Robinhood contributed to the popularization of zero-commission trading, but also enraged users with gamified features and high-profile restrictions on stock trades amid the meme-stock frenzy.

Last year, the brokerage was fined a record $70 million by FINRA relating to systems outages and misleading communications.

If you are looking for other strengths—more research, global access, or retirement tools—these five apps make more sense depending on your needs.

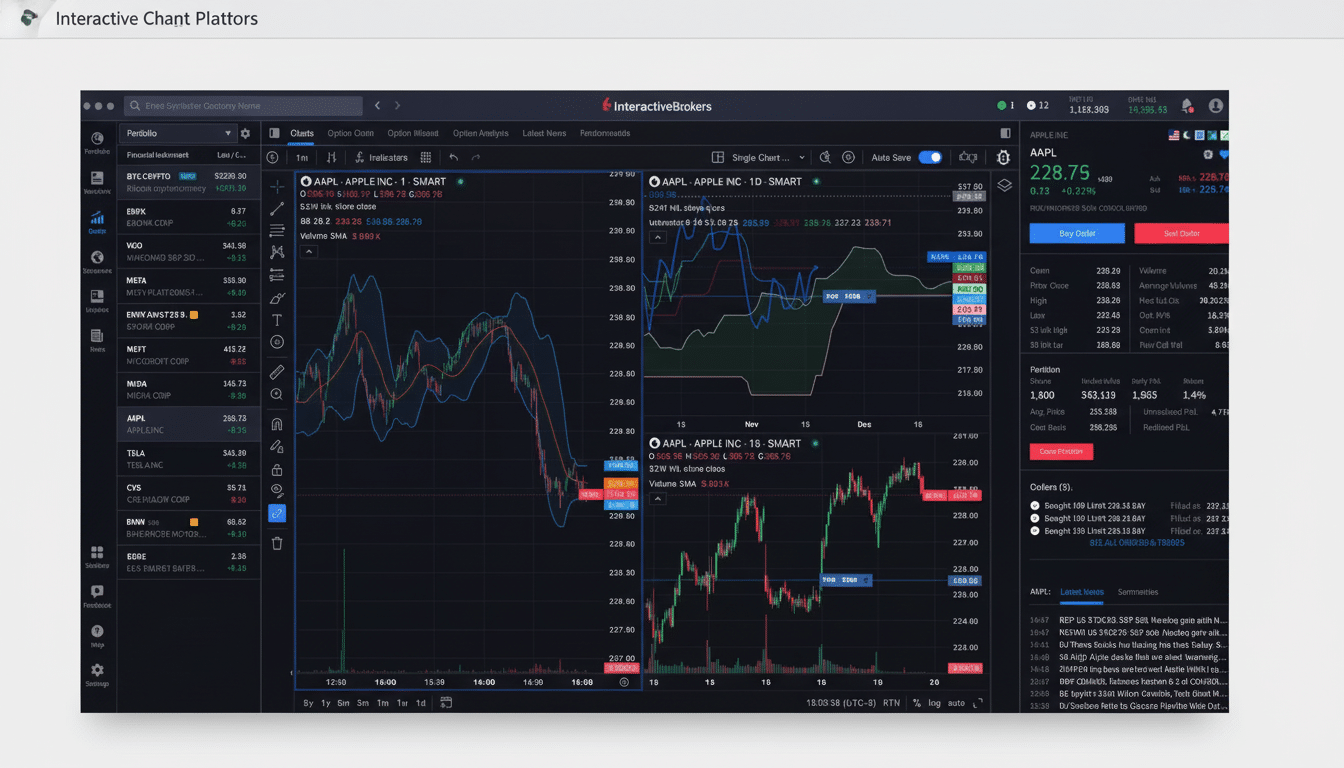

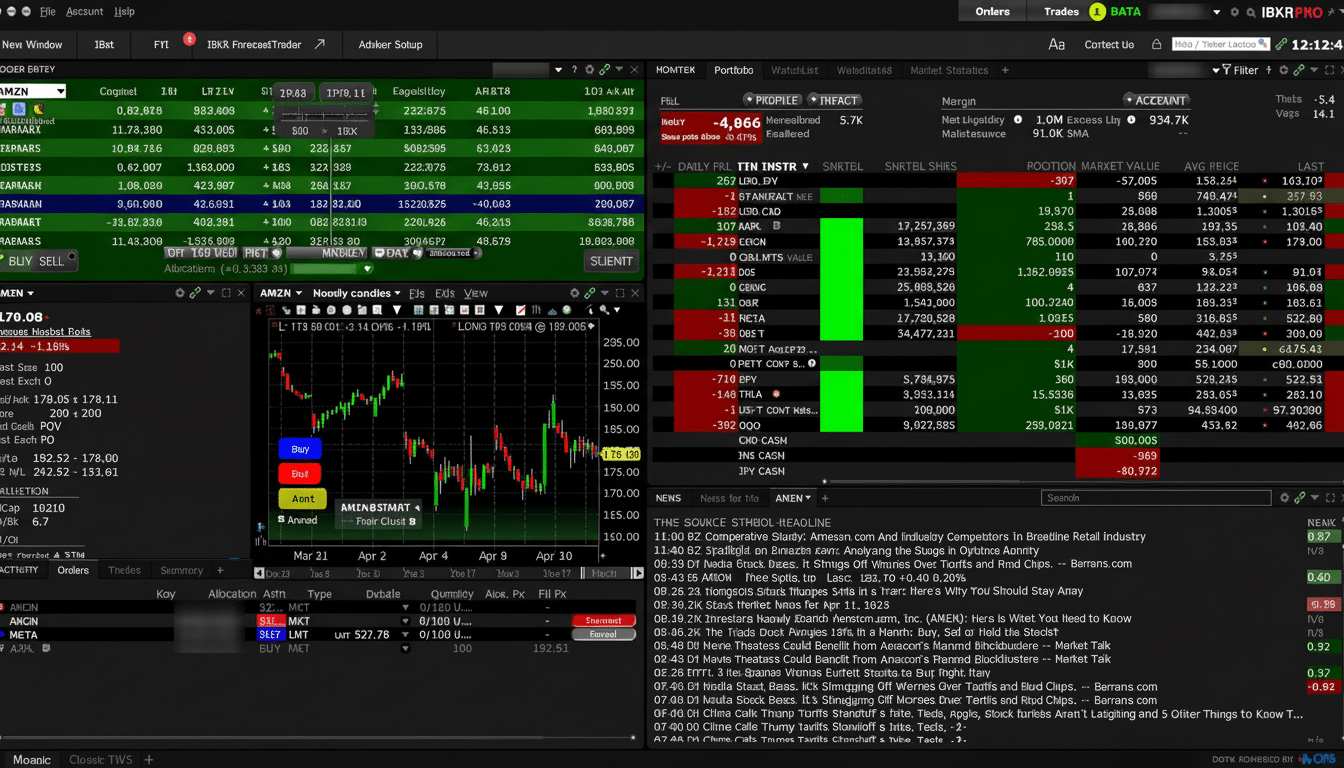

Interactive Brokers for Global Reach and Pro Tools

Interactive Brokers (IBKR) is the one if breadth and accuracy count for you. It provides access to over 150 markets in 30+ countries and 20+ currencies, with a broader suite of products that includes stocks, ETFs, bonds, futures, and options under one account. Its Trader Workstation and IBKR Mobile offer market depth, algorithmic order types, and risk tools that active traders can actually use.

Costs are clear and margin rates remain among the lowest of those we track by industry comparisons, which is significant in a higher-rate environment today. There’s a steeper learning curve than app-first brokers, but order execution, portfolio analytics, and tax-friendly reporting are first-rate for serious and international investors.

Fidelity: Long-Term Investing & Retirement

For the buy-and-hold investor, Fidelity combines a clean app with excellent abstraction of investment fundamentals. The company has more than $12 trillion in assets under administration, offers a wide range of low-cost index funds, and neatly wraps IRAs, 529s, and brokerage accounts into one package. Its research offering draws on Morningstar and Argus, with screener tools that are actually helpful.

Notably, Fidelity says it does not receive payment for order flow on orders to trade stocks, an area of controversy as PFOF can influence where a client’s trade is routed. If you prioritize discipline over dopamine, though, it’s also a great choice thanks to its fractional shares, automatic dividend reinvestment, and robust investor education.

Charles Schwab for Service and Thinkorswim Power

Charles Schwab folded the popular Thinkorswim platform in alongside TD Ameritrade when it took control of its rival brokerage, providing active traders with advanced charting, options analytics, and strategy testing on desktop and mobile devices. Schwab operates a vast network of branches, and its all-hours customer service support may be a plus if you prefer dealing with live people when your questions get complex.

There are trade-offs when it comes to access from around the world: Schwab’s list of foreign markets where you can trade directly with its platform is nowhere near as extensive as Interactive Brokers’. For U.S.-based investors, however, it’s going to be tough to beat the package of great tools, education, and customer service.

