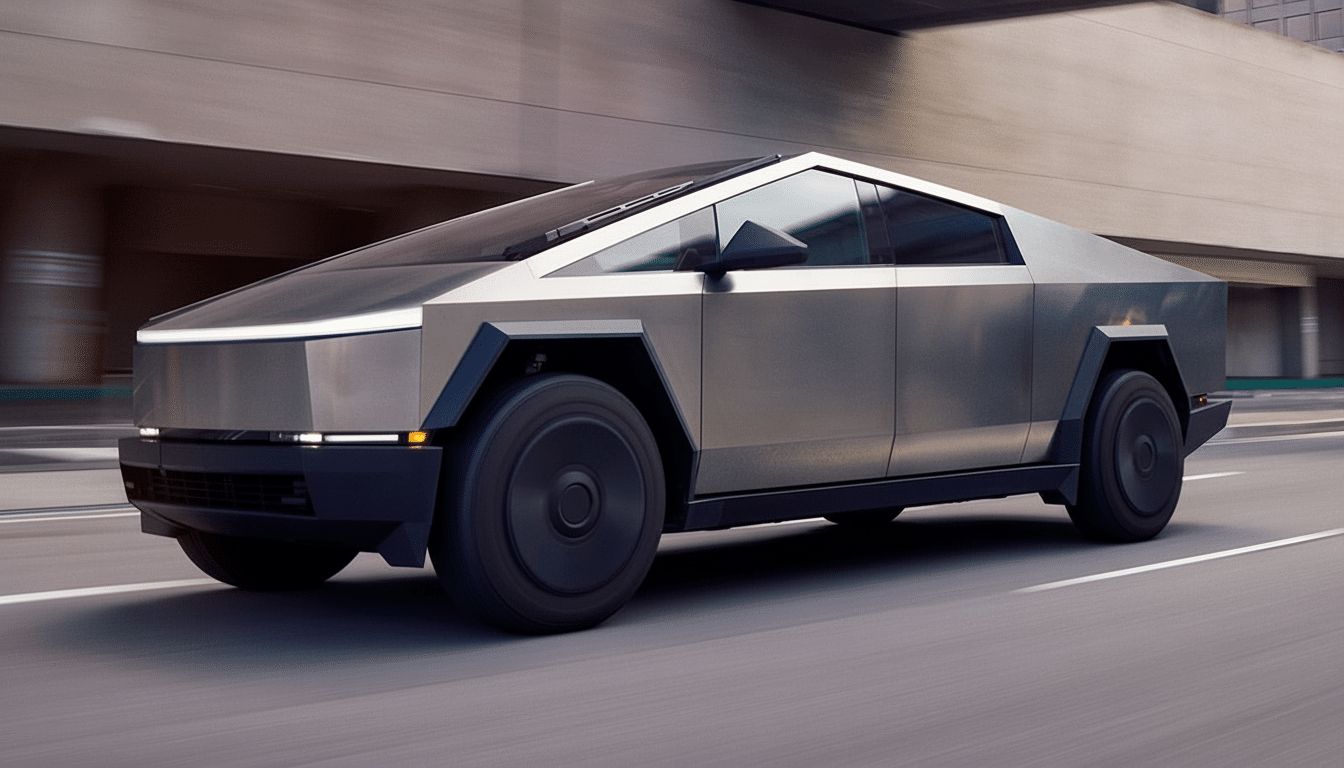

Tesla is facing new leadership turmoil as the leaders of its Cybertruck and Model Y programs separately announced their departures. The exits come at a delicate time for the automaker, as it grapples with slower growth, margin pressure, and the challenging ramp of its most unconventional vehicle to date.

Two Program Chiefs Leave Tesla on the Same Day

Siddhant Awasthi, who started at Tesla as an intern and grew to run the company’s Cybertruck program, said in a post on LinkedIn that he had departed the electric car and renewable energy company. And hours later, Emmanuel Lamacchia, who was responsible for the vehicle program for Model Y, announced that he too would be leaving. Each had spent close to eight years at Tesla, and both framed their departures as amicable.

Program managers are essential at Tesla: They connect up the design, engineering, machinery, manufacturing plant, supply chain, and quality into one build plan. The loss of two at the same time matters because it can slow decision-making and create friction with already tight production schedules.

Cybertruck Faces a High-Stakes Push to Reach Scale

It’s still a high-attention bet with a potentially challenging path toward volume.

A big official number for the percentage of reservation holders who coughed up deposits to get in line (more than $50 million, we were told), as well as tidbits coming from Musk on Twitter following the reveal, all add fodder and intrigue here.

A recent filing for a U.S. recall by the National Highway Traffic Safety Administration accounts for approximately 63,619 Cybertrucks impacted since launch as a rough proxy for current deliveries to date. That’s well short of Elon Musk’s oft-stated ambition for the plant of reaching 250,000 vehicles a year when it hits maturity.

Scaling an exoskeleton in stainless steel with new modes of production is by its nature difficult.

So too, early production rushed through high-profile fixes — from accelerator pedal issues to wiper-related troubles — as both suppliers and factory processes continued developing. But as The Verge and others have pointed out, the ramp has been slower than initial hype would suggest.

Awasthi’s tenure covered the all-important prototype to customer deliveries. His departure raises questions about continuity as Tesla tries to steady production yields, ramp down rework, and get per-unit costs back to levels that will give it meaningful margins on the truck.

Model Y Remains Tesla’s Global Workhorse for Volume

Model Y, by contrast, is Tesla’s volume linchpin. The industry researcher JATO Dynamics said it was the world’s top-selling car of 2023, surpassing long-time champions in the compact segment. Under Lamacchia, Tesla also localized production in Austin and Berlin as with Shanghai, which would improve logistics and expand trim levels.

Even the market leader is feeling pressure. Defensive price reductions helped preserve share, but squeezed automotive margins into the high teens, Tesla’s financial filings show. Meanwhile, more aggressive competitors from China, Europe, and legacy U.S. brands have escalated the crossover EV battle with quicker model cycles and incentives.

Leadership Change Adds to a Fraught Year

The twin exits come after multiple high-profile departures and restructurings. Senior executive Drew Baglino departed earlier, after a tenure of almost two decades, while the company’s head of public policy, Rohan Patel, did too, as company filings showed. Tesla has also laid off a substantial number of employees, more than 10 percent of the workforce according to Reuters, in its efforts to become more efficient overall.

It is not the first instance of leadership churn for Tesla, but timing matters. When program leadership changes at the time of product ramps or significant refreshes, execution risk increases. Replacements might inject new energy — and there is plenty of deep bench within Tesla’s engineering ranks — but handoffs can also slow down validation gates, line changes, and supplier commitments.

What Investors and Customers Will Watch Next

Two questions now dominate.

- Who runs the Cybertruck and Model Y programs, and how quickly they can close cost and quality targets.

- How Tesla manages short-term execution versus long-term bets — such as the next-gen manufacturing approach laid out at Investor Day and ongoing software-led features that differentiate the fleet.

Watch for investors to look at delivery trends and repair rates, as well as margin guidance, for a sign that the shake-up is contained. Customers won’t give a damn about org charts; they’ll care more about consistency in product, responsiveness of service, and price stability. If Tesla can stabilize the Cybertruck ramp and maintain Model Y as cost-competitive versus increasing competition, then the latest departures can be absorbed by the company. If not, losing two program chiefs might wreak havoc with an already brutal production schedule.

For now, the departures highlight a well-known Tesla paradox: relentless innovation along with relentless turnover. The next couple of quarters will tell if its execution engine is as modular — and therefore, resilient — as the public story also tells.