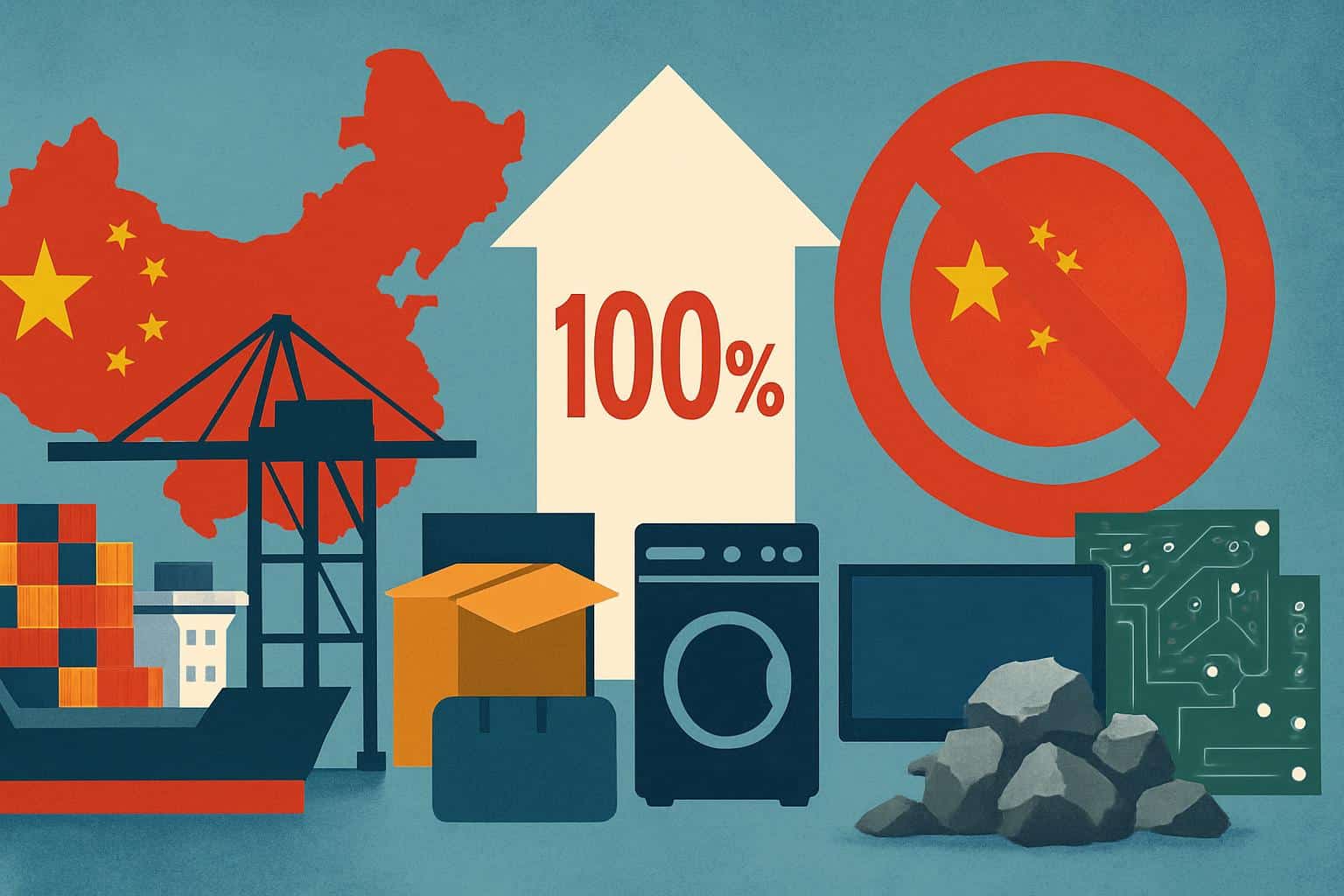

President Trump raised the stakes in a trade war with Beijing, warning of a 100% tariff on all Chinese imports and prohibiting the export to China of “critical software,” in an apparent response to renewed restrictions by China on rare earth materials. The battle further imperils the world’s supply chain for advanced manufacturing, clean energy and defense technologies.

What a 100 percent tariff on Chinese imports looks like

A blanket tariff at 100% would effectively double the landed costs of Chinese goods, shifting pricing for everything from consumer electronics to industrial inputs. Roughly $400-500 billion in goods from China ended up on American soil each of the past two years, so aggressive action — even if it is only temporary — could ricochet through retail shelves, factory floors and corporate balance sheets.

