Toyota Motor Manufacturing Canada has brought seven Digit humanoid robots from Agility Robotics into its RAV4 production campus under a robots-as-a-service agreement, marking one of the clearest signs yet that bipedal robots are graduating from lab demos to real factory work.

The deployment follows a year-long pilot and focuses on a narrow but consequential task: unloading totes of parts handed off by an automated tugger system. By bridging “automation islands,” Toyota aims to cut non-value-added movement, reduce ergonomic strain, and smooth the flow of material to assembly.

- Why Toyota Is Testing Humanoids On The Line

- What Digit Will Do At TMMC’s RAV4 Production Campus

- Robots-as-a-Service And The Cost Equation For Automakers

- Safety And The Path To Human Collaboration

- Competitive Landscape And Benchmarks For Humanoid Robots

- Why This Matters For Canadian Manufacturing

- What To Watch Next As Toyota Scales Humanoid Robots

Why Toyota Is Testing Humanoids On The Line

Automakers have long used fixed industrial robots for welding, painting, and precision assembly. The hard part has been everything in between—variable, unstructured jobs that change with model mix and shift schedules. TMMC’s leaders say Digit is being deployed to remove repetitive manual handling so human team members can focus on quality and higher-skill tasks that improve throughput.

This specific use case is deliberately constrained: move totes reliably, safely, and on time. Narrow scoping is a common success factor in early humanoid rollouts, industry consultants note, because it controls integration risk while building data on uptime and cycle times.

