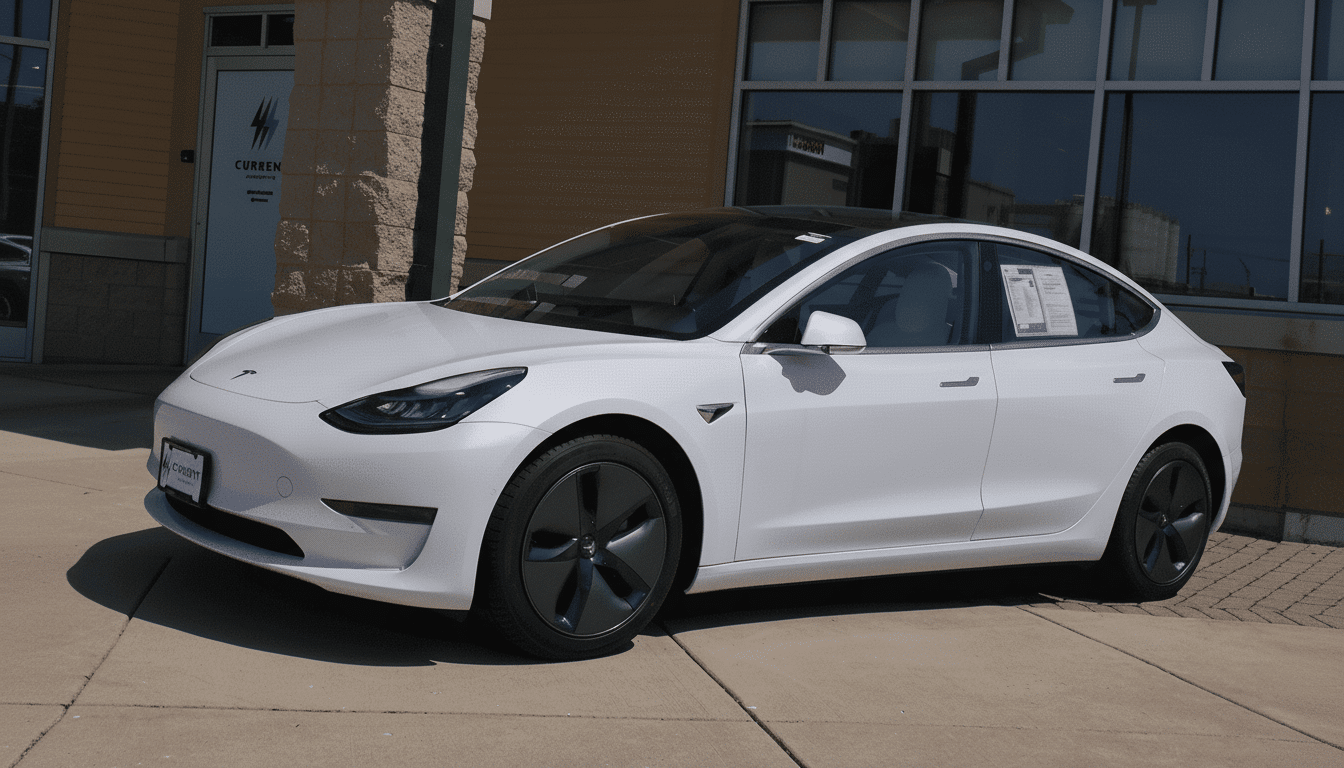

Tesla has introduced new Standard trims of the Model 3 sedan and Model Y crossover, taking a few thousand dollars off their starting prices while keeping headline range. Both the Model 3 Standard and Model Y Standard have a full-sticker price of $36,990 and $39,990, respectively, with estimates of both models hitting 321 miles on a single charge. The move is aimed at buyers who care more about the core performance of an EV rather than premium feel, and marks Tesla’s latest drive to stimulate demand in a market that is more sensitive to price.

Pricing and estimated range for the new Standard trims

With a just-below-$37,000 price for the sedan and around $40,000 for the crossover version, they’re less expensive than Tesla’s better-appointed trims without dropping down below the sub-$35,000 number. Tesla estimates 321 miles on each, and if the real-world results live up to that figure for both models, they’ll be among the longest-range offerings in their price class. Buyers should plan on the typical Tesla nuance around range as it varies by wheel choice, climate and driving style, and final certifications may vary market by market.

