Tesla is phasing out Autopilot, its long-standing basic driver-assistance suite, in a strategic move to funnel customers toward its more advanced Full Self-Driving (Supervised) software. New vehicles now list only Traffic-Aware Cruise Control as standard, signaling that lane-centering and automated steering functionality will live behind the FSD paywall.

The change lands as Tesla navigates regulatory pressure in California, where authorities have challenged the company’s past marketing around autonomous capabilities. It also aligns with Tesla’s broader shift from a one-time FSD purchase to a subscription model, creating a clearer product ladder and a recurring revenue stream.

- Why Tesla Is Retiring Autopilot and Clarifying Features

- What Changes for Drivers After the Autopilot Retirement

- Subscription Economics Take Center Stage

- Regulatory and safety backdrop for Tesla’s strategy

- Robotaxi Signals And The Path To Autonomy

- Industry context and buyer implications of Tesla’s move

- The bottom line on Tesla’s Autopilot retirement strategy

Why Tesla Is Retiring Autopilot and Clarifying Features

Autopilot originally combined adaptive cruise with lane-centering. That blend created enduring confusion about what the system could actually do and how drivers needed to supervise it. Retiring the Autopilot brand helps address that ambiguity while satisfying regulators who argued that the name overstated capability.

There’s also a commercial logic: adoption of FSD has lagged expectations. Company disclosures indicate only about 12% of owners had paid for FSD, a modest figure for a flagship software product. By removing lane-centering from the base package, Tesla increases the incentive to subscribe to FSD (Supervised) for richer automation features.

What Changes for Drivers After the Autopilot Retirement

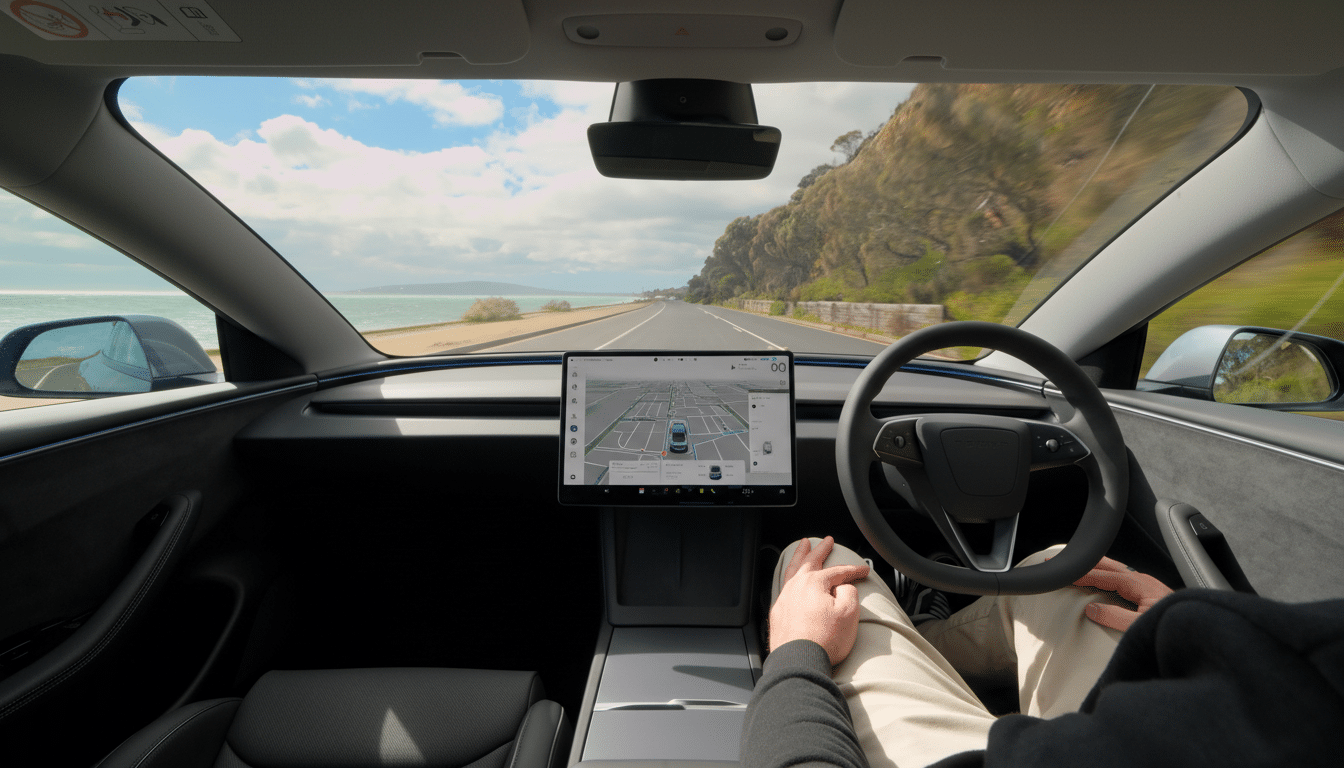

Tesla’s configurator now lists Traffic-Aware Cruise Control as the standard offering. That keeps speed and distance control on highways but drops built-in Autosteer. The company has not detailed how the change affects existing owners, leaving open questions about grandfathered features and regional variations.

FSD (Supervised) adds lane-keeping, automated lane changes, traffic light and stop sign handling, and city-street maneuvers—while still requiring a fully attentive driver. Regulators classify these systems as SAE Level 2: driver assistance, not autonomy. In practice, that means hands on the wheel, eyes on the road, and legal responsibility remaining with the human.

Subscription Economics Take Center Stage

Tesla is replacing the one-time FSD purchase with a monthly subscription, currently advertised at $99 and expected to rise as features evolve. That pivot lowers the upfront barrier for buyers and builds predictable software revenue, a prized metric on Wall Street.

At $99 per month, a year of FSD produces $1,188 in software sales per vehicle. Even with churn, multi-year retention can eclipse the old one-time fee for owners who keep cars longer. Because software typically carries higher gross margins than hardware, the model helps offset thinner profits from aggressive EV pricing.

Regulatory and safety backdrop for Tesla’s strategy

California’s motor vehicle agency secured a ruling that Tesla had marketed Autopilot and FSD in ways that could mislead consumers about their capabilities. The state has moved to suspend certain licenses for 30 days, with a 60-day stay to allow compliance—pressure that dovetails with Tesla dropping the Autopilot name.

Safety scrutiny remains intense. The National Highway Traffic Safety Administration has linked Autopilot-involved misuse to hundreds of crashes and at least 13 fatalities. Tesla has pushed software updates and driver-monitoring tweaks aimed at curbing misuse, but regulators continue to emphasize that these are assistance features, not self-driving systems.

Robotaxi Signals And The Path To Autonomy

Tesla has begun operating robotaxi-configured Model Y vehicles in Austin without in-car safety monitors, though company vehicles still follow for supervision. The deployment suggests growing confidence in its vision-based stack while stopping short of fully unsupervised operation.

By contrast, players like Waymo and Cruise run driverless services within tightly geofenced areas under specific permits and intensive remote oversight. Tesla’s approach leans on its vast consumer fleet and over-the-air learning, but it must still reconcile bold autonomy claims with legal requirements for human attention and safe operation.

Industry context and buyer implications of Tesla’s move

Rivals such as GM and Ford have positioned hands-free highway systems as distinct paid packages while keeping basic lane-centering widely available. Tesla’s move flips that script: lane-keeping now lives with the premium software tier, potentially widening the perceived feature gap at the base price and nudging more owners to subscribe.

For buyers, the calculus shifts. Drivers who valued lane-centering will face a subscription decision, while those who relied mainly on adaptive cruise may find little change. The critical test will be whether FSD (Supervised) delivers consistent, measurable improvements that justify ongoing fees—and whether Tesla can communicate limits clearly enough to keep regulators and safety advocates onside.

The bottom line on Tesla’s Autopilot retirement strategy

Retiring Autopilot cleans up a legal headache and tightens Tesla’s upsell funnel to FSD. If the company can edge FSD adoption higher from its current 12% and sustain retention, the software annuity could rival hardware profits. But the strategy hinges on safety performance, transparent messaging, and steady feature gains—any stumble on those fronts risks undercutting the very adoption Tesla seeks to accelerate.