Tesla is winding down production of its pioneering Model S sedan and Model X SUV, drawing the curtain on the vehicles that pushed electric cars into the luxury mainstream. The company said final builds will roll out next quarter, while support, service, and parts for existing owners will continue.

Framed as a strategic shift, the move reallocates resources toward autonomy and advanced robotics, Tesla’s next act beyond premium passenger cars. It also caps a defining chapter for the brand, which used S and X to make electric performance aspirational and to set early benchmarks for range, software, and over-the-air updates.

Why Tesla Is Ending Its Model S and Model X Flagships

The decision reflects where Tesla’s volume and margins have concentrated for years. The Model 3 and Model Y dominate the company’s delivery mix, while Model S and X are high-profile but relatively low-volume offerings. According to Tesla’s public delivery reports, S/X combined represented roughly 4% of total shipments in 2023, a share that has hovered in the low single digits despite periodic refreshes.

As the premium EV field crowded with rivals—from Porsche’s Taycan and Mercedes-Benz’s EQS to BMW’s i7 and startups like Lucid and Rivian—S and X faced a tougher battle for affluent buyers. At the same time, Tesla’s core strategy has centered on scaling more affordable platforms, driving manufacturing efficiencies, and channeling engineering resources into autonomy and AI-led products.

Elon Musk characterized the change as an “honorable discharge” for the programs, positioning the shift as necessary to accelerate autonomy. With capital and factory space scarce commodities, retiring low-volume lines reduces complexity and frees capacity for projects Tesla sees as its next growth engines.

What Ending Model S and Model X Production Means for Owners

Tesla says it will continue to support Model S and Model X “for as long as people have the vehicles,” including parts, software updates where applicable, and service. The company has a track record of supporting aging fleets—including the original Roadster—well beyond initial production runs, an important signal for residual values and ownership confidence.

Short-term, the final production window could spur a last wave of orders from collectors and loyalists seeking late-build examples, especially high-spec variants like Plaid. Longer-term, the used market may see tighter supply of well-kept S and X models, with pricing influenced by ongoing software support and battery longevity.

Industry Context and Competition in the Luxury EV Market

Luxury EVs no longer compete in a vacuum. Legacy automakers and startups now field products with comparable range, rapid charging, and richly appointed interiors. That competition has put pressure on Tesla’s older premium nameplates, even as the brand continues to lead in software-driven features and charging network access.

Broader market dynamics also favor scalable, mid-priced EVs. The International Energy Agency’s Global EV Outlook has tracked rapid growth in electric car adoption, with global EV share of new car sales rising into the mid-to-high teens by 2023. In mature markets, the bulk of that growth is concentrated in segments where the Model 3 and Model Y compete, reinforcing Tesla’s decision to align production with higher-demand categories.

