TDK Ventures and Accel are in advanced talks to fund Bengaluru-based EtherealX, a startup building an entirely reusable medium-lift launcher, people privy to the transaction said. The round is being co-led by TDK Ventures and Vietnam’s BIG Capital, the people said, who requested anonymity because the terms aren’t public yet, and investors declined to comment.

Funding lifts EtherealX’s reusable launch bet

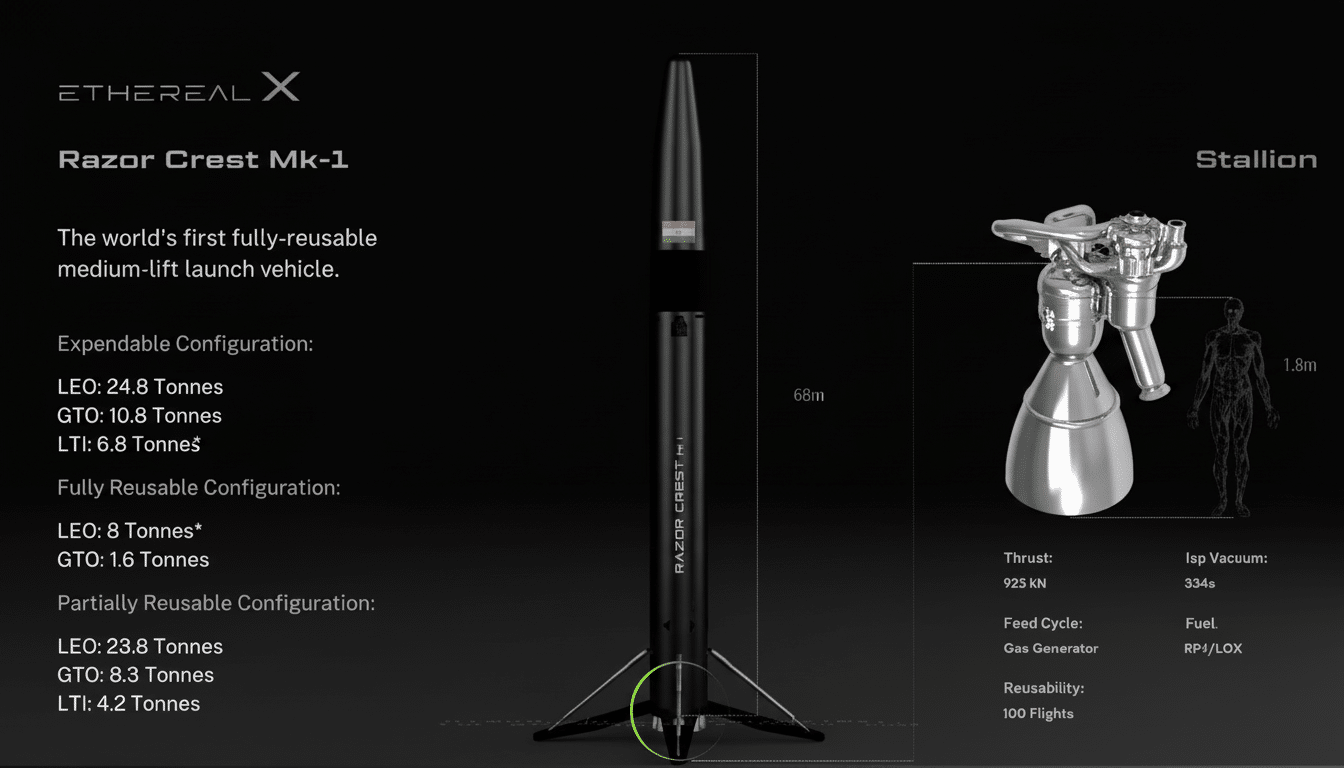

Established in 2022 by CEO Manu J. Nair and COO Shubhayu Sardar, an ex-ISRO scientist, along with CTO Prashant Sharma, EtherealX Technologies is developing Razor Crest Mk-1, a fully reusable rocket capable of taking up to eight tonnes to low Earth orbit. The design is envisioned to fly payloads to geostationary transfer orbit and potentially trans-lunar injection orbits, putting the projectile in the same performance category that many institutional and constellation customers prefer for batch deployments.