What Digit Will Do At TMMC’s RAV4 Production Campus

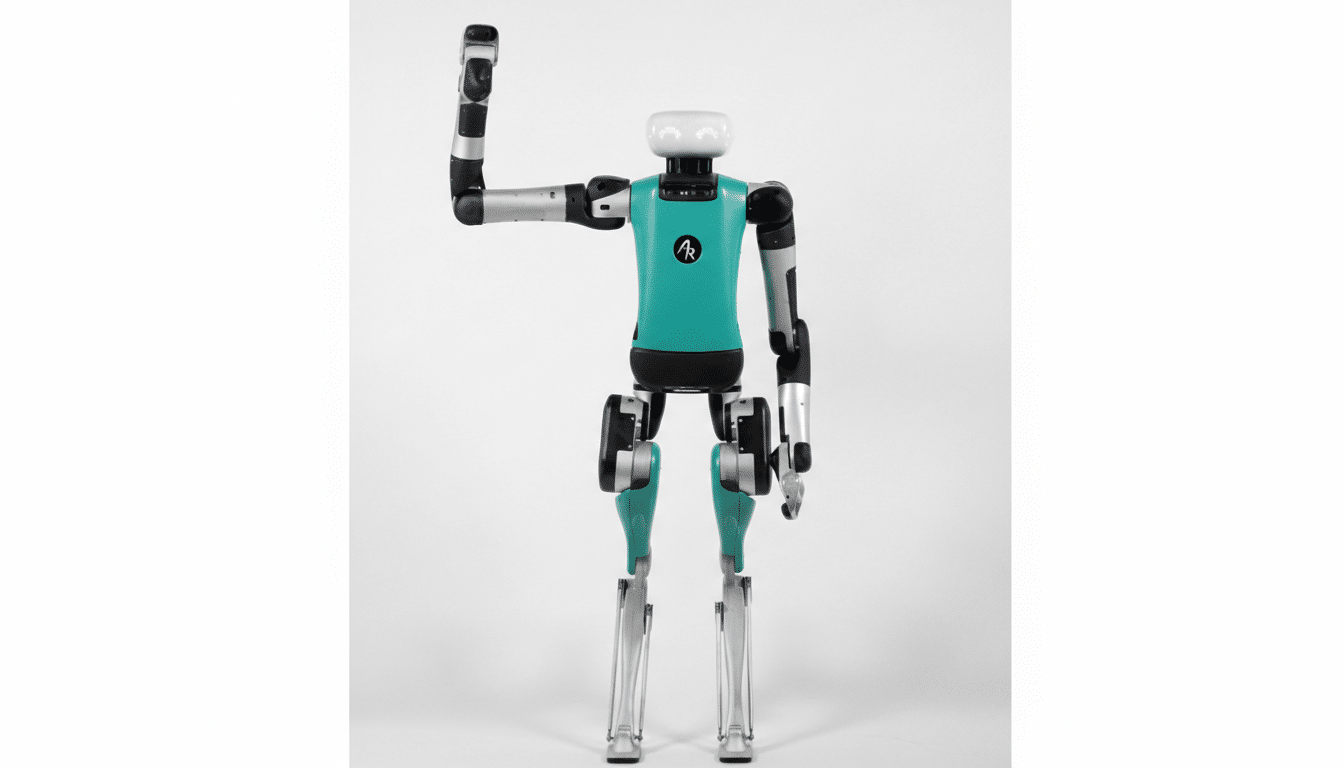

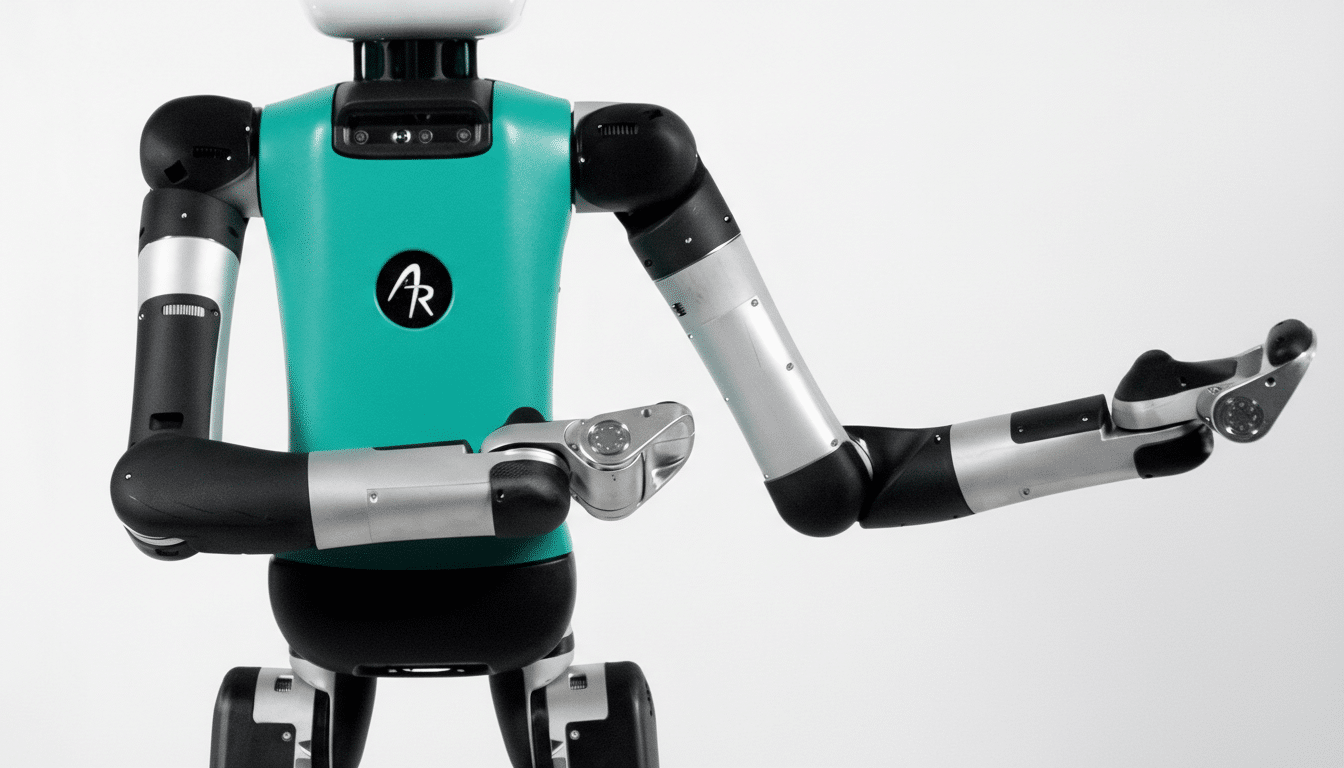

Digit is a bipedal, torso-and-limbs platform designed for industrial spaces—not for backflips or viral stunts. Its advantage is mobility: walking into spaces built for people, navigating curbs, ramps, and tight aisles without retooling facilities. At Toyota, the robots will receive totes from an automated tugger and stage them for downstream processes, a classic “handoff” job that benefits from humanlike reach and footprint.

Agility pairs the hardware with Arc, a cloud-based fleet management system for mapping tasks, scheduling charging, and monitoring performance. The company has said that AI-driven tools now shorten configuration time and reduce on-site engineering effort—critical because integration often costs more than the robot itself, according to Agility’s technical leadership.

Robots-as-a-Service And The Cost Equation For Automakers

Robots-as-a-service converts a capital purchase into operating expense, bundling hardware, software, updates, and maintenance into a per-robot subscription. For automakers operating on thin margins and frequent model refresh cycles, RaaS can de-risk pilots and scale only when KPIs—like picks per hour, mean time between failures, and fleet availability—hit targets.

Analysts have noted growing interest in RaaS across logistics and manufacturing as labor markets tighten and product variability rises. The International Federation of Robotics reported record global robot installations in recent years, with hundreds of thousands of new units added annually, but most remain fixed arms; humanoids are the next frontier for unstructured work.

Safety And The Path To Human Collaboration

Toyota’s deployment keeps the humanoids away from close human-robot interaction, reflecting a cautious industry stance. Robots strong enough to lug heavy totes must meet strict reliability and safety standards before working shoulder-to-shoulder with people. Agility says its next-generation platform is being engineered for collaborative operation, aligning with safety frameworks such as ISO 10218 and related guidance derived from cobot practices.

