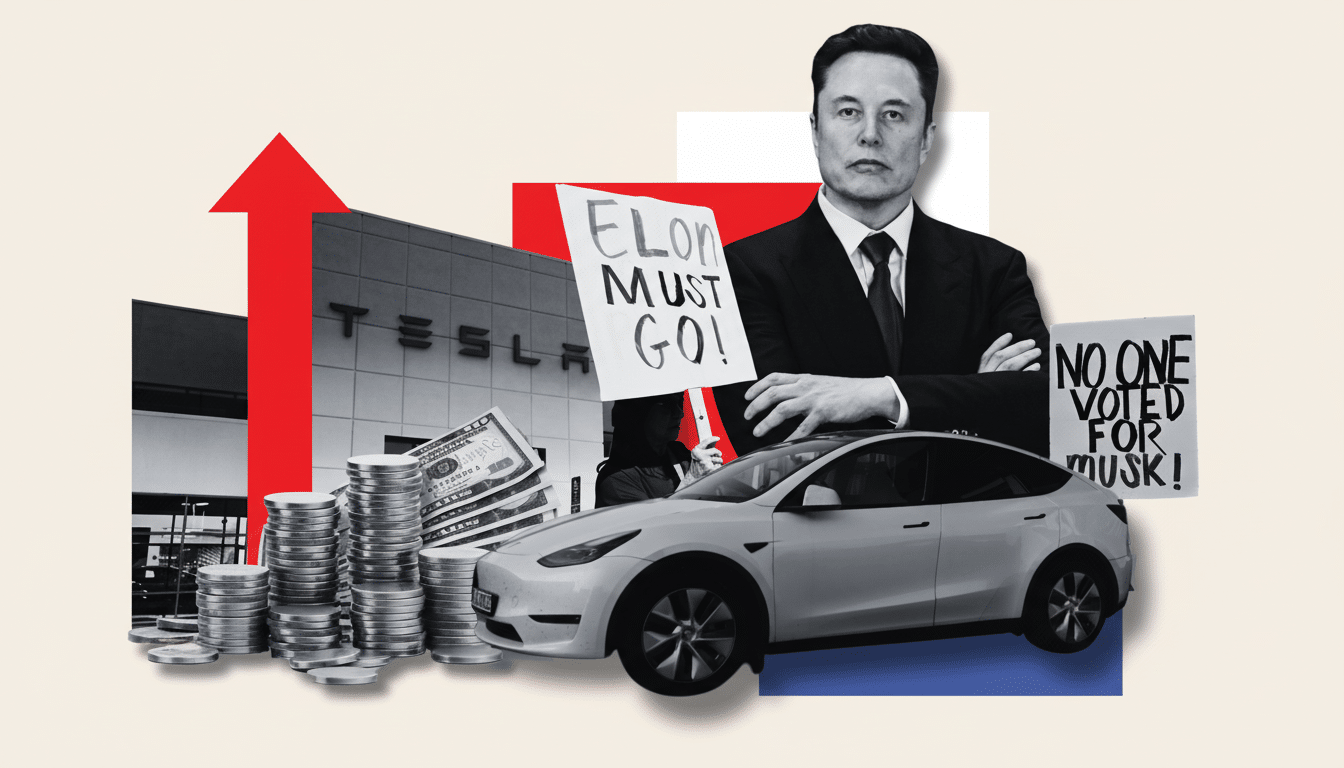

Tesla’s insurance program came under formal review after the California Department of Insurance accused it of “egregious delays” and broader “systemic failures” in processing claims, naming both Tesla’s insurance entities and State National Insurance Company as its affiliated underwriter. In new enforcement filings, regulators detail intentionally unfair claims practices that left customers waiting and waiting for responses, staring at unreasonable denials, and experiencing financial hardship and emotional pain.

Tesla has ignored years of federal warnings, the agency says, despite increasing complaint volumes and violations. The companies could be subject to fines per violation and have a short time to respond. The filings also say that Tesla’s practices could leave it vulnerable to wider legal action, echoing a proposed class-action lawsuit claiming the company has delayed and underpaid settlements.