The company has targeted a first flight around early 2027 and secured 16 acres in the Indian state of Tamil Nadu for manufacturing and testing work it intends to ramp up in the coming years. Recent development activities from the team indicate propulsion hardware progress, which includes a liquid oxygen turbopump for its upper-stage engine, Pegasus 2.0—one of the most challenging subsystems in any cryogenic engine program.

EtherealX claims that reusability is the leverage to squeeze launch costs and increase frequency. The company’s pricing has previously been indicated by management to be aggressive enough that, once stabilized, the firm is targeting 30%–40% of addressable demand: an ambitious goal indicative of the pressure on new entrants in this space to show very quick turns and low refashioning overhead.

Why Global Capital Is Watching India’s Rocket Launchers

With its latitude, coastline and regulatory momentum, India is presenting a rare combination that has rocket scientists seeing the country as a more attractive scene for launching.

IN-SPACe’s creation as a single-window interface, and the concurrent liberalisation of foreign investment norms in space—both analogous to policy decisions between 1991 and ’94 which saw myriad private sector players try their hand at building modern industrial India—have theoretically lowered barriers for new business.

Policy tailwinds are accompanied by a demand wave. Tens of thousands of satellites, market analysts at Euroconsult have projected, will feature in the decade’s launches driven by broadband constellations, Earth observation and defense. Launch capacity has been tightening as rideshare manifests are booking up months in advance, meaning there’s some room for others to sift through and offer those medium-lift options at a good price along with dedicated orbits and queues.

India’s leadership has articulated a drive to increase the country’s share of the world commercial space market to an estimated 8–10% over the next decade, aimed at establishing a $40–$45 billion space economy. A meaningful portion of that growth will be shouldered by private launchers alongside satellite manufacturing and downstream data services.

The Reusability Bar And Competitive Landscape

For EtherealX the goal is obvious: reusability has to be commonplace, not experimental. The industry leader has already demonstrated that reflown boosters and a high launch cadence can transform economics. To do that at medium lift calls for high-cycle engines, and thoroughgoing thermal protection for reentry, precision landing and a turnaround not in months but days.

India’s ecosystem is already sprinting. Skyroot Aerospace conducted India’s first private rocket launch and is building larger orbital-class vehicles, while Agnikul Cosmos has developed iterations of a 3D-printed engine design for a small launcher. ISRO has also succeeded with significant components of winged recovery via RLV landing experiments, invaluable know-how for Indian entities eyeing reusability. EtherealX’s competitive edge is probably going to centre around medium-lift and quick-turn capabilities—both of which are features constellation operators want (dedicated slots, tailored orbits).

What the backers bring to EtherealX’s launch program

TDK Ventures has been gradually investing in deep tech, energy systems and robotics—fields that interface with propulsion, materials and power electronics vital to reusable launch. Accel’s history in India includes early bets in frontier tech—from space downstream to advanced hardware startups—bringing scale-up discipline and the networks that matter as programs move from lab demos to flight hardware. BIG Capital’s involvement is further evidence of the growing interest in India’s nascent launch lift to orbit and its emerging supply chain from Southeast Asia.

At a minimum, a new round would immediately underwrite long-lead items—engine test campaigns, composite structures, avionics qualification—and build out the Tamil Nadu site for integrated stage testing and turnaround operations. It also enables the startup to court anchor customers that usually do not sign on until funding and testing timelines seem plausible.

Milestones to watch next for EtherealX’s reusable rocket

Key de-risking events to watch include:

- Full-duration hot fires of Pegasus 2.0

- Acceptance tests for turbopumps and valves

- Structural tests for first stage and upper stage

- Recovery demos demonstrating guidance, navigation and control through reentry and landing

Regulatory clearance on IN-SPACe and range transaction with the Satish Dhawan Space Centre will be critical preludes to any flight campaign.

If EtherealX achieves those milestones on time, the company could be positioned as India’s first solid medium-lift reusable alternative—a force multiplier for small-lift domestic players and portfolio expansion for the country at large. For investors that are going long on reusability as the default, the thesis is simple: continued demand, constrained capacity and a market entry point for a low-cost provider with rapid reuse cycles.