The stepwise approach—first automating handoffs, then encroaching on mixed workflows—mirrors how autonomous mobile robots matured on factory floors over the past decade, moving from fenced zones to shared aisles as sensing and controls improved.

Competitive Landscape And Benchmarks For Humanoid Robots

Agility is among a handful of firms with field deployments beyond the pilot lab. Logistics providers including GXO and Schaeffler have tested Digit for tote handling, and the company has cited progress using Arc to manage multi-robot fleets across sites. In parallel, Figure reported that its Figure 02 robots supported a BMW facility for about ten months, handling roughly 90,000 parts in a trial focused on material moves.

Other contenders—Apptronik, Unitree, Boston Dynamics, Tesla, 1X, and Reflex Robotics—are racing to prove reliability, battery endurance, and safe manipulation at useful payloads. The winners will be those that convert demos into dependable shifts, not just minutes of performance under ideal conditions.

Why This Matters For Canadian Manufacturing

Ontario’s auto corridor thrives on uptime and ergonomics. Using humanoids to absorb repetitive handling could help stabilize staffing, reduce injury risk, and unlock incremental efficiency in a plant building one of Canada’s best-selling SUVs. It also aligns with national priorities around advanced manufacturing, where groups like Next Generation Manufacturing Canada advocate for flexible automation that can be re-tasked as product lines evolve.

If the seven-robot fleet delivers sustained throughput and favorable total cost of ownership, similar tasks—kitting, lineside replenishment, end-of-line handling—are likely next. The bigger prize is standard work packages that can be replicated across plants without bespoke integration every time.

What To Watch Next As Toyota Scales Humanoid Robots

Key signals will include the speed of scaling beyond seven units, any expansion of duties beyond tote handling, and evidence of reliable uptime across full shifts. Just as important will be whether Toyota reports measurable gains in ergonomics and team satisfaction—outcomes that often determine whether early robotics pilots become the new normal on the line.