What The Regulator Alleges About Tesla Insurance

California’s insurance regulator points to the state’s Unfair Insurance Practices provisions and Fair Claims Settlement Practices Regulations, which require the timely good-faith handling. One fundamental rule requires insurance companies to acknowledge and respond to communications within 15 calendar days. Most of Tesla’s transgressions, according to the filings, have come from missing these deadlines, while others are related to a failure to conduct “thorough, fair and objective” investigations.

Regulators say the failures were at “all steps” of the claims process, from initial acknowledgment to investigation and payment decisions.

Though Tesla and State National had promised over and again that the processes would be revised, the problems persisted – and intensified – which suggests systemic issues outweighing occasional hiccups, the agency says.

Number Of Complaints And Possible Penalties

The escalation is vivid in the regulator’s tally. Complaints from consumers went from 83 in 2022 to 829 in 2024, with the agency finding that state insurance law had been violated in 775 cases that year. As of the end of September this year, the department reports 1,481 complaints and 1,969 other violations. Tesla’s insurance operation had racked up nearly 3,000 violations in California as of 2022, according to the filings.

Each illegal act has a potential fine of $5,000 and up to $10,000 if the action is determined to be willful. If even a fraction of the nearly 3,000 apparent violations were punished at the lower threshold, potential fines could stretch into the tens of millions of dollars. The agency also identified 166 cases of incomplete investigations, which can be an important issue for bad-faith litigation.

To be sure, most auto insurers have grappled with supply chain and repair capacity issues in recent years. But California’s filings depict Tesla’s spike as far more severe than ordinary turbulence. The National Association of Insurance Commissioners monitors complaint ratios for carriers nationally, and the numbers can play a role in regulation oversight and rate-setting conversations.

How We Got Here: Tesla’s Insurance Background

Tesla introduced an in-house insurance product in California that it said would be cheaper and more convenient than those of rivals because of a companywide vertical integration. Early execution was bumpy — website outages, and quotes that far exceeded what some would-be buyers anticipated. The product in California is facilitated through Tesla Insurance Services using State National Insurance Company to underwrite policies; in other states, some of Tesla’s telematics via its Safety Score have at least historically faced a bit more regulatory flak than they have in California.

The state said it had first taken Tesla to task in 2022, following a surge in complaints. There had been a vacancy in the position of head of claims for months. Watchdogs tracked progress for six months after Tesla and State National admitted they’d underestimated the volume of claims, as well as staffing requirements. Tesla recruited a new claims leader in 2023 and reported improvements, but an independent review conducted by Reuters that year found tensions persisted even as complaint data rose again in 2024 and this year.

What It Means for Policyholders And The Market

Slow claims can, for owners, make a minor fender-bender mean weeks without a car, costlier rentals, and delayed fixes — issues that could be compounded with EVs in which parts availability and sensor calibrations complicate matters. The filings also allude to potential third-party liability exposure; if that were to be proven, it escalates the stakes beyond run-of-the-mill administrative violations and into costly litigation and reputational harm.

For Tesla, insurance is not just an add-on with a lock-in feature for its broader strategy. It bolsters the company’s argument that software and data can shave loss costs and pass along savings to drivers. If regulators assert systemic failures, Tesla may have to increase the staffing of claims, tighten vendor management at body shops and automate communications and adjudication. The legacy carriers have poured resources into straight-through processing, parts networks and analytics-based triage — capabilities Tesla will struggle to meet.

What To Watch Next In California’s Enforcement Case

The companies have a few weeks to respond to the enforcement action, and that response could lead to an administrative hearing, a consent order requiring fixes, financial penalties or some combination of the three. Accompanying civil litigation may answer whether the regulators’ issues related to claims handling manifest as bad-faith exposure in court. The practical takeaway for policyholders is to document all claim communications and, if deadlines get pushed back, to escalate up the chain of command or contact the Department of Insurance’s consumer services unit.

The result in California will be watched closely by other states where Tesla sells insurance. Whether that becomes a cautionary tale or a forcing function for a more mature, data-driven claims organization will depend on how well and how fast the company can translate regulatory criticism into operational change.