Private fusion has entered a new era: at least thirteen companies have bagged $100M or more in capital each, a club that did not exist a decade ago. PitchBook counts and company disclosures indicate cash is coalescing around teams with physics that can be believed, hardware milestones that make sense to VCs and, increasingly, first-of-a-kind commercial commitments.

Here is a quick roundup of all the fusion startups at $100M and above (each startup’s shtick below, sorted by total funding), from high-temperature superconducting tokamaks and stellarators to z-pinch, field-reversed configurations, and inertial confinement. Together they paint a picture of the overlap between money and ideas — and where the greatest technical risks still lie.

- Tokamak and stellarator leaders gaining major funding

- Field-reversed configurations and Z-pinch players

- Inertial confinement projects and major funding updates

- Magnetized target and fusion supply chain bets

- Revenue-first strategies targeting nearer-term markets

- Why the $100M club among private fusion firms matters

Tokamak and stellarator leaders gaining major funding

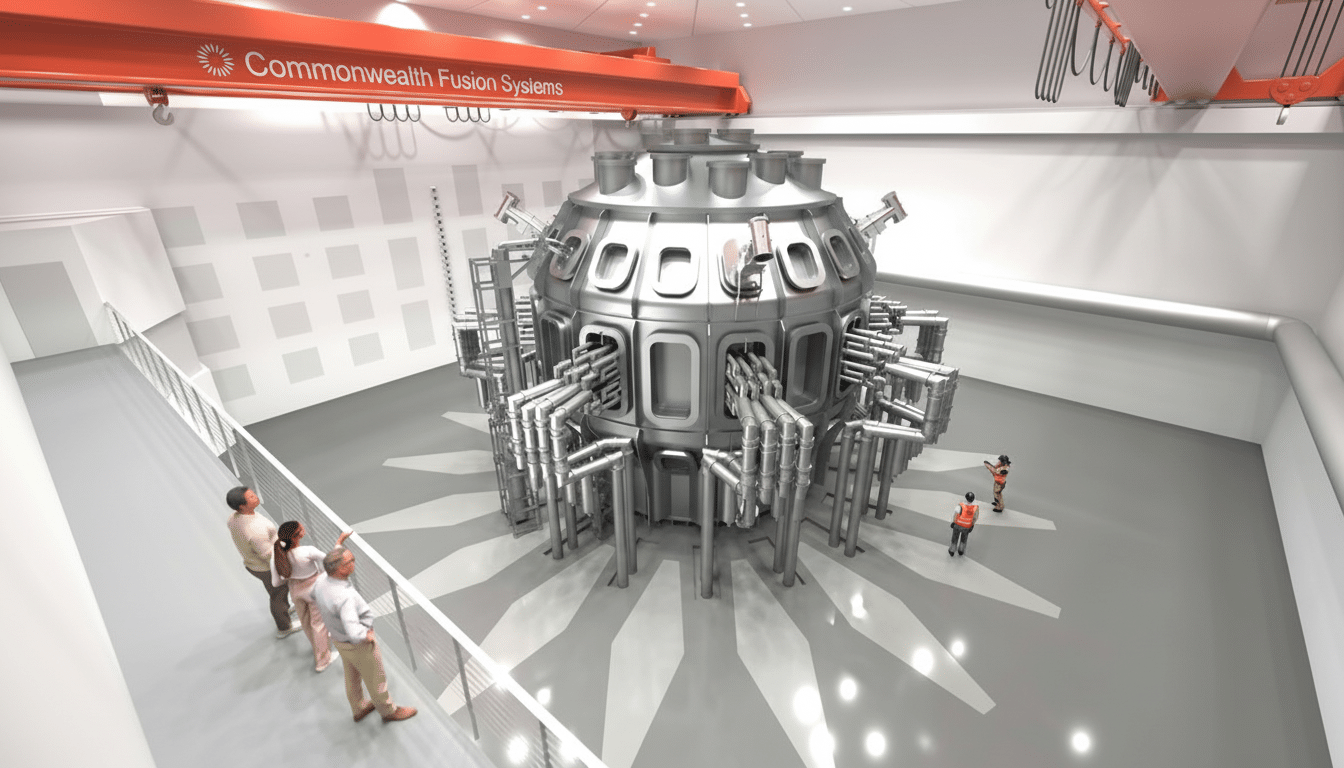

Commonwealth Fusion Systems has now raised close to $3B, with a $863M round valuing its work on high-temperature superconducting magnets (co-developed with MIT) at tens of billions. The company is developing SPARC, a small tokamak to prove power at commercially useful scale, and ARC, a planned 400-megawatt plant that the company hopes to build near Richmond, Va. In a milestone offtake, Google signed up to buy 50% of ARC’s output, suggesting increasing willingness to underwrite early-era fusion electricity.

Tokamak Energy has received approximately $336M for development of a compact spherical tokamak design with REBCO magnets. Its ST40 reached 100 million °C plasma, and the next step is Demo 4 to test magnets in power plant–relevant environments. The company also peddles magnet technology, a diversification play many investors like to see.

