Smartphones may soon become even more expensive as the artificial intelligence boom puts pressure on memory supply. IDC warns that average selling prices for phones may increase 3% to 5% in a moderate scenario, and up to 6% to 8% in worse conditions — pressure that would rest mostly on budget-focused Android brands. The same conditions are likely to filter through to PCs, with some prices potentially rising by as much as 8%.

Why AI Is Throwing a Squeeze on Phone Memory Supply

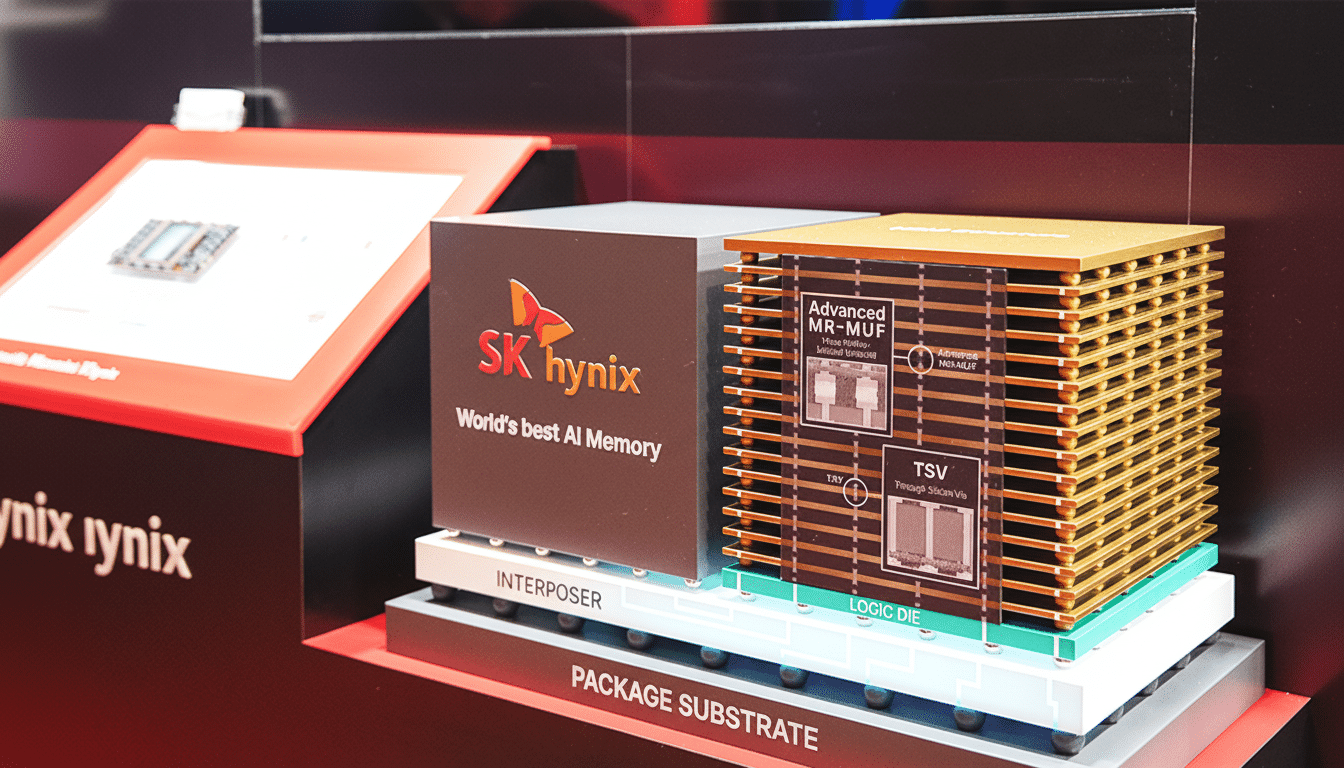

At the heart of the crunch is DRAM, the memory that every phone depends on for multitasking and on-device AI capabilities. AI data centers are consuming an excessive portion of the world’s DRAM production, especially high-bandwidth memory (HBM) for AI accelerators. That redeployed wafer capacity gets diverted from other uses of the same wafers, such as mobile-grade LPDDR chips, to help lower component costs for consumer devices.