Webull for Advanced Charts and Paper Trading

Webull is somewhere between simple and complex. Its mobile and desktop applications include dozens of technical indicators, drawing tools, multi-leg options trading, and three types of paper trading modes. Easy account opening and extended-hours trading are among the app’s appealing beginner features.

Webull makes money like many zero-commission brokers, through payment for order flow. If you are actively trading, execution quality and margin rates merit a hard look. For intermediate traders who seek more signal without enterprise-grade complexity, it’s a good match.

eToro for social investing and copy trading tools

eToro adds a social layer to investing, allowing people to follow other investors and view their performance stats, as well as automatically copy the trades made by select individuals.

The company says it has tens of millions of registered users globally, and the app is designed for simplicity—fractional shares so you can own a piece of your favorite companies even if you don’t have a ton to invest, easy order tickets to help avoid making trading mistakes, and built-in risk control parameters like stop-loss settings.

In the U.S., eToro provides access to stocks, ETFs, and cryptocurrencies; contracts for difference are offered in certain international jurisdictions and options are not available in the U.S. Copy trading is convenient, but don’t forget that copying someone else’s moves is no replacement for your own risk management.

How to choose the right alternative to Robinhood

Align app with strategy. If you are interested in international diversification and institutional-grade tools, IBKR is the more obvious choice. Fidelity takes the cake when it comes to retirement planning and research depth. If you appreciate service, plus an elite trading workstation, Schwab with Thinkorswim is a power-packed package. Webull works for beginners who are looking for superior charts and a sandbox. eToro is the choice for social discovery and low-cost execution.

Look beyond features and compare the quality of execution and routing disclosures, fee schedule (including fees to route your trades to better prices), margin rates, and the total account value threshold that triggers higher levels of customer service. Check SIPC protection, and keep in mind that crypto assets are mostly not SIPC-protected. Regulators like the S.E.C. and FINRA have issued warnings about gamification nudging users toward risk—turn off confetti, turn on discipline, and pick the platform that works with how you actually invest.

The bottom line: there is not a single “best” broker—it’s all about what will work best for your goals. These five offer more features than Robinhood in their categories, and any of them could be the best long-term home for your portfolio.