A new reader survey of more than 6,600 smartphone owners points to a blunt reality for handset makers betting big on artificial intelligence: most people don’t want AI running the show on their phones. The poll shows 33% of respondents actively avoid AI features, with another 20.2% trying to avoid them but using them occasionally. Only 12% say they lean on AI daily. The rest are split between using just a few specialized tools (19.7%) and not being sure whether the features they use even count as AI (about 14%).

What the survey numbers say about AI phone use

Read together, the findings are stark: roughly 53% of participants are steering clear of AI features most of the time. That suggests cool demos aren’t translating into everyday habits. Enthusiasts exist—those 12% heavy users—but they’re dwarfed by a silent majority that either doesn’t buy the hype, doesn’t notice the tools, or would rather not use them at all.

Equally telling is the confusion. About 14% aren’t sure whether what they’re using is AI. That’s a branding problem and a product design problem. If users can’t tell what’s new, or why it matters, they won’t seek it out—especially when the phone already handles baseline tasks just fine without a fancy label.

Why the cool factor hasn’t landed with phone AI

Consumers cite a familiar mix of friction: privacy and data security worries, inconsistent quality from generative tools, battery and performance hits, and unclear real-world value. We’ve all seen features that feel half-baked—summaries that miss the point, image tools that produce odd artifacts, or assistants that require perfect prompts—followed by a marketing push that promises more than the product delivers.

Public sentiment also shapes adoption. Pew Research Center has reported that Americans are more likely to express concern than excitement about AI, a climate that makes opt-in features a tougher sell. Meanwhile, energy and environmental questions around model training and inference—often cited by academic and industry analyses—add to a sense that “AI everywhere” comes with real trade-offs.

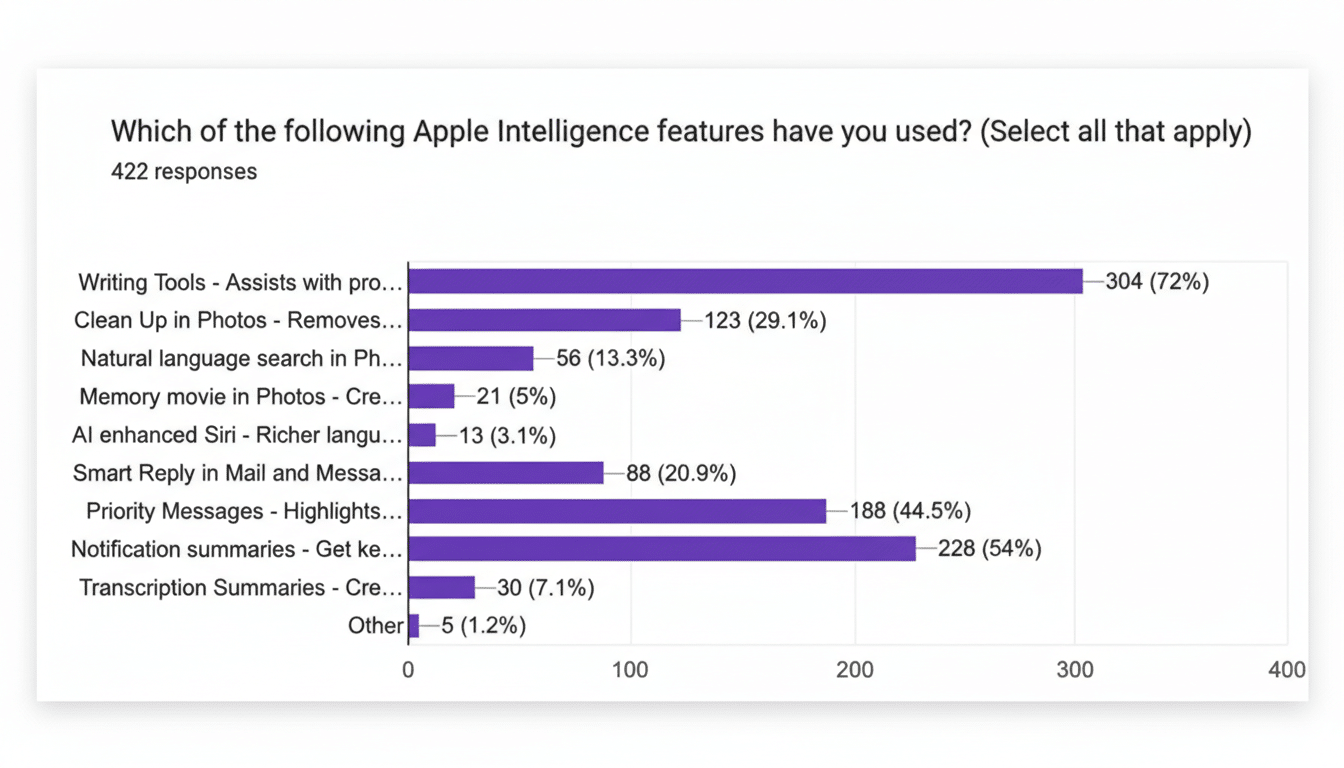

The AI that does work for everyday smartphone tasks

The survey’s nuance is important: 19.7% use AI for targeted, high-utility tasks. That bucket typically includes photo cleanup and portrait edits, transcription and voice notes, spam and scam call filtering, language translation, and smarter text suggestions. When AI drives a single, concrete outcome—cleaner images, faster notes, fewer nuisance calls—people notice and stick with it.

On-device processing also matters. Phones that run features locally rather than in the cloud can be faster, more private, and more reliable on the go. Google’s push toward on-device models, Samsung’s system-level tools like translation and Circle to Search, and Apple’s emphasis on private, on-device intelligence all point to a path consumers tend to reward: make it instant, make it invisible, and don’t ship a science experiment.

What phone makers should do next to boost AI adoption

Turn AI into outcomes, not buzzwords. Label features in plain language—“Erase Objects” or “Summarize This Screen”—and show measurable gains like time saved or taps avoided. Default to on-device processing where possible to ease privacy fears and reduce latency. Publish transparent diagnostics about battery impact, data handling, and model limitations. And stop packaging routine upgrades under an “AI” banner; no one needs marketing to overpromise on alarms or weather summaries.

Pricing strategy is just as critical. If “AI phones” cost more, the advantages must be obvious in daily use. Bundling genuinely valuable tools—reliable call screening, enterprise-grade transcription, auto-form filling that actually works—may justify premiums more credibly than novelty features that fade after a week.

The market context for AI features in smartphones

Industry trackers consistently show that battery life, camera quality, reliability, and price drive most phone purchases. IDC and Deloitte have highlighted these basics for years, and they remain the yardstick that consumers use. Counterpoint Research projects growth in “GenAI smartphones,” but hardware shipments don’t guarantee feature adoption if everyday value isn’t clear.

In short, the new survey doesn’t say users hate AI; it says they haven’t been given enough reasons to care. When AI quietly removes friction—cleaner photos in one tap, flawless captions offline, fewer spam calls—people keep it. When it’s hyped, power-hungry, or error-prone, they turn it off. The message is unmistakable: build AI that earns its place in the status bar, and the usage numbers will follow.