Proxima Fusion, a stellarator spinout from European research, has raised more than €185M to turn lessons from Germany’s Wendelstein 7-X into designs for the commercial sector. Stellarators exchange geometric simplicity for intrinsic plasma stability; the gamble is that longer, steadier confinement might make up for engineering complexity once modern design and manufacturing tools come into play.

Field-reversed configurations and Z-pinch players

Helion has raised about $1.03B and aims to have direct electricity production with the so-called field-reversed configuration (FRC) in which two plasmoids are created and fired at each other. The company has a power purchase agreement with Microsoft — always a promising sign of commercial pull-through, assuming the timelines hold. The Polaris prototype is designed to demonstrate important physics, and energy extraction from the plasma’s dynamic magnetic field.

Founded in 1998, TAE Technologies has raised approximately $1.8B from investors such as Google, Chevron and NEA. TAE’s beam-driven FRC is a linear, or cigar-shaped, plasma that is stabilized by beams of particles and allows for longer confinement times. The company also unveiled a planned merger that will bring in added capital, showing how fusion financing is expanding beyond traditional venture and government channels.

(Image credit: Zap Energy)

With a constellation of private companies capturing well over $1B in government contracts and investment, we are seeing the emergence of a modern space race for nuclear fusion driven by funds from space investors who have played a big role in this new wave of startups.

Zap Energy has brought in about $327M to build a sheared-flow Z-pinch that targets aneutronic fusion without expensive megawatt-class superconducting magnet arrays, passing intense current through isotropic plasma being ejected by detonations or neutron streams (wind blast on our reactor walls). The method is elegant in hardware terms — no superconducting coils or giant lasers — but it requires exquisite control of plasma’s instabilities. Its backers include Breakthrough Energy Ventures, DCVC and Chevron Technology Ventures.

Inertial confinement projects and major funding updates

Following in their wake, Pacific Fusion debuted with a staged $900M Series A.

Pacific Fusion burst on the scene with a staged $900M Series A using an inertial confinement system that features 156 impedance-matched Marx generators performing in synchronicity, providing about 2 terawatts for a hundred nanoseconds. Funding is tranched to milestones, a biotech-style model that rewards specific technical progress in a field where schedule risk is very much real.

Marvel Fusion has garnered some $162 million for a laser-driven concept that entails implanting targets with silicon nanostructures meant to enhance compression. By exploiting mature semiconductor fabrication, Marvel is poised to scale target production — widely perceived as one of the hidden roadblocks in IFE cost estimates. Work is also underway on a demo plant with an academic partner.

First Light Fusion received around $108 million to develop projectile-driven inertial fusion with a two-stage gas gun and specially designed targets to enhance the effect of impact energy. The company shifted from the original full-power plant to licensing and pulsed power demonstrators (with potential defense and science applications) — an early decision to make money without risking the core IP.

Xcimer recently closed a $100M funding round to redesign not just the laser system, but the stack of lasers themselves, for a 10 megajoule system — about five times the pulse energy that helped secure scientific breakeven at a U.S. national lab. Its design marries high-energy lasers to molten-salt first walls for heat absorption and structure protection, a nod in the direction of power plant survivability.

Magnetized target and fusion supply chain bets

General Fusion has raised at least $492 million for magnetized target fusion, where pistons compress a liquid-metal cavity to squeeze injected plasma. The company ran into a cash crunch and laid off 25% of its staff before getting last-minute, emergency funding in the form of a pay-to-play round followed by SAFE notes, according to investor communications and Canadian securities filings. It is one of the oldest private fusion efforts, with support from backers that include Jeff Bezos and Temasek.

Kyoto Fusioneering has raised about $191M to construct the “balance of plant” that all reactors will require: high-power gyrotrons, tritium handling, blankets and heat extraction, and integration services. It is a picks-and-shovels approach: if even one of these reactor teams makes good on sustained power, the whole supply chain will need to scale quickly, and early specialists would then be well positioned.

Revenue-first strategies targeting nearer-term markets

SHINE Technologies has already raised approximately $778M and is working to serve near-term markets — neutron services, medical isotopes, and nuclear waste recycling — with technology applicable to future fusion power. It is perhaps the most practical route to cash flow in a sector where grid-scale production is still multiple development cycles distant.

Why the $100M club among private fusion firms matters

Covering Positive Fusion News: Want to be the big fish in a small fusion pond?

The $100M+ roster covers almost every conceivable fusion pathway: tokamak, spherical tokamak, stellarator, FRC, Z-pinch, magnetized target and various flavors of inertial confinement. It’s on that diversity that science’s healthy uncertainty and the market work their magic. It also demonstrates how the ecosystem is now a mix of VC, strategics, project finance and corporate offtakes. Total private fusion funding has surged, according to the Fusion Industry Association and PitchBook. Meanwhile, despite (or because of) the trifecta unleashed by AI-driven control, high-temperature superconductors and pulsed-power hardware that shortens cycle iterations, the next test is execution — delivering net energy at plant scale, at costs utilities can underwrite, with components that can be manufactured in the thousands.