Synthesia has secured a $200 million Series E that lifts the London-based AI video company to a $4 billion valuation and, notably, opens a structured path for employees to sell shares. It’s a dual signal of investor conviction and operational maturity in a category where enterprise-ready AI is starting to separate from the hype.

A Fresh Round And A Structured Liquidity Event

The round was led by GV with participation from existing backers including Kleiner Perkins, Accel, NEA, NVentures, Air Street Capital, and PSP Growth. The new price tag nearly doubles Synthesia’s valuation from roughly a year prior, reflecting a business that has already crossed the $100 million ARR mark and landed blue-chip customers such as Bosch, Merck, and SAP.

Alongside primary capital, the company is facilitating a secondary program so early team members can convert equity to cash. Rather than allowing off-market deals at varying prices, Synthesia is running the process through Nasdaq’s private markets unit and anchoring all transactions to the same $4 billion valuation. That keeps governance tight, reduces cap table noise, and gives employees clarity on price and timing.

Crucially, this is not an IPO. It’s a controlled tender that balances employee liquidity with long-term stewardship—an approach more late-stage AI and software companies have adopted as public listings remain sporadic. Structured tenders like this have been used by high-profile AI peers to retain talent, avoid pricing arbitrage, and align incentives without rushing to the public markets.

Why Employee Liquidity Matters In AI Startups

AI startups can face unusually long, capital-intensive build cycles—training models, scaling inference, and hardening enterprise-grade security. Offering periodic liquidity helps seasoned engineers and go-to-market leaders stay the course, especially when compensation includes sizable equity grants. It also reduces pressure for opportunistic secondary sales that may undermine internal morale or investor expectations.

By standardizing the sale price and using a centralized facilitator, Synthesia avoids the common pitfalls of fragmented secondary trading, such as uneven information, side letters, and valuation whiplash. For investors, the model strengthens cap table hygiene. For employees, it turns paper gains into real outcomes while keeping the company private and focused on execution.