Market trackers have warned of the trend for months. TrendForce has frequently reported on limited DRAM supply and climbing contract prices over recent quarters as HBM ramps up aggressively. As SK Hynix, Samsung and Micron put more emphasis on state-of-the-art AI memory and complex packaging, downstream buyers — smartphone vendors among them — are scrabbling for LPDDR5 and LPDDR5X supply.

Add on the industry’s drive toward more on-device AI features — voice summarization, image generation and offline assistants — and the memory equation gets worse. More AI translates to more RAM and faster storage, just as the least expensive capacity becomes harder to come by.

Which Smartphone Brands Will Be Hit the Hardest by Costs

Low-margin vendors are forecast to be hit first, according to IDC. Price-aggressive brands — like, well, Xiaomi, Oppo, Vivo, Realme and Transsion; also TCL and Lenovo; Honor et al. — have less headroom to absorb memory inflation and are thus more exposed to spot-market swings. For many, their choices will be limited to either passing increased bill-of-materials costs on to consumers or simply eating the margins at risk.

Units will also be soft, the company has projected. IDC expects the entire smartphone market to slightly contract, by about 2.9% in a base case and up to 5.2% in worst-case scenarios as higher component costs and skittish consumers thwart upgrades. That can add additional pressure on vendors that need scale to maintain wafer-thin margins.

Premium Makers Are Insulated, Not Entirely Immune

Apple and Samsung are better equipped than most. IDC says both companies are supported by healthy cash positions and long-term supply agreements that commit them to purchasing quantities of memory 12 to 24 months forward. That cushion means less volatility and steadier flagship pricing, even as the wider market is raiding parts bins.

Insulation isn’t immunity, though. Look for conservative memory on higher-priced models as suppliers curtail costs — that means some, but not all, “Pro” variants get 12GB of RAM, short of the 16GB we’d rather see across the board. Another, more subtle effect: last year’s flagships may not witness their usual price erosion when new models are available, keeping margins as the cost of memory remains high.

The Squeeze Is Also On for PCs and Consoles

The AI-induced land grab in memory doesn’t end with the phone. Average selling prices of PCs are forecast to rise by 4% to 6% in a moderate scenario and by 8% in a worst case, potentially with the largest OEMs best placed to handle the impact. Smaller regional and “white box” builders — those who buy memory closer to spot pricing, that is — will be the ones to suffer most.

Gaming hardware is also exposed. Nintendo watchers have cautioned that if DRAM pricing remains high, cartridge production could remain relatively expensive for next-gen Switch, which the analysts say might constrict the number of fully physical releases. It’s yet another illustration of how far-flung the memory appetite that AI is creating throughout consumer tech.

What This Memory Squeeze Ultimately Means for Buyers

Shoppers looking for budget-friendly Android devices should expect shallower deals and less drastic price cuts, even on units with higher RAM tiers. Unless you’re really pushing the limits of multitasking or on-device AI, choosing 8GB over 12GB would help keep costs in check without much (or any) hit to day-to-day performance.

Timing may be even more important than before. Purchasing early after a product’s launch is one way to steer clear of that late-cycle price creep, while last year’s “premium” models (if they do indeed drop) may be a better deal than midrange newcomers. For used units on reputable marketplaces, it’s still a good hedge if component prices are so volatile.

What to Watch Next as AI Reshapes Memory Supply

Three signals will help set the pace:

- The rate at which HBM capacity increases

- Whether DRAM suppliers rebalance production in favor of LPDDR as AI backlogs are cleared

- The speed of adoption in on-device AI, which defines how much memory phones will require

Should demand for these AI servers remain red hot, that 6% to 8% phone price bump IDC laid out could hang around. Should supply loosen, the strain on entry-level and midrange models should diminish in future product cycles.

And for the time being, the supply chain’s message is crystal clear: AI is rewriting memory prices and consumer pricing is along for the ride.