. That’s less scrambling among audio, slides and third-party notes when a management team changes guidance or capital allocation strategy.

For active traders and long-term investors, speeding up that post-call analysis from an hour to a few minutes matters. Below, management’s commentary and fast takes on the strategic sell-side question components of the Q&A are summarized in a commentary that you can screen quickly to help build your short list while maintaining detail and nuance from the transcript.

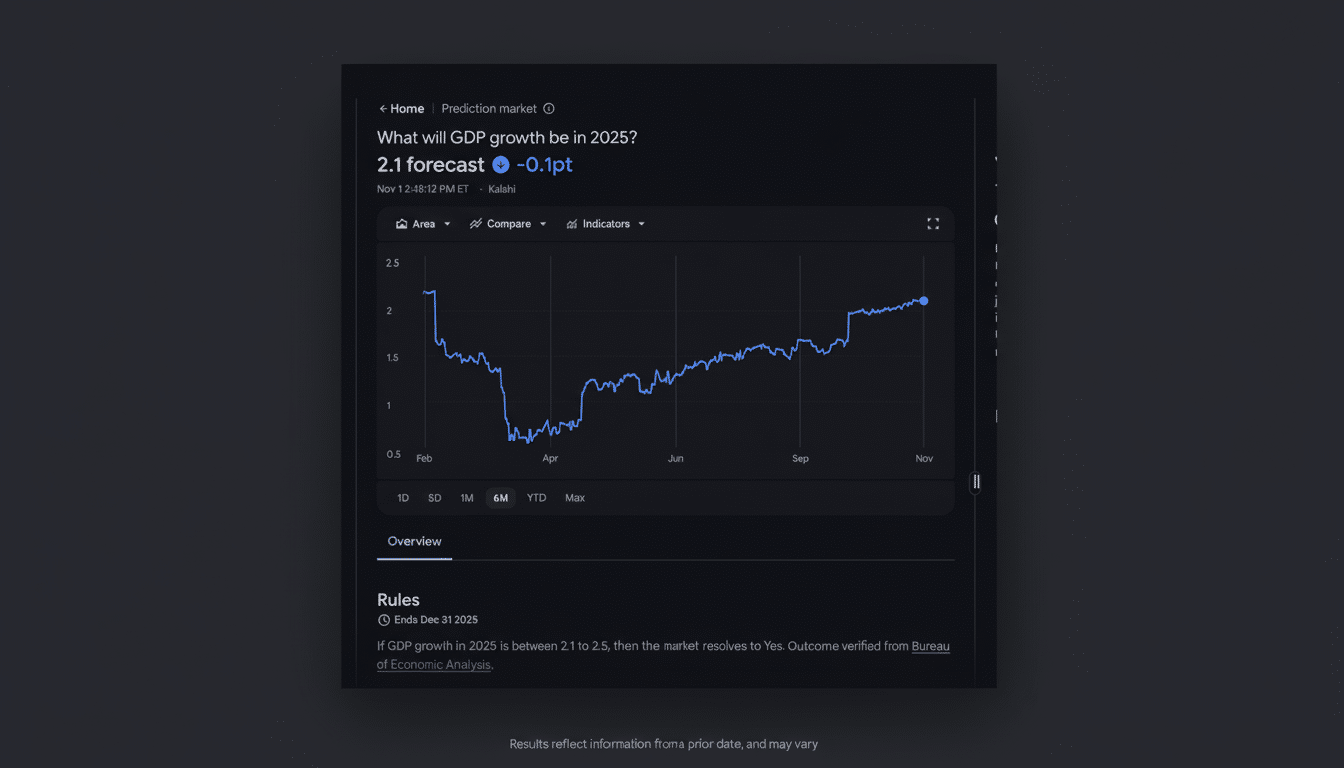

Prediction Markets Meet Market Research Methods

Finance is importing probabilities from Kalshi and Polymarket so users can ask questions about future events and get real-time odds, as well as trendlines. Kalshi is a CFTC-regulated exchange that lists event contracts on such topics as inflation prints and rate decisions. Polymarket, a leading prediction location based on crypto, has had surging volume ahead of elections, tech launches and macro results, serving as an unadorned peek at crowd expectations.

The appeal isn’t just novelty. Research on the Iowa Electronic Markets and forecasting research from Good Judgment Project has long found that well-made prediction markets can be well calibrated and, in some situations, competitive with expert consensus. For investors, odds can be a sanity check: if a probability that the central bank will cut interest rates or delay introducing a product re-prices dramatically, it might run counter to market moves that fundamentals alone are missing.

There are caveats. Markets represent beliefs, not realities, among participants and liquidity can be variable. Kalshi’s regulation provides clearer guardrails and Polymarket’s transparency around probabilities can be valuable even to customers who cannot trade in some jurisdictions. In Finance, these are in addition to traditional data, not instead of it.

What Retail Investors Should Do Now With These Tools

The bigger story is convergence. Search and real-time transcripts, AI synthesis and crowd forecasting are being spit out on a single screen. That reduces the cost of discovering, vetting and contextualizing information — a permanent edge in markets where the hardest thing to do is to separate signal from noise. The capability to iterate and ask of sources based on citations also helps overcome the one-shot nature of classic search.

Although Deep Search, prediction market data and the new earnings flow come to the US first — that redesigned Finance experience is growing as well, rolling out in India with support for English and Hindi. When it goes live in more areas, localized coverage and language support will be as important to consider as the underlying models.

How to Try It and Start Using the New Finance Features

Join the Finance experiment from Labs to see the Deep Search button on pages that feature it. Ask specific questions — such as, “What are the primary risks to X company’s gross margin over the next four quarters?” — and see the research plan and citations change even as you develop an answer. Check out earnings call summaries for some of the recent results, as well as a prediction market on what those numbers might look like over time. As with all AI assistants, use the output as a launch point and verify its sources before taking action.