From AI Video To Enterprise Knowledge Agents

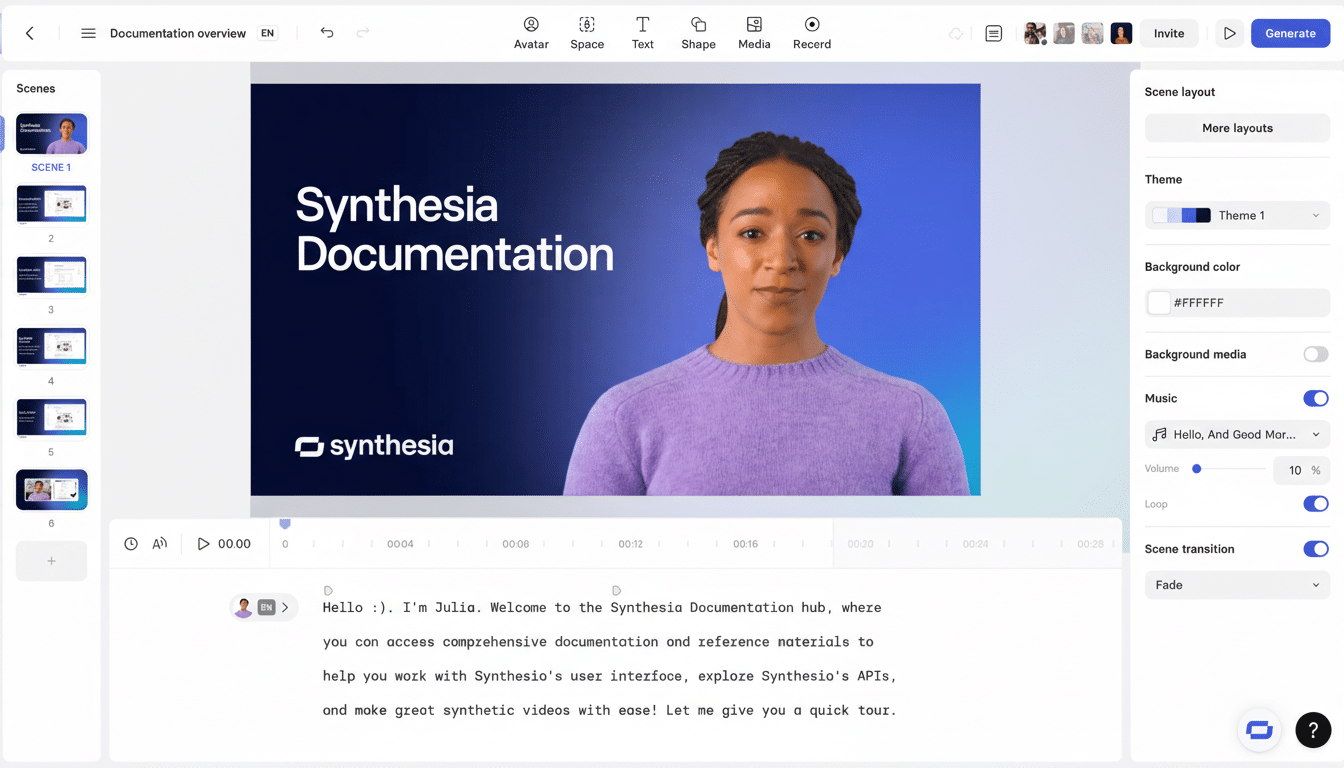

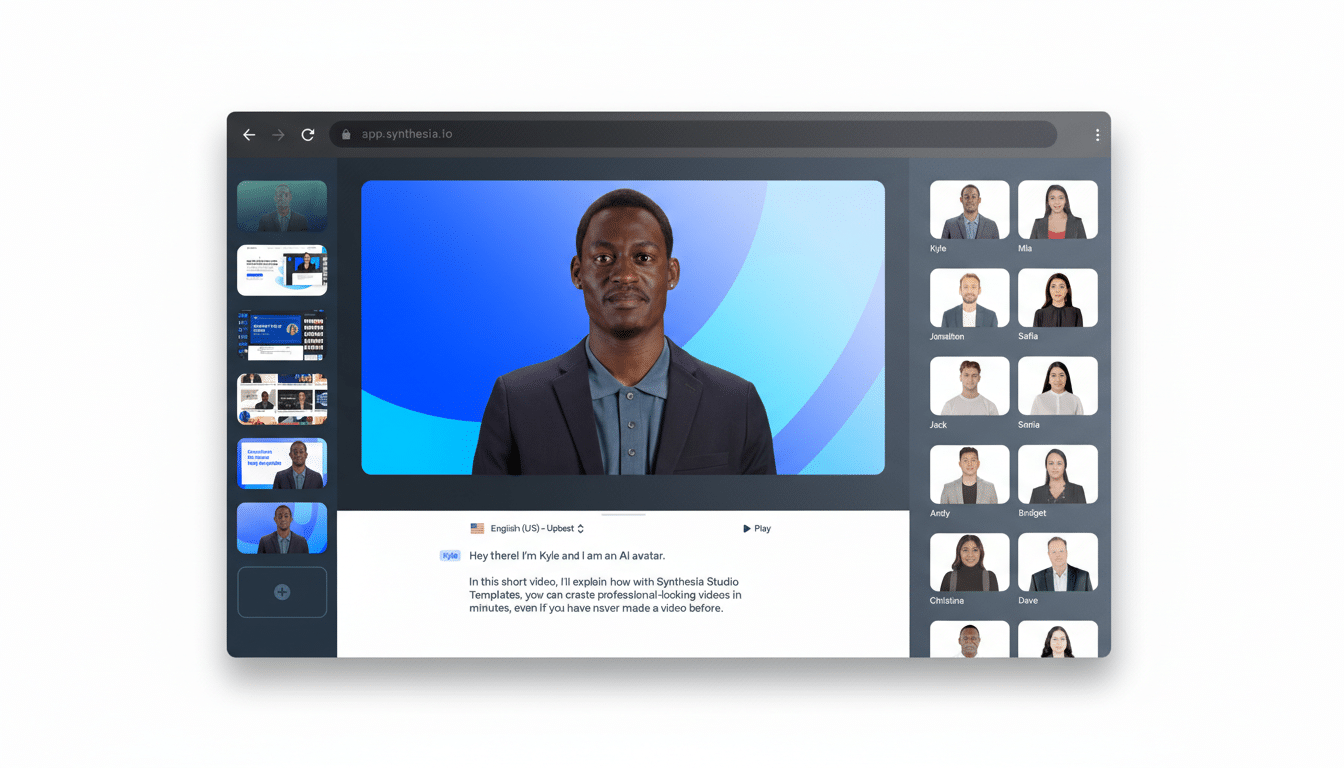

Best known for AI-generated presenters that let companies transform scripts into multilingual training videos, Synthesia is now leaning into AI agents that can parse and respond to company-specific knowledge. The aim is to let employees ask questions, role-play scenarios, and receive tailored explanations in natural language—moving beyond “watch and learn” to “ask and practice.”

Early pilots, according to the company, show higher engagement and faster knowledge transfer versus traditional e-learning content. That tracks with broader trends: boards are raising the priority of upskilling and internal knowledge sharing, while CIOs shift budget toward tools that boost productivity without compromising compliance. If agents can safely sit atop proprietary data—via strong access controls, audit trails, and content watermarking—they could evolve from training aids to everyday copilots.

Enterprise Traction And Competitive Landscape

Synthesia’s enterprise footprint matters in a crowded field of AI video and avatar platforms that includes players like HeyGen and Colossyan. Large buyers consistently rank data security, identity controls, and brand safety alongside realism and ease of use. Synthesia’s focus on compliance and multilingual localization, combined with steady improvements in lip-sync, prosody, and on-screen interactivity, has made it a default choice for global training teams.

The investor roster also hints at a strategic agenda. With NVentures participating, expect continued optimization around GPU efficiency and real-time rendering—critical for scaling interactive agents across thousands of learners. Meanwhile, established backers doubling down suggests customer retention is strong, expansion rates are healthy, and churn is low—key signals for any ARR-driven business at this stage.

What Comes Next For Synthesia After $200M Series E

An IPO can wait; the bigger questions now are whether Synthesia can broaden its product from polished video to trustworthy agents, maintain margin discipline as usage grows, and keep its lead in enterprise readiness. If it succeeds, the company won’t just be a bellwether for AI video—it will be a case study in how to turn generative media into measurable learning outcomes at scale.

For employees, the sanctioned secondary is a timely reward. For the market, the $4 billion mark is a signal that enterprise AI built on real customer demand can still command premium valuations—especially when paired with a pragmatic approach to liquidity and governance.