Analysts at the Peterson Institute for International Economics previously estimated that earlier rounds of tariffs lifted average duties on Chinese goods to roughly one-fifth of their value — levels far exceeding historic norms. A leap to 100% would be historic in scale for a major trading partner, likely triggering legal challenges at the World Trade Organization and testing U.S. powers under domestic laws such as Section 301 or those related to national security.

The administration also suggested export controls on “critical software,” which would have to be defined with specificity by the Commerce Department’s Bureau of Industry and Security. Depending on how the category is drawn, that could include electronic design automation tools, some AI and cybersecurity products or specialized industrial software. This creates a set of complicated issues for cloud services, open-source projects and international research collaborations.

China’s rare earth leverage and new licensing rules

China said it would tighten regulations that require licenses to be obtained for anything containing even trace amounts of rare earths, a group of minerals critical to high-performance magnets in EV motors, wind turbines, phones and guided munitions systems. Though rare earths aren’t necessarily scarce, efficiently and cleanly processing them is challenging and China controls most of the world’s refining capacity.

China has dominated mining (responsible for about 60–70% of mined rare earths in recent years) and processing (approximately 85–90%), according to the U.S. Geological Survey and the International Energy Agency. This dominance bestows leverage across a range of industries. A single large offshore wind turbine can require hundreds of kilograms of neodymium-iron-boron magnets — and many electric vehicles feature magnet-heavy drivetrains, leaving demand linked to Chinese refineries and component makers.

Beijing has used this leverage before. Its export quotas a decade ago were the cause of a WTO showdown and an explosion in diversification efforts in Japan and beyond. In more recent months, China introduced licensing on gallium, germanium and graphite — other materials vital to chips and batteries — to clamp down on supply when strategic competition heats up.

Market shock, investor reaction, and the risk of inflation

Investors quickly seized on the tariff threat. Major U.S. stock indexes tumbled in a sweeping sell-off, with high-growth technology names bearing particularly heavy pressure. Semiconductor and EV bellwethers like Nvidia and Tesla fell about 5%, on fears of supply chain disruption and higher input costs for advanced components.

There was also a squeeze on crypto markets, as traders unwound leverage in the face of uncertainty. Crypto analytics companies noted an uptick in forced selling volumes, a phenomenon which tends to occur with macro shocks related to policy risk.

Economists caution that broad tariffs of this magnitude could exacerbate inflation at a time when manufacturers and sellers are restocking their inventories. Broad-based tariff increases have also been found by Oxford Economics and other forecasters to seep rapidly into consumer prices, particularly in cases where substitutions are difficult or require long lead times to set up.

Can the U.S. diversify critical supply chains quickly enough?

Washington has sought to loosen China’s control on critical minerals, but creating end-to-end supply chains takes time. The Mountain Pass mine in California is run by MP Materials, and Lynas is expanding processing capacity in Australia and Texas with U.S. government backing. The Department of Defense has finally used the DPA fund to open two refineries and a magnet plant, itself a fulfillment for the Pentagon’s Critical Minerals Stockpiling Act; and DOE’s own Critical Materials Assessment points to recycling and substitution as short-term pressure valves.

Still, the bottleneck is midstream processing and magnet fabrication, not just mining. European and Japanese companies are also seeking to onshore parts of the value chain, with the EU’s Critical Raw Materials Act focused on domestic processing as well as reserves. Japan’s playbook after the 2010 dispute — long-term offtake agreements, stockpiling and technology substitution — provides a template but highlights the time and capital needed.

What to watch next: rules, carve-outs, and corporate moves

Main signals will come from formal notices and rulemaking: what the 100 percent tariff covers, whether there are carve-outs for essential goods, and how the Commerce Department defines “critical software.” Corporate disclosures from automakers, wind developers, defense contractors and electronics suppliers should show how fast purchasing managers are able to change plans or swallow cost increases.

Allies’ responses matter, too. Likely approaches, such as coordinated stockpile releases, joint purchasing and shared refining projects would also take the sting out of Beijing’s leverage — and stop it from squeezing too hard on individual firms. Without a de-escalation, the world’s most intricate supply chains are bracing for yet another redraw — this time at the nexus of tariffs, export controls and the minerals that make modern technology hum.