The Legacy of Model S and Model X in Shaping Electric Luxury

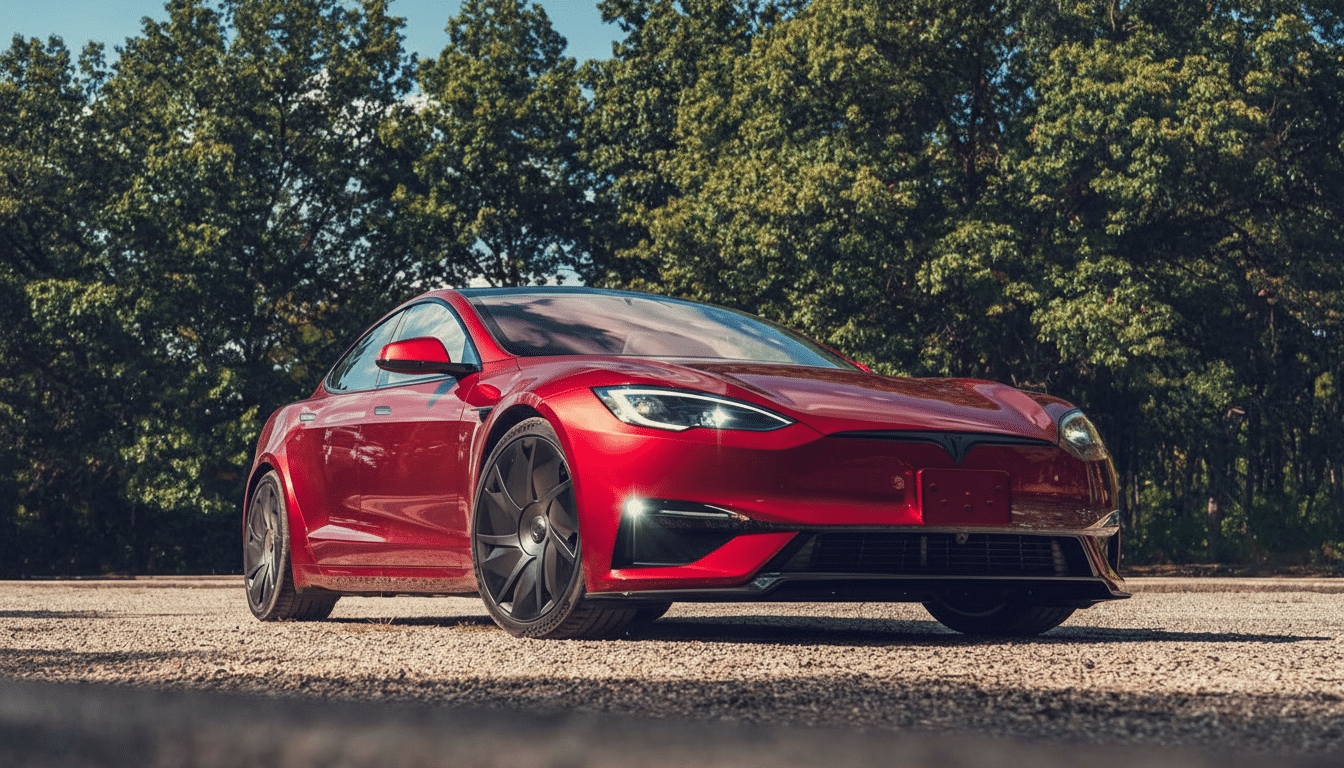

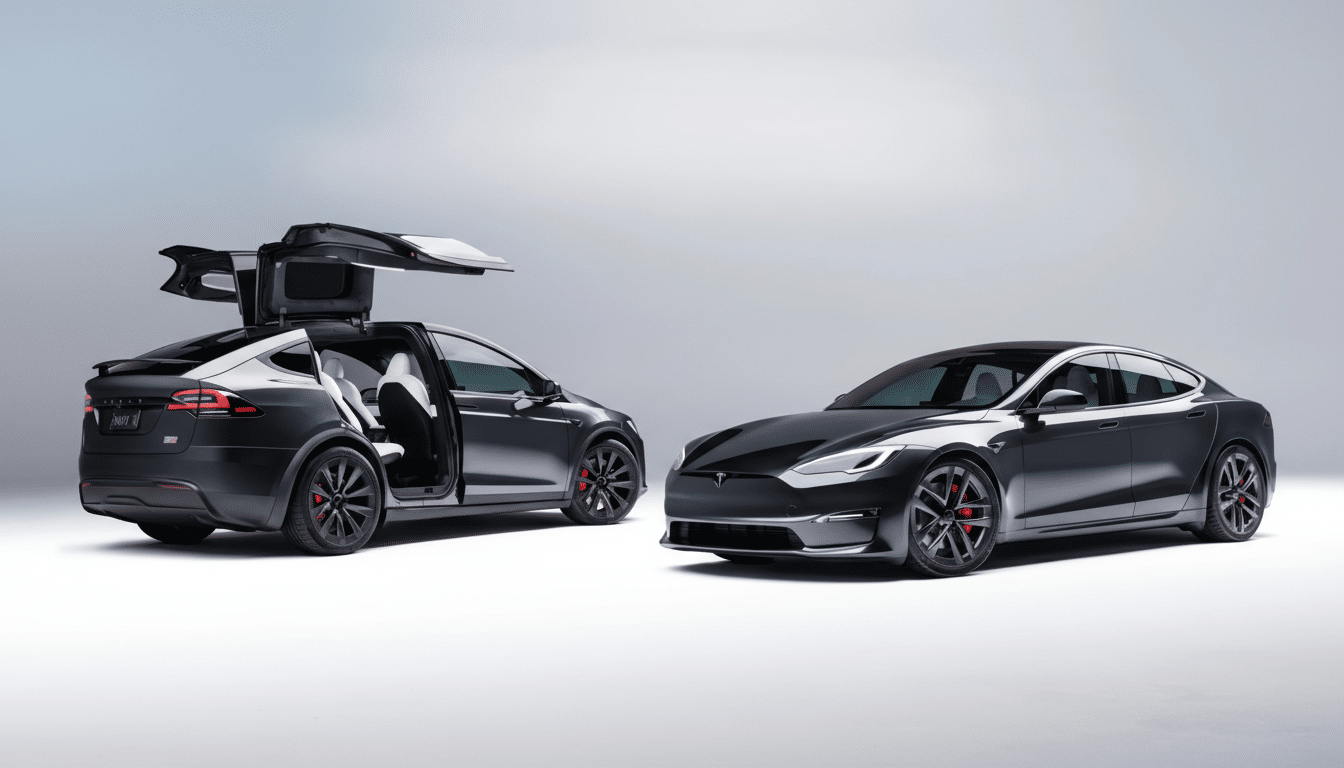

Launched in 2012, Model S reset consumer expectations for electric range, performance, and over-the-air software. It helped make EVs aspirational, not just economical. Model X followed, packaging family utility and signature falcon-wing doors into a distinctive flagship SUV. Together they gave Tesla brand credibility that later allowed the company to scale smaller, more attainable models.

The vehicles also served as rolling testbeds for Tesla’s software stack, from advanced driver assistance features to the in-car infotainment model that the industry has since emulated. The Plaid variants, with their headline acceleration claims, cemented Tesla’s reputation for performance engineering in an EV context.

Fremont’s Next Act Focuses on Optimus and Robotics

Once S and X production winds down, Tesla plans to use the Fremont factory space for its Optimus humanoid robot program. That pivot underscores Musk’s thesis that Tesla’s future valuation will be driven as much by autonomy and robotics as by carmaking. It also suggests a tighter integration between Tesla’s AI teams and its manufacturing footprint, with lessons from vehicle production informing robot assembly and vice versa.

Retiring Model S and Model X is a symbolic moment for Tesla. But the calculus is straightforward: double down where demand is deepest, redeploy scarce capacity to AI-driven bets, and keep legacy customers whole. The cars that made electric luxury credible are exiting the line, but their engineering DNA—and the market they helped create—will shape Tesla’s next chapter.