Cost with incentives still could adjust the effective purchase price, but determining eligibility has become more challenging. Some buyers will be able to take advantage of state or local programs, while others will pay sticker. Tesla says the Standard trim will come in various versions for global markets, including Europe where there are many different incentives and taxes.

Features Tesla trims or removes to reach lower prices

The cost-down approach can be seen in the cabin and the features as well. The Standard models scale back the second-row screen, and creature comforts are a bit more humble: the steering wheel and side mirrors adjust manually; the audio system comes down to seven speakers from 15 plus a subwoofer in the premium setup; only the front seats are heated. There’s no AM/FM radio (Pandora and Spotify come standard), an eccentric omission that still counts for some of the buyers migrating from legacy vehicles.

Advanced driver-assist is also stripped down. These Standards do not include Tesla’s full suite of Autopilot features. Traffic-aware cruise control is still around, but there is no Autosteer—the feature that many owners refer to as “Autopilot” by shorthand. Buyers desiring lane centering or premium driver-assist packages will have to get them post-purchase.

External differences also play a role in the delta. The Model Y Standard is missing the light bar found on higher trims, and both cars ditch the panoramic glass roof. Though mostly aesthetic, those deletions trimmed cost, weight and complexity — all the ammunition in Tesla’s long-standing battle to extract dollars from the bill of materials.

How Tesla positions these trims in a dynamic EV market

The Standard trims come as many automakers are recasting EV plans around less expensive architectures. Ford is at work on its own dedicated platform for a budget EV, General Motors has promised to bring back the Bolt nameplate here in America, and newer players like Rivian, Lucid and Slate Auto all have models above and below this price range planned. In leading with very strong range at a sub-$40,000 starting price, Tesla hopes to reinforce its high-volume matrix and take the edge off competitive model launches.

Crucially, those two vehicles are now the source of most of Tesla’s deliveries around the world, according to Tesla production reports. New, cheaper trims may unlock incremental demand but also risk cannibalizing more lucrative models. Analysts at firms including Bernstein and Wedbush have been pointing out this tradeoff for some time: more units sold versus squeezed gross margins. How many buyers trade up to software and hardware options over time will be the calculus.

Battery and manufacturing considerations

Tesla has not specified battery chemistry for these trims. In the past, the company has relied on lithium iron phosphate (LFP) packs for some standard-range configurations in specific markets, a chemistry that brings down the overall price point and adds to durability at the cost of energy density. Whether that model is at the foundation of these new U.S. offerings isn’t confirmed. Either way, the playbook is the same: Simplify content and optimize assembly; make every purchase an opportunity to recoup sunk costs from selling that 777 at a negative margin; expect software upgradability to grow revenue well after delivery.

Cost-down engineering probably goes further than just feature removal. In recent years, Tesla has pushed for big parts and simpler wiring to reduce labor and materials. Simple changes, like fewer harnesses for a second-row screen (“we found that the brackets were unnecessary”) or a single-pane roof (reduce costs by losing actuators), multiply over high-volume lines to give Tesla more opportunity to offer aggressive entry prices while not completely sacrificing the bottom line.

What the new Standard trims could mean for Tesla buyers

For customers, the new Standards should provide a recognizably Tesla-driving experience; long range and access to the Supercharger network and its free electricity fountains coupled with over-the-air updates are all present and correct, albeit without some of the more upscale touches or lane-centering assistance as standard. That mix will attract value-minded commuters, fleets and rideshare drivers more interested in total cost of ownership and uptime than in-cabin fripperies.

It also creates pressure in the used market. Older, higher-spec Model 3 and Model Y vehicles may have to discount even more aggressively to compete, while new buyers can weigh a factory warranty and fresh battery against more features in a second-hand vehicle. And market watchers like Cox Automotive have chronicled electric vehicle transaction prices, which have been declining, closing the gap with gasoline-powered cars; these trims will support that.

Tesla has hinted for years about a mass-market EV, going as far as floating the notion that it would offer a $25,000 car before abandoning those plans. The Standard trim levels do not go quite that far, but they demonstrate the company’s willingness to chase volume by washing complexity out of a product. Whether that will be enough to re-accelerate growth depends on execution and on how fast rivals land their own budget-oriented EVs. For now, Tesla has reset the entry point into its lineup and it’s without sacrificing the one spec most buyers